This article was inspired by a series of posts by fellow early retirement bloggers about how to live off your wealth during retirement (thanks, PoF and Fritz for getting it started). They called this a retirement drawdown or withdrawal strategy, which, by the way, could be very different than your strategy to build wealth. I touched on my withdrawal strategy in How to Retire Early & Confidently Using Real Estate, but I will go into more depth in this article.

For me, a good retirement withdrawal strategy has two primary goals:

- Pay for all your current living expenses

- Not run out of money in the future

It turns out that rental income and other real estate investing strategies work great to achieve these goals. And real estate can make a big difference whether it’s a small or large portion of your overall portfolio.

So, in the rest of the article I’ll share ideas on how to use rentals for a retirement withdrawal strategy. Here’s a table of contents to help you navigate to the different sections.

No Perfect Plans

As you read this, keep in mind that I am not an authority figure or guru who has this all figured out. I currently live off of my real estate investments in my 30s, but I’m learning and growing as I go. Many of the ideas I’ll share below I learned from more experienced investors and teachers.

Also, keep in mind that a withdrawal strategy could vary significantly depending on your age, ability to work if needed, and personal preferences. There is no perfect early retirement withdrawal plan to copy.

Instead, a perfect plan for you should be flexible and dynamic. You’ll probably continue to tweak and improve it throughout your life. So, take and adapt the concepts here that you like, ignore the rest, and let what matters to you be the ultimate guide.

Let’s start by looking at the basic challenge of living off your investments in retirement.

The Challenge of Living Off of Your Investments in Retirement

If you’re living off the income from your investments, the biggest fear is usually running out of money. Your investments are like a large lake or reservoir full of water. When you are working, you save money and continually fill the lake up. But when you stop working (or go part-time), the reservoir has to support you on its own.

When you’re building financial reservoirs, it’s not acceptable if the reservoir dries up before you and your loved ones do!

In the past, pensions were a primary solution to this challenge. People retired in their 60s, and if they were lucky, a pension (typically from a former employer) comfortably paid their bills until they died. The former employer withdrew from its own pension reservoirs so that the retirees didn’t need a large reservoir of their own.

But outside of military and some other government worker plans, pensions are by and large a relic of the past. You must create your own pension. The primary exception is social security income, which begins at the retirement age of between 62 and 67 for those born after 1960. You can estimate your future social security benefits here.

But most people are living much longer than before, and social security income doesn’t usually cover all of their living expenses in retirement. So, a personal reservoir of retirement savings is still a necessity. And for those leaving full-time work earlier in life, like in their 30s or 40s, social security income isn’t even a part of the solution until much later.

So, the plan for most of us is to build up our own reservoir of savings as large possible. This is also called building wealth. You can read how to do this with the power of your savings rate and my real estate wealth building plans.

But how will you know if you’ve saved enough to support a withdrawal plan for the rest of your life? Let’s take a look.

Do I Have Enough Saved For Retirement?

You may have heard that a nest egg of 25x your annual expenses is a reasonable goal for financial independence. So, if you have personal expenses of $60,000/year, you need $1.5 million of investment savings according to this rule of thumb.

The source of this “25x expenses” goal is something called the 4% rule. It’s a rule of thumb that says you can withdraw about 4% of your investment portfolio each year without it running out (4% x 25 = 100%, thus 25x). With a traditional portfolio of stocks, bonds, and mutual funds, this rule of thumb usually assumes the 4% withdrawal will come from a combination of dividends, interest, and some sales of assets.

If you want to learn more, The Ultimate Guide to Safe Withdrawal Rates over at earlyretirementnow.com is the most detailed and nuanced explanation of retirement withdrawal strategies and the 4% rule I’ve ever seen. But I’m warning you, the author Big ERN is SMART, and his graphs, statistics, and explanations may have your head swimming on first reading!

The subject is complicated because the withdrawal strategy counts on, at least in part, selling investment assets in order to pay out that 4% annual withdrawal. And this makes you vulnerable to something called the sequence of returns risk. This means that if you sell at the wrong time, like right after a major stock market crash, you could permanently disable your portfolio.

While I’m fascinated with the 4% rule discussion, it’s honestly never been a major concern for me as a real estate investor. Real estate isn’t perfect and has challenges of its own, but it does give you a major advantage when living off your assets. The right real estate investments tend to produce income at a much higher rate, while also offering a reasonable inflation hedge if you choose locations well.

This combination of factors allows you to build a simple real estate portfolio where you never have to eat into your investment principle. And I’ll explain why that’s important below.

A Simple Rental Income Retirement Strategy

Let’s say you buy a single-family house in an economically strong metropolitan area. In my experience, a well-trained real estate investor can eventually find properties that produce between 5% and 10% unleveraged rental income yields (i.e. cap rates).

And based on historical real estate appreciation rates, your rent on these well-located properties may keep up with inflation. This means your rentals should be able to buy the same amount of lifestyle in 30 years as they do today.

So, the right real estate investments allow you to have a withdrawal strategy of more than the traditional 4% rule for the same money invested. This allows you to pay for your lifestyle expenses with more ease (goal #1 of a good withdrawal plan). And at the same time, you’re not eating into any of your principal.

And why is not reducing your principal important? Because when you never reduce your principal, it’s kind of hard to run out! And not running out was my goal #2 of a withdrawal strategy.

