This article is about using real estate investing to help you reach a destination of financial independence. More specifically I’ll be sharing the basics of a plan called the Rental Debt Snowball, which helps you achieve a goal of free & clear (no debt) rentals.

Your free & clear goal might be, for example, to own 10 houses that together rent for $12,000 per month ($1,200 per house) and net $7,000 per month after expenses. In other words, you put $84,000 per year in your pocket.

That’s not bad for a simple little goal with 10 houses!

But a goal is not enough. You also need a plan to achieve that goal. So, that’s what you’ll learn in the rest of this article.

The Rental Debt Snowball Plan

The Debt Snowball Plan is a popular strategy used to pay off personal debt more quickly. You might have heard of it from famous financial experts like Dave Ramsey. But the strategy can also be used to pay off debt on investment properties.

The Debt Snowball Plan basically works like this:

- Save cash for down payments

- Purchase several income properties using conservative, low-interest loans.

- Save 100% of the real estate income plus extra savings from a job.

- Use all savings to apply towards one of the loans each month until one loan is paid early.

- Use all savings + new free & clear income to apply towards another loan until paid early.

- Repeat until all loans are paid off.

A Rental Debt Snowball Plan Example

Let’s say you want to end up with 3 properties free & clear. You could do more properties of course, but this will keep my example simple.

You decide to buy easy-to-manage single family houses in good locations. Your target properties might be 3 bedroom, 2 bath homes with a garage, in a solid neighborhood in a good school district.

Let’s say each house rents for $1,200. After subtracting $500 in operating expenses, which does not include your mortgage payment, you would net $700 per month.

Since you have good credit, you plan to put 20% down and get a 4.5%, 30-year mortgage.

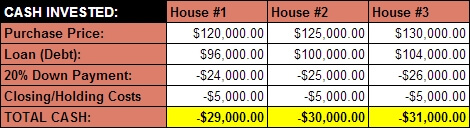

You work hard for one year and you buy three investment properties. Here are the numbers:

So, to purchase these three houses, you needed $90,000 cash plus good credit.

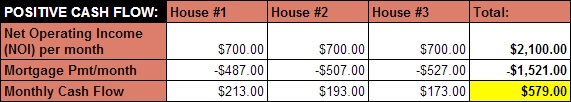

Here is what your positive cash flow would look like once you get all three properties rented:

As you can see, your rentals produce $579 per month in positive cash flow. I also assume you would save an extra $500 per month from a job or other income source.

