Real estate investing is my favorite path to retire early and confidently. Whether real estate is a small or large portion of your investment portfolio, you can use it to build wealth, generate income, and reach financial independence.

How long does the journey to retirement or financial independence take? Of course, it depends on your situation.

But in this article, I will show you examples of how hard-working investors could retire within 10 to 25 years depending on their savings rates, income, and self-discipline with investing.

My examples will share three different scenarios:

- A 35-year-old who wants to retire in 25 years by age 60

- A 35-year-old who wants to retire in 10 years by age 45

- A 50-year-old who wants to retire in 10 years by age 60

Each example is necessarily simplified so that this doesn’t turn into a book (although a book IS coming)! But the principles within the examples are most important. So, I hope you’ll study the core ideas and think about how they could apply to your own situation.

Let’s get started!

The 2 Financial Goals When You Retire

Before we get into specific examples, let’s look at the end destination. What specifically do you need financially in retirement? What should be your goals?

Here are two simple goals that resonate with me:

- Investment income that pays for all of your personal financial needs and wants

- The money never runs out

There is no one right way to accomplish these goals. Part of the confusion of retirement planning is that you have SO many different options and choices bombarding you.

Who do you listen to through all that noise?

Personally, I like listening to Warren Buffet. He has a core philosophy of only owning and depending on investments that are simple and understandable.

For me (and many of you) that means a core focus on residential real estate investments. We live in real estate markets and can intuitively learn how to pick the right place to invest. And the fundamentals of running the numbers can be done on the back of an envelope.

I’m also a fan of diversification. So, spreading out your bets among other assets like stocks, bonds, CDs, and cash makes sense. This diversification can help ensure your assets and income will still be around in the end.

But I’ll try to make the case here that allocating real estate as one of your largest holdings makes a big, positive difference in your retirement finances. And for those with a net worth on the smaller side as you approach retirement, real estate may be your only hope for a decent income to support you.

Now, let’s look at the phases a typical investor will travel through on their way to traditional retirement.

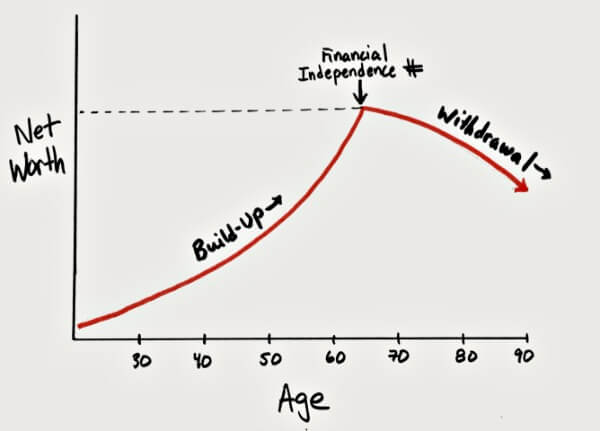

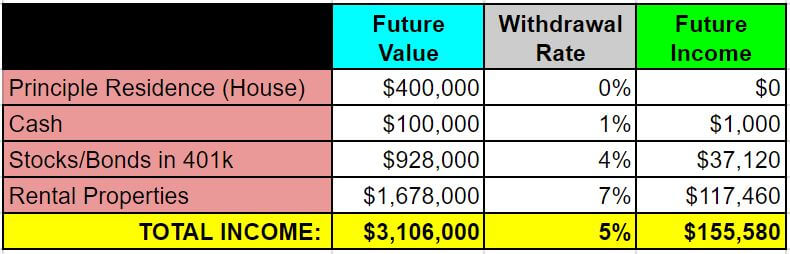

Traditional Retirement Phases: Build-Up & Withdrawal

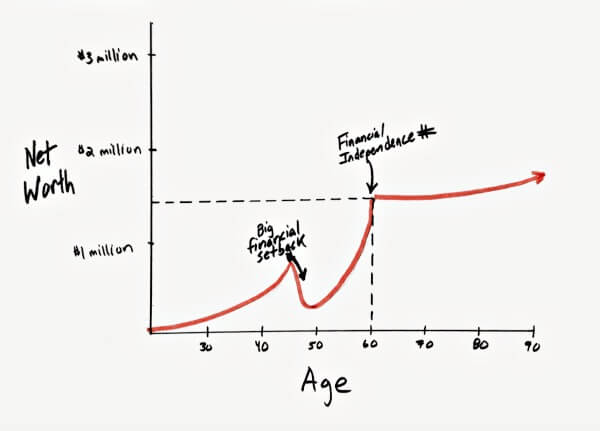

You can look at the traditional path to retirement like a journey. Here is what the journey looks like:

You begin the journey by building up. This is the phase where you earn money working, save as much as possible, and invest it for growth.

