Fund Your Retirement

Rental properties are a great way to fund some or all of your retirement. They produce steady, predictable income without eating into your principal. And they have many tax advantages and other benefits for retirement.

But before you embark on a multi-year real estate investing journey, you should first figure out how many rental properties you actually need to retire.

Once you know how many rental properties you need, you can more easily pick an investing strategy and find the right real estate niche. You’ll also have a clear milestone to measure your progress against. And you might even realize that you’re closer to retirement (aka financial independence) than you think!

In the rest of this article, I will share the math behind real estate retirement planning and examples of how to retire with rental properties. Then I will also show you 5 steps to help you personally calculate the number of rental properties you will need to retire.

No Real Estate Retirement Calculator Needed

Traditionally, people who plan for retirement use tools like a retirement calculator. For example, there are two free ones that I like:

- The calculator app at caniretireyet.com

- Or this online calculator from Todd Tresidder at financialmentor.com.

Retirement calculators are helpful, especially when investing in typical assets like mutual funds and stocks. But as you’ll see below, the retirement math is much simpler when using rental income.

** For extra help with terminology and formulas for real estate analysis, see my Comprehensive Guide to Calculate Real Estate Cash Flow.**

Real Estate Retirement Math

The real estate retirement math has 3 variables:

- Your expenses in retirement (E)

- Your wealth invested in real estate (W)

- The conservative income yield or cash-on-cash return on that wealth (r)

The basic formula is this:

W x r = E

or

E ÷ r = W

For example, let’s assume your expenses in retirement will be $70,000 per year. Let’s also assume you can find properties with a 10% cash-on-cash return.

This means you need to invest wealth (aka equity) of $700,000 into rental properties.

E ÷ r = W

$70,000 ÷ 10% = W

$700,000 = W

If that math doesn’t work for your situation, you can change each of those three variables as needed.

For example, if your expenses will be $100,000 per year, you may need to invest $1 million instead of $700,000

$100,000 ÷ 10% = W

$1,000,000 = W

Or, you could also be more conservative with your cash-on-cash return. Let’s say you could only get a 6% return. How much wealth would you need in order to still cover $100,000 in expenses? Let’s look.

$100,000 ÷ 6% = W

$1,666,667 = W

Next Steps

So, the math begins with your retirement expenses (E). You decide what that number is. But if you’re unsure how to estimate your expenses, I’ll get into how to calculate those needs in more detail later in the article.

Next, you plug in (r), your cash-on-cash return assumption (like 10%). This is the cash yield you can expect from your rental properties.

The result of that math equation is the amount of wealth (W) you need to either invest (if you already have the capital) or accumulate (if you’re still growing your portfolio).

Simple math, right? But of course actually DOING that math in the real world is a little trickier.

So, let’s look at an example.

What a Retirement Rental Property Looks Like

Examples are always the easiest way for me to understand concepts. I bet you feel the same way. That’s why I want to give you some real numbers here.

But examples are only helpful when you understand the assumptions. You may need to adjust these assumptions to make them relevant to your situation.

So, in my examples assume that all of the rental properties will have the following characteristics:

| Rental Property Assumptions | |

| Property Type: | Single Family Houses |

| Market Location: |

|

| Total Cost of Each Property (Purchase, Closing Costs, Repairs) |

$120,000 |

| Cash Investment Per Property | $30,000 |

| Mortgage Details | $90,000 principal (4.4% interest, 30 years, $450/month principal & interest payment) |

| Total Rental Income | $1,200 / month |

| Operating Expenses | -$500 / month |

| Net Operating Income | $700 / month |

In an ideal world, each house would also be built for low maintenance renting with a large crawl space, masonry or brick exterior siding, hardwood and tile floors inside for inexpensive tenant turnovers, and wonderful neighbors. But getting 100% of that may be asking for too much!

Now let’s look at two different examples of rental properties to produce retirement income.