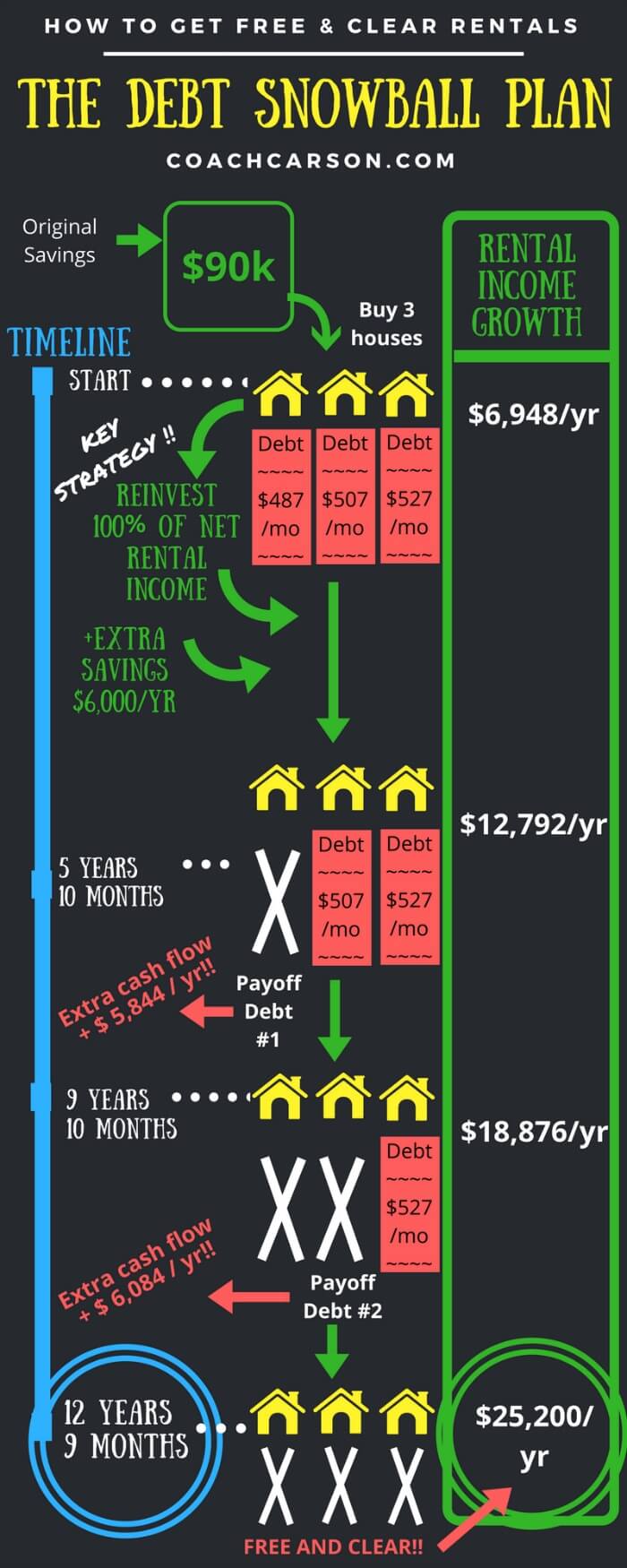

In this plan, the main point is to snowball your mortgages (i.e. pay them off faster and faster over time) by eliminating one mortgage as quickly as possible, and then the next, and the next.

To do this snowball, you use every bit of the positive cash flow and extra savings to make an extra-large monthly payment on one mortgage.

Here is what that would look like in this case:

+$579 … positive cash flow from rentals

+$500 … extra savings from job

+$487 … regular mortgage payment (Loan for House #1)

= $1,566 per month extra-large mortgage payment

This massive extra payment begins the snowball. Each time a mortgage is paid off, the additional savings are then added to the next loan. So, the snowball gets bigger and bigger.

The Amazing Momentum of Debt Snowballs

How fast does your debt snowball accumulate in this case? Take a look at this infographic for the big picture.

So, in a total of 12.75 years (153 months), you have your 3 properties free and clear. This means all $2,100/month or $25,200 per year of net operating income from the rentals goes into your bank account.

You have essentially started with a $90,000 investment, added $500/month for 153 months, and ended up with $25,200 per year income for life.

Not bad! And if $25,200 per year is not enough, you can buy more properties in the beginning or buy more properties at the end using your extra cash flow.

Benefits of the Debt Snowball Plan

No plan is perfect. But, I think you’ll find that The Debt Snowball Plan has several big benefits.

Benefit #1 – Control

Success does not depend upon inflation, luck, speculation, or a Wall Street expert.

What does it depend upon?

- Buying good properties, up front.

- Financing with good loans, up front.

- Remaining a disciplined saver for almost 13 years.

These can all be accomplished with a little education, focus, and soul-searching.

Most real estate investors I know like this idea of having more control. They like that success depends upon their own efforts, not someone they don’t even know on Wall Street.

Benefit #2 – Visible, Measurable, and Steady Progress

The progress you make in the Debt Snowball Plan is visible, measurable, and steady.

You can literally track your progress month by month as you pay off your mortgages. Each chunk that is taken out of your mortgage is one step closer to your end goal.

The psychological benefit of this visible progress is HUGE.

Personal finance teacher Dave Ramsey often says that success with money is 80% behavior and only 20% math.

In other words, we are not robots, no matter how rational and intelligent we think we are. Visible and measurable progress (especially for long-term goals) gives us a little reward that reminds us “You’re on your way. Keep going!”

While rising stock prices can also give us visible and measurable feedback, they often roller-coaster up or down and terrify even the most self-disciplined of us.

