I’ve never climbed extreme mountains. The idea of risking hypothermia, frostbite, and deadly falls never appealed to me. But I do love the outdoors, hiking, and ascending less risky peaks. And I love comparing the climb towards financial independence to the thrill of climbing a real mountain.

But there’s a problem comparing financial climbs to real climbs. In the financial world, do we really know the destination we are climbing towards? On a real mountain, there is only one peak. There may be several possible paths to reach the top. But in the end, we all celebrate together at the same summit.

The peak destination of financial independence is less clear. Many people yearn for it, but even financial professionals give different definitions for the same concept. And the guaranteed pensions and done-for-you retirements of the past are quickly disappearing. It’s like the peak is hidden in clouds of mystery.

So, how will you ever reach the financial peak if you can’t see it clearly?

My goal in this article is to help you clear the clouds. First, I’ll share two helpful definitions of financial independence that will bring the peak into focus. Then, I’ll share milestones on the mountain (aka plateaus) that can make life more fun and meaningful even before you reach the peak.

As you’ll see throughout the article, I use financial independence (FI) and retirement interchangeably. Fellow financial nerds are welcome to call me out on the differences, but I use them both for easier explanations.

Let’s start by exploring the basic definition of FI.

The Basic Definition of Financial Independence (FI)

I borrowed this definition of FI from fellow blogger ESI Money because I liked its simplicity:

Financial Independence = having wealth to cover expenses indefinitely

This definition assumes you accumulate a large nest egg of wealth. It then assumes you use that nest egg to cover your personal expenses. The wealth can pay for your expenses with income (ex: stock dividends or rental income) or by drawing down the equity (ex: selling a stock or rental property).

Importantly, financial independence means you can depend on this wealth indefinitely without running out. That’s the tricky part.

So, how much wealth do you need to reach this pinnacle of FI? That’s a hotly debated topic in the financial blogging world.

With traditional investments like stocks, bonds, and annuities, most estimates range from 25 to 33 times your annual expenses. So, if your expenses are $60,000 you need between $1,500,000 to $1,980,000 in accumulated wealth to achieve FI.

**UPDATE** The estimate of 25 x your net worth comes from something called the 4% Rule. It’s a rule of thumb that states you can safely withdraw about 4% of your net worth in a typical retirement scenario. 25 is just the inverse of 4% (1/.04), and 33 is just the inverse of a more conservative withdrawal rate of 3%. You can read more about the 4% rule and its limitations at Early Retirement Now.

This simple definition certainly makes the destination of financial independence clearer, doesn’t it? You just need to achieve your net worth goal and you’re done. But for real estate investors, the definition could be slightly different (and more attractive).

Financial Independence For Real Estate Investors

Rental properties are unique assets because they produce more income than traditional investments like stocks, bonds, and insurance annuities. And this causes real estate investors to focus both on net worth AND the income produced by that net worth.

For example, the dividend rate on the S&P 500 as I write this article (June 2019) is only 1.91%. A 10-year U.S. treasury bond only yields 2.05%. A low-risk rental property, free & clear of all debt could produce an income yield of 5-6% or better in the same investment climate.

For this reason, real estate investors tend to define financial independence more on the amount and the quality of income produced by their net worth. I wrote a detailed article that explains how many rental properties you need to retire.

Using this income-based approach to financial independence, you’ve reached financial independence simply when your income from investments exceeds your personal expenses.

So, if you need $60,000 per year to cover your expenses and your rental properties produce that income, you’re financially independent. A net worth of $1 million invested in real estate and earning a 6% yield could produce this income. That’s $500,000 to $980,000 less than was required in the traditional portfolios.

I would add that it also helps to consider risk factors, like outstanding debts, quality of the rental properties, and any looming major expenses (roofs, driveways, HVAC systems, etc). You may need more income and net worth to compensate for some of those risks.

Can you begin to see the clouds clearing on the financial peak? The basic and real estate definitions of FI have certainly made the concept clearer.

