This is a guest post about a real estate strategy called the Live-in Flip. The author is my friend Carl (aka Mr. 1500) at the blog 1500days.com.

In addition to being one of the funniest and most down-to-earth people I know, Carl also has an equally impressive financial story. He originally set out to retire 1500 days (4+ years) from the time he began the blog, which was 1/1/2013. He’s well ahead of his goal, which you can read about here.

Flipping their residence (aka the Live-in Flip) was the tool he and his wife used initially to grow their wealth. I asked him to share their story with you. You’re in for a treat!

Now I’ll turn it over to Carl.

I never planned to be a home flipper. In college, I studied biology and through a serendipitous turn of events, ended up working as a software developer. When I started my first real job, I had no interest in home improvement or real estate investing of any kind. My skills were limited to changing light bulbs and I had almost no knowledge of real estate. That was back around the year 2000.

Fast forward to today. I’ve successfully flipped five homes. I did it at my leisure, paid nothing in income tax and took on very little risk. The flips brought in over $400,000 in beautiful profit. This money got my nest egg started which sits at over $1,200,000. Today, I’ll introduce you to my favorite flipping strategy, the live-in flip:

Live-In Flip: A flip performed while you live in the home.

My Story

When my wife and I got married, we both had homes. We decided to sell her condo and move into my house. However, there was one problem; the linoleum floor in her kitchen was poorly installed and needed to be fixed. I had no idea how to replace it. My father-in-law agreed to help us install a new floor.

In one weekend, I learned how to install tile and it felt wonderful. Looking at the completed job gave me a huge sense of accomplishment and I was eager to take on more. I applied my new skill to the bathrooms in my home with great success. Emboldened, I started trying other tasks including basic plumbing repairs and replacing old electrical fixtures.

We sold the home a couple years later at a profit of $100,000. While some of that appreciation was due to a healthy real estate market, the improvements ensured that we got top dollar for the home.

One thing we realized was that in many improvements, especially cosmetic fixes (tile, cabinets, installing light fixtures) the main cost is labor. We worked this fact to our favor; installing beautiful slate or travertine floors for far less than others paid to have ceramic installed.

Let’s do it again

My wife and I were so happy with our success that we decided to keep flipping. Our strategy was simple:

- We sought out the ugliest homes in the best neighborhoods. These houses had things wrong that we either knew how to fix or that we could learn.

- We would spend the next two years fixing up the home. Two years is important for tax reasons (more on this below).

- We’d sell and start over at step 1.

Why Live-In Flips are Awesome

Low risk: The flips you see on those TV shows are high risk because the flippers need to sell the house quickly. They usually have a second mortgage and if they don’t turn the home quickly, the carrying costs will eat int0 profits. If you’re living in the home, there is no rush. After all, you need a place to live.

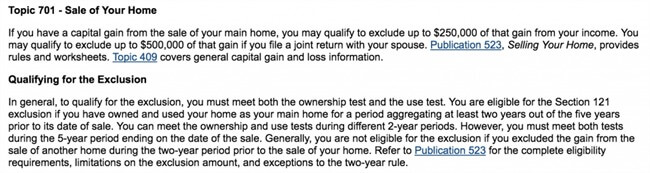

Tax-free: You heard right! If you live in the home and own it for two of the last five years, you will probably get to keep all of your gains. Here is the rule, straight from the IRS:

Read more about the “2 out of 5 year” rule here.

No rush: You’ll want to stay in the home for two years to get the full tax benefit, so you can update the home at your leisure. Note that while most municipalities allow the homeowner to do all work on their own home, some have rules stating that the homeowner must live in the home for one year after the work is done. Check with your local inspector.

You don’t have to sell: Fixing up a home to turn into a rental is a wonderful strategy. Because the home needs work, you’ll purchase it at a discount. You can then install tenant friendly finishes. You’ll also have a mortgage at the lower rate of a home-owner (rates are higher for properties that will be immediately rented). If you decide that landlording isn’t for you, you have 3 years after you move out to still sell tax-free.