Instead, progress with the Debt Snowball Plan is steady and gets better and better over time.

Benefit #3 – Flexibility

Real life is unpredictable, and our plans should be flexible to reflect that reality.

The Snowball Plan can be slowed or stopped as needed.

If you hit a major job crisis that cuts your extra savings, you can temporarily hold off on the full Snowball until you get back on your feet. You will actually continue making progress, just a little slower.

You are also flexible to decide how many or how few properties you want in the end. A bigger portfolio of free and clear properties will require more cash and more time invested, but you’ll have a bigger cash flow in the end.

Is the Debt Snowball Plan Right For You?

My hope with giving you a plan like this is not to tell you exactly how it will happen in your life.

Former president and general Dwight Eisenhower famously said:

In preparing for battle I have always found that plans are useless, but planning is indispensable.”

That is the idea here.

This plan will be useless if you think the details will happen exactly like I’ve written them here. But it may be very helpful if it gets you planning and thinking and moving forward.

So, now back to you.

Is the Snowball Plan something you’d like to implement? If yes, what is the next step? If no, why not? Are free and clear houses part of your financial independence plan? I would love to hear from you in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

I am so happy that I found your blog! I found it when listening to the Mad Fientists pod cast when he interviewed you from Ecuador. Your site has so much information and I am slowly working through reading your articles. I found myself stuck trying to strategies on an FI plan using our real estate. I think this snowball plan could get us there. We have one free and clear single family home, a condo with $122K left to pay and then a triplex (we are house hacking currently) with $425K left. I couldn’t decide whether I wanted to invest our savings in an index fund or pay off the mortgages first. You’ve given me motivation to see through with real estate as our ultimate plan! Thank you. My question would be should we continue house hacking (living in the third unit of our triplex) or should we move out and rent it out too? This would only work if we could find a rental for ourselves that fit into our budget I guess.

Thanks for stopping by, Dora! It sounds like you’re off to a great start. Well done. If those current properties can meet your future needs, a snowball to get them free and clear seems like a solid plan. I’d compare the cost of a rent/mortgage payment on a new property to the amount of rent I could get on my triplex unit. If the new house would cost more than the potential rent I’d just stay put. Moving is rarely an inexpensive proposition. But you might have other personal motivations that factor into this too.

But I’m impressed with your plan and your progress. Keep me updated how it goes!

So with more reading and using your rental analysis formulas I have a couple follow up questions for you.

My condo was purchased prior to me educating myself on investing. I purchased it in 2009 for $186k. I lived there for two years but have rented it out since then. It produces negative cash flow (HOA fees are killing me) . I considered selling it but it would be at a loss (don’t think I’d get more than $150 for it). If I pay off the mortgage it would produce $500 per month positive cash flow. If I’m aggressive I could pay it off in 1.5 years. Is this a good plan or should I cut my losses and sell it? I know now how to evaluate real estate so I don’t think I’d purchase a bad deal like this again. But without a mortgage it could be beneficial to our long term goal.

Dora,

I’m glad you’re using the tools to analyze your existing property. Sometimes that is more valuable than using it for new ones.

My question would be how much do you have to spend to pay off your mortgage and get that $500/month ($6,000 per year)? In other words, what’s your loan balance. And do you have other good investment opportunities available?

I personally don’t like to hang on to negative cash flow properties. It’s bad for the bank account and the psyche. And given there is not much upside with resale value, I’d take a hard look at potentially selling and reinvesting the money rather than paying off a low-interest loan.But there are definitely other details to consider to know for sure.

Loan balance is $120k. My goal is to pay it off in about 2 years. I agree with you on the mental toll it takes to hang on to this property. It’s been frustrating everytime I evaluate the numbers. HOA fees also keep climbing which makes it harder to get positive cash flow. Maybe I’m answering the question for myself haha.

Completely agree that HOA fees are a killer, I would get rid of it and buy another one. Another thing to keep in mind is (from personal experience): don’t buy houses in flood zones. Something else to avoid Dora and Chad?

This is the closest to the plan I’m on. Except I don’t have enough saved up for 10-20 down payments right now, so I am doing a “building” phase over a number of years.