At some point (hopefully) your net worth reaches your financial independence number. Traditionally, this number is 25 – 30x your annual income needs.

For example, let’s say you need an income of $50,000 per year. Your financial independence number may be 30 x $50,000 = $1,500,000 net worth.

After reaching your financial independence number, you could choose to stop working and begin the withdrawal phase. This means you live off your assets instead of working for money.

Withdrawing Without Running Out of Money

The key to a sustainable withdrawal phase is not taking out too much. Many retirees with traditional investment portfolios (stocks/bonds) follow some version of the 4% rule. This rule states that you should take out 4% or less of your net worth each year in order to not deplete all your money.

My favorite resource on the 4% withdrawal rate is from my blogging friend the Mad Fientist:

- Article – Safe Withdrawal Rate For Early Retirees

- Podcast – Michael Kitces – The 4% Rule and Financial Planning for Early Retirement

In an ideal world, your total net worth still grows to exceed or keep up with inflation even after withdrawing 4%. This happens because your investments would earn more than you take out.

Here’s what that would look like:

Of course, the real world is not always ideal. There are a lot of factors you can’t control that affect successful withdrawal phases, like a big market downturn right when you retire.

But this is where real estate investing shines as a healthy part of your portfolio.

In my experience, carefully picked real estate can produce income at a rate of 6% to 10% or better without any debt. On top of that, the value and the rental income of this quality real estate tend to grow along with inflation.

Essentially, you create your own inflation-adjusted pension using real estate income properties. They produce above-average, consistent income that creates a financial floor for your entire retirement plan.

This means:

- You can possibly live off more than 4% without depleting your net worth

- Your net worth will grow or stay the same during retirement (depending on the real estate you own)

- You can reach retirement earlier because real estate meets your income needs with a smaller net worth

To explain what I mean, the following example shows the build-up and withdrawal phases of a 35-year old married couple who want to retire within 25 years by age 60.

Example #1: 35-Year-Olds Retire in 25 Years (Age 60)

A good example needs realistic people. So, let’s call our fearless retirement couple Rachael and Justin.

Rachael and Justin are both 35 years old, and they live outside of St. Louis, Missouri. They bought a $200,000 home 5 years ago with a 5% down, 30-year, $907/month, 4% fixed-interest loan. They also recently paid off the last of their personal debt (cars, student loans, etc).

So, they’re now ready to begin building wealth in earnest through both their 401k and their real estate investments.

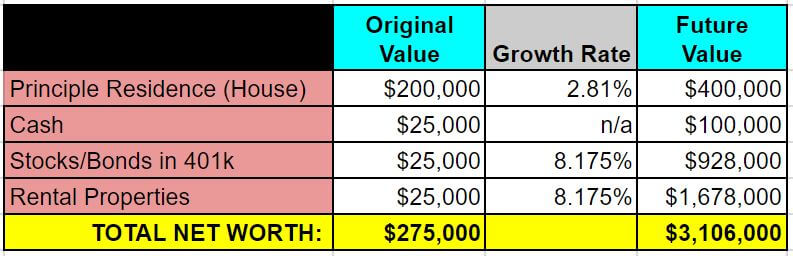

At the start, their assets look like this:

- $28,000 = current equity in their house (total value was $200,000)

- $25,000 = cash reserves

- $25,000 = 401k balances

- $25,000 = cash saved for real estate investing

And going forward, their savings and investment assumptions look like this:

- $150,000 = collective earnings per year

- $30,000 = investment savings per year

- 8.175% = average return on investments over time (401k and real estate)

- 25 years = target date for retirement

- $150,000 = target retirement withdrawal income

Their wealth-building plan will have three parallel paths.

- Contribute $10,000 per year to their 401k, receive an employer match, and invest in broadly diversified index funds with the lowest expense ratios possible (like Jlcollinsnh recommends in his stock series).

- Use $20,000 per year to buy a small portfolio of rental properties that will be owned free and clear of debt well before their retirement date using the rental debt snowball method. A portion of the rental income will also be saved for extra cash reserves.

