Real estate investing is an I.D.E.A.L. investment. But the umbrella of real estate investing contains many different ways to make money (i.e. strategies). As a new investor, these numerous choices can be overwhelming.

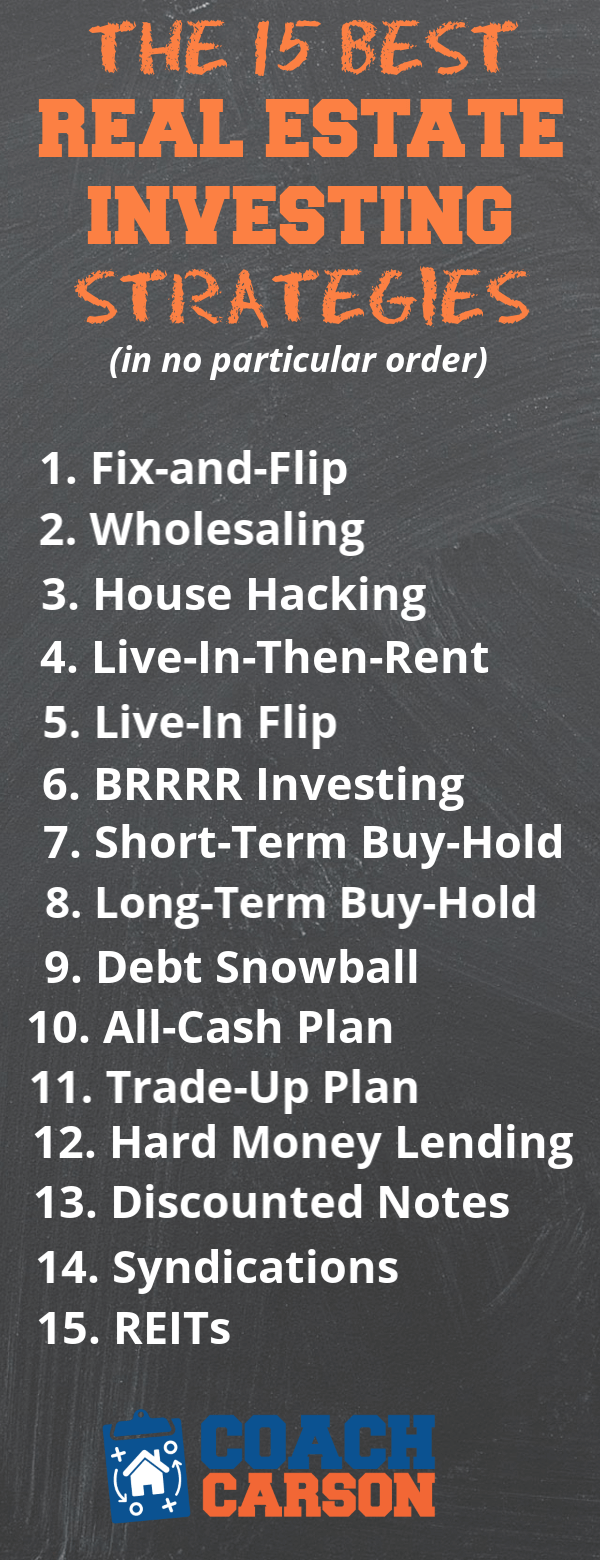

So in the rest of this article, I will explain what I think are the 15 best real estate investing strategies. These strategies will give you a better idea of how to make money in real estate investing.

And hopefully, one or more strategies will be a good fit for you. If so, this article can provide the perfect starting point for your own real estate investing journey.

Let’s get started by learning the difference between goals, strategies, and tactics.

Real Estate Goals vs Strategies vs Tactics

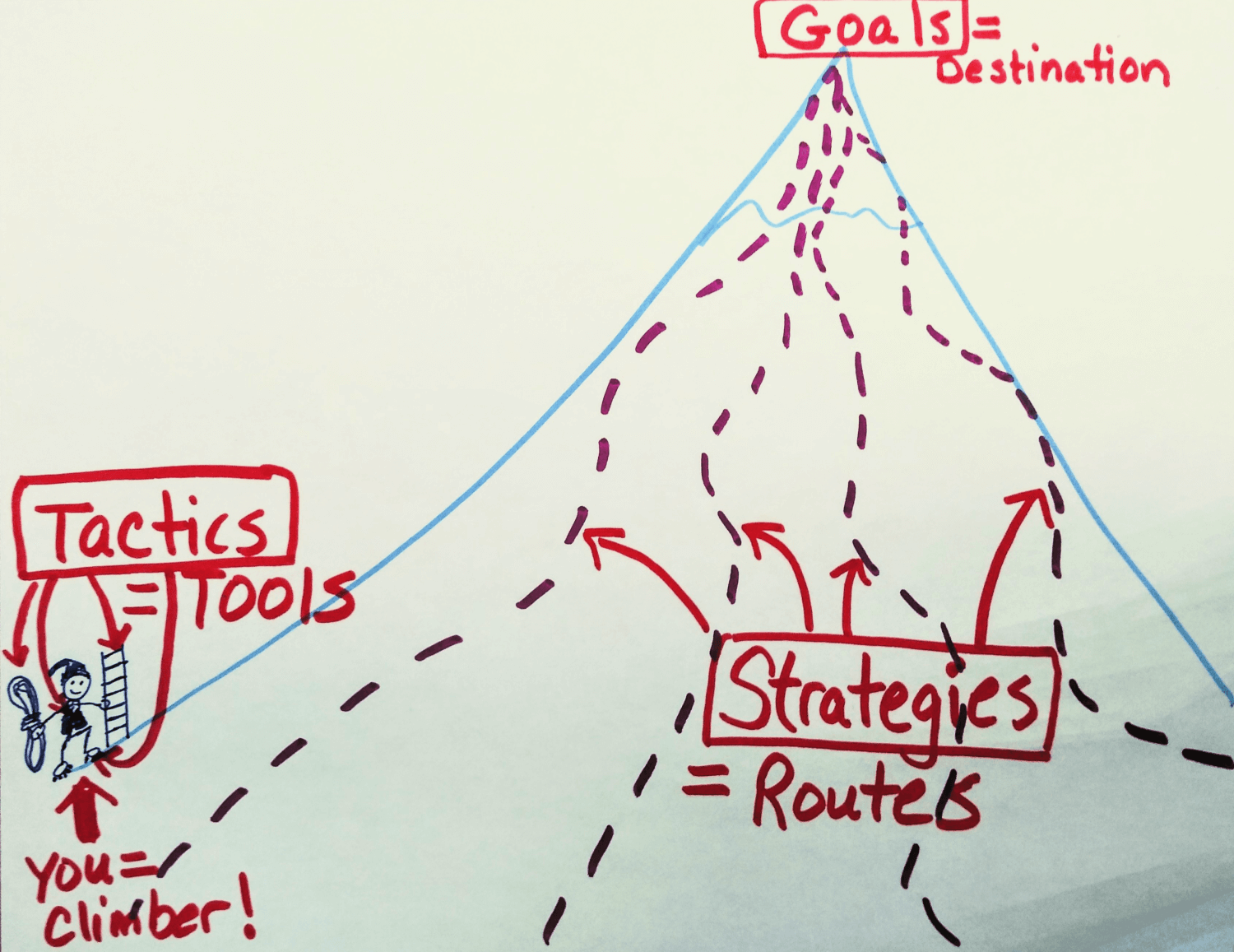

You could look at real estate investing and wealth building as climbing a mountain. And of course, you are the courageous mountain climber!