Then I’ll probably do the debt paydown portion a little differently too, but with a similar goal. I have a while to figure it out, but I think of it as consolidation – maybe 1031 exchange 2 properties with 50% leverage into 1 without (can get a higher class of property this way, B to A-?). I don’t believe it is wise to make extra payments on a mortgage, save outside of it, then do it all at once when you are ready (if you have the discipline to do this). But a similar result!

Thanks for sharing your own variation, Brian. That’s what I love about flexible plans – they’re made to apply in different ways.

Keep in mind on 1031 exchanges that you would have to replace the value of the debt you paid off – either with new debt or cash from another source. For example, if you sold two properties for $100,000 each and each had $50,000 debt, in order to avoid taxes your replacement property would need to have $200,000+ value and $100,000 debt (or you could replace the debt with another source of cash). The point is, you’re not using the profit from the 2 sales to pay down debt if you want to avoid tax. Here’s a simple article that explains it well: https://www.ipx1031.com/replacing-debt-in-a-1031-exchange/

I’m going to write a future article on exchanging as a plan to get to financial independence. So, thanks for bringing up that example!

Great article and love the graphics! I’d say that as investors, we are in the #1 and #3 category. As you know, we have four properties that we paid for with cash, but we also have three properties that have mortgages because they were previous residences. While they do pay down the mortgage, they don’t cash flow, so we definitely want to sell one off and pay down the smallest mortgage for quick cash flow. I think at that point, we might considering paying down the last one, but I kind of like some leverage. Definitely some good ideas to think about though!

I love how you mix the plans. That’s really more true to the real world, because different properties and different times in your life will warrant different approaches. There is really a nice synergy when combining them.

Agree on keeping some leverage these days. I like the idea of having a number of properties free and clear and other properties leveraged with long-term, fixed interest mortgages to hedge inflation a bit.

Thanks for sharing!

I really like this! I have a friend that did exactly what you’re talking about with his properties (I believe he had 5 houses). That’s an amazing outcome!

I’m hoping to do this with a total of four properties – the SFH and duplex I have and the plan to pick up two more duplexes. My struggle is going to be that I’m hoping to quit the 9-5 a couple years after we buy the other two. However, I’ll have the SFH paid off and will use the income to start paying off the duplex, which should be halfway into the mortgage by then.

It’ll be a slower process, but I think I’ll still be able to do it. Great post!

— Jim

Thanks for sharing your own plan, Jim! That’s great. I like how you can adjust timing as needed given your own life situation. We had to delay a lot of our own plan during 2008-2011 recession as we just stashed away cash (or more accurately in some case threw into money eating property-alligators!!). Life never works in a straight line like our plans, but luckily as small investors we can be nimble, regroup, and adjust.

Best of luck! I look forward to following your journey on your blog buying the other two properties.

New in your Blog, not a pessimist or hater, just pointing out some stuff:

1) $1,200 month is $13,200 yr. $500 month in operating expenses is $6,000 year. How exactly do you spend just $6,000 per house? In my area: $120,000 house is $3,000 taxes, $1,000 insurance and let’s say $500 interest in the loan. That is $4,500 just on fixed costs. What about Maintenance? Just $1,500 for maintenance? Is that accurate? Just wondering

2) If you already have a mortgage in one house how would the bank approve another one? I mean, If you make $20,000 per month maybe but it will be almost impossible to get an additional mortgage after the second one regardless of your credit score.

3) Numbers look good but what about finding good renters? It can take months, also are you considering that the investor is managing the rentals or a property management company? If the later then those $1,500 of number 1 are pulverized just for the fees.

Really not trying to be critical, just want to understand if I am missing something. I have two rentals and has been harder than I thought (Amazed of how renters lie and try to cheat you / break stuff)

Hey Tyler, I’m happy to get devil’s advocate questions. I’ve been corrected plenty of times. But let me attempt to address your questions:

1) Clearly property expenses vary depending upon your location. But the numbers in this example are real for properties I have in South Carolina. For example, I have a single family house in a good location (near a school, attracts quality, long-term tenants) that rents for $1,200/mo. The taxes last year were $2,063, insurance was $646, repairs were $1,820, and permits were $100. I’ll also throw in capital expense reserves (roof, HVAV, etc) for another $1,000 per year. In this example I assumed no management fees because I assumed a small, local owner who self-manages.