- Make the minimum payment on their home mortgage until it’s completely paid off in 25 years. This will eliminate the need for housing mortgage or rent payments when they retire.

Let’s take a look at the results.

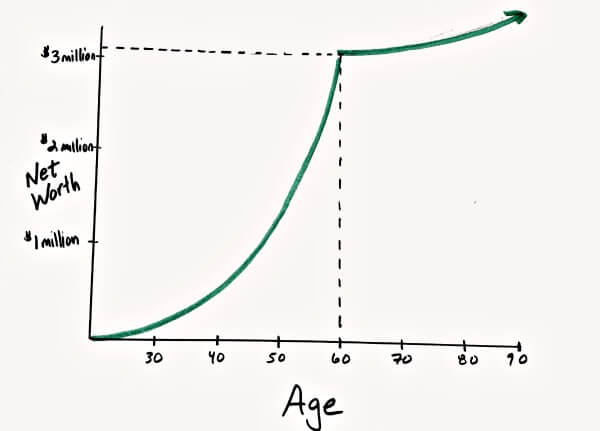

Financial Results of Example #1

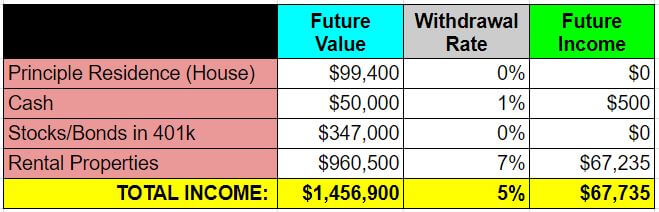

The results of Rachael and Justin’s build-up phase looks like this:

After 25 years, Rachael and Justin have a total net worth of over $3,100,000. The breakdown between different categories looks like this:

And most importantly, their income looks like this:

I assume their free and clear rental properties produce net rental income at a rate of 7%. I also assume they could withdraw 4% of their 401k portfolio each year without penalty now that they’re over the IRS threshold age of 59.5. And finally, I assumed their cash reserves received 1% yield per year.

Although these results are in future dollars (i.e. worth less because of the value erosion of inflation), you can see that Rachael and Justin met their goal of $150,000 per year. Their $2,706,000 of investments ($928,000 in the 401k, $1,678,000 in real estate, and $100,000 cash) now support them financially. They also have no housing payment to worry about now that the mortgage is paid off.

It’s worth noting that if the $2,706,000 had only been in traditional investments, a 4% withdrawal rate would drop their spendable withdrawals to $108,000 from $155,000. Because of this, they might have had to keep working longer in order to accumulate a larger net worth, or they might have had to settle for a lower withdrawal amount.

Their real estate investments and the higher income they produce allowed them to avoid that choice.

I haven’t mentioned another income source, social security, because Rachael and Justin are only 60 years old. They can begin withdrawing social security income at age 62 (with decreased benefits) or age 67 (with full benefits).

I’m no social security expert, but I played around with this cool social security benefits calculator. Assuming they made similar incomes until 60 years old, the calculator told me that together Rachael and Justin would collect $68,000 per year if they withdraw early at 62 and $97,000 if they wait until age 67 (all future dollars, not adjusted for inflation). So, whatever their actual social security income is, it will give Rachael and Justin an additional financial cushion at that time.

So far, the example has been traditional because Rachael and Justin worked until 60 years old. But what if someone wants to retire much earlier – like in 10 years?! Let’s look at an example of how real estate investing can help.