The Leveraged Rental Retirement Portfolio

There is an endless debate about how much debt you should use in real estate investing. Some even question whether you should use debt at all. I’ll be happy to jump into the nuances of that debate in future articles, but for now, I’m just going to give you two examples – one with debt leverage and one with no debt.

The goal in both examples will be $84,000 per year in rental income (pre-tax).

Here’s example #1 with leverage:

- 28 rental properties

- Total cost = $3,360,000 ($120,000 per property)

- $840,000 equity capital invested ($30,000 per property)

- $2,520,000 debt financing ($90,000 per property)

- Total rental income/month = $33,600 ($1,200 per property)

- Operating Expenses/month = -$14,000 (-$500 per property)

- Net operating income/month = $19,600 ($700 per property)

- Mortgage payments/month = -$12,600 (-$450 per property)

- Total net positive cash flow/month = $7,000 ($250 per property)

- Total net positive cash flow/year = $84,000

Using the math formula from earlier, we can calculate our cash on cash yield as follows:

$840,000 x r = $84,000

r = 10%

There are positives and negatives to every investing and life decision you make. This portfolio is no different.

Positives/Negatives to The Leveraged Rental Retirement Portfolio

Positives:

- You locked in low-interest, long-term debt secured by quality rental properties. This is a GREAT inflation hedge.

- In addition to cash flow, you will also receive growth from amortization of loans ($41,356 just in year #1 of the loans)

- You have the potential for price and rent appreciation since you bought these in a solid location, which could send your returns off the chart in the future.

Negatives:

- 28 properties to care for as an asset manager and/or property manager. Without strong systems, this could be a hassle.

- Financing for 28 properties at those attractive terms could be challenging (probably the weakest link of this portfolio).

- The next Great Depression could expose the entire portfolio to a risk of loss. Would you have cash reserves to survive if rents crater by 25% or even 50%? Few investors could survive that, which is something to think about even if the chances are very small.

This example, like all case studies, has more details we could discuss and debate. But I hope it illustrates one possible type of retirement rental portfolio.

Now let’s look at one without debt.

The Free and Clear Rental Retirement Portfolio

In this example, you have the same goal of $84,000 per year in net, pre-tax rental income. But the portfolio looks very different.

- 10 rental properties

- Total cost = $1,200,000 ($120,000 per property)

- $1,200,000 equity capital invested ($120,000 per property)

- $0 debt financing

- Total rental income/month = $12,000 ($1,200 per property)

- Operating expenses/month = -$5,000 (-$500 per property)

- Net operating income/month = $7,000 ($700 per property)

- Mortgage payments/month = $0

- Total net positive cash flow/month = $7,000 ($700 per property)

- Total net positive cash flow/year = $84,000

Using the math formula from earlier, we can calculate our cash on cash yield as follows:

$1,200,000 x r = $84,000

r = 7%

Just like the last portfolio, there are positives and negatives to this example.

Positives/Negatives to the Free and Clear Rental Retirement Portfolio

Positives:

- Asset and property management is relatively simple. I could easily manage this number and type of properties part-time while traveling and enjoying life. A third-party property manager could make it even more passive.

- Low deflation risk. Even in the next Great Depression, rents could be lowered or even bartered for goods and services, if needed.

- Benefit from price and rent appreciation if and when it comes.

Negatives:

- Higher equity capital requirement ($1,200,000) means it could take longer to reach retirement goal.

- Less attractive inflation hedge compared with a leveraged portfolio (although growth is less of a concern in a mature portfolio as long as it generally keeps up with inflation).

I have used two extremes in these examples to demonstrate the positives and negatives. In real life though, it may make more sense to mix the two (which is more like what my business partner and I have done). You can and should adjust the basic principles to the reality of your situation and to your comfort level.

Now that I’ve shared some general examples, let’s move on to your situation. I’d like to share 5 steps to calculate the number of rental properties you will need to retire.