So, my total OPERATING expenses excluding property management on this actual rental property are 5,629/year. That’s less than the example. The mortgage payment then is $5,844/year for property #1 from the example. Together that’s $11,473 going out the door. And we have $1,200 x 12 = $14,400 per year in gross rent coming in. So, there is positive cash flow, just like the example.

Finding general regions of the country and properties within that region where the numbers work out this way is an important first step of this whole process. And it’s not always easy. If you’re having a tough time in your area, you either have to adjust this plan, go to a new location, or use another plan (see my next article about “Buy 3, Sell 2, Keep 1” for higher priced markets.

2) If you have decent income from a job, good credit, AND if you get the first property rented out and seasoned, it’s possible these days to get between 5-10 conventional loans. When I started I was self-employed, so I went more the route of creative (non-bank) financing like seller financing and private loans. Both can work.

3) You’re right that finding renters is not a given. And keeping good ones is not easy either. The single biggest recommendation I can make is buy the right location and the right attractive property. If you have something everyone wants, it’ll be easier to get lots of applicants and then pick the best one. I have a rental right now that does NOT fit those criteria, and we’re having a tough time finding or keeping good tenants. It will likely be on my “to sell” list soon.

Hope that helps. Thanks for stopping by and best of luck with your own rental properties.

I appreciate the response, I understand you have a lot of people in your blog and you cannot afford to give these extensive answers to everyone.

I just noticed that I did the Math wrong, $1200 a month is $14,400; I was thinking what I make for another house which I charge $1,100 per month (Got it for 94K). Anyway, I learned a good valuable lesson from your answer: “The single biggest recommendation I can make is buy the right location and the right attractive property”, agree sooo much and the $1100 house is in a bad location (Renter is HUD and she gets behind on paying every single month). I will definitely follow you advice, for the next one (I have two) I will look for forclosed house in a better neighborhood and will fix and rent. I will let you know if that works better.

Anyway, I would be interested in articles regarding finding good renters and whether is a good idea to form a LLC (I dont have one but I do have a $1,000,000 umbrella insurance policy), also what insurance do you use? Maybe I have the wrong insurance company? I have a hard time finding insurance companies that agree to insure rental properties in TX.

Thanks!

Tyler,

No problem. Happy to respond. Good luck finding your next rental. I know from personal experience (having the bad and the good) what an incredible difference a good location and attractive property makes. I used to get too caught up in ONLY the numbers, when in reality analysis is a mix of the numbers and the property/location itself.

I am actually going to be sharing a guest post next week from an expert on screening tenants. I think you’ll enjoy it. She will go step by step through her recommended screening process, and then she’ll give some examples.

Most real estate attorneys recommend an LLC for holding rentals. Not a bad idea to treat it like a separate business in any case. You definitely have to shop around with insurance. It’s not always easy. And the prices vary from state to state. I recommend going on BiggerPockets.com and asking around in the forums what other people are paying for insurance in Texas for similar properties. If you’re too expensive based on those responses, then you can shop around.

Good luck!

Hey Coach! Hope Ecuador is treating you well. I’ll be in Colombia in 14-days and counting down! A bit of a 40th bday extravaganza for myself and my three best friends. I’m STOKED!

Back to Business…have a question that has NO easy answer, I believe, and I am a numbers guy!

I put into place a snowball plan exactly as you described in your post on my 14-units I own. Numbers are not dissimilar. Payoff was within 8-years. AMAZING!!! Right?

Where I was losing sleep at night was in trying to calculate the ACTUAL percentage that I was “saving” by paying my mortgages off, rather than riding the debt (you know how beneficial that mortgage interest is for tax purposes), and using the money to invest.

Essentially, I was trying to figure out what percent annual gain I would need to realize to “beat” my snowball layoff plan.