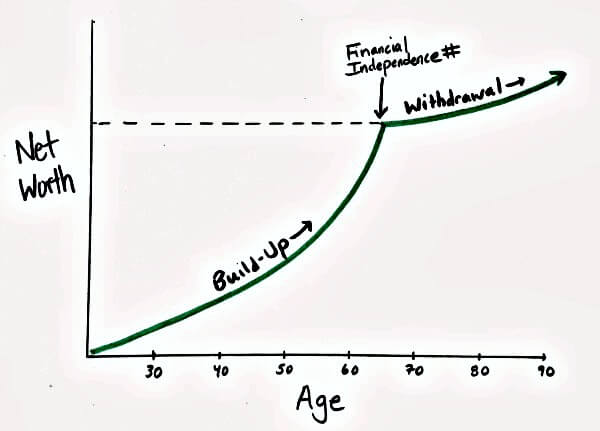

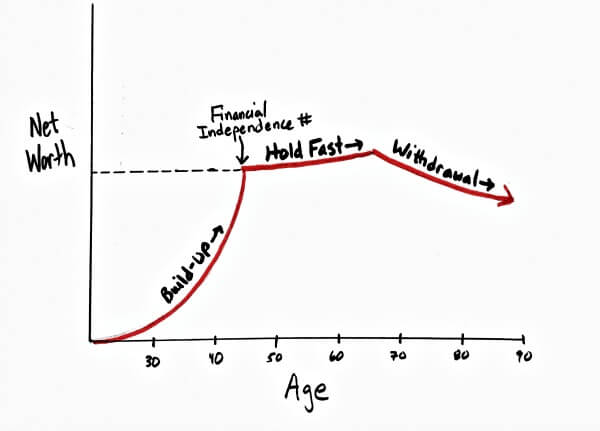

Early Retirement Phases: Build-Up, Hold Fast, & Withdrawal

Early retirement adds a new dimension to planning. It’s possible to build up an enormous nest egg at an early age and then just withdraw from investments for the rest of your life. But in practice, many early retirees hedge their bets with an intermediate phase called hold fast (thanks to Joe at RetireBefore40.com for giving me the name for this phase in his article about retirement withdrawal strategy).

The three phases of early retirement look like this:

The goal of the hold fast phase is to avoid withdrawals from tax-sheltered retirement accounts (401k or IRA) and minimize erosion of principal from taxable accounts (real estate investments in this case). This allows the early retiree to bridge the gap from early retirement (leaving a 9-to-5 job) to a traditional withdrawal phase when retirement account and social security withdrawals begin.

To accomplish this, many early retirees depend on income sources like dividends, interest, or (you guessed it) real estate investment income. It’s also common to find fun hobbies that turn into side businesses that generate income (like online courses and 1-1 coaching have become for me!).

Let me demonstrate this early retirement scenario with an example.

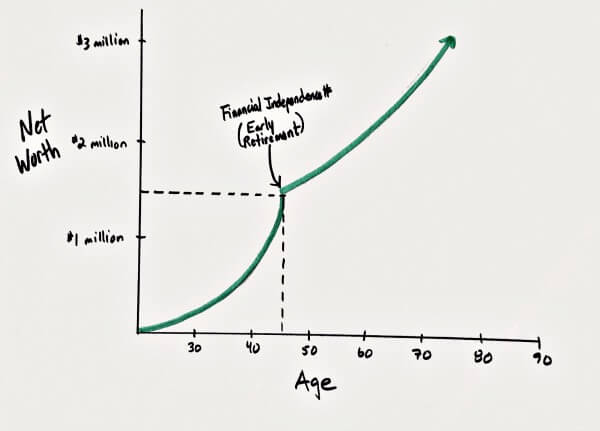

Example #2: Early Retirement in 10 Years

Rachael and Justin had some friends named Kim and Steve. In many ways their lives were similar. But Kim and Steve had an itch to leave their regular 9-to-5 jobs MUCH earlier.

Why did they want to leave their jobs? First, they didn’t want to wait until their 60s to enjoy the lifestyle and flexibility of retirement. They wanted to pursue mini-retirements, and they wanted options to engage in what matters to them while still relatively young.

Like their friends, Kim and Steve are both 35 years old, and they live outside of St. Louis, Missouri. But unlike their friends, they didn’t just buy any old house. Kim and Steve applied the strategy of house hacking to buy a similarly priced house ($200,000) with a rentable garage apartment.

Their house financing terms were the same with a 5% down, 30-year, $907/month, 4% fixed-interest loan. But by renting the garage apartment on Airbnb, they easily earn $1,000/month or more to eliminate their entire mortgage payment.

Of course, they long ago paid off the last of their personal debt (cars, student loans, etc). And because of their ambitious retirement plans and because more spending doesn’t make them happier anyway, they save a HUGE portion of their income ($82,000 per year).

Like their friends, Kim and Steve are now ready to begin building wealth in earnest.

At the start, their assets look like this:

- $28,000 = current equity in their house

- $25,000 = 401k balances

- $25,000 = cash saved for real estate investing

And going forward, their savings and investment assumptions look like this:

- $150,000 = collective earnings per year

- $82,000 = extra savings for investing per year

- 8.175% = average return on investments over time (401k and real estate)

- 10 years = target date for early retirement

- $60,000 = minimum early retirement withdrawal income

Their wealth building plan will also have three parallel paths.