The peak of the mountain is like your financial and life goals. And there are numerous milestones (or sub-goals) along the way.

Strategies are like plans for how to climb up the mountain in the first place. They are the routes that will take you towards the peak in the fastest AND safest manner.

And tactics are like the climbing tools (ropes, ladders, binoculars, etc) that help you actually climb up those routes.

I have many articles on real estate investing tactics, including analyzing your market, finding good deals, running the numbers, seller financing, negotiation techniques, and more.

But too many real estate investors get caught up in tactics without clarity on why they are using the tactics in the first place. Getting good at tactics without a strategy can simply make you better at hiking right off financial cliffs!

So I first recommend getting clear on basic real estate investing goals, like financial independence or a certain number of free and clear rental properties. Then get clear on one or two strategies that you like. After that, all of the tactics you learn will become much more useful.

Now let’s take a look at the real estate investing strategies themselves.

The Best Real Estate Investing Strategies

In my opinion, the following are the 15 best real estate investing strategies.

To make them easier to understand, I’ve divided each of these strategies into groups based on how they’re used. These groups include:

- Business strategies

- Starter strategies

- Wealth building strategies

- Debt strategies

- Passive strategies

I’ll now unpack and briefly explain each of these 15 strategies. When possible, I’ll provide links to other articles and resources to help you use each of these strategies if you’re interested.

Business Strategies

More businesses than investments, these strategies can generate income and replace your job. But you must be prepared to invest the upfront time and effort of a business start-up in order to make them work.

1. Fix-and-Flip

The Fix-and-Flip strategy is the business of finding properties that need work, doing the repairs, and reselling them at top price for a profit. If you’ve ever watched the flipping shows on HGTV, this is what they do!

I used this model for much of my early years in real estate in order to pay the bills and generate cash savings for future investments. It was not always easy, but the beautifully finished houses and the sometimes large chunks of cash were rewarding.

My favorite resources on this strategy are The Book on Flipping Houses and The Book on Estimating Rehab Costs by my friend J Scott.

2. Wholesaling

Wholesaling is the business of finding good deals on investment properties and then reselling them quickly for a small mark up. The crux of this business is being good at marketing and negotiating to find those good deals.

If you’re good at sales, you’ll like wholesaling. But if the idea of sales makes you cringe, I’d look for a different strategy.

I also began my real estate career doing a variation of this strategy called “bird-dogging.” I essentially hunted down deals for other more experienced investors. I then got paid whenever they bought a deal that I found.

My friend Brandon Turner published the free, Ultimate Beginner’s Guide to Real Estate Wholesaling.

Starter Strategies

These are my favorite, safest ways to get started in real estate investing. And in some cases with a little hard work, you can even get started with a small amount of cash.

3. House Hacking

House Hacking means living in a home that also produces income, like in a duplex, triplex, fourplex, or house with extra rentable space like a basement, guest house, or spare bedrooms. By renting out part of your residence, you can reduce your total housing costs.

House hacking is also an amazing strategy because you learn the landlord business while living at your rental. And once you are done living there, you can move out and transition the property to a long-term rental.

Check out why I love this strategy in The House Hacking Guide, which has step by step instructions and a case study of my first house hack.

4. Live-In-Then-Rent

Live-In-Then-Rent is simply living in a house that will eventually become a rental. This means the house must work as your home AND as an investment later on. But unlike house hacking, you don’t rent the property while you live there.

Doing this strategy a few times is a great way to build a small portfolio. And you don’t have to live next to your tenants like house hacking.

If you’d like to learn more, you can use my first live-in-then-rent as a case study.

5. Live-In-Flip

The Live-In Flip is a strategy where you buy and move into a home, fix it up, and wait two years or more to resell it for a profit. If you follow the IRS rules, you pay NO tax on the profit up to $250,000 for an individual or $500,000 for a couple filing jointly.

My friends Carl and Mindy Jenson from the blog 1500days.com used a few Live-In-Flips to amass savings of several hundred thousand dollars early in their careers! You can read their story in Getting Rich With the Live-In Flip.

6. BRRRR Investing

BRRRR stands for Buy-Remodel-Rent-Refinance-Repeat. When done carefully, it’s an excellent way to build a rental portfolio without running out of cash early in your investing career.

Essentially you look for fixer-upper properties that you can buy below their full value. You use short-term cash or financing to buy the property, and then after it’s fixed and stabilized, you refinance with a long-term mortgage. If done well, you can pull most or all of your original capital back out for the next deal.

My friends at Bigger Pockets have a lot of great information on BRRRR investing.

While I like this strategy, I think it’s best when used early on to first build your portfolio. Eventually, it’s smart to transition to lower leverage and lower risk approaches instead of constantly leveraging as much as possible. An example of an ideal transition strategy is the Rental Debt Snowball below.

Wealth Building Strategies

The focus of these core wealth building strategies is turning a small nest egg into a large amount of wealth. Real estate investing has long been an ideal vehicle for this purpose.

7. Short-Term Buy and Hold Rentals

This strategy involves buying and holding rental properties for relatively short periods of time – perhaps 1 to 5 years. Often the purpose of this strategy is to force property appreciation (aka add value) by remodeling, raising the rent, decreasing expenses, or all of those.

The short-term buy and hold strategy works very well for multi-unit apartment turn-around projects. It also works well for rentals in high priced, appreciating markets that don’t cash flow as well.

I share an example of one particular application of the Short-Term Buy and Hold Rental strategy in the Buy 3-Sell 2-Keep 1 Plan.

8. Long-Term Buy and Hold Rentals

This is the strategy of owning real estate with the intention of keeping it for the long haul. The benefits of this slow and steady (and very successful) strategy include rental income, tax shelter from depreciation expenses, amortization of loans, and price appreciation.

I continue to use this strategy, especially on my properties in the best locations. I like to keep these properties because they attract the best tenants, are the least hassle to manage, and tend to appreciate the most over time.

My friend Brandon Turner from Bigger Pockets has a great book called The Book on Rental Property Investing if you want to go deep on this subject. You can also read my article Landlording 101 to see how I manage my portfolio of buy and hold properties (even while traveling abroad!).