This approach also makes the early retirement math a lot simpler. As I explain in How Many Rentals Do You Need to Retire, you don’t need a fancy retirement calculator with rental properties. When your real estate investments produce enough net rent to safely covers your lifestyle expenses, you can relax a little bit.

And after reaching this milestone, there is little need to sell investments to support your living expenses. You may choose to sell for other reasons, like improving your portfolio. But overall you can be a patient, opportunistic investor who can hold on even when property values drop.

But you might rightly point out that traditional assets like stock, bonds, and CDs produce income too. Can’t you use the same approach of not touching the principal with those investments? Let’s take a look.

Non-Real Estate Plans That Don’t Touch the Principal

You could use a non-real estate portfolio to produce enough income to fund living expenses. And that’s actually what dividend stock investors do. They pick a portfolio of individual stocks that pay higher than average dividends, and the income performs in a similar way to rental income within a withdrawal strategy.

But other assets like a bank certificate of deposit (CD) and broadly diversified funds of stocks or bonds give a much lower income yield (at least as I write this in 2018). This means you’d have to save a LOT more money or reduce your living expenses in order to live off income and not touch the principal.

As of January 2018 when I’m writing this, the dividend yield on the S&P 500 index is only 1.73%. The rate on ultra-safe 10-year U.S. Treasury bonds is slightly higher 2.55%. And the interest rate on the best, FDIC-insured 5-year bank CDs is 2.45% according to BankRate.com.

So, if you wanted to live on dividends of the S&P 500 without eating into principal, you’d need to save about 58x your annual expenses (100% / 1.73% = 58). So, annual expenses of $60,000 would require investment savings of almost $3.5 million!

With a portfolio of 10-year treasury bonds at 2.55%, you’d need about 39x your annual expenses. So, annual expenses of $60,000 would still require investment savings of $2.34 million.

On the other hand, with a portfolio of single-family houses with rental yields of 6%, you would only need savings/equity of 17x your expenses. So, with annual expenses of $60,000, you’d only need investment savings of a little over $1 million.

That’s a big net worth difference for the same income-producing result!

But this isn’t a battle between real estate investing and other assets. Every asset has its pluses and minuses and proper place in an overall diversified portfolio. But even with diversification, I like the idea of using real estate as a foundation or income floor for the rest of the portfolio. Let me explain how.

Build an Income Floor, Then Invest for the Upside

Some of my best learning about retirement planning and withdrawal strategies came from an excellent book called Can I Retire Yet by Darrow Kirkpatrick. In the book, Darrow recommends a hybrid approach where you first build an income floor to cover your essential expenses. Then he recommends upside investing to provide for discretionary expenses, future uncertainties, and inflation.

Darrow describes the difference between essential expenses and discretionary expenses as follows.

For me, essential expenses allow for a small condo or townhome, food, insurance, medical care, taxes, and utilities. That works out to about 60% of our current retirement budget. The rest is discretionary spending, and could be foregone or cut way back if necessary, especially later in retirement.

To cover the essential expenses, Darrow likes to build an income floor with safe, consistent, income-generating assets like annuities, pensions, and social security income. These assets do not always provide inflation hedges or a lot of personal control over performance, but they do lock in guaranteed income and give predictability and security to your financial life.

And to cover discretionary expenses and uncertainty in the future, Darrow also invests in the market where you benefit from growth but also have some downside risk. You can see Darrow’s complete 2018 investment portfolio here, which is a diversified mix of funds that hold stocks, bonds, commodities, and cash.

Darrow’s approach does not get into real estate investing. And I’ve got no arguments with how he does it because it works very well for him and others. But what I want to explore is how Darrow’s floor + upside concept can be applied beautifully by those of us who like to use real estate investments.

Using Free & Clear Rentals to Create an Income Floor

An income floor must be built on sources that are consistent and safe. The point is to remove as much risk and unpredictability as possible. This way you can sleep comfortably knowing your basic expenses are covered.

My favorite way to create an income floor using real estate investing comes from a long-time teacher and mentor of mine named John Schaub. In his book Building Wealth One House at a Time, John explains something I’ve called the free and clear real estate goal.

Basically, the idea is to own a small portfolio of safe, easy-to-manage rental properties (likely single-family houses in quality neighborhoods) that have their mortgages paid off.

Why no debt? Because it reduces your risk, increases your income, and simplifies your life.

Why single-family houses in quality neighborhoods? Because they tend to attract tenants who stay the longest, pay on time, and are most self-sufficient. And that translates to less time and hassle with property management.

Houses in quality neighborhoods have the added benefit of being more than an income floor. As I said earlier, if you chose your location well, there is a good chance the price and rents will increase with inflation over time. But even if they did not perfectly keep up with inflation, the security of their steady income is the main point.

Let’s look at the numbers for a simple portfolio of 6 free and clear houses.

The Retirement Income Numbers With 6 Free and Clear Houses

Let’s say you owned 6 single family houses that each rented for $1,500/month. To be conservative, let’s assume your operating expenses and savings for future capital expenses cost 50% of your rent. So, you’ll net $750/property each month after all expenses (not including income taxes).