- Contribute $20,000 per year to their 401k, receive an employer match, and invest in broadly diversified index funds with the lowest expense ratios possible.

- Use $62,000 per year to buy a small portfolio of rental properties and aggressively pay off the mortgages using the rental debt snowball method.

- Make the minimum payment on their home mortgage for 25 years. Of course, they’ll still owe money on the debt at their target early retirement date in 10 years. But their house hacking plan using Airbnb effectively eliminates their out of pocket housing expense.

Let’s take a look at Kim and Steve’s results.

Financial Results of Example #2

The results of Kim and Steve’s build-up phase looks like this:

After 10 years at the age of 45, Kim and Steve have a total net worth of $1,456,900. The breakdown between different categories looks like this:

And most importantly, their income looks like this:

Like example #1, I assumed their free and clear rental properties produce net rental income at a rate of 7% and their cash produce 1% interest.

Because they’re too young to withdraw from a 401k penalty free, they withdraw 0% from retirement accounts. They’ll let it continue to grow and compound. Even if no more contributions are made, at their current growth rate of 8.175% the $347,000 could grow to around $1,128,000 by the time they are 60 years old.

Kim and Steve now have the luxury of covering all of their living expenses ($60,000/year) with rental income. True to the hold fast phase described above, their net worth stays intact until they can reach retirement age and access retirement account and social security funds.

But because they are only living off rental income AND because they keep their expenses at a reasonable level, their net worth will likely continue to grow at a good rate even after early retirement. They’ll continue to build equity in their home, their untouched holdings in their 401k account will continue to grow, and the value of their real estate investments will likely grow at the rate of inflation.

This is a big reason to love real estate investing as a strategy to retire early!

The key question is what do Kim and Steve do with their time now? And the answer is whatever they want!

They can contribute to their families and to causes important to them. They can revive long-neglected hobbies, passions, or travel plans. And they can also start a side hustle business that is fun and also generates extra income.

So, you’ve now seen two examples related to aspiring retirees in their 30s. But these examples are different from those beginning the journey later in life. If someone is behind on retirement savings or perhaps digging themselves out of prior financial challenges, they may need a different approach.

This third example addresses that situation.

Example #3: Late-in-Life Retirement in 10 Years

A 50-year-old man named Jim is a work colleague of Steve (from the prior example). Over the water cooler, they discuss Kim and Steve’s early retirement plans, and Jim is intrigued.

Jim had a divorce in his 40s, and it set him back financially. But he still has aspirations to retire at age 60 or earlier. So, he and Steve sketch out a plan during a few lunch breaks.

As Jim starts his plan, his assets look like this:

- $25,000 = current equity in his $150,000 house

- $250,000 = 401k balances at old employer built over the years

- $50,000 = cash saved for real estate investing

And going forward, his savings and investment assumptions look like this:

- $100,000 = earnings per year

- $50,000 = extra savings for investing per year

- 8.175% = average return on investments over time (401k and real estate)

- 10 years = target date for early retirement

- $100,000 = minimum retirement withdrawal income

Like the others, his wealth building plan has three parallel paths. But given his late start and need for income faster, he takes a little different approach:

- Transfer $250,000 401k balance with the old employer to a self-directed 401k custodian. This allows him to begin investing in private mortgages secured by quality, local real estate. His private lending goal will be 8-10% returns and safe, low loan-to-value balances (70% or less). By networking on BiggerPockets.com forums and at local real estate associations, Jim finds several good borrowers doing house flips and rentals. He’ll keep $50,000 of the $250,000 set aside as an emergency cash reserve.

- Use another $50,000 cash plus the extra savings of $50,000 per year to quickly buy a small portfolio of rental properties. He then uses the rental debt snowball method to get them paid off before his 10-year deadline.

- Convert existing basement of his home into a rentable apartment using $10,000 from a home equity line of credit plus his own sweat equity. He uses the extra rental income to first pay off the line of credit and then accelerate his mortgage payoff date to 10 years.

Let’s take a look at Jim’s results.