9. The Rental Debt Snowball Plan

The Rental Debt Snowball Plan is one of my favorite strategies to predictably build wealth, reduce risk, and eventually create an ongoing income stream from rental properties. It basically involves gathering all of the cash flow from your current rentals and any other sources, and then concentrating that cash flow to pay off one mortgage debt at a time.

The magic of this strategy is the speed that debt payoffs start to snowball (i.e. accelerate) over time. If you’d like to retire within 10-12 years or less, check out this Rental Debt Snowball case study.

10. The All-Cash Rental Plan

The All-Cash Rental Plan is similar to the Rental Debt Snowball Plan because it snowballs rental income for growth. But instead of using mortgages, you just save up cash and buy a rental property without any debt.

Some financial teachers like Dave Ramsey advocate this type of investing. It would be tough to get started with all cash investing in a high priced market, but in many areas, it’s still a great plan.

In the article Real Estate Investing While Overseas in the Military, my friend Rich Carey explained how he built a portfolio of 20+ rentals in Alabama without any debt.

11. The Trade-Up Plan

The Rental Trade-Up Plan is perfect for entrepreneurial investors willing to juggle a lot of moving parts. This strategy is a way to quickly build real estate wealth and income by moving from smaller to larger properties, typically using a technique called a 1031 tax-free exchange.

See this case study for an example of how the trade-up plan works.

Debt Strategies

These debt strategies put you into the profitable (and often passive) role of lender instead of an owner of real estate.

12. Hard Money Lending

Hard money lending is the strategy of making short-term loans to real estate investors who buy rentals or fix-and-flip properties. Usually, the loans involve high-interest rates, points (i.e. upfront fees), and lower loan to value ratios.

While the strategy can be very profitable, it also has large risks. If you have to take the properties back at foreclosure, you need to make sure you’re protected.

I recommend educating yourself well before doing hard money lending, beginning with Ian Ippolito’s free Hard Money Lending Guide. And if you’re very serious, you should consider paid education with my go-to teacher on the subject, Dyches Boddiford’s Hard Money Lending class.

13. Discounted Note Investing

Discounted note investing means creating or buying notes (i.e. real estate debt) at a discount to the note’s full value. Because of this margin of safety, you can create large returns and reduce your risk.

One form of Discounted Note Investing involves buying notes (typically those that are delinquent) from other owner financing sellers or from banks. This is a much more advanced strategy, so I recommend studying it carefully before jumping in. You can begin with note investor Dave Van Horn’s book Note Investing.

My experience with Discounted Note Investing came from creating my own notes. I sold some of my rental properties to my tenants using seller financing.

For example, I had approximately $70,000 invested in a property. I then sold the property to my tenant for the full value of $100,000. But instead of my tenant getting a loan at a bank, I became the bank. The buyer paid me $10,000, and I financed the $90,000 balance (i.e. received monthly payments of interest and principal).

While this is a profitable strategy, federal and state regulations like the Dodd-Frank Act have made it much more difficult for small investors to navigate. While there are a few exceptions, small investors must follow many of the same, expensive rules as large lenders. So, get help from your local attorney before beginning this strategy.

Passive Strategies

Although some of the passive strategies below still involve important upfront investment decisions, they require less day-to-day hassles than some of the prior strategies.

14. Syndications & Crowdfunding

Syndication is essentially pooling your money with other investors to buy real estate or make loans. It’s a way to invest in any of the other strategies mentioned above without having to put the deals together yourself. You invest your money with syndicators or general partners who find and manage deals for you (and they receive a fee).

Crowdfunding is a relatively new form of syndication investing where deal opportunities are marketed through online platforms like Peer Street (this is an affiliate link). Most require you to be an accredited investor, but you can sometimes begin investing with as little as $1,000 to $5,000 per investment.

I am beginning to explore some of these syndication deals myself, and one of my favorite sources of information is Ian Ippolito at theRealEstateCrowdFundingReview.com.

Although I put Syndication/Crowdfunding as a passive real estate investing strategy, this is bit misleading. Investing in syndications and crowdfunding CAN be very easy and passive, but successful investors with this strategy are still active.

These successful investors actively screen the sponsors, general partners, and deal opportunities before making an investment. In other words, they say “no” a lot more than they say “yes.” And that’s very different from passive index investing or even REIT investing where you make very few active decisions.

15. Real Estate Investing Trusts (REITs)

Real estate investment trusts (i.e. REITs) are very similar to a mutual fund. But instead of allowing you to own a piece of many stocks or bonds, these REITs allow you to own a piece of many commercial, income-producing properties.

And unlike most of the other investment strategies above, this strategy truly is passive once you buy it.

REITs are not my specialty, and they are not something I have invested in. But you can get a good introduction to REITs in Where Do REITs Fit in a Portfolio and When Is the Right Time to REIT?

Conclusion

You’ve now read through the 15 best real estate investing strategies. These are the different routes up the financial mountain using real estate. Each has its own pluses and minuses.

Keep in mind that most investors combine different strategies at different times. For example, you may begin with House Hacking, then transition to Long-Term Buy & Hold Rentals, and finally, do a few Fix-and-Flip deals on the side.

And also don’t worry if you try one strategy and realize it doesn’t work for you. Real estate investing is an entrepreneurial venture. Sometimes you have to experiment and try things that don’t work before you find your sweet spot.

Best of luck with your own real estate investing strategies!

Which of these real estate investing strategies resonates most with you? Are there any of these strategies that you’ve tried that haven’t worked for you? I’d love to hear from you in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Hi Chad

Thanks for the wonderful article. Such a useful summary of some key strategies.

My skills are more design oriented – I have a good eye and really enjoyed renovating one rental apartment to date for a very reasonable budget here in the UK. Many of the tenants say it looks like something in a design magazine. So I enjoy creating beautiful spaces for people and I feel good knowing they are enjoying living there. I’m hopeless at fixing things though so I need to use a contractor for most jobs.

Given my strengths and weaknesses which strategy do you feel would work well for me in future?

With thanks,

Rob, London UK

Thanks for reading, Rob! Your design skills (which are something I lack!) could really be well-used in several strategies – include Fix-and-Flip, Live-In-Flip, BRRRR Strategy. And even Buy-and-Hold could work well because you can use your eye for design to make something of spaces that tenants can enjoy and perhaps pay more for. I am equally hopeless at fixing things, so there is hope! Luckily there are competent contractors who like receiving money whom we can pay!

Thanks Chad for getting back to me. Really enjoyed your book too – it’s a great resource : )

This is a great list! Thank you for sharing. I recently spoke with an attorney about properly setting up a syndication. After that meeting, he scared me a bit. It’s a minefield and should only be done with professional help (lest you feel the wrath of the SEC). I love all the crowdfunding options we have these days, though!

Good point about the minefield of syndication. I agree – it should not be even considered without some sort of GOOD professional help. And you have to spend money to get that help, which means to justify that cost you have to sort of go bigger. That’s been one of several reasons syndications haven’t interested me (as in being the person syndicating the deal).