Step #1 – Calculate Your Current Personal Expenses

Financial blogger JD Roth says your current expenses (and not your income) are the best starting point to figure out how much money you need to save for retirement. Once you know your current expenses, you can then make adjustments (like for inflation) to figure out your future needs.

This makes sense, of course, because financial independence means owning investments that pay your living expenses. Free from the need to work for money, you can then do what matters.

The problem is that many of us don’t really know our personal expenses. Sure, you spend less than you earn. And you probably save a lot of money too.

But if you want to gain extreme confidence in your plan and possibly retire earlier than you thought, you need to know your expenses with more certainty.

Tools to Help You Calculate Your Expenses

If you’re a financial nerd like me, you will probably already know your current expenses and even have a detailed spreadsheet! But if you’re not a nerd yet, here are a few tools to help you get started calculating your personal expenses:

- Spreadsheets – this is always a very simple, effective, and flexible tool to track your expenses. You can use my personal finance spreadsheets by getting my updated and free Real Estate Investing Toolkit.

- Mint.com – This is a free online tool from Intuit that automatically tracks your personal expenses by pulling data from your bank accounts and credit cards.

- YNAB (You Need a Budget) – This is a paid software app that has more bells and whistles than Mint. I have not used it personally, but you can read a good review from my blogger friend J Money at budgetsaresexy.com.

If you have not calculated your expenses before, just know that it won’t be a quick 60-second exercise. But it’s not overwhelming either. I recommend scheduling a few hours on a weekend to really dig into the numbers.

But for now, just make an educated guess and let’s move on to the next step.

Step #2 – Adjust Expenses For Retirement (if needed)

Will you spend more, less, or the same in retirement? Of course, that depends on your situation. But don’t be surprised if the total expenses are less than you spend during your working years.

Why would this be so?

What if you own your residence free and clear? Won’t that save you money?

What if you earn most of your income from rentals sheltered by depreciation? That’s the point of this article, right? You’ll pay a LOT less in taxes with sheltered rental income compared with the high salary years at work.

Other Examples of Savings

In addition, what if the free time and flexibility you have as a retiree allows you to negotiate much more than before? When you’re working a job 50 weeks per year, that 2-week vacation in the summer will be expensive. However, when you have many months of free time, you can choose to travel during the times of year and to the places where you find good deals. There are many more examples of savings just like this.

But in the end, you’ll want to make an estimate you’re comfortable with. For some real numbers and perspective, you might enjoy “How Much Will It Cost You to Live in Retirement” by Darrow Kirkpatrick at CanIRetireYet.com.

Step #3 – Estimate Other Sources of Income

Will you have other sources of income when you retire? Or will rental properties be your only source?

Other sources could include:

- Social security pension (for those of us old enough to receive it)

- Employer pensions (more rare today than ever)

- Stock dividends

- Interest from bonds

- Interest from personal loans or crowdfunding sites like Lending Club.

- Annuities

I tend to heavily concentrate in one sector (real estate). I do like Warren Buffett says and “put my eggs in one basket and watch them very closely!” But I plan to continue diversifying over time. So, an estimate of other income sources makes sense.

And if real estate investing is only a small part of your overall retirement plan, this is where you incorporate the other income streams from your portfolio. Mixing and balancing those will take some thinking and perhaps some professional advice. But real estate can be the solid and steady source of income at the core of your plan.

Step #4 – Create a Profile of Your Retirement Rental Property

Earlier in this article, I described what a retirement rental property looked like for my example. I included characteristics like:

- The property type

- The general location within the country

- The specific location within a region

- The price range

- The cost and debt structure

- The rental income, net operating income, and cash-on-cash return

At a minimum in this step, estimate the cost, debt structure, and cash-on-cash return for your rental properties. The cost and debt structure can be figured out with your real estate agent and with your mortgage lenders, respectively.

Cash-on-Cash Return

For the cash-on-cash return, I don’t recommend going below 6%, even on a free and clear property in a quality location. On the other hand, I also don’t recommend assuming you will get larger returns like 15-20%. Although those yields are possible and I have achieved them, it is better to build a retirement plan on a more conservative foundation.