Top Tips

You can do the work: The number one response that I hear from people who I discuss this strategy with is this:

I can’t possibly do the kind of work you do. Tiling (hanging cabinets, installing a ceiling fan, fixing a leak) looks hard.

When I started, I knew how to do nothing. I checked out books from the library and carefully followed instructions. I readily admit that the first time I attempted a new project, it took a lot longer than a pro. However, the jobs always turned out great because I took the time to do it right – and do it over again if necessary. But I learned something every single time I did a job myself.

Now there are resources like YouTube and free classes at big-box home improvement stores to help you out. You could also offer to help a knowledgeable friend with a job. There is no reason not to try.

Still scared? The worst that can happen is that you have to hire it out, but I know it won’t come to this.

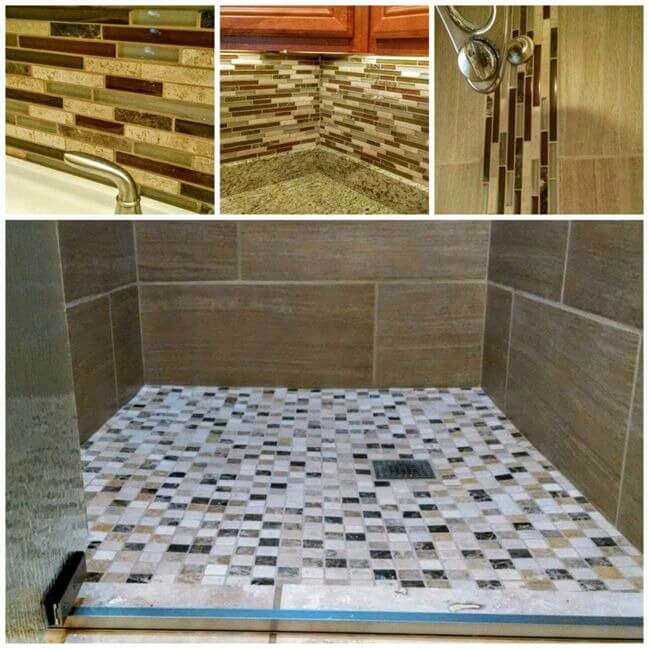

A couple basic skills will take you a long way: If you can install tile and hang cabinets, you can turn an ugly kitchen into something beautiful. Next, learn how to install other types of flooring, basic plumbing, and electricity and you’ll be on your way.

Know when to hire out: In some cases, it’s cost (and time) effective to hire a pro. I don’t take on rough carpentry, drywall or big concrete jobs.

Look for great homes that are cosmetically ugly (you need vision): The pink toilet is your friend. A broken foundation is not. I always seek out homes with cosmetic flaws but have level floors (pro-tip: bring a marble with you on home tours), solid mechanicals and a dry basement.

Have fun with it: Let your creativity shine through. An ugly home is like a blank canvas, only limited by your imagination. Small, artistic touches can go a long way in really helping your home stand out:

The good news is that most home buyers don’t want to be bothered with an ugly home, no matter how solid it is. In my experience, the average homebuyer will choose to pay a premium for a beautiful home rather than put a little elbow grease into the ugly one. This phenomenon was never clearer to us than when we bought our current place. The real estate market in northern Colorado was red hot in 2013, but our home, despite having a great location, sat on the market for 40 days before we made an offer.

My Last Flip (for now)

I just completed my last flip. It’s my current home:

Here is what it looked like the day we closed on it:

We bought this home to flip or turn into a rental, but we liked the neighborhood so much, we decided to stay. I still consider it a flip, just a very long term one. We bought the home for $176,000, put about $90,000 into it, and now could sell it for around $425,000.

It wasn’t always fun. Some of the work was downright terrible. I remember working on unheated parts of the home when it was 5 degrees. It got so cold that my air compressor hose cracked. Another low point was when the drywall guys worked in the new addition. Despite our best efforts at sealing the home off with tarps, we ended up with a coating of white dust on everything. However, those memories are easy to swallow when I think about the tremendous profit we’ll pocket when we sell the home.