But while we see the peak, the definitions still don’t give us a complete picture of the mountain you’re about to climb. The definitions tell you the outcome, but the process of climbing is just as important.

The Peak AND Plateaus of Early Retirement

I discovered a great irony in my own financial journey. From the beginning, I thought the peak was the ultimate destination. I thought life would get really good once I arrived there. But surprisingly, life also got really good along the way!

For me, these great life moments were about more than money. They were about life options, free time, and personal growth. They were about deep contributions and relationships with people. And they were about having interesting and rich experiences. I summarize these ideas as doing what matters in my Money-Life Manifesto.

For example, during my early years of starting a business, I regularly played pick-up basketball and hiked in the middle of the work day. And I even took extended multi-month trips (aka mini-retirements) to Spain, Peru, Chile, Argentina, and across the western USA.

Did these experiences matter to me? Absolutely! I would not trade them for any amount of money.

Had I arrived at the peak of financial independence before doing them? Absolutely not!

I still had a goal of climbing higher up the mountain towards the peak. But even a fast climb might take 10 years. So, why not also enjoy life along the way?

These financial plateaus have made that possible.

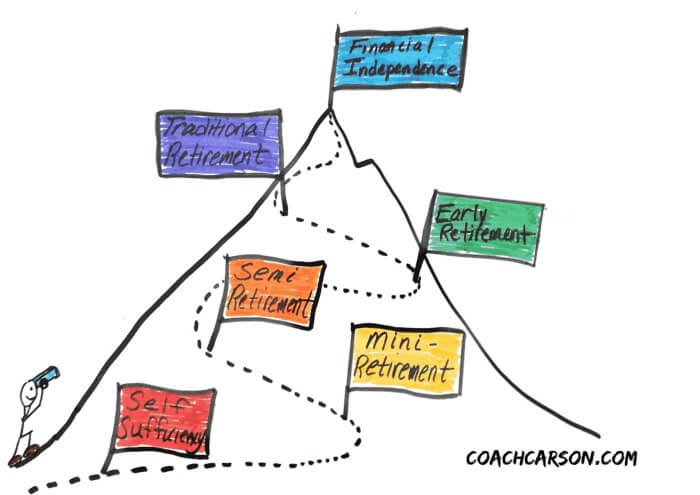

So, to give you a more realistic picture of your climb towards financial independence, I’d like to share five of the more common plateaus or milestones you may reach while climbing towards financial independence.

You won’t necessarily reach them all. And they may not come to you in the order I’ve given. But here are the financial plateaus:

- Self-sufficiency

- Mini-Retirement

- Semi-Retirement

- Early Retirement

- Traditional Retirement

I’ll briefly explain each one below.

Plateau #1: Self-Sufficiency

Many of us pass this stage without pausing for a moment to reflect or to celebrate. This is the stage where your day-to-day finances cease to become an emergency.

Practically speaking, some of your milestones at this stage might be:

- Paying off all personal debt like student loans, car loans, and credit card balances

- Establishing a cash emergency fund equivalent to 3-6 months of your personal overhead

- Achieving a level of professional competency which translates to higher income

If you are a Dave Ramsey fan, you might recognize these as some of the first of his financial baby steps.

If you read the blog jlcollinsnh.com, this stage is similar to your first F-you money. You’re not totally independent yet, but you now have the courage and leverage to do more of what matters (and less of what doesn’t). This was me as I played basketball and hiked for several hours in the middle of the day as a 25-year-old!

Just like the first campsite while climbing a mountain, you get to relax and rest here for a short time. But soon you need to begin climbing once again.

Plateau #2: Mini-Retirements

Mini-retirements are extended periods like a month or year away from a normal work routine. These are like taking extended breaks from climbing. While on a nice, comfortable plateau you take your climbing shoes off and enjoy a swim under a waterfall or a nap!

I wrote extensively about how to do mini-retirements in “Mini-Retirements: How to Retire Before You’re Ready.”