Of course, this differs from state-to-state, considering tax rates differ by state, but we all pay the Feds the same.

Any help would be greatly appreciated!!!

PS – there are some awesome “payoff calculators” (yes, that is a Google search term) out there that are SUPER helpful in setting up a snowball plan of folks are keen to do the calculations. They make it easy to get excited about it!!!

Hey Nic,

Hope you’re having a good time in Colombia! I’ve heard it’s great, and we can’t wait to visit there.

Regarding the calculations to compare investing somewhere else/keeping loan in place vs doing the snowball – I don’t have anything fancy for you, unfortunately. I’m decent with spreadsheets, but I haven’t tackled that one yet (though I might try if I’m also losing sleep one night:). Lol.

But beyond the math, I think it comes down to goals. If completing the snowball completes my goals, gives me passive income, and reduces my risk so that I can move on with my life and do other things I enjoy – I probably won’t worry about it. Just work the plan. Sometimes returns are “good enough” instead of figuring it out exactly. The point is simply to get to the destination.

Thanks for sharing, and I’ll check out those other snowball calculators for future reference.

Hi Carson,

I’m writing you from the other end of the world, Istanbul. My problem is we don’t have good mortgage rates like in US. In order get positive cash flow, you can only use around 30% leverage. That means 20 down, 80 loan with good rent is not an option here. Rents are also lower than the interest you would get otherwise. (Or maybe I couldn’t find a similar property)

My first question is, instead of investing in a rental property, is it also applicable to get a personal finance credit and use its interest as the same 30% leverage? This way you don’t have to worry about screening tenants, HOA’s etc.

My second question is about splitting the personal finance credits into 3 with 25% positive cashflow. I have worked on simulating this but found that having one credit with equal cash on cash has more leverage and you don’t have to work on keeping positive cash and reinvesting it. Am I missing something here?

My last question is about the existing mortgage we have. Does it make sense to leave the current mortgage and start building the “grow cash with credit plan” as I explained above? OR should we first pay off the existing mortgage? I can’t decide because there’s no cash flowing in other than “what if we rented this house” scenario which is 40% lower than our monthly payment = negative cashflow.

Thank you so much for your help!

Hi Gbesen! Thank you for visiting from Turkey. It’s great to have you, and I appreciate your questions.

Can you give me an example of a typical property you could buy as an investment in Istanbul? What is the price and what is the gross monthly rent?

Also, can you help me understand what you mean by personal finance credit. Do you mean loaning your money to someone else? So, you’ll be the lender and receive interest each month?

Paying off your mortgage or investing somewhere else is a decision with a lot of factors. What is the interest rate? What is your personal comfort level with risk? What other opportunities do you have and how do their returns compare to your interest rate?

I look forward to hearing back.

Hi Chad,

Thank you for your quick response. A typical property looks like this: http://bit.ly/2ku9Rwe. Single room, 68 m2 property with 350.000 TRY asking price. It could be rented for 1200 TRY. Lowest mortgage rate is 1,05 / month. Max term length is 240 months. Sample mortgage calculation for 100K is here http://bit.ly/2kQ63c9

By personal finance credit I’m referring to borrowing money as cash from the bank. Lowest interest rate for debt is 1,14% / month. Maximum term length is 48 months. Highest interest for the deposit (money you put in the bank) is 0,95%. Sample cash debt calculation for 40k is here: http://bit.ly/2lgJC0c

So for example the interest income generated with 140.000 TRY cash can pay the monthly payment of 40.000 TRY you borrow from the bank. Sample income interest for 140K is here: http://bit.ly/2lMQtg2

Regarding my current mortgage, the interest rate is 0,95% I have 247.000 left to pay. I don’t want to take risks like stock trading. I prefer safe and steady plans like the snowball 🙂

Thanks!

Hi Gbesen,

Thanks for clarifying. So the credit is just a different type of loan instead of getting a real estate mortgage.

There may be a lot of other details I’m missing in your situation since I’m not familiar with the market or circumstances. So, take what I say with a grain of salt. But the there are a few things that strike me about it:

The rent/price ratio on that particular property is not exciting to me. $1,200/month x 12 = $14,400 per year which is a ratio of 4.1% of the purchase price ($14,400 / $350,000).