Thats true, you also have to be careful when setting up and advertising the PE fund(s) offering if you choose to use PE, one type of fund is accredited only but open to the public, and the other is anyone “sophisticated” but is very private. I recommend starting both, the benefits of the one negate the drawbacks of the other. However, this is more of an advanced form of investing. Yes, the attorney fees are high, but also to attract LP’s to your (very young) fund you need GREAT deals with limited liability exposure, and to get these you need high powered LP’s to be attractive more to the CRE brokers and sellers who have other funds and fund managers with a better pedigree so to speak. Its possible, you just need more credibility and capital going into it which most new investors lack.

Wow!! I just loved the ideas.

I am surely gonna follow these.

I read your article. Thanks for sharing.

Thank You, Chad, for sharing these awesome strategies with us.

Writing from El Salvador. Great article, no doubt it is going to be very helpful for myself. Thanks Shad, for sharing it.

Bien venidos, Felipe! Thank you for reading from El Salvador.

Thank you for this valuable information. I have use some extrategies myself. Live in then rent and sindicated mortgages.

I am working on house hacking at the moment. Investing in real estate has been life changing for me.

that’s exciting! Congrats on your progress so far, and good luck on the house hack!

If an inheritance put me at wealth stage #5 should I begin with becoming a real estate agent? Would that be my best starting place?

Hi Cheryl, becoming a real estate agent is a great way to learn your market. But I’d only do that if you think that’d be a fun profession. Otherwise, you could just learn the market on your own with the help of an expert agent or property manager. Either way though – I think you’re really smart to learn the market first and move slowly with your money. The key is investing it wisely, and as my mentor John Schaub has always said – that usually means buying one deal at a time. Good luck!

Getting leads is way hard when you have a higher CPC rate in the real estate industry. Previously I had used google Ads for getting leads and I see that there is a much higher CPC then usual. So, what is the best strategy you want to suggest to us in that pandemic situation via Facebook ads?

Hello Chad,

Amazing post.Thanks for sharing:)

nice post.

Nice article on investment

Great article and very informative , I think people should more invest for long term like in non removable property like house, land, flat, etc. because this is the safest investment mode where you can grab almost twice the actual value of the property in very small span of time. Keep adding such content to your site. Bookmarked your site.

These are the truly best real estate investment strategies I believe. Thank you for such an article which gives us a spread of content at one place in a very organized way. Thank you so much.

I read your article it’s fabulous. Some of my friends and relatives are really searching for this information. So I’m sharing these articles with them. So they too can get the benefit out of this. Thanks for sharing this article. Keep on sharing this kind of articles. Keep us more updated

Wishes to read this guide sooner. 🙂 …thanks for very informative share! These investing strategies really make sense.

Hello Chad,

Very insightful post. Thanks for sharing it with us:)

Hi Chad,

Very insightful post. Thanks for sharing it with us

Very interesting

Hey Chad this is great work. Keep it up.

However the situation arises, Bad credit does not necessarily mean its end of the road for people who need to secure good loans.

The application process was slow and not quite easy and I wasn’t approved because I couldn’t meet up with some demands. Same thing I experienced when I was applying for loans for my most recent investment property , my score was in the mid-600’s. I had four late payments, but the lenders actually looked at my report and refused me a loan. I explained this to my close friend who later introduced me to a credit repair specialist whose hacking skills are the best I know. They helped clean debts on my credit card, my report, increased my score to 795 and erased all the negative items and all the late payment appeared as on time payments. I simply can’t thank him enough. Six One Nine Six Three Zero Nine Zero Eight Five… for credit help.

great work chad.

Great info admin. Keep it up.

It very painful when I see people complaining of getting their investments lost when investing in binary option trading, the purpose of investing is to gain profit but it become painful when you lose your investment, I know how it feels like, when you lose your funds while trying to make profits but I was able to get back all my funds through a recovery Team and with their recovery Expertise i was able to to get back my lost funds plus my profits , if you ever lost hope on recovering your stolen investments by scammers, Contact :NewHorizons001 at AOL dot Com.

Honestly, getting a real professional hacker is very rare but I found an assembly of the finest hackers in Shanghai, Texas & Paris who helped me hack into cell phones of company board members. They do a wide variety of hacks such as intercepting bank transfers, hacking into sophisticated devices such as phones, computers, CCTV’s, ATM Cards, cryptocurrency accounts and much more. They show proof of their authenticity. You can contact them for help: F I X U R W O R R I E S at D O C T O R dot C O M.

I had two cards that was closed in 2017 and I had no knowledge of those being open until 2019 when I filed for a dispute. This year, I offered to pay those debts with the debt collectors and they refused to accept my payment without a guarantee of a credit score increase. However, I reached out to a credit expert to see if they could help. They started and finished repairing my credit in 3 weeks and my score was boosted to 794 across all credit bureaus. Newhorizons 0o1 AT aol. For credit help

My wife and I were looking into applying for a home loan. Unfortunately my FICO score of 583 was dragging us down. After I got recommended to RAYLINK CYBER SERVICES through my pastor who testified good about his services, getting in touch with him, he deleted all the negatives on my credit report and raised my score to 803 across all bureaus. Just successfully purchased a new home. Gladly appreciated. Reach him with the following details r a y l I n k c y b e r s e r v I c e s at gmail dot com 7707695986

My credit was bad. I was at 600 and I had a lot on it that I would like to remove. I wanted to buy a house for my family and but no one would even listen to me. I made a research on a professional credit repair contractor to help me restore my credit and perhaps boost my score a bit so I can qualify. I read about a specialist on a credit forum on quora. He had a beautiful review. I contacted him for help ( C Y B E R D O N @ T E C H I E dot C O M). To cut the long story short, he restored my credit and I got over 150 points added to my score. I bought the house afterwards, it’s been the best thing that ever happened to us this year. You can contact him on the email address above.

Low credit scores were keeping us in a trap of being unable to refinance our home. When I hired r a y l i n k c y b e r s e r v i c e s [ AT] gmail. Com. I thought it will take six months to fix my credit, with my greatest surprise he got all the negatives like collections, hard inquiries, bankruptcy and late payments deleted from my credit report permanently with a good score of 802 within 12days interval, his trustworthy and willing to teach you step by step on how he got your credit fixed. Phone 7707695986

Somehow, real estate investment is still very hard at the financial stage where I’m currently. But thanks for the guide though.

thank you for reading. Sorry to hear real estate has still been tough for you.

Where do you find yourself currently?

After losing a lot of money to Binary Options and Cryptocurrency Trading, my credit report went from bad to worse because I had to live off loans and debts but MY MONEY HAS NOW BEEN RECOVERED AND MY CREDIT THOROUGHLY REPAIRED all thanks to a recovery expert. You can reach out to him via REPAIRHACKS at TECHIE dot COM.