This upfront work is really the blessing and the curse of real estate investing. Few people will choose to do it, but that leaves you with less competition because you will!

Step #5 – Calculate Rental Properties Needed to Retire

Now we’re back to the simple math and three variables from the beginning of the article.

- Your estimated expenses in retirement (E)

- Your wealth (aka equity) invested in real estate (W)

- The yield or cash-on-cash return on that equity (r)

In this case, you already have #1 and #3 from prior steps, so you need to figure out #2 – the wealth to invest.

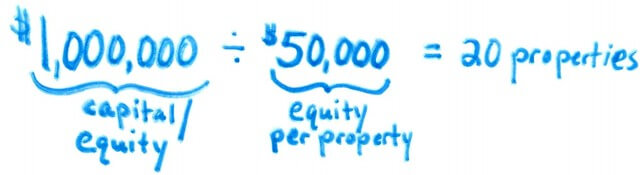

For example, if you want $80,000 income at retirement and expect to get an 8% cash on cash return, you need to invest equity of $1 million.

W x 8% = $80,000

W = $1,000,000

With that number in hand, your final calculation depends upon the property values and the debt structure you’ll choose.

For example, if the properties in your market will cost $100,000 and if you plan to own them free and clear, you’ll need 10 rental properties.

But if you plan to have 50% leverage and the properties cost $100,000, you’ll need to own 20 rentals.

The point of this step-by-step process was to focus your financial goals down to a certain number of rental properties. Your goals may vary, of course, but I highly recommend you try the process for yourself.

How Many Rental Properties Do YOU Need to Retire?

So far I’ve shared the simple math of real estate retirement, two examples of rental retirement portfolios, and 5 steps to calculate the number of rental properties you need to retire.

Will this be a perfect prediction of your retirement rental income? Of course not. But it doesn’t need to be perfect in order to move you towards your goals. A solid, approximate goal will do the job.

But most importantly I hope this information will give you confidence and a solid framework. You can then build upon those to create a retirement income from rental properties for yourself.

Keep in mind that this article primarily shared the end result of a retirement plan. If you want case studies and articles that explain how to grow your portfolio and move towards retirement, I’ve got more reading for you:

- Case Study: Financial Independence Using Real Estate Investing

- My Rental Retirement Strategy (or How to Not Run Out of Money)

- The All-Cash Plan to Free & Clear Real Estate

- The Snowball Plan to Free & Clear Real Estate – The Snowball Plan

- The Buy 3, Sell 2, Keep 1 Plan to Free & Clear Real Estate

>>> You can also buy my book, which has all of my best advice (and 25 case studies!) all in one neat, portable package! It’s available in print, digital, and Audible on Amazon. <<<

I wish you a successful journey towards rental retirement income!

How many rental properties do you need to retire? Were these examples and steps helpful for you? What do you think about using rental income to fund some or all of your retirement?

I look forward to receiving your comments below!

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Chad, awesome article!! This is filled with tons of clear steps to get to financial freedom. The examples with and without debt are very powerful. I love it!!

Thank you, Buddy! Glad you liked it. There is no one right way to do it, so I wanted to give alternative options and encourage investors to land wherever makes the most sense.

I know you are aware from our offline conversations, but we have seven properties. We own three free and clear, and all of them are nice cash-flow-ers which cover all our basic living expenses, they have very good ROIs from our cash outlay and they’ve all significantly increased in value. Another one, we live in, so we pay the expenses, but will be a good investment when we leave to travel. Another two were previous residences from my partner and I before we met, and they barely cash flow, but we are paying down the mortgages each month with these and have significant equity in each for when we decide to sell. They are also Class A and always rented with good tenants. The last property also does not cash flow and is far away from us. We want to offload that ASAP. For us, we want to sell the three non-cash-flow-ers and then invest in just another 2 properties that cash flow. So, for us, seven properties is just fine. If we buy more, it will be more for fun than anything.