Financial Results of Retirement Example #3

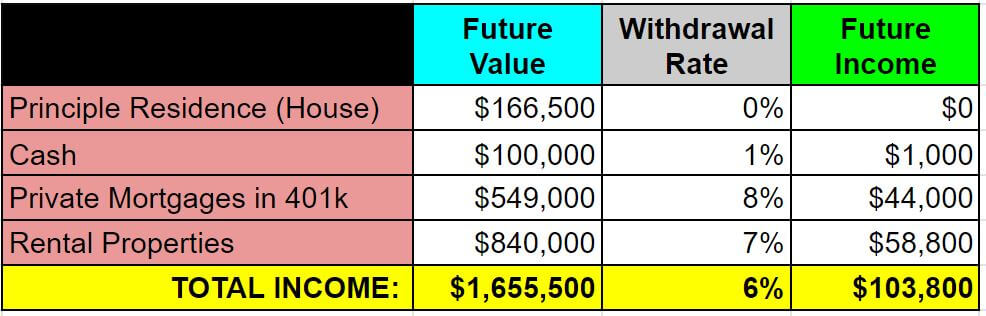

The result of Jim’s build-up phase looks like this:

After 10 years at the age of 60, Jim has a total net worth of around $1,655,500. The breakdown between different categories looks like this:

And most importantly, Jim’s income looks like this:

Like example #1 and #2, I assumed Jim’s free and clear rental properties produce net rental income at a rate of 7% and his cash yields 1%. I also assumed his 401k private mortgages averaged 8% yields. And because Jim is 60, he can take withdrawals of any amount from this 401k each year without penalty (although it will be taxed).

Jim had to work very hard for 10 years, but now he can relax a little and retire off more than $100,000 per year from his portfolio without depleting the principal. He may choose to diversify away from so much real estate at some point, but for now, he is comfortable with the properties and loans he owns and the low-risk capital structure (no debt except his principal residence).

And after another 2 to 7 years, he can begin receiving his social security pension which will add another layer of financial security as he ages.

The Fundamentals To Retire Early and Confidently

Did you notice any common principles throughout the 3 examples? Here were some common themes that I found important:

- They all developed strong, consistent savings habits that fueled their growth

- Each of them created a goal and a plan up front to guide their decisions

- Everyone used real estate investing as a core driver to succeed in different phases of their retirement plan

Saving, investing, and then executing a plan to retire early is no cakewalk. Of course, reality will throw you many obstacles and details that I did not address here.

But I have found that the control, leverage, and strong income production of real estate investing makes it an ideal vehicle as a small or large part of your plan to retire even faster and earlier than normal.

What do you think? How does real estate fit into your retirement plan? Are you using it during the build-up, hold fast, or withdrawal phases? And what is your timeline for when you’d like to retire?

I’d love to hear from you in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

I was wondering what strategies you use to protect you and your properties. I’m looking to make RE a large portion of my portfolio now that I have some capital to work with, but I’m worried about the liability aspect.

By following the advice from you “How many Rental Properties do you need to retire?” post, and some of you strategy videos, our plan is to do 4-5 live-in-rent scenarios before we buy our permanent residence.

Following this strategy opens us up to owner financing but will make it difficult if not impossible to put our properties in an LLC. Will requiring renter’s insurance, having a good landlord insurance, and possibly umbrella insurance be good enough for 4-5 properties? Will all the insurance eat up most of our cash flow, making index funds better in the long run?

Thanks for answering the questions. This is the last bit of REI I’m struggling with.

Hey Tyler. Thanks for the question. I think you’re getting at the idea of liability protection. And it’s sort of a tricky subject that even a lot of attorneys have discussions and arguments about. So, I’m not the final word on this by any means.

The problem is you’re balancing different risks – like the risk of someone suing you, the risk of having negative cash flow and running out of money, the risk of having to refinance or sell during a down market, etc. Different strategies (often competing) will address different risks in different ways. For example, getting the LLC to help with one risk would prevent you from getting the least risky, long-term financing.

But to your situation, I think the biggest risk that can topple a real estate empire is bad financing. I’ve seen more people go out of business and lose money because of a balloon note payment than I have from someone getting sued out of business. That doesn’t mean getting sued isn’t a risk, but the wrong financing is a more obvious challenge. If you have to buy the houses in your name in order to get the best financing, it could be solving the biggest risk of financing. You’d then have to address the other liability – the possibility of being sued, with other avenues like extra liability insurance. You can talk to your insurance agent, but it’s actually quiet cheap to get extra liability insurance. I think I got a $1 million umbrella liability policy for a few hundred dollars. You also typically have some liability insurance with your landlord insurance policy, which is built into your cost of operating the rental.

Down the road you could also talk to your attorney and your mortgage lender about moving the property into an LLC after you get the financing. There’s some risk there too, like getting the due on sale clause envoked, but you might decide it’s worth it.