With those numbers, here’s what your retirement income floor would look like:

| Retirement Income Floor – 6 Free & Clear Houses | ||

| Investment | Net Rent/Month | Net Rent/Year |

| House #1 | $750 | $9,000 |

| House #2 | $750 | $9,000 |

| House #3 | $750 | $9,000 |

| House #4 | $750 | $9,000 |

| House #5 | $750 | $9,000 |

| House #6 | $750 | $9,000 |

| Total | $4,500 | $54,000 |

Would $54,000 be enough to cover your essential expenses? You’ll have to decide that for yourself. But remember that Darrow in Can I Retire Yet said his essential expenses (not including discretionary expenses like travel, eating out at nice restaurants, etc) were about 60% of his total budget. So, be sure to differentiate between the two types of expenses.

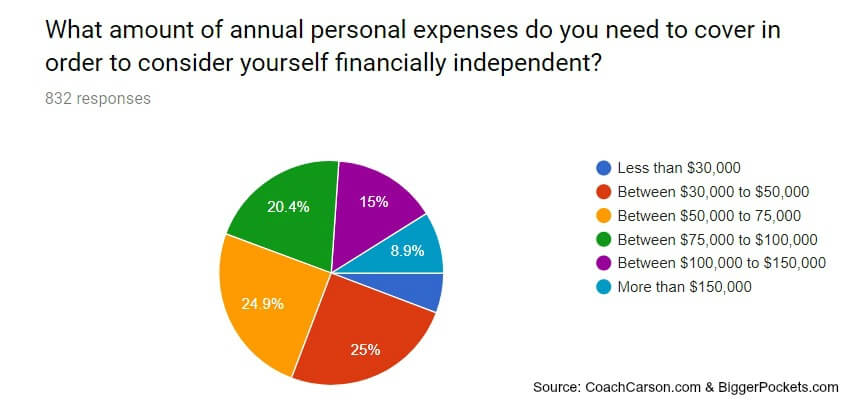

And even if you include all of your expenses, a small number of houses may be enough. In a recent survey that I conducted for my upcoming real estate early retirement book with BiggerPockets.com, 832 aspiring or current real estate early retirees shared the expenses they needed to cover in order to reach financial independence. Here’s a chart of the results:

Over 30% of respondents needed less than $50,000 per year, and over 75% needed less than $100,000 per year. That means most people would cover all of their expenses with between 5 and 12 houses using my example numbers above. And I can tell you from personal experience, self-managing that number of properties is a VERY part-time retirement job (like less than an hour per week). And hiring 3rd party managers would even reduce that.

It will be your choice how much of an income floor is necessary. If your absolutely essential expenses are $36,000 per year, then 4 of the houses above would be all you need. If you need $100,000 per year, you’ll need a lot more.

And you’ll also want to judge where you are in life. If you still plan to work for another 5 years, you may not need to lock-in an income floor yet. Growth may still be your priority. But if you want to leave an income-producing job as soon as possible, an income floor is a top priority.

Once your income floor is in place, then you can also build up investments for the upside.

Investing For the Upside

Investing for the upside means you continue to prioritize long-term growth of your wealth. This gives you the flexibility to pay for discretionary expenses. It also allows you to contribute to important causes, leave an inheritance, and prepare for the unknowns.

In many ways, the approach is similar to the investing you did to build wealth in the first place. You’ll need to find an overall growth strategy for the portion of your wealth not invested for the income floor. And it will need to meet your personality and risk tolerance.

One of my core strategies has been investing in quality real estate leveraged with safe debt. So, that will continue to be part of my upside investing approach, especially with inflation as a possible future challenge. But as my investment portfolio becomes larger, I continue to reduce the overall percentage of leverage. I’m closer to 50% leverage now. But over the long run, I’m moving towards a more comfortable 25% of my overall portfolio.

I also invest in my self-directed IRA with private notes, limited partnership investment properties, and broadly diversified stock index funds. For an early retiree who doesn’t touch these funds, retirement accounts are perfect for upside investing vehicle.

I also see entrepreneurship as upside investing. Within real estate, I occasionally flip houses, develop properties, and otherwise create wealth with my efforts and knowledge. This is something I can continue to do my whole life at a pace that’s fun for me. And outside of real estate, I’m slowly but surely building the revenue of my Coach Carson business with online courses, a few affiliate products, and 1-1 consulting.

A business or part-time work that you enjoy can be great long-term wealth builder. You can use it to cover your discretionary expenses and to hedge for the future. But as I’ve found out, this is very different than traditional work. With an income floor in place, this kind of work is much more fun, flexible, and on purpose.

One final consideration in my withdrawal plan has to do with backup plans and flexibility.

Flexibility and Lifeboat Strategies

So far, the plans I’ve laid out may seem neat and tidy. But I realize that life is uncertain. Major changes could occur in both my life and the world around me. So, backup plans and flexibility must be a key part of a long-term withdrawal plan.

First of all, both in my personal finances and businesses, I like to keep cash reserves. My preference is to keep the equivalent of 3 months of expenses. In my real estate business, this typically gets even larger.

Cash reserves are particularly important for a real estate investor. Properties can’t be converted into cash in a pinch as easily as other assets types. So, you need cash for the inevitable uncertainties of the market.

Second, I prefer not to have any personal debt. We don’t have any credit card balances, car debt, or other personal loans. I still have a mortgage on my principal residence, but my wife and I are considering paying that off.

Eliminating debt makes your financial life safer and more flexible. Yes, those funds could be invested for more growth. But as my blogging friend John at ESImoney.com says, when you’ve won the game, it’s time to stop playing. Simplicity and safety become a higher priority than growth at some point.

Third, I love another idea from Darrow Kirkpatrick at CanIRetireYet.com called “lifeboat strategies.” It made Darrow sleep better at night to create backup plans. Essentially he was defining nightmare scenarios and using pessimism to his advantage.