My life was a mess after I lost my life’s savings in a crypto investment scam COMPANY called Duxlin…I went ahead and loaned $50,000 to pay lawyers and agencies that promised to recover my money back but all this was empty promises. My credit was practically nothing to reckon with. In a desperate attempt to savage my situation, I saw many good reviews about W I Z A R D C R E D I T H A C K. The best decision I have made was to email him on W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M. He helped me recover documents that helped incriminate the Duxlin and raised my credit score up to 737. Duxlin have refunded all the money they took from me and are due to pay for damages and my credit score is great. Thanks W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M.

HACKINGPROFESSIONAL is the answer to all your Credit issues,Recovery of lost Bitcoin and Binary Option scam issues. They’ve been so good to me and are so reliable. write him via: HACKINGPROFESSIONAL3 AT GMAIL DOT COM

I really loved and enjoyed the generosity, responsiveness, and 100% credit repair service HACKING PROFESSIONAL offered me. Hit him up (HACKINGPROFESSIONAL3atGMAILdotCOM) for credit repair services (removal of negative items and score increase across all bureaus).He fixed mine too which is amazing, my reports is now freed from 14 negative items and few derogatory marks and score move up by 286pts.

Real estate investment is all time one of the best investment plan for everyone that have the highest ROI

Real estate investment is all time one of the best investment plan for everyone that have the highest ROI thanks for sharing it

Want to improve your credit score, recover your cryptocurrency, or money? Hear my story:

I had a very poor credit score because of the a bad business decision I made. I invested with a fraudulent crypto trading company that stole my money. I went online and saw some good reviews about REPAIRHACKS, I filed my reports to him and he helped me improve my credit score from low 485 to 790 and cleared all negative items on my credit in 14 days and then helped me recover my money back a week after. It’s a long story but the bottomline is that I have my life back. if you also need assistance, contact him on (REPAIRHACKS at TECHIE dot COM.)

With the recent resurgence of the cryptocurrency market, it’s no surprise that the fraud and scams that became so common in 2017 are picking up again. If you’re an IEO or STO investor, it’s critical to have a good understanding of blockchain technology so that you can spot the obvious scams and avoid losing money. However, not all scams are so easy to spot. Our company fell victim once and lost a huge amount, but thanks to the expertise of “JimfundsrecoverY at ConsultanT dot CoM” and his team that helped us recover almost 95% of the funds.

W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M is considered to be very reliable and trustworthy when it comes to micro-finance credit repair services. I found his contact on a credit repair post on facebook. After discussing my credit issues with him, he thoroughly gave me a breakdown of his work which is very important to me because I can spot a scammer from a distance. He fixed my credit, raised my scores to a high 788 within 2 weeks and now I’m qualified for a home loan. hit him up on

W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M

I am a cryptocurrency trader. Last January a man contacted me to sell my BTC to him, the price looked good so I naively went all in. The supposed buyer got 2BTC from me and took undue advantage of a loophole in crypto policy and never paid for it. I felt so stupid but then I was referred to CYBER HACK SERVICES @ CONSULTANT DOT COM who helped me track down the pig and recovered my BTC.

My phone was recently stolen. My Blockchain and Trustwallet apps were on it. I bought a new phone the next day but couldn’t log into my Cryptocurrency apps. I tried all i could but nothing was working,so i decided to come and do a search online on if it is possible to recover lost Bitcoins and Cryptocurrency apps passwords. Luckily for me i saw many reviews about a recovery expert and reluctantly decided to contact him via HACKINGPROFESSIONAL3 AT GMAIL DOT COM. To my suprise he helped me recover my passwords and my lost Bitcoin and other coins i had. I’m still surprised till now so i decided to share this here to help others.

Hi everyone, I am so grateful for all the help you have given me! Today I was able to buy a new house. I would love to continue to aggressively improve my credit! Thumbs up I really appreciate your effort, you indeed proved you are real.. hey guys for any kind of hack service you will need, get in touch with him Email on HACKINGPROFESSIONAL3 at GMAIL dot COM….Thank me later

I AM A DISABLED VETERAN WHO OVER THE PAST 2 YEARS HAD TO LET MY CREDIT GO BECAUSE OF HEALTH PRIORITIES THAT WERE NOT COVERED BY VA OR OTHER INSURANCE. ANYWAY RAN INTO SOME TESTIMONIES ON SOME CREDIT BLOGS ON THE NET WHICH LED ME TO (F.I.X.M.Y.C.R.E.D.I.T at W.R.I.T.E.M.E dot C.O.M). MY CREDIT SCORES WERE AT 512 – 513 – 517 WITH THE 3 BUREAUS. NO PUBLIC RECORDS ONLY 3 OPEN ACCTS BUT SEVERAL COLLECTION ACCTS WITH HIGH BALANCES ON CARDS. WITHIN FEW WEEKS THEY WORKED ON MY CREDIT, MY SCORES IMPROVED TO 788 AND ALL COLLECTIONS, DEBTS ON CARDS WAS CLEARED OFF MY REPORT.

GREAT EXPERIENCE

I have always paid my bills regularly and lived within my means but year 2020 hit me hard when I lost my job because of the pandemic. As if that wasn’t enough my already tensed marriage ended and it soon started to reflect on my credit report. Tax liens, evictions and all that meant that my score was in the 500s.Thanks to some good credit reviews about REPAIRHACKS at TECHIE dot COM…I got a message across to him and he responded promptly, fix my issues and gave my credit a boost so now I can apply for loans to operate my farm. Thankful.

Get in touch with a Cryptocurrency expert for help on this topic of recovering your stolen Bitcoin. I reached out to Hacking Professional when I had a similar issue and he helped me get my Bitcoins back from the scammers wallet. He also has a mail you can reach him on HACKINGPROFESSIONAL3 AT GMAIL DOT COM for more information and tips on how to avoid any issues relating to Bitcoin scam and also recover your stolen funds…

The last 5 years have been the toughest of my life. My credit score has been impacted heavily because of some bad choices I made. Then last month I searched through the internet for credit repair services which I found good reviews about W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M… I e-m-a-i-l-e-d him, gave him all the info he needed and went to sleep. He lived up to the hype and right now my credit score is high up in the 700s and I’m able to get good loans. Thanks W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M.

Cryto currency scam is on the rise because of the huge volume of money available in that market. A lot of scammers take advantage of the loopholes in the crypto market to target unsuspecting traders. Unfortunately I was a victim. I lost 5BTC working as a funds manager for my former employer. It cost me my job. Like they say a man who is down fears no fall, I went to look for a solution. After thorough research on the internet I found CYBER HACK SERVICES @ CONSULTANT DOT COM. He did a great job by helping recover some files that has helped to incriminate the evil guys. Fortunately for me they live in US and are being thoroughly investigated.