Those are some rambling thoughts. Hope that helps.

I recommend consolidating properties and transfer deeds to an LLC depnding on what state you are in. The LLC will shield you from tenant liability issues. Then move the LLC into a Living Trust, and that will protect both the LLC and you.

As usual Chad…Great article. Thanks again.

Thanks Martyn!

Solid writing. Enjoyed the are and contrast among the three scenarios. Thanks Chad.

Glad the contrasting scenarios were helpful, Nic. In real life every scenario will be as different as the variety of people out there. But I was trying to give a cross section that many people could identify with.

I always enjoy reading your articles, Chad. You are easily my favorite source of real estate knowledge and I look forward to reading more!

That means a lot Zac! Thank you. My goal is to be a go-to source online for anyone wanting to use real estate investing to achieve financial independence. So, I’ll keep working at it!

Great thoughts on the different potential scenarios! I appreciated seeing the timelines broken out.

Thanks Kristine! The timelines/graphs are most helpful for me too. I’m visual!

I like the details in each case. They show a little variation depending on where you’re starting from. Rental real estate is a great way to generate dependable income. The only issue is the extra work you’ll have to do as a landlord. I don’t want to be a landlord when I’m 60. We want to travel and not worry about our rentals. Hopefully, we’ll be able to find a good property manager before that point.

Thanks for the mention!

Happy to share your article, Joe. You do great work! And yeah – directly owned real estate has extra work in comparison to other asset classes. But I think the benefits are worth the extra effort, and with a small portfolio and a property manager, we’re talking hours every month from my experience. But everyone has to decide their own approach – that’s what keeps it interesting!

I love these examples. It’s similar to the approach that I have taken, in which we have a number of paid off investment properties to pay our living expenses, including healthcare insurance. We also have a separate fund that generates dividend incomes to help support travel and other big ticket items. I consider these two buckets our core positions, similar to the hold-fast period to support our life style between our late 40s and 50s, while our longer term investments (e.g. 401k, IRA, brokerage) continue to grow.

On investment properties, we have a good property management company and most of the work I do is monthly bookkeeping (minimal) and taxes (moderate).

Thanks for sharing your own experience, Kyle! I love that combo of real estate and dividend stocks. Probably even safer than my own plan with primarily rentals:)

Great article, Chad! Really enjoyed the diversity in examples provided to show how anyone can make it happen regardless of where they’re starting in their journey.

Was curious about the acquisition strategy (Number of properties, price) for the income property in the plans. For example, would you recommend acquiring the batch of properties in the first 1-5 years, then rental debt snowball the next five using the income savings each year?

Was also wondering if you’ve ever thought about offering custom early RE retirement game plans based on the situations of different people. Inputs could be financial state, retirement savings, emergency savings, target retirement timeline, current holdings. I would pay for this type of value add/ service. (Knowing that the proposed plan is hypothetical / accepting market risks involved.)

Thanks,

Patrick

Thanks for reading and commenting, Patrick!

With the acquisition strategy, I definitely like phasing your approach. So, you load up for the first phase and concentrate all your excess cash flow on new properties, reserves, etc. Then the second phase is the debt snowball.

This often happens naturally because financing (at least conventionally with banks) gets difficult after 4-10 properties. So, it can make sense to switch to debt pay offs for a while or you have to switch to alternative financing sources.

I have begun offering a 2x/year coaching and mastermind group where I do get into that type of feedback on real estate game plans. It opens in January and July for now, and details are here: https://courses.coachcarson.com/p/coach-carson-private-mastermind

At the moment I don’t have a lot of bandwidth for one-time strategy sessions where I can help build those, but it’s an idea for the future. I appreciate your feedback and asking.

Does your snowball method work if there are just several contributions made in 1 year that are in excess of the baseline mortgage and escrow payments? To clarify, if one does not have the means of paying excess each month, but intermittent bonuses allow a larger payment to occasionally be done, can this work?

Good question, Justin. I didn’t model the process with payments like that. It would help, but obviously it would take longer. I think I’d be more inclined to save enough to make big chunks of payments (like $5,000 to $10,000 at a time). Little ones here and there, while saving interest, are harder for me and possibly the bank to accurately keep up with.

I recommend consolidating properties and transfer deeds to an LLC depnding on what state you are in. The LLC will shield you from tenant liability issues. Then move the LLC into a Living Trust, and that will protect both the LLC and you.