The main point was that you don’t have to wait until the end of life to experience many of the benefits of retirement. In fact, in my case, a series of mini-retirements throughout life has become a necessity for my physical, emotional, and spiritual health.

I began my work career as an entrepreneur, so my lifestyle has been much more negotiable than others who work for “the man.” This is why I’m such a big advocate of entrepreneurship.

But even traditional employees or professionals can negotiate mini-retirements. This US News & World Report article explains how a mini-retirement may rejuvenate your career. This designer in New York closes his studio every 7 years to refresh his creative outlook and recharge. Even doctors, lawyers, engineers, nurses, and other professionals can find creative ways to escape for a period of time. You’ve just got to set the goal and think outside the box.

Plateau #3: Semi-Retirement

Retirement and financial independence are usually associated with not working. This doesn’t have to be the case. A combination of living off your wealth and living off work income can create a fun and fulfilling plateau called semi-retirement. This milestone can allow you to leave a job you dislike, check out of a schedule that stifles you, or begin a career path you enjoy more.

For example, let’s say you’re tired of your current job routine. You need $80,000 per year to cover your family’s expenses. Your real estate investments produce $40,000 per year in net positive cash flow. Your current job that you don’t like pays you $100,000.

The $40,000 per year in positive cash flow is not enough for full financial independence, but it is enough to give you leverage with your current job. You could possibly do one of the following:

- Request to work 50% of the time, at a reduced rate

- Request a transfer to a different role that you enjoy more, even if it pays less

- Quit (nicely, of course) and find a completely different job that you like, even if it pays less

- Quit and spend more time as an entrepreneur to build your own income (I suggest starting the business and getting it profitable before you quit)

The main point here is that even a partial retirement income can give you leverage to increase your options, your flexibility, and your enjoyment of life. And you might even find that your renewed energy and enthusiasm help you replace your former income quite easily.

When you start looking around you’ll notice that the job world has plenty of semi-retired workers and professionals. There are dentists working 2 days per week. Some carpenters work summers and take off winters. Nurses travel to work in exotic destinations and then stay after work is done. Real estate agents list 5-6 houses per year instead of 20-30.

When you give yourself permission to explore the idea of semi-retirement, the possibilities will begin to open up in ways you could have never imagined. And while this could delay your arrival at the peak of financial independence, you’re likely to be much happier on the way up.

Plateau #4 – Early Retirement

An entire movement called FIRE (financial independence, retire early) has sprung up over the last few years. Probably the most famous FIRE example is Pete from mrmoneymustache.com. Pete and his wife worked for less than 10 years, saved a huge portion of their income, invested it, and then retired early at age 30 so they could start a family.

Retiring at 30? Really? This seems like a paradox. It’s certainly unconventional. But people in their 30s, 40s, and 50s are all doing this more often.

The obvious benefit of early retirement is to experience the freedom and flexibility of retirement without waiting until later in life. Why save all the fun until old age when your energy and health are not a given?

But early retirement also has its challenges. Financially you must depend upon your wealth to support you for a long time. Traditional retirement may last 30 years, but early retirement could last 50 or 60 years! As a result, there is a risk of the money running out before you die.

But Darrow Kirkpatrick, an early retiree and blogger at caniretireyet.com, shows in the 3 Stages of Retirement Income that this isn’t impossible to overcome. Successful early retirees are willing to work, if needed, to preserve their capital. They also remain flexible by changing their lifestyle and even their location to reduce expenses. This is especially helpful during market downturns or lean times.

In this way, early retirees work to address future uncertainty, and in exchange, they get an incredible amount of freedom earlier in their lives.

Plateau #5 – Traditional Retirement

This is the stage most people associate with retirement. It has to do both with age and with wealth accumulation.

Social benefits begin for people in the U.S. between the ages of 60 to 65 (at least for now). These benefits include social security income, Medicare health insurance coverage, and the ability to withdraw retirement account funds without penalty. For a lucky few, there may even be a pension from a previous job at this age.