I don’t know the rental expenses for that property, but around here it would be 50% or more of the rent. So, you may be making a 2% net rental return even if you paid cash for the property. You can get that return in the US stock market and a lot of other alternative investments with a lot less hassle. Most importantly you’d make a lot better return AND reduce your risk just paying off your 247,000 home mortgage at .95%/mo (11.4%/year)!

So, bottom line – borrowing money against that new property would not be profitable at 12% interest mortgage. Your cost of financing is MUCH higher than your rental income. See this video about “Why Positive Leverage is Bliss.”

I would keep looking at other properties. Perhaps there are better deals in other locations.

And my point of comparison would always be the rate of my home mortgage. If I can earn .95/month paying it off and reducing my risk, the other investments need to do much better and provide equal reduction of risk.

Thank you Carson,

I wonder why you don’t consider gains from selling the property after few years. Real estate in Turkey return ~10% per year on average. I ask because many people tell me you can get higher returns from bank interest vs rent income (interest brings double the rent here), but the house value will also increase and eventually will bring more value.

I kind of disagree with this unless the property triples its value by luck and waiting for this to happen for years doesn’t create cashflow. What do you think?

Gbsen,

The problem with appreciation is that it’s speculative. How do we really predict it? The best you could do is evaluate the fundamentals of your market and learn about supply and demand. If the demand (buyers and renters) is MUCH higher than the supply (new housing) and if that trend will continue for many, many years, you may have something. If you’re convinced of this, then you may use some sort of appreciation factor in your calculations. But 10% consistent price appreciation is a LOT to sustain. I’d be nervous counting on that. But again – I don’t know your market. For comparison, the overall U.S. real estate market has appreciated at 3% per year for almost 100 years.

As I said before, I think if you want the most certainty, earning 11% returns by paying off debt is solid. It reduces your risk and eventually increases your cash flow when it’s paid off. AND it’s more certain than real estate appreciation.

Best of luck!

While making payments on a FHA loan as an occupant, would it be possible for me to create a lease option vs seller financing to a buyer (Frank Dodd worries me)? I haven’t purchased a property yet, but I am looking at plans that work best for me.

I’d like to use the live-in method, but instead of flipping, later turn the property into a lease option- or use seller financing. I’m hearing not to be too worried about due on sale. Have you done this before? Do I need a conventional loan to do this vs a FHA? I need a plan that prevents me from being a “landlord,” because I don’t want that responsibility. In that case is it best for me to work on ways to only seller finance due to my fear of being a landlord?

If you seller finance you WOULD want to be concerned with the due on sale clause. While many banks do not call it due, they might. So, it is a risk.

And I’d think about why you don’t like landlording. Perhaps you could hire a property manager to help you with the parts you don’t like.

Hey Coach,

Love this blog and Ep 35 of the podcast!!! Appreciate you putting out this great content!!!So easy to understand and a great outline to win with a small portfolio. Had a question for you that goes along with the debt snowball. I’d be interested to hear your opinion on the right time to start paying off your primary residence? I am at the stage where we would like to start to implement the debt snow ball. We have 2 quads that we were able to house hack that are very highly leveraged but cash flow well with very low interest rates so my intent is to keep those leveraged. Since then we have purchased our primary and are ready to continue to grow. Just wondering when you think the best time to start the snowball on primary res vs investment properties is? I believe we will be investing in single fam homes from this point forward. Thanks in advance! Hope all is well, looking forward to hearing your thoughts!

Thanks for listening and for commenting, Ryan! Great to have you.

It’s a tough call when to start. But typically I think about it as a 1) growth phase 2) pay off phase. In growth phase, you use the cash flow to reinvest into more properties. And in pay off phase, you focus on paying off and not growing as much.

Of course, real life doesn’t always work so simply. So, you might want to do a combination. Like payoff one, then go back to growing after. I’ve personally worked to pay off my personal residence before a lot of my other rentals. Helps me sleep well at night.

Good luck!