These past 3 weeks, HACKINGPROFESSIONAL3 a t GMAIL d o t COM have provided me with valuable services in correcting and improving my credit score. Few collections was deleted from my credit report, score was raised to 742. He also helped me recover my lost Bitcoin

I consider boost credit as my life saver. I’m a single mother of 3 and in the pursuit of trying to get a comfortable home for myself and kids, I got scammed couple of times. I somehow got connected to this team, discussed my credit issues and predicaments encounters to him. He was readily accessible and in all, was able to increase my score, fix my credit and made the dream of purchasing my house become a reality. The joy on my kids face is everything for me and I’ll be forever grateful. Here’s his contact; b o o s T m y c R E D I t A T f a s t s e R V i c e D O T c o m.

C Y B E R H A C K S E R V I C E S has surpassed my expectation and I’m so pleased with them. I lost 3 BTC to some scammers who stole my identity. I reported the case to the The Financial Crimes Enforcement Network but they could not track down this scammers until I contacted C Y B E R H A C K S E R V I C E S at C O N S U L T A N T dot C O M who did a thorough job tracking the transaction and recovering my BTC back to me. 5 star job guys.

I never thought it can done until I gave it a try this month. I invested my 5BTC in one online site I saw via facebook, I was promised mega profits in 3months time. After two months the site stopped opening, I tried all I could to contact them, nothing worked. Luckily for me, earlier this month Brenda Hepler my friend told me about a Bitcoin recovery expert she met online who helped her in same situation. I asked for his contact details, messaged him, we discussed and today my lost Bitcoin have been returned to my Blockchain wallet. I don’t know he did it, all I can say is that he is indeed a genius. You can also reach on HACKINGPROFESSIONAL3 At Gmail COm

My ex ruined my credit due to his incessant extravagant spending so I found myself in a big mess. I talked to a credit repair company and I was told that it would take me non less than a year to fix my credit. I was devastated, that’s a very long time which I can’t cope with. I looked online and came across REPAIR HACKER, hit him up and to my greatest surprise, my credit was repaired in 4 working days from 486 -810. I was so amazed and it didn’t cost me too much really. I implore you to contact him for all credit issues and hacking issues. No doubt that he’s the best out there and your problems will be solved!

R E P A I R H A C K S @ T E C H I E dot C O M.

”B o o s t m y c R E D I T a t F A S T s e r v i c e d o t C O M” for me now, is the ”run to” mail as he’s known to be tested, reliable and highly recommended. I had a car repossession and foreclosure two years ago, my credit score dropped to Equifax: 521, TransUnion:501 and all attempts to get my credit back in a clean slate proved abortive. Depression was slowly setting in as I literally slept on my computer trying to find a good credit repairer. Luckily for me, I stumbled on good reviews about ”boost credit” on a credit blog so I immediately reached out to him. His response and step to step conversation was very soothing. I had a strong conviction so I gave it a try. On checking my credit report 10 days after he had started, I noticed the car repossession, foreclosure, hard inquiries, late payments on my credit report had been deleted and my score skyrocketed to Equifax: 794, TransUnion: 780. I’ve never been happier. You can reach him via the above mail.

Do you know having a reliable hacker means a lot? I just thought of sharing here to help other people that may need this kind of services!!! He saved my life literally, after all I owe him a positive review. I recommend REPAIR WIZARD who is my personal hacker because the first and second job he did for me came out successfully, He helped me wipe out my credit card debts and personal credit loans because I couldn’t continue with the debt payoff plan, which I verified its removal. He also offered other great hacking services at a very affordable price… mail : W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M.

Well technically stolen bitcoin end up in the wallet of the thief or person who stole them, but that doesn’t have to be the end of your bitcoin, in recent times, there has been good reviews on experts who are able to recover stolen crypto currencies, and I personally have been a victim to a scam on coin-base, and thought I had lost all my bitcoin and my account was also suspended, thanks to “JimFundsRecoverY at ConsultanT dot CoM” I was able to recover over 90% of the stolen coin.

To be very honest, I had the worst experiences with false investment firms as an Amateur but couldn’t fold my hands and do nothing while these scammers take us for fools which I’m not. So, I had no choice but to make a report to Michealmurphy at repairman dot com assigned by the Regulatory Agency who assisted with my case without any hassle. It was a bad experience at first, but it’s good it went that way because I know better now, was depressed when I thought I lost it all but I’m so happy Michael Murphy helped me get a refund and also made me improve my trading ability. I’m back to my profit-making days and you can start winning with Michael just message +1 (925) 238 2217 for further enquiries.

Do you have the desire to increase or repair your creditworthiness? REPAIR WIZARD is available to do just that. He saved me and my wife from a credit mess raising our score to 715 and 801 respectively. Don’t cheat yourself (R E P A I R H A C K S at T E C H I E dot C O M)

I have a credit repair recommendation for you all. R E P A I R W I Z A R D S are the pros behind credit repair, they removed several negative items from my report in just 14 days, raised my score in a discreet manner and also added trade lines. Don’t waste your time with those companies that promise and fail…reach them here (R E P A I R H A C K S at T E C H I E dot C O M)

I was at the end of my rope and greatly desperate to turn my credit score around. In search for a credit repair, I came across ”boost credit” multiple times on different sites. I was intrigued by the number of attestation and for some weird reason, I was willing to give them the opportunity to assist me. I filled him in on every credit issues I was having, I could tell he was mostly keen on getting me out of this mess through his excellent and constant communication. In a little under 21 days, my credit got fixed and my score raised hugely. Should you need help with your credit issues, you can reach out to them via ; B o o s t m y c r e d I t AT F a s t s e r v I c e DOT c o m. Definitely a 10/10 recommendation.

W I Z A R D C R E D I T H A C K at C O N S U L T A N T dot C O M helped me and several others fix their credits in no time. After 3days he completed my job and I currently have a score of 801, no more negative items on my report in fact they were all replaced with some couple of beautiful trade lines. I have purchased a car and I’m free to apply for anything, so happy right now because it’s amazing after several bad experiences.

I read a post of a lady testifying about how she was saved by a God sent credit specialist when she had several old collection accounts that went to debt collectors. According to her, there were been sold, put back on as new debt and this was the exact issue I was facing. Luckily for me, she included a mail and I immediately reached out to him via; b o o s t m y c r e d I t @ f a s t s e r v I c e dot C o m. Today, I guess I’m twice happy as she was cos he got my credit fixed, raised my score and I got qualified for a personal loan I was unable to secure for months now. I’m most grateful for this.

I am so grateful to REPAIR WIZARD for helping me get my life back. He removed the hard inquiries and collections on my profile. Cleared the eviction and judgments on my report and student loans are gone permanently, just like they were never there and then raised my score from 520 to 812. Just in case you need his services here: R E P A I R H A C K S at T E C H I E dot C O M.