Lifeboat strategies should be both ways to increase income and reduce expenses. Here are a few of mine:

Income:

- Sell properties to raise cash quickly

- Refinance properties to raise cash quickly

- Annuitize assets to withdraw both interest and principal

- My first choice would be selling a property or two with owner financing

- I’d also consider an annuity (the good kind), especially as a plan for my heirs if I die or can’t actively manager investments

- Work (especially while still young) – Both my wife and I could pursue active income much more than we are now

Expenses:

- Use location arbitrage – expenses are not the same in different locations. If you’re in a big city, move to a small city. If you’re in the US and healthcare is too expensive, move to Costa Rica or Ecuador. This could just be temporary, and it could also be a lot of fun

- Move to a smaller residence – like a condo, townhome, RV, or tent (ok, not for most of you – but I’ve considered it!)

- Take cheaper vacations – use travel hacking and other creative ways to have fun without spending much money

Finally, I think it’s most important to keep your own mind flexible. YOU are your #1 asset, no matter how big your net worth. So, stay healthy, never stop learning, ask questions, and keep an open mind. As long as you’re still alive and sharp, you can adjust to the punches life throws at you.

Conclusion

You’ve now seen my early retirement withdrawal plan built around real estate investing. If you’re still building wealth, just let these ideas simmer until you need them at a later date. And if you have enough wealth already and want to use real estate as part of your withdrawal plan, I hope these ideas will be helpful for you.

Remember that there are no perfect plans. The goals are to cover your personal expenses and never run out of money. But the methods to accomplish the goals may vary.

Build your withdrawal plan around your own strengths and investing preferences. And then be open to changes that improve your strategy as you go. This evolution has been a fun part of my own process thus far. And I’m sure I’ll continue to update my thinking and strategies as I go.

Other Blog Posts in the #DrawdownStrategy Chain

As I mentioned in the beginning, I’m not the only one who has written about this. At least 20 other interesting and intelligent bloggers have shared their own drawdown or withdrawal strategies. Most are not real estate investing based, which makes them even more interesting. You learn the most from those outside your circle of competence.

So, I recommend you check some of them out.

- Our Drawdown Plan in Early Retirement by Physician on Fire

- Our Retirement Investment Drawdown Strategy by Retirement Manifesto

- Retirement Master Plan by Othala Fehu

- Planning for Success: Drawdown Versus Wealth Preservation in Early Retirement by Plan.Invest.Escape

- The Groovy Drawdown Strategy by Mr. Groovy

- The Nastiest, Hardest Problem In Finance: Decumulation by The Green Swan

- Show Me the Money: My Retirement Drawdown Plan by My Curiosity Lab

- Early Retirement Portfolio & Plan by The Financial Journeyman

- Our Drawdown Strategy by Cracking Retirement

- Our Unusual Early Retirement Drawdown Strategy by Retire by 40

- The ERN Family Early Retirement Capital Preservation Plan by Early Retirement Now

- Mr. 39 Months “Drawdown” Plan by (you guessed it) Mr. 39 Months

- Drawdown Strategy — Joining the Chain Gang by 7 Circles

- How I’ll Fund my Retirement by Ms. Liz Money Matters

- Rich’s Retirement Plan: Playing BINGO Will Not Be A Source Of Income by Penny & Rich

- DDD Drawdown Plan Part 1- Living with a Pension by Dads Dollars & Debts

- Saving Is The Easy Part: Our Retirement Drawdown Strategy by Atypical Life

- 5 Steps for Defining Your Retirement Drawdown Strategy by NewRetirement

- Practical Retirement Withdrawal Strategies Are Important! by Maximize Your Money

- Drawdown Strategy | Retirement Manifesto podcast by ChooseFI

I’d love to hear from you in the comments below. What do you think of the withdrawal strategy I’ve outlined? Is real estate part of your pan? How is yours similar or different? What are your core strategies to live off your assets and ensure they never run out?

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Love this post. We own outright 4 Properties that spin off 50-60k a year. I agree a hundred percent with what you have described.

Thanks Doc! I love the simplicity and financial impact of your 4 properties. How long did it take you to get free and clear? Did you just buy them that way in the beginning?

We bought the first outright as a city place to use on the weekend. It was a Condo. After 6 months we didn’t use it so rented out. Then the market crashed and we bought two foreclosures with cash and a small line if credit. The first was a Condo and rented quickly. The second was a Lake house. We remodeled it, rented it out for three years, and then sold it to a neighbor without realtors for a 200k profit. We then 1031 the cash into 2 more condos. All four are rented. We collect $9500 a month but have HOAs, Insurance, tax. Condos, however, are low maintenance and easy to take care of.

Very interesting. Thanks for sharing. I love that there are niches for everyone. I have not purchased condos, but I’ve now talked to you and a couple of others who’ve used them as an integral part of their financial independence plan.

Great post! Thanks for adding to the withdrawal strategy series! It’s amazing that the rental strategy isn’t used more in early retirement. It seems like such a natural fit: income that’s roughly inflation protected (and right now rental inflation actually grows at CPI inflation+1 or 2% nationwide!!!) and you avoid digging into principal as you would with equities and their sub-2% dividend yield. Best of luck and I’m honored to be mentioned in your post! 🙂

Happy to share your early withdrawal series, Big ERN! I am learning a lot from your work, and I know others will too.