We don’t have another flip lined up. Yet. Last year, we told our elderly next door neighbor that if he ever wishes to sell, please talk to us first. His home needs a bit of work and I’d love to get my tools on it. He said that he would be selling in the next five years and would let us know.

When that time comes, would you like to help me out? I promise not to work you too hard and I’ll pay you back by teaching you some wonderful skills. Heck, I’ll even buy you a beer on Friday after we’re done working! What do you say?

What do you think about the live-in flip strategy? Could you see yourself using it to build wealth for yourself? Please leave your comments and questions below.

Thanks Carl for this post! Your story and the work you do on the houses are inspiring.

Please visit Carl over at 1500days.com. You may also find him on Twitter and Facebook.

If you like Podcasts, I enjoyed these episodes with Carl and his wife Mindy:

– So Money With Farnoosh Torabi – Mr. and Mrs. 1500 – Early Retirees

– The Mad Fientist Podcast Pulling the Early Retirement Trigger

~ Chad

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Hey Mr 1500 and Chad!! Awesome post. I think the idea of live in flips is awesome and a great way especially for beginner investors. I unintentionally did a live in flip on my last house. I wasn’t initially planning on flipping it but I did and I made over $100k in profit. Was great!!

Ha, Ha. Where’s the story about an accidental flip for over $100k?! I know you’ve written about that somewhere (or should).

Thanks for reading and commenting. Good to hear from you.

One thing that I didn’t mention in the article is that a live-in flip is a great idea even if you don’t want to sell. Allow me to explain.

It is popular now to dismiss home ownership. If your plan is to buy a new or almost new home in a cookie cutter subdivision, I agree.

However, if you can get a home that needs a little love in a great neighborhood, why not purchase at a discount and put some elbow great into it to force some equity? I take comfort in knowing that I can sell my home at a far greater price than what I purchased it for, even though I’m not looking to sell. I’m using that equity to open a line of credit. I may never use it, but just like Financial Independence, options are power baby.

Well said. I agree on going against the grain with the popular (at least in FIRE circles) idea that you shouldn’t own a home. Using the approach Mr. and Mrs. 1500 have, it can be a very good financial move.

And the appraiser just came by this afternoon. Next week, I’ll know just how just how good of a financial move the current one is…

Quick question, just out curiosity — would it be technically possible to “house hack” your primary place of residence, and then after the two year mark, you sell it and still be eligible for the tax exclusion on any capital gains made on said sale? That way, you can still get your house paid off by potential tenants?

Thanks in advance.

Hey Gustavo, great question! My understanding is house hacks are a hybrid residence and rental. So, you’d only get the tax exclusion on PART of the sale (not on all of it). So, you’d pay capital gains tax (or do a 1031 exchange) on the other portion that was rented.

In a podcast I did last year, one man sold his duplex and did excactly what we’re talking about (https://www.coachcarson.com/59-year-old-teacher-house-hack-to-13-properties/). He got one part tax-free and the other part he exchanged into another rental so he wouldn’t pay taxes.

We like to think our home is a live in flip, but now that we are done all the work It’s nice to take some time to enjoy it. Our market has not been very hot for years, but it’s starting to come along slowly. The two year rule is a big one for us, no taxes on all your profits is hard to beat!

Thanks for sharing your story. I think that demonstrates Mr. 1500’s point about flexibility. If you want to chill out and enjoy your work for a while, no problem. You still get the tax benefit whenever you sell.

What market are you in?

We are in Connecticut.

Ok. I would have thought you’d have a pretty good real estate run lately up your way. But I guess it depends upon the specific location. Thanks for commenting.

Love it! What a great strategy. I think the only problem could be if you have young kids at home running around. That would be tough to manage over months of rehab work. If you’re without kids, it’s basically a very lucrative hobby!

Mr. 1500 will be the best one to talk on the subject of house rehabs with kids! I think it is the perfect tool for a season of your life. You just hit it hard for 5-10 years, and walk away (or start settling in) with a much bigger net worth.

I have done a little work to my home so far. It’s been a great home and I love the idea of a flip but at times the amount of work scares me. Quick question for you, how is/was the flips on your marriage? Did it cause any stress?