Hi Chad,

Greeting from Bangkok Thailand. I’ve just found your blog 2 days ago and found it very interesting and could help me clear the unanswered questions in my head during the past 4 years of realestate investment life.

I started late, my first 3 condos were bought when I was 44 and I continued buying 2 more in the 2nd and 3rd year, all 5 condos were on 100% loan as our law allowed. I rented out 4 condos and stayed at the 5th. Since the loan is 100%, shorter loan period compared to younger starters, cashflow has been negative and paid off by my salary.

Last year Thai regulation changed to only allowed 70% loan from 3rd property onward. So I saved up and just bought the 6th unit before the covid-19 lockdown. The 5th unit just rented out with 3yrs contract and I am moving to 6th condo next week. Current asset value estimated USD 800k while remaining bank loan is USD 600k, home loan interest rate here is from 3-4.5% at present.

Reading through the Debt Snowball strategy, I like it and fully agree with the concept. Best way for me is to focus to pay off this 6th unit within next 5 years as some of my properties’ cashflow become even and some are less negative after refinancing and rental fees increased.. Of course there are 2 out of 6 that are not in potential location and I plan to sell out in next 1-2 years and buy better ones. And I plan to adapt a mixture with the Buy 3-Sell 2-Keep 1 strategy along side with the Debt Snowball strategy.

Many thanks once again for your great ideas and practical blog which I can’t find much available data source locally here.. there are some great local investors, but I couldn’t get the suitable strategies from them which could match my situation until I found your blog.

Now I am much much clearer and more confident to achieve my goal of 6 debt free properties generating a net USD 5k monthly rental income by the time I turn 55, which is not too bad to be a passive income allowing a good living standard in Thaland, and to continue my plan to grow my portfolio after my retirement.

I also started my part-time as realestate agency since end of last year and plan to top up the commission on debt in the debt snowball plan. Being agency will give me opportunity to find good properties to continue my investment.

Thanks and good luck!

Woratep T.

Great Concept, thanks for sharing!

Good article..

My question is the following.

what type of mortgage is best suited for debt snowball and/or avalanche?

Interest only?

Umbrella?

Any suggestions on the financing side of the mortages?

Cheers,

Good question! I like mortgages that give me the most flexibility. So, that usually means longer-term mortgages with the lowest payment possible. For example, a 30-year fixed, low-interest mortgage is great. I’ve also done interest only mortgages for 15 years with private lenders. In both these cases, I can then take the excess cash flow and apply it to one loan at a time (i.e. debt snowball). But if I had done 15 year mortgages on several properties, I’d spread out my payments too much and not benefited from a debt snowball. Hope that helps!

Darn it Chad, I think you’re post is making me reconsider our brilliant plan to finance 40 rentals. ? Instead, we might just keep the 20 with the super low interest rates and then begin purchasing Rental 21 and up with cash to avoid a portfolio loan. The 20 leveraged SFH get us to fat FIRE.

Another option is to invest passive income so that eventually there is enough to pay off the mortgages if we ever needed/wanted to.

Think the other thing I’ve heard is to not focus your portfolio in 1 sector only, so throwing the income from the rentals into index funds, will keep our portfolio at a 50-50 balance.

Appreciate the information you offer. Thanks!

I’m 62. I own 3 very profitable rental properties. I tell every young person I meet to invest in real estate. If only I had started sooner…I could have retired at 40!

I need advice. I love the snowball method, but at my age should I snowball or should I just use the profits to enjoy the life benefits now.

Or should I use profit to buy another property?

Or is there something else I should be doing?

Coach Carson, thanks for the plan. I’ve been following it for years and I just paid off my first rental property. My small snowball is starting to grow. Thank you for sharing this information.

Coach Carson,

I found you on BiggerPockets a few days ago and have listened to easily over 30 of your podcasts since. I have been suffocated with these incredible stories from BP and social media outlets and it was incredibly refreshing to hear your story and your approach. These past couple of days I have been able to identify what matters to me and have found a path to get there. I am completely behind the Small and Mighty Movement and will use the Rental Debt Snowball Method to get where I want to be.

Thank you so much for your content and the information you share.