Hopefully this article will continue to inspire others to use rentals for their early retirement strategy. I agree it is a great way to go.

Very well written article. Love your strategies as you outline them well. About 12 years ago I began using similar concepts and now have 17 doors if you will. I use doors as my investment strategy is small multi-family properties (duplexes/fourplex). I understand your rational for SFH, but the biggest advantages to multi-family are two fold, bigger bang for your buck (more cash flow) and during a recession it is easier to find two $1000 renters than one $1500 renter with less risk, IMHO. However, for ease of management I can see myself transitioning to SFHs when I begin to slow down and have the game won. Great article keep it going!

Thanks for the comment, Joe. Small multiunits are actually a core part of my portfolio as well. And as you said, they did also give us a bigger bang for our buck and produced more cash flow for us early on. So, think either approach or a combination makes a lot of sense. But long run the core of our portfolio will still be SFH for the reasons I outlined.

Very good article. I’m doing this but need a couple more rentals. In my area the rentals aren’t cash flowing like they used to so I’ve had to switch my strategy up a bit. I started mortgage pay downs, the numbers are ominous but I think with dedication the goal will be reached.

Congrats on your progress so far, Dave! And thanks for commenting.

Markets and prices definitely affect our strategies. You are wise to be working on a way to adjust. Have you read my Buy 3, Sell 2, keep 1 article? It is a way to buy properties below value, even if they don’t cash flow well, and still help you get to your free and clear goal: https://www.coachcarson.com/buy-3-sell-2-keep-1-plan/. It may be helpful in your situation. Or you might have to look at different niches in your market: https://www.coachcarson.com/real-estate-investing-niches/.

Good luck!

Great post, Chad. Love the concept of building an income floor and then chasing upside.

I am still in the accumulation/wealth building phase. I closed on rental property #4 back in November and am wrapping up the renovations. Expecting renters in Feb/March.

Once rental property #4 is rented, I will have my income floor (and then some) established. My properties have debt though, so this isn’t as ‘secure’ as you mentioned. However, I plan to use dividend stocks and index funds, along with cash savings to help mitigate the risk.

Congrats on property #4 and reaching your income floor, Guy! As I said in the article, it’s cool to see that there are a lot of variations to the plan.

What I outlined is our ideal, but it is a process for us as well. For example, we chose in 2016 to buy more units with safe, low LTV leverage when we could have used our capital to pay down more debt and increased our free and clear income floor. We chose growth at that time because – like you – we felt comfortable with the overall risk at the time, already had decent income, and wanted the growth. But the trajectory over the long run will still continue to be less debt, less risk, and more simplicity.

Love how well thought-out your posts are, Chad! I also love the idea of using real estate as part of a portfolio.

Right now, we have a single-family and a duplex, but I plan to possibly take our residence and convert it into a rental (if the numbers make sense) when we FIRE and move to Panama in a couple of years. Knowing that we have a solid hedge against the fluctuations in the stock market really helps ease a lot of my concerns about retiring.

— Jim

Thanks for reading and commenting, Jim. Awesome to hear about your plans with Panama! I love that idea (obviously, when I’m spending over a year in Ecuador). I like your point about real estate being a hedge to the fluctuations in the stock market. I personally love the idea of owning a part of so many dynamic businesses over the long run. But over the short run, the stability of a “salary-like” income from real estate gives me peace of mind to ride the ups and downs of the overall market.

Let me know if you need to bounce ideas around on the numbers for your personal residence when you decide to rent it.

You’re too nice of a guy, Chad – I’m probably going to be forced to take you up on that offer! 😉

— Jim

Great post! I currently have three units and while I know it’s a great investment, I sometimes wonder if I will be able to keep it up. Being a landlord does have its challenges!

HI Caroline, I’m sure Chad self manages most of his portfolio, I self manage 38 rentals. A big help is going to David Tilney’s landlording coaching weekend. https://davidtilney.com

I wrote a talk I give and you can down load that file off my BP profile. https://www.biggerpockets.com/users/sweetgumga

See the URL in my profile Experience section. It’ll help you realize why you may feel self managing is an effort, and the path forward to lower effort. Best of luck.

Caroline, self-managing can be a hassle – especially at first – until you’ve built up systems and a good team around you. Some of the most important steps that have helped me are (1) tenant marketing & screening systems (2) turnover checklists and processes (3) reliable repair contractors. (4) bookkeeper/assistant who can grow into more and more tasks. But if you decide to hire out management, there’s nothing wrong with that either. It takes a cut out of your net income, but it also may keep you in the game!

I agree with Curt’s comment above that David Tilney is a great teacher for property management. I’ve taken his class and learned a lot. And I also like these books:

– Brandon Turner’s the Book on Property Management (http://amzn.to/2DG1kle)

– Landlording on Autopilot by Mike Butler (http://amzn.to/2DDaE9m)

– Every Landlord’s Guide to Managing Property by Michael Boyer (http://amzn.to/2DE8HJQ)

Good luck!

Thank you to both of you. I will make sure to check out those books:)

Such a timely article. Thank you very much. I spent the last week designing a draw down strategy almost identical to what you just described. Now I’m really pumped about it. My wife and I have 5 income properties. Our plans are to pay them off one at a time within the next 8 years with the positive cash flow they currently generate. At that time they will spin off $60K+ per year net income. This income floor will allow me to retire which will trigger my pension further increasing the base. One question though – can you please share your thoughts on ways to keep my tax burden low as I lose the mortgage interest deduction on those loans? Thank you in advance for any thoughts you can share.