Hey MSM, yeah it did. At times, flipping has been overwhelming. The first few weren’t, but trying to do the last two with kids was a struggle. There just wan’t enough time in the day. This last one took me 40 months to finish. Without kids, I could have finished it in under a year.

I’d suggest that anyone considering this have a good talk with their spouse. Carefully plan your work so you know exactly what you’re getting yourself into. And know when to take your foot off the gas.

I’ve definitely thought about this as well. The capital gains exclusion when you live in it is huge to your return on investment. Then if you sell it without a realtor that’s another 5-6%. I definitely couldn’t do this while working a full-time job though. It would have to be after pulling the plug. Great post Mr. 1500!

Good point on the 5-6% commission, FF. Yeah, you’ve got to carve out time in your life for this. It’s really like a part time job (but a profitable one).

We solved the commission problem having the wife get a real estate license. It cost about $700 for an online course. There are still fees involved, but it is completely worth it if you’re going to be an active real estate investor.

I just bought my first house and we’re also doing a live-in flip. Well, it’s more of a renovation than a flip I suppose, but we’re definitely hoping to make money off of our investment when we eventually sell the house.

I think the pro of a live-in flip is that you’re making the changes slowly and (hopefully) in the right way. There’s much less corner-cutting going on and more quality upgrades to the home. I can’t tell you how frustrated I was with the “bam bam thank you ma’am” flippers that we have in our town–all shoddy work done by amateurs that ruined an otherwise good house.

Mrs. Picky Pincher, really good about about slow, quality work.I think that’s one of the biggest benefits, too. I tend to have better ideas on how to do a remodel after sitting around in the house for a while. There are so many creative nuances that can add value, so that 2 years gives you time to think out all of the details.

Best of luck with your house remodel/flip! Hope you get to exclude big gains from taxes some day:)

I’m living in such a “flip” right now. Purchased 3 years ago as a short sale for $34k. I put another $9k and a bunch of sweat equity into it, and we moved in. Love it, love the new neighborhood! After finishing the work on this house, I renovated our old house and just sold it for close to the top of the market in its neighborhood. I’m up roughly $40k in value (new house) and $40k in cash (sale of old house). I’m taking a break for a year or so, then it’ll be time to look for the next one..

That’s an awesome, story Kendall! Congrats on making it happen. It sounds like you owned both houses during overlapping homes, right? How long was it when you owned both. If you can make the finances work, that is a great way to make the move and perhaps rehab easier.

I had both houses for about 3 years; probably about 2 years longer than I had originally intended! My daughter was living in our old house for a good portion of that time. When she moved in March of this year, I spent about 3 months doing a final push to finish renovations there and sold it.

It’s definitely easier when you aren’t living in the house you’re renovating, but it’s a cash drain as well. I will probably do the next renovation before moving as well, but I’d like to do it in a few months instead of years!

Plans and reality don’t always match up. I understand! But I love your story. Thanks for sharing, and congratulations!

How much down should one put down for a home to do this live in flip and make it worth it.

Hey Vince, I don’t think there is a set number to put down. In some markets, you may need to put more down in order to have an affordable monthly payment on the loan. But in other cases and other markets, like with a VA loan, it’s possible to get 0% down and still have the live-in flip work great.

Aside from down payment, however, you will want to set aside cash to cover the costs of the remodel. In order to really add value, this could be as much or more than the down payment.

Great article !!

That is exactly what we did. Our first home was 110,000 on a mortgage, when we bought it and when we sold it we got 550,000 BUT since we were young and had a small budget month to month it took us 13 year lol. We had basically replaced EVERYTHING.

After that first one the flips went faster. We just lived in them long enough to not have to pay income tax.

Now 30 years into this lifestyle we own 4 houses at the moment (just bought another one to reno and move into) plus we can say we accumulated a very healthy and substantial cash flow under the pillow lol

That’s amazing! Thanks for sharing your story, Ursula. I’m sure it took a lot of persistence through the ups and downs of renovating, but it paid off in the end!