I needed a loan for a business deal but I got denied because of my poor credit history, so I checked up some reviewed available offers for various micro-finance credit repair organisations to help me improve my credit. I stumbled on a particular name numerous times so it was easy and safe to pick him. In 16 days, he was able to erase all derogatory remarks and a few collections on my profile. It was the best news I had gotten in a while as I got the money just after that, although the procedure was a bit stressful but was worth every bit of it. Compared to other credit specialists, he was communicative in every step and service offered. ”B o o s T M y c r e d I T @ F a s t s e R V I c e dot C O M”. I implore that you hit him up via the above mail if you have similar issues. No regrets, 100% recommendation.

You can recover your stolen money or BTC with the right hacker, don’t let them tell you otherwise because I have been there done that. Crypto recovery expert [C R Y P T O R E C O V E R Y X AT C O N S U L T A N T DOT C O M] is one of the best in recovery jobs. Try him out.

Very informative as always. I have been reading all your blog post and it is really worth.

Few months ago ,I could remember when I got serious about buying our first home, my wife thought I was insane because we had a terrible credit and couldn’t get a loan with that. The previous house was slowly becoming an eyesore and we were expecting our first baby so those were bigger determination for me to get us a better place. I spoke to a few trusted colleagues of mine about it. Coincidentally, two from the rest of my friends had incredible testimonies about a particular credit specialist. Without hesitation, I sent him a mail via; B o O s t m y c R e d I T at F a S t s e r v I C E dot C O M. Honestly, I absolutely cannot overstate how good this hacker is; he raised our scores, fixed our credit and we were eligible to apply for the loan. Can’t remember the last time my wife questioned my decisions. I’m so proud to be writing this from the comfort of our new home. Big thanks to my friends too.

EQUITY LOANS is a companion indeed. My daughter got a student loan from them and I got approved for a house loan. Whatever loan you need you can count on them [E Q U I T Y L O A N S at M A I L dot C O M].

Wow, so many blogs all are good. Thanks for sharing this quality content with us. Really, it is very informative. Great work!

Boost credit was amazing throughout the fixing process even when there were unexpected delays. He and his team were responsive throughout the period in which he sometimes offered ideas and proposals when needed without being prompted. In a few weeks, he was able to Fix my credit and that qualified me for my house purchase. It’s been nothing but excitement knowing that my score is still up there at 782 across all bureaus with all negative items wiped clean. I highly recommend him, you can reach him on; ”Boostmycredit @ fastservice dot com”.

I had read and heard good reviews about boost credit on multiple platforms but I still was cynical, I mean I’m supposed to be. After careful deliberation, I sent an email to him via ”BOOSTMYCREDIT at FASTSERVICE dot COM”. I’m still in awe of how he increased my score to 804 and erased the evictions, foreclosure and IRS amongst other negatives on my record. You clearly know who to message if you ever need a credit repair service. My name is Stella if need be for referral when you contact him. Exceptional team for real!!

A good credit score/report places you in a good position to qualify for loans and take advantage of some Government provisions but how can you succeed with a terrible credit score? This is where REPAIR HACKERS comes in. They cleans your credit report and raise your credit score….REPAIR HACKERS [R E P A I R H A C K S at T E C H I E dot C O M].

I thought I married the best person on earth but we later had a divorce and realized she had messed with my credit so bad. I had over limit, multiple charge-offs and my score was at 487. I needed to get a new apartment for a fresh start so I applied for a loan but got denied as a result of my bad credit report. I got recommended to a life-changing credit specialist and after discussing my credit issues with him, he explained in detail how he intended to fix my credit which I consider to be very vital. He fixed my credit, raised my scores to a high 798 within weeks and I qualified for a home. I’m super grateful to ”B o O S T M Y C r e d I t @ f a s t s e r v i c e . com”

Thank You for sharing the information that have all the ways of good investment in real estate, many have best idea for the investing, good to real this kind of blogs.

I was charged with a DUI crime (driving under the influence of alcohol) during summer, I started classes that cost me 4000$ and I had to give the court 6000$, life became frustrating at a point i was filled with so many questions. If I’m guilty, will I have a felony conviction on my record, i almost lost my job during the whole mess. Then a coworker who had his criminal records expunged told me about a credit specialist called KMAX CYBER SERVICES COMPANY. Immediately I contacted him to fix my dui records and to my greatest surprise he fixed both my dui records and increased my credit score to 350 points, i didn’t understand he removed all negative items from my credit report back when I had bad credit. So I recommend you contact him for any kind of credit issue (Kmax cyber services at gmail dot com). And also refer me to a loan officer where I took a business loan of $170.000 am happy this is one of the greatest things that has happened to my family this new year..

I believe it’s natural for people to change after a period of time but working with ”boost credit” for over four years now has got to be the most trust-worthy team out there. Working with them offers you a whole team of speed, relentless and knowledgeable credit specialists ever. In a few weeks, He was able to erase my bad records all clean and increased my score to 800 above. I found a credit saver and i implore you to utilize this team if you have any credit trouble whatsoever. His email; BoostmycredIt @ Fastservice dot Com.

Thank You for sharing this information and having the great lines to read and could change our strategies inn real estate.

Thank You for Sharing This Information, Was Really Good to Read This Kind of Article and Have a Great Idea With This Article

Thank you for sharing this kind of information having the great information in your blog.

IS IT POSSIBLE TO ACTUALLY GET BACK FUNDS LOST TO CRYPTOCURRENCY SCAM? ABSOLUTELY YES! BUT, YOU MUST CONTACT THE RIGHT AGENCY TO ACHIEVE THIS.

Recovery Precinct is a financial regulator, private investigation and funds recovery body. We specialize in cases concerning cryptocurrency, FAKE investment schemes and recovery scam.

Visit WWW. RECOVERYPRECINCT. COM now to report your case or contact our support team via the contact information below to get started.

📪 RECOVERYPRECINCT (@) G MAIL . COM

Stay Safe !

Nice Blog. Very Useful Information.

Thanks for sharing.

To know more about investing strategies you can visit @https://appleswaygroup.com/investment-strategy/

Very Useful Information. Thanks for sharing. Buying and owning real estate is an investment strategy.

Follow Applesway Multifamily investment strategy to make money in real estate investment.

To know more about investing strategies you can visit @https://appleswaygroup.com/investment-strategy/

Buying and owning real estate is an investment strategy.

Follow Applesway Multifamily investment strategy to make money in real estate investment.

To know more about investing strategies you can visit @https://appleswaygroup.com/investment-strategy/

Buying and owning real estate is an investment strategy. Follow Applesway Multifamily investment strategy to make money in real estate investment.

To know more about investing strategies you can visit @https://appleswaygroup.com/investment-strategy/

Buying and owning real estate is an investment strategy. Follow Applesway Multifamily investment strategy to make money in real estate investment.