I imagine most of you don’t plan to depend only on these social benefits. But they do provide a comforting financial floor. And particularly with health insurance, which in the U.S. is a source of anxiety and uncertainty for early retirees, these financial certainties are welcome.

But the gap between these benefits and your desired lifestyle must still be filled by your wealth accumulation. Darrow Kirkpatrick again created a useful resource with his retirement income blueprint. It visually shows the decisions you must make to fill these gaps in income.

If you have a sufficient amount of wealth built up, filling this gap will be easy and comfortable. But for many others with smaller nest eggs, filling the gap will be a challenge.

Darrow also has advice for those in this situation of too little net worth during traditional retirement. In order to guarantee yourself sufficient income, sometimes you may need to “annuitize” your assets. This means turning some or all of your assets into a regular payment of income and equity. It’s like the reverse of mortgage payments you make to a bank.

This could mean buying an annuity contract from an insurance company. Or in the real estate investing world, you could begin selling some of your rental properties with longer-term seller financing. This financing converts your equity into regular, passive monthly payments. In both cases, you sacrifice growth, but you give yourself the needed certainty of income.

Back to Your Destination and Your Financial Mountain

I’ve given you some basic definitions of financial independence. I’ve also shared some plateaus or milestones that you can use to guide your way up the mountain.

But your destination of financial independence is unique. In the end, you’re the one who has to climb the mountain. And that means you have to use what you’ve learned and define financial success for yourself.

One of my favorite authors and teachers, Joseph Campbell once said:

Where there is a way or path,

it is someone else’s path.

You are not on your own path.

If you follow someone else’s way,

you are not going to realize

your potential.”

The secure, guaranteed retirement paths of the past are gone (if they were ever really there). But in exchange, you have the excitement and freedom of doing it YOUR way on YOUR terms. Isn’t that freedom and independence worth the effort and the challenge?

I wish you the best on your personal financial journey towards destination financial independence!

What does financial independence mean to you? Are any of the plateaus I shared here goals on your path? Please share your ideas, questions, and comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

That’s a great article CC! I also like the visual presentation of the climb towards FI.

My definition of financial independence is essentially the dividend crossover point – where the amount of dividend income meets or exceeds expenses. At that point, I am free to do whatever I want. Of course, this concept could be adapted to the rental income crossover point 😉

Good luck in your journey!

DGI

Thanks DGI! I think dividend investors and real estate investors see the world in a similar way:) And I love the crossover point reference. One of my favorite concepts from one of my favorite books (Your Money or Your Life). Thanks for stopping by to read!

Love this! And thanks for using my definition of FI. It’s an honor that you like it.

Thank you for providing a succinct explanation for a big concept! And I hope others will check out your site. You do an excellent job.

The extreme version of financial independence – retiring early – is tough. Some people get really excited about it, others think they could never do it.

One way I encourage people to think about it – what money saved or cash flow would you need to quit the job you hate and work for half the money doing something you love?

Yeah, I like thinking of it that way Brian. I think the hardest decisions are for people who make a lot of money but who don’t hate their job. It’s not bad, not great, but just comfortable. It’s hard to get out of that routine. But over the long run that can be just as life-draining as other paths.

This is so great! I realized that being overseas has granted me mini-retirements without the need to actually quit my job (I used to get 14 weeks off per year). I’ve taken off a year from my teaching career to be at home with the kid and am ready to go back, as well as stash up some moolah for rental properties. Even though I’m not where I want to be financially, I’ve lived a wonderful life so far, full of travel, love and friendship I do not regret overspending on certain things one bit. Now brokerage fees is another….

Thanks for commenting Sarah! Those plateaus you’ve enjoyed sure seem worthwhile to me! You can “bank” those memories and experiences, and they can never be taken away from you. Valuable, in deed! I know if I could just get as much travel, love, and friendship as possible in my life, I’d sure be happy:)

chad your’e a great writer your info. is timely , direct, and so clear to understand. I don’t usually comment on blogs, but after reading your piece I had to. thanks.

Thank you for reading and commenting, Kofi!