Schedule E will always (least as of this tax over haul) allow all sorts of business expenses including interest paid for business debt. Business debt is safe as paying taxes.

Congrats on putting your own plan together, David! I like your simple plan.

Once you pay off your mortgages, there is no way around increasing exposure to taxes by losing the interest deduction. It’s part of the luxury of having free and clear cash flow, less risk, and more simplicity.

But part of it should still be sheltered by depreciation expenses. And on your personal tax return, the first $20,000 or so is sheltered by standard deduction, etc. Then the next portion is at a lower tax bracket. So, your overall tax rate could be very low on $60 – $70,000 of rental income if that’s all you have once you stop working. But I recommend putting your scenario into actual tax software or even better sitting down with a CPA. That’s what I do in my own tax planning.

That is exactly what I will do during my March appointment. I have many questions for my accountant now that I have my sites set on the plan. Thanks for your response.

Hi Chad, Good you turned to living off rental income topics! I’m now at year 1.5 post quiting my day job after my wife and I worked our butts off, litterally day and night and weekends for 6 years solid while each of us worked day jobs. My wife retired from a teaching job and we rolled her 403B into a SD-IRA and bought more rentals in her SD-IRA. On the day I quit we had 31 rentals, all high cap high appreciation and low management effort, all self managed. Off my biggerpockets.com profile, https://www.biggerpockets.com/users/sweetgumga , I have a BP file upload URL in the first paragraph of my profile, giving my tips: How to buy a bullet proof rental portfolio. It takes a decidedly different tact than most guru advice.

What I can add to this discussion of actually living off our rental income and a small teachers pension from my wife and business partner is:

– you need a lot more rental income than the math says. Because you will have bad luck months where you need to fund 1 roof, 2 HVAC replacements AND 2 tenants giving notice and 2 more no-pays, 50% are slow pays. In fact this may just be the normal month?!?!

– After 1.5yrs and a few black swan events I’m now certain that my ramp all the way to 31 is why we where mad, frustrated, nurvous but never financially in rocky shape during the black swans which I’ll describe below.

– You need reserves!!!! As much as the raw spread sheet monthly income over your FI number what will kill you during a bad month is the lack of reserves. How much? At lest a few months of cash flow needs. Plan B reserves like an un-used HELOC on your residence just sitting there is very good idea. It takes 30 days to cash out REFI some equity as plan C… You need plan A cash reserves is what we learned. We had several draw downs that taped our reserves!

– once you quit your day job your W2 that access to cheap bank loans stops. True you can still get all the portfolio (soft money) loans to buy rentals and I’ve done 2 of those. They are ok, 7.5% on up interest plus points for 30 yr money.

– Nassim Taleb wrote several good books, Black Swan, and Anti-Fragil. We had a black swan event in our business in an area where we don’t generally dig into the resilience / failure tolerant ness of the company you are entrusting for a critical aspect of your business. We had the rental collection service we had 70% of our rentals on to transfer rent each month from the tenants bank account to ours. We used erentpayments.com (we don’;t today) Erentpayments.com used a xfer company that blew up and ate $4.1M of small fry landlords rent. About $10k of our monthly cash flow was never xfered misteriously… Over 3 months and hard work we did get about $8k of that rent back. We now have a new business rule, only use Anti-Fragil companies, tools that are large enough to stand behind any blow ups or are smart enough to never have blow ups.

Re rent collection services, Pam Storm owner of rentmarketplace.com who I used for electronic applications and where tenants pay on their side for credit screening, is working on rolling out rent $$ xfer services as well. I’ll move my tenants to rentmarketplace.com when she rolls rent collections out in a few months. Hopefully Pam will let you know when its up and open for customers.

– Living of rental income is actually just like living off social security (or any fixed income source). Your income is fixed, yet your expenses, life style wishes are not. You don’t really get the gist of this realities till you live for more than a year on a fixed income, incure problems, loss of rent and having to worry about paying the bills. Yes I can’t even imagine elevators and tall glass buildings (my day job) anymore, but being self-employed has its issues as well. Alls great I’m saying, mainly because we have a lot of rentals, more than whats needed and we are pretty smart at thinking our way out of problems!! I strongly recommend becoming over educated. Take education from all the experts, Dykes Boddiford, Pete Fortanto, Gary Johnston (big help!!) etc. So you have the tools to solve your business problems, plan for a path that avoides big pot holes etc.

Bottom line: Have reserves to cover not getting some large percent of your rent for a month or 2…

– Other typical scenarios that can hardly be called Black Swans: several move outs at the same time, surprise maintenance costs etc etc.

What makes me concerned from some of the comments in this article is:

– 6 rentals == time to quit. I know this is not what was said. But even the inference makes my hair stand up. Even 10,,, but more like 20 free and clear rentals is a number that makes more sense to me,,, based on my above real world issues.

– Not enough focus on reserves. The cash cash kind. But a HELOC is good I agree. You will have events where you need to write a large check. So having money in Scotttrade where it takes a week for that check to arrive, then 5 days to clear your accountt is NOT good enough. That is plan B reserves. Everyone needs plan A reserves where you just write a check or do an account to account instant xfer.

Thanks so much Chad you are doing a huge service to so many real estate investors. Keep it up, good luck with your book efforts.