I also do diversify by maxing out my IRA every year. But after that, all investing goes toward our real estate.

Yeah, I like the approach you’re taking. And I like that you’ve just kept moving and learned from each deal as you go. Selling off the high equity/low cash flow deals makes a lot of sense to top-off your cash flow to really be set at 7 free and clear properties. Awesome! It’s a lot of fun to see other people really doing this, because it gives examples to everyone out there who are thinking about it or just getting started.

Yes, I love it! It doesn’t sound all that hard to get there…

As you noted in the positives for the financed route, there are other ways the properties will make money (Step #3 – Estimate Other Sources of Income). So you won’t really need that many if you are willing to sell as you go along (accessing that amortization and leveraged appreciation). Maybe you need 28 for cash flow at the beginning, but after a few years of appreciation, could sell 1 to pay off another 1 completely. Rinse, repeat.

Yeah, great point Brian. My 28 property example is a little extreme in that most people would buy-sell along the way so that they don’t have to own so many. But somewhere in between or on either end most of us can find a sweet spot to shoot for.

Thanks for commenting!

Great article Chad. Thanks for sharing.

Thanks Jay!

Great stuff, thanks Chad! I know you have written on this topic from a few different angle but this was your best work in my opinion. You laid out very well for us how to do the thorough analysis as well as some great real world examples of how to apply it. Extremely timely info as I was wanting to go into “pay down mode” of the debt that we have but in reading the article numerous times, that won’t get us exactly where we want to be. I really appreciate you sharing this information and keep it coming!

Thanks Sean! I’m glad this helped you analyze your own situation. That’s the most important reason I wrote it. Good luck with the next step!

I got drawn into the article, because I was thinking, “It’s not the number of properties… it’s the value of the properties.” You did a great job of covering that though.

One area that I always find difficult is calculating cash-on-cash return on our properties. We have 15-year mortgages. It’s a better interest rate and we are happy to give up some return now to be free and clear in 11 more years. Our rental income from the property is minimal now, but will drastically increase.

For example, we put down around $20K for a $95K condo 4 years ago. It rents for around $1000/mo. after the condo fee (which covers some of the maintenance obviously). Our rental income might be around $100/mo. ($1200 annually) after maintenance. When the mortgage is paid off, it will probably be $800/mo. (call it $10K a year).

It feels like there are two cash-on-cash returns, mortgage and port-mortgage. I’m not really sure, what the rates are, but I’m comfortable in spending $20K 4 years ago, to have $10K a year for life 11 years from now. We have 3 properties that I conservatively estimate will bring in 35,000-40,000 a year (and adjust with inflation). Two of the properties were our homes that became rental properties when we moved.

The calculation that I care mostly about is the income in 11 years.

You bring up a good point. I always look at cash on cash return first because I like the discipline of having some cash flow for unexpected issues. But like dividends with stock investing, the bulk of the growth can come from other places – like in your case – principal paydown. The 11 year income really is the most important thing. So I love your plan in that way. It’s buy 3 properties, set it, and look-up in 11 years to an income for life. Very cool!

Well, my wife bought her condo to live in in 2003. I bought mine for the same reason in 2005. We merged our lives and moved across the country for a job opportunity. They became investment properties, because there was no point in selling them in that market of 2007-2008. We got them both refinanced to a 15-year about 5 years ago.

The one we bought 4 years ago was the only one bought for investment. That was actually fairly difficult because we already had 3 properties (the house we live in). I can’t imagine how someone would get loans for 28 properties like in your example above. I imagine the bank would require them to have a few million around (which kind of defeats the point).

Turning a residence into a rental makes a lot of sense. Especially in a down market like you said.

The 28 loans would be almost impossible at 30-year, fixed conventional financing. You’d have to start looking at commercial/in-house lenders like at a local bank. And the terms would not be as attractive as they typically have an adjustable rate or a balloon. So like I said in the article, the financing would be the biggest reason not to go for the 28 deals.