I think I’m one of the few people who don’t believe in luck, just do the right thing and you will see result(s). I worked with team ROOTKITSCREDITSPECIALIST AT GMAIL DOT COM barely a week and I can tell you I regret the 2years I wasted with Lexington Law. The customer service was definitely too notch ROOKITS REP was honest about the procedures and what they were going to try to get done from the start and after a few days, all the debts (student loans, car loans, credit card debts) were deleted off my record. ROOTKITS COMPANY is rooted in credit help and made it possible for me to be in position to buy my first brand new home! And today I bought my first brand new 2021 truck to go with it. Thanks ROOTKITS ROOTED IN WHAT YOU DO for all the help!!! 5/5

My loan request was declined because of my poor credit history. Then I contacted 760Plus Credit Score via 760pluscreditscore AT Gmail DOT Com, they helped me raise my credit from 491 to 767. I have been Pre-approved.

I quit my retail job last year and was in so much debt and I had no way to keep up with my payments, To get my career back on track I decided to go back to school and took a $30,000 student loan debt.I wanted to start rebuilding and working toward my future. After hearing about Eaglespy from a friend, I made up my mind and contacted him through his email address “Eaglespy HACKER at GMAIL dot COM” my credit score was 424, he told me all I needed to do, I gave him all the information he needed and he deleted my negatives, paid off my student loan (I don’t know how he did that) and boosted my score to 790. I was able to pay off my car loan and certainly looking forward to buying a house in the future. Eaglespy Hacker helped me a lot during those hard period.

another great article I find after your article “How to Pick the Ideal Market For Investment Properties” no doubt you are expert of this field and many of your articles are ranking.

thanks

If you need a perfect job done on your credit score and clearing debts do contact: REVOXCREDITSPECIALIST AT GMAIL DOT COM, He is the only real one I’ve come across…. a lot of them here don’t really know what they are doing and I got ripped a couple of times before I came across REVOX. He is confidential and reliable and because of him I’m able to keep my home and got a better job.

I had a 530 with Transunion, 420 with Experian and a 460 Equifax. I also had repossession, charge offs 6 negative items and closed credit card accounts. I was trying to get a new house for my family and a new car but I had a bad credit and needed help ASAP. My colleague who previously was in my situation gave me the contact of this credit repair company who helped him fixed his. I quickly emailed and texted them through ([email protected]) To cut the long story short Michael calce came through for me in just 72hours, he cleared all my credit card debts and mortgage, he also raised my score to 815 on all Bureaus. I am so grateful to him and I bless the day I got his information. Email him now and have your credit issues resolved.

Look at me as your REDEMPTION, that is if you’re currently in search of a CERTIFIED CREDIT SPECIALIST. Trust me, you don’t just come across them easily. It took me around 4 months to finally get to find him. He [CYBERTRONCREDIT @ GMAIL.COM] was able to remove all the negative items on my report, added several tradelines, and my score increased to 780 from a low 450 in a week. Reach out to him now and get your bad credit fixed once & for all.

Got my new car after I contacted KNIGHTHOODBOT @ GMAIL .COM about my credit issue , I can actually remember having lots of negatives on my credit report then , as well as a poor credit score and this has been on my mind way too Long for me to hold back anymore , I couldn’t thank my friend who referred me to them enough after I saw my credit ,at first I had a credit score of just 480 but later on when they were done I had an additional +320 to my credit score , Isn’t that a huge progress in just a month working with them . I bless the day I came across these team .

Is it possible for scam victims to receive their money back? Yes, if you have been a victim of a fraud from an unregulated investing platform or any other scam, you may be able to reclaim what was stolen from you, but only if you report it to the appropriate authorities. You may reclaim what you’ve lost with the appropriate strategy and evidence. Those in charge of these unregulated platforms would most likely try to persuade you that what happened to your money was an unfortunate occurrence when, in reality, it was a sophisticated theft. If you or someone you know has been a victim of these situations, you should know that there are resources available to assist you. Simply contact>quickrecovery07 gmail DOtcom) . It is never too late if you have the right information, your sanity can be restored.

After investing all my money with this scam platform they froze my account and they didn’t allow me to withdraw a penny, i searched for help on how to recover my money back which I got help from a recovery agent from Quick RE CO V ERY after seeing several testimonies about their recovery service, And they indeed helped me in recovery back my lost funds, i will recommend their help to scam victims kindly contact them on ( quickrecovery07 at GMAIL (*gmail*) com )

I have always wanted to get my credit fixed but the issue is how to get this done , worked with several credit repair companies in the past and none of them was able to get this done , the last person I worked with before I got to know about CLASSICREPAIR4U was a total flop , didn’t even remove at least 1 negative report after working with him for over 3 months , after that my credit still dropped and I was so furious but couldn’t do anything than to look for a better alternative and that was when I learnt about CLASSICREPAIR4U @ GMAIL dot COM , they left me dumbfounded after the incredible work they did on my credit and gave me a new score which was the best part of it all . Trust me they are the best credit team out there to work with .

Asides benefiting from learning how the credit building process works, Boost credit was able to miraculously expunge all the negative items I had on my record and increased my score by 200 from the initial 580. These were things I thought were impossible but you took my doubt and I’m beginning to see changes that I know will be for the better. Thank you BOOSTMYCREDIT at FASTSERVICE dot COM.

It is possible to recover what you lost to scam brokers but most people don’t know this because they are either not informed or they have been conned by a recovery expert. Truth is there are only a few people who can pull this off and I was lucky to meet with one of them. If you need help with this I suggest sending mail to QUICKRECOVERY07@GMAIL COM .they are 100% legit. Get the peace of mind you deserve.

Came to this country and made a few financial mistakes. People told me I’d never be able to get my credit back on track and that it would take years. My friend introduced me to PINNACLE CREDIT SPECIALIST and trust me when I tell you I can’t believe my scores!!! I keep checking to ensure its saying 805. I love you guys!!! Reach them via : pinnaclecreditspecialist AT gmail DOT com

Thank you for the useful Content

Thanks for the interesting article

Real estate investing is one of the most excellent investment strategies with the highest return on investment. Thank you for sharing it.

Amazing strategies. I find this post really helpful.

I personally use this Short-Term Buy and Hold Rentals strategy and this is very impactful for those who want a short time profit. This guide gave me some more relevant ideas and I’ll surely implement them on my business. Thank you so much for sharing this. Keep posting.

Nice information but how we can know major factors before any investments?

Nice article. Keep up the good work.

Thanks for sharing informationi really like it

. Seriously thanks for posting this great information for us.

n buying my new house, Kmax and his Credit Repair Crew were invaluable allies. Sincerely, I don’t think I could have gotten an excellent credit without his assistance. They are understanding, truthful, and well-informed. Kmax built me a trust that was necessary for my credit to be fixed and for me to be eligible to purchase a home. Knowing that my score is still high at 799 across all bureaus and that all of the bad entries have been removed is a comfort. I heartily recommend contacting him at KMAX CYBER SERVICES AT GMAIL DOT COM, and be thankful to God.

Wow, Thats great information will really help me for taking next steps.

Thanks Chad Carson for this kind of detail, this was really great information.

Will be waiting for other investements related posts as well.