Curt / Atlanta / glad to be a member of GaREIA.com

Wow, Curt. So much detailed, insightful feedback on your own experiences. Thank you!! That’s disturbing to hear about your issue with the rent collection service. I use Buildium currently, and I’ll be double checking with them about their behind the scenes process. And I like everything Pam is doing at rentmarketplace.com, and I look forward to seeing her next rollouts of online rent payments.

I hope I echoed your advice and conveyed in the article the need to be flexible and have back-up plans. As you say, black swan events are going to happen – both personally and on a broader scale. Cash reserves give you the most flexibility.

And I’ll add that during 2008 – 2010, our close relationships with private lenders and our wits, hustle, and tenacity were the other wildcards that allowed us to address bad event after bad event that occurred.

Hope to have some conversations in person with you sometime in the near future! Maybe at GaREIA?

There’s a lot of prudent advice here. Thanks for taking the time to share. While I’m in the acquiring phase of real estate investing and using long term, low rate debt for cash flow and wealth build with buy-and-hold, your thoughts help to solidify my multi-year strategy. And I ALWAYS like how your real “floor” is not just financial, but being enabled to do more of the things that matter the most.

Thanks Russell! Congrats on your progress in the acquiring/growth phase. Long-term, low rate debt against quality buy-and-hold rental properties is a solid strategy.

And thanks for bringing up the real “floor” of doing what matters! That’s what all this financial work is about, right?!

Coach, great to have you in the Chain Gang!! Interesting to see a real estate focused Withdrawal Strategy, and seems a very sound approach. I like the fact that rental income is a natural inflation hedge, and a nice diversification play. Also, great point about delineating between essential living expenses vs. nice to haves (Needs vs. Wants). Welcome to the chain!!

Thanks Fritz! Great to be in the blog chain gang:)

Although I’ve thought about the essential vs discretionary expenses a lot, I can’t take credit for the terminology and clear explanation. That was all Darrow Kirkpatrick at caniretireyet.com.

Great post Chad!

Thanks Joe!

Coach, I stumbled across your blog through Twitter, and have been avidly reading for the last two days. I am using a “multiple bucket” approach to retirement planning, using a dividend account, mutual funds, cash savings, hard money real estate loans, and (so far) three rental properties. I started my FIRE journey five years ago at the tender age of 47, so maybe it’s more accurate to say I’m on a FI journey at this point. :)) But I am encouraged by your posts, and I appreciate all of the detailed information.

I note that you provide coaching services. My biggest issue is finding good properties (from a numbers standpoint), and it would be great if you can provide specific guidance on how to do that. I am willing to put in the work, just need some guidance on where to start and what to look for. I will roam around the site to see how to set that up – I’m definitely interested in getting some help from an experienced RE investor.

Thanks for the excellent info!

I like the multiple bucket approach! Thanks for sharing your strategy.

Finding a good deal is certainly the tough part for many investors. I will be opening 1-1 coaching back up soon, and you can contact me at https://www.coachcarson.com/contact/.for more details.

But you might also want to look into my Real Estate Start School online course. It costs the same as a 90 minute strategy session with me, and during the February 2018 launch you can get a strategy session with me free just for finishing the course. Plus we also have many small group coaching calls and a private Facebook community to get questions answered. Here’s the link: http://realestatestartschool.com/

Best of luck with your next steps!

Interesting! When I read these articles, I realize that I’ve thought about all this stuff in the same ways, but I’m more intuitive about it as opposed to being very deliberate with a well defined plan and I never ponder the creative ways to describe what I’m actually doing! It’s great to have descriptive names for it. As you know, real estate notes from Peer Street are an important part of my plan and are providing most (actually all currently) of the income I need and I’m hoping provide the floor/hedge when the stock market declines. While I adhere to the 3% rule generally, I tried to design a plan so that I likely wouldn’t have to sell any shares of stock and could also maybe shift some of the Peer Street note payoffs into index funds when prices fall below the historical means. As I write that, it sounds like I’m trying to time the market. Really I just wanted to have a way to access cash flow that wouldn’t stress me out in a declining equity market with some flexibility to move between asset classes if opportunities arose. Chad, I’m curious as to the longer term performance of the real estate notes you have participated in. I’ve got 2.5 years of Peer Street under my belt now but am curious how it’s worked out for you.

Liz, I think what you’re saying is that this stuff comes a lot easier to you than me! Lol. Probably true!

I originally planned to talk about real estate notes as a great alternative to rentals for the income floor. But the article just got too long! So, I’m glad you made this point. I think your point about an income source that allows you not to sell other investments is one of the biggest points of the article. It takes away that edge of insecurity (which we all have to some extent) so that you can stick to being a disciplined long-term investor with your other money.

I have had notes since 2008 or so. A significant % had issues during the down turn of 2008 – 2010. Some we were able to work out, and others we had to take the property back. We lost money on probably 1 out of 10. The rest we either made money on the property or still receive payments on the notes. They are still some of our most consistent income generators. BUT … we did more long-term, discount notes than lending hard money to fix-and-flip investors. I like the consistency and longevity more, but I can also see advantages with hard money that you get your money back more often.