Thanks for commenting.

I am in a similar situation to Lazy Man and Money. Two condos owned and rented (with my wife); we live in our own home and would like to buy another property. Maybe even move out of this one, rent it, and buy another. So in a way follow your plan. But I don’t see how we would get approved for another mortgage based on our income and the stress test the banks (we live in Canada) would put us through when we’re looking to borrow and follow your plan. In short, I don’t understand how without significant existing equity any of these plans could work.

This article was shared with me by my mortgage broker so I was excited to read your article but I am wondering if it was sent in error and that the article is actually not meant for an average income earner.

I have 25 renters across 8 properties. With a multifamily, you can definitely make more than your numbers show.

Agree on the multi-family comment. I think it’s a balancing of low-hassle with SFH vs more income and potentially more turnover and hassle with multifamily. I’ve leaned towards multifamily myself.

Hey Chad,

I would log to get a chance to chat, I have came to my own conclusion recently that this is the path I want to take and am actively in the process of gaining knowledge and capital to take a leap into real estate investing…my rough plan is basically in the same manner you lay out.

P.S. I am also going into it with one of the reasons being to eventually be able to teach others as well in my local community, interested in your thoughts on how/when to approach that.

hey James!

Thanks for commenting. Exciting that you’re doing the preparations for jumping into real estate investing. The knowledge and the capital are certainly two important places to focus. The other is your network – which you’re beginning by commenting here!

Feel free to contact me at http://coachcarson.com/contact if you’re interested in a 1-1 coaching strategy session to work on a plan for your situation.

I love the idea of learning and applying these ideas so that you can share with others and teach. That’s been exactly my motivation for a long time. It’s never to early to do that. I have blogger friends who write about their journey from the very beginning. Every step of the way is valuable to others, and your perspective will be unique and valuable to many people.

Hi Chad,

Thank you so much for sharing this. I truly find your article helpful and very easy to understand, especially for those who are new to this business. I have been thinking about venturing into real estate because I have a property big enough for me and my partner, and I wanted to renovate this property in such a way that I can construct 8 studio units at least to fund our retirement.

More power to you and your team.

Love,

RIA

Hi Ria! So happy to hear the article was helpful. Thanks! And I love the idea of converting an existing structure to a multiunit rental. You may have already done this, but be sure to begin by checking with your local code enforcement/building official in your town to understand all of the rules with conversions. Sometimes it’s not allowed, and even when it is you may have some hoops to jump through. But it could be worth it! Good luck.

Hi Chad,

Great site, good info, however, on your ” Free and Clear Rental retirement property” example, the math should be $5,000.00 ($12,000.00 – $7,000.00) Total net positive cash flow/month not $7,000.00 unless I’m missing an expense somewhere along the line.

Hey Rob,

Thanks for reading and commenting. The $7,000 in the free and clear example was actually net operating income and not the expenses. The way I presented it, however, I can see how it was a little confusing. So, I’ve added a line item to show the $5,000/month expenses. Thanks again for stopping by!

Wow those articles were just what my partner and I needed!! So great

Thanks

J2 sikma 🙂

glad to hear it! thanks for stopping by Joanie!

Great stuff which now brings a question.. I am 63 and my son 35. He asked me if I was interested in investing in rentals with him. This sounded good so we started looking around. Based on your experience I understand we should do the math first I like that approach which I am a numbers guy so I know my expenses. Now my question given I am 3 years from retirement am I getting into this to late? Is there some way to figure at what age do you begin buying rental properties? Fantastic info thank you for sharing.

Wooow,

i feel so poor right now. Those figures are NOT comparable to the situation in germany. Reality in germany is more like this: 400.000,-€ cost for the house (with Property), plus 6% to 8% real estate seller fees, plus 6% to 8% buyers Taxes. Equals around 464.000,-€ in costs. (in an ok neighborhood, not in the city). Earnings then are around 1500,-€ to 2000,-€ (max) per Month equals 18.000,-€ to 24.000,-€ a year. So 2000,-€/month income -900,-€ credit -500,-€ in expenses gives you a cool, like 600,-€ a Month for an investment of almost half a million bucks.

So at the end of the day you make a whapping 1,5% profit.

(4%~5% if you payed of your mortgage after 20 or 30 years)

What bugs me most is that the bank (for the loan) won’t do the math with all of your rent income. They just calculate with 50% (max) of your income from rent. So you will have to pay off mortgage for ever, plus the max amount of interest (3,5~4% interest rate minimum) that accumulates in the meantime.

I do that business for 20 years now, in third generation, but i start failing to see why i even do that “job” any more.

Plus i live in the country with the highest tax rates. Not just in europe but in the wold, highest income tax, plus 19% sales tax, the highest electrical bills, highest real estate taxes, high heating expenses (whether oil or gas), most expensive internet connection (50,-€ a month!!), additional television connection contribution (GEZ) (just another television tax) 200,-€ per year, and so on, and so on.

Oh, and not to mention it’s ~4,95 € a gallon (U.S.) gasoline in my country. Got to love it.

Why do i even do that any more ?

Oh i almost forgot the very strict building laws. It can take years before you get an building permit. If you even get one. Oh, and you for sure can’t just raise rent as you wish (or need). That’s regulated by a rent index (called Mietspiegel) accessible at your local town hall. Cause where would we get when everybody could set the price for lending his property by himself ? Capitalism ? No, not in my country tho….

So in short, i’m very envy right now for those opportunities you guys have over there.

And i wish everybody just the best for all of your future investments. And now i have to go, crying myself into sleep.

Dude. Socialism sucks.

Your math is off on your video. When you divide, numbers get smaller not larger. 🙁

Chad, great article. You make the equations easy. There is one thing I disagree with and that is needing (wanting) less money during retirement. We have more free time, 3 adult children and so far 4 grandchildren. We want more money! We hope to leave an inheritance for our children and we save for our grandchildren’s education. Of course, we love spoiling them a bit too. For ourselves, we want some of the things we couldn’t have while raising our children and we want to travel more.

We own our rental properties and have increased our income every year, as well as our net worth. We are very confident that we will be able to maintain our life style for many years and enjoy our retirement years. We know our children will never have to support us financially, and we can be retired and still bring in a pay check. I can’t think of anything better than that!

How much you’ll need/want is certainly very personal, Terry. Thanks for sharing your own fantastic reasons for wanting to earn more. I agree that leaving that kind of legacy and enjoying life in the meantime are wonderful.

Hey Chad, thanks for the video. Say rent is 2100 / month in Toronto because it isn’t cheap and expenses are 1700 leaving me with 400$ rent/property/month with 4800/yr. Say I sell 15 properties, i would not even get a good lifestyle of traveling the world living off of 72,000.

Hey Chad, thanks for the video. Say rent is 2100 / month in Toronto because it isn’t cheap and expenses are 1700 leaving me with 400$ rent/property/month with 4800/yr. Say I sell 15 properties, i would not even get a good lifestyle of traveling the world living off of 72,000.

I have never though about the number of rental properties for my retirement. The fact is that, I don’t have any property for renting at this time.

Thank’s, it’s a great thing that this article suggested the importance of 6 steps to repaying reverse mortgage after death

Chad,

Good article. Puts in perspective, for me, what is needed. My wife and I have two 401(k)s we take advantage of the company matches. Further, we max out one HSA and currently have one Roth IRA. Given that the retirement funds don’t kick in until 60, my main concern would definitely be the 40-60 range when kids are going to college, getting married, buying cars, all the good stuff.

Would like to see depreciation, one of the biggest potential write offs, mentioned as part of the equation, as that will lead to cash in the bank by decreasing taxable income.