It doesn’t necessarily come easier because being an intuitive thinker, I see the end answer a lot of times but I don’t know how to explain or even understand a lot of the steps. I tend to have to reverse engineer a lot of things to understand what’s going on and at times it can be very difficult to verbalize so I tend to draw pictures to explain my thought process. Thank you so much for sharing your experience. I like the idea of the type of notes you have done but just wasn’t in a geographical location nor did I have the knowledge to take on any types of those projects. Now, I still am not an expert but at least I know what I don’t know. 🙂

This is such a great post, Chad! I love your detailed, but easy-to-follow examples and comparisons. Many financial advisors will focus on helping their clients build a portfolio of stocks, mutual funds, permanent life insurance policies, etc and calculate plans around the 4% withdrawal strategy (which I’ve always questioned and pushed back on)…but many don’t bring up having the right real estate portfolio so clients don’t have to eat into their principal. I love how you take an overall approach and share the concept about creating an income floor. Will definitely be sharing your post with friends, family, and clients who are working on their financial independence or debt payoff!

Thanks Sylvia! Yeah, other assets seem to be the go-to sources for most traditional planners. I have heard of some who recommend their clients get into real estate. But it’s typically not something they have expertise in, so it’s not as easy to help with. Real estate is more of a DYI approach, but as I hope I showed, it has MASSIVE positive benefits when done well.

Thanks for sharing the concept and post around to your friends, family, and clients!

Great article, Chad. I’m an early retiree with no real estate. So this is a useful one! I would only caution that stock investors not over-index on dividends. Most of our most dynamic companies (even those raising dividends quickly) tend not to have a high dividend yield. If you tilt towards high current yield when buying stocks, you may end up with a bunch of companies in decline in sunset industries. Cheers!

Thanks for reading and for the feedback, Mighty Investor! Your point about not over-indexing on dividends actually reminds me of what happens with real estate investing. The properties with the best numbers on paper are often in bad locations and attract less than ideal tenants. And they also tend not to appreciate well. So, they don’t always make more money.

Wow. Interesting parallel, and something I will keep in mind. There are always the intangibles to consider, that’s for sure.

Thank you Chad for this comprehensive article it is exactly what I was looking for and you are a great example of how to successfully employ real estate as a viable source of livable income. I am only a year away from “early retirement” with my company of 33 years and will be fortunate enough to have a pension with healthcare benefits but in order for my husband to “retire” from his day job we decided on rental properties so last year we bought 4 and after much work to renovate they are up and running and we just acquired our fifth one which is still in the renovation stage. So I guess our thoughts are should we just stick with what we have or finance the first 4 and acquire more? But like you wrote above that if you can live on 5 ( in our case) why keep acquiring and adding complexity to a good plan?

Hey Laurie! Thank you for reading and for your compliments. Really glad the article was helpful.

It’s hard to say what to do in your case without a longer conversation and more details. But I do know that sometimes after you’ve bought a group of properties it’s good to take some time, digest them, and learn before moving on to the next one. First, you’ll learn how good the deals really were by evaluating the books for a while and evaluating your tenants. Second, you might get a clearer answer to your question about whether you need to keep buying more or if that’s enough. Even if you want to buy more, you’ll be more informed and ready to take the next step.

Best of luck!

Nice post explaining your withdrawal plan and the income floor. It is good to have a solid plan in place and put it in writing. Thanks for sharing!

Are you still actively adding to your real estate portfolio? With the uptrend in real estate valuations, is now a good time to purchase properties?

Thanks for stopping by Palmetto Millennial! Nice to have a fellow South Carolinian in the conversation.

In 2017 we did not add any to our portfolio other than getting a couple of deeds on tax sales. But in 2016 we bought a lot of units, and I was out of the country this year. So, that’s the main reason.

If I were in a growth phase and in town, I’d certainly be trying to buy. There are deals in any market. But when it gets hotter, you just have to niche down some (https://www.coachcarson.com/real-estate-investing-niches/) and get really good at lead generation and finding off-market deals (https://www.coachcarson.com/find-real-estate-deals/). Best of luck !

Chad,

Great article, thanks for putting it together. I’ve seen similar articles, but few do justice in explaining how real estate can contribute to a more stress free retirement. I am surprised by how much real estate is overlooked with regard to retirement portfolios. I’ve been a big fan of Darrow K. for years and was glad to see this link on his recent CanIRetireYet post.

I retired at 55 a few years ago with multiple rental properties. We then “thinned the herd” of SFR, keeping a few townhomes (less maintenance) and select properties. We then rolled some money into a mobile home park. For me, the park is the best real estate investment I have made (just 50 spaces). It takes some of my time to maintain and improve the place, but I really don’t consider it work after many years in the corporate world. I have found that renting a parking space (i.e., dirt) to people can be a nice source of income. For those interested in building wealth and steady cash flow, I would highly recommend mobile home park ownership for the purposes of early “retirement”.

I am now able to spend winters in Mexico and Central America with the stream of income from the properties, and not drive the wife crazy by sitting around the house all day claiming to be bored. So I am a true believer in the approach you have summarized in your article.

Thanks again for pulling this all together and sharing, well done.

So long from Belize….

Thanks for sharing, Mick! And I love that latin american lifestyle, obviously! So I think we’re in the same boat. I’ve only done a little of renting mobile home spaces, but it does sound very appealing. Owning dirt and renting lots actually seems as good as it gets:)

And I agree that real estate as a primary retirement vehicle still does seem very “niche” in many circles. I guess people are put off by the possibility of tenants, work, or “non-passive” investments. I’ll take a few hours a month of “work” instead of volatility I can’t control and low income that doesn’t pay the bills. But I’m preaching to the choir:)