Listen to or Download the Audio/Podcast Version of This Article

A financial independence number tells you when you’re free from the need to work. It’s basically a math equation, as you’ll see later in this article. But discovering your personal financial independence number is about much more than money or math. It’s about your life and what matters to you. And it’s about whether money supports your ideal life or simply suppresses your potential.

While I don’t believe money is the most important thing in life, I do agree with Zig Ziglar that money is reasonably close to oxygen on the “gotta have it” scale in today’s economic-centered world. A financial independence number is useful because it tells you exactly how much money you really need.

In the rest of this article, I’ll show you how to calculate your financial independence number. Plus, I’ll also even share my own number.

Money and the Ideal Life

You certainly need money to survive. But you also need money for opportunities to live a life that is more fulfilling, flexible, and fun. Money buys you food to nourish your body, but it can also buy you the time and flexibility to nourish your sould. It can give you freedom to become your best, to share your gifts with the world, and to do what matters.

Ahhh. Becoming your best self. Sharing your gifts. Doing what matters.

Those are the lofty ideals that I aspire to. Perhaps you have your own lofty ideals.

Whatever your personal ideals are, I bet they’re bigger than money. But as I realized soon after I graduated from college, simply trading my time for dollars wouldn’t lead to my ideals.

It’s not that working a job or running a business were bad things. Serving others with your time, energy, and skills can be incredibly fulfilling. But even a great job can become a drag when you know you must do it to earn money.

Instead of happiness and growth, a less than ideal job situation traps you like a rat running on a wheel. While most people call it making a living, you’re really on a long path called “making a dying.”

Luckily, there is a different financial path you can take. Instead of trapping you, this path creates more freedom and independence. Which brings us back to the financial independence number.

The Financial Independence Number Defined

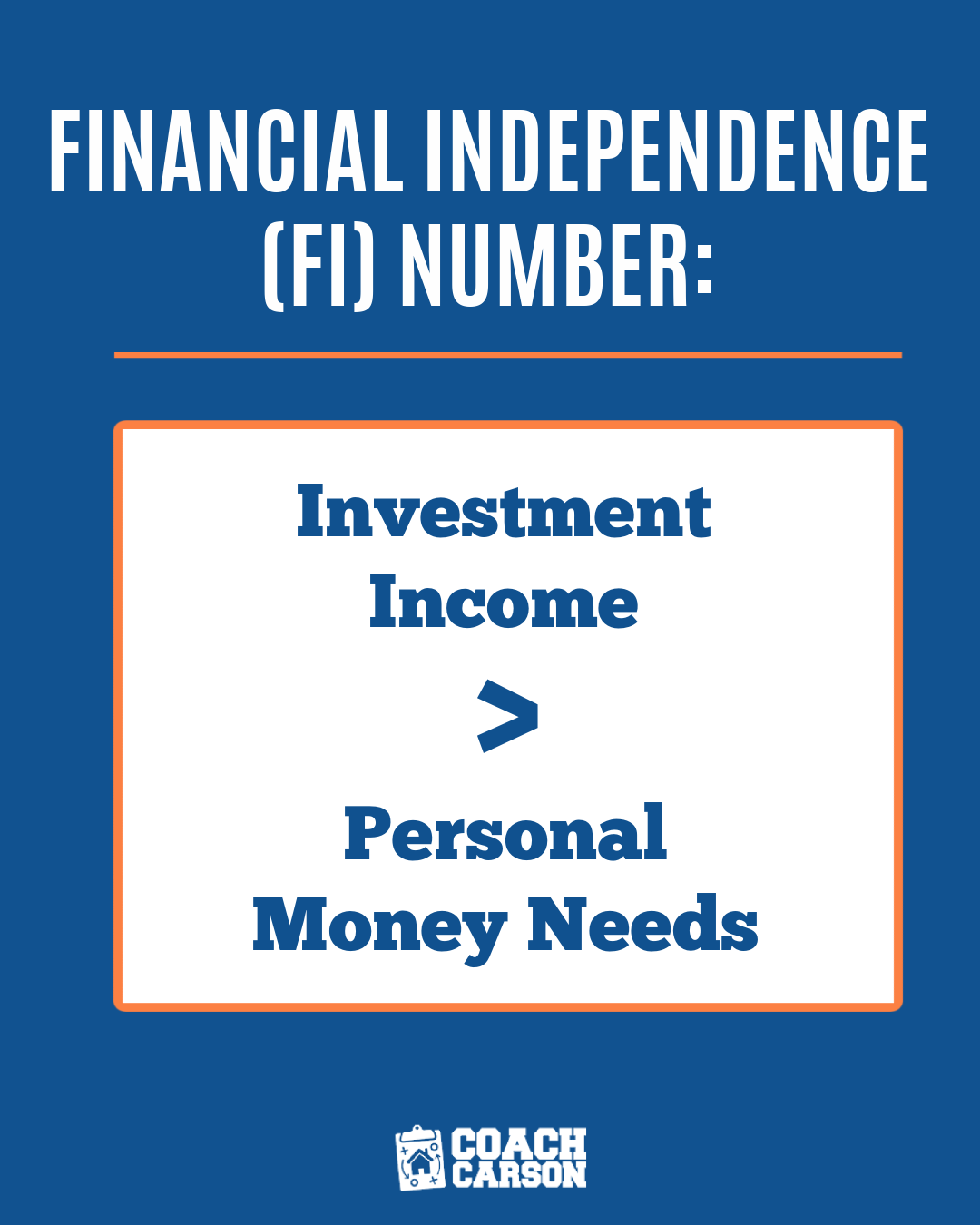

Written as a formula, your financial independence number looks like this:

Investment income is the money you receive from investment assets like real estate, stocks, and bonds. When your investment income exceeds your personal money needs, you no longer need to trade hours for dollars in order to survive financially.

When you reach your financial independence number, you break the cycle of working for money. You draw a line in the sand beyond which you will no longer financially need a job.

Joe Dominguez and Vicki Robin in Your Money or Your Life call this line in the sand the crossover point. Robert Kiyosaki in Rich Dad, Poor Dad calls this leaving the rat race.

In the language of real life, this financial independence number means you could survive at a certain level only using the production of your investments. For example, your net income from rental properties would cover your personal overhead. Or with more traditional investments like stocks and bonds, the 4% rule for safe withdrawal may allow you to live off of 4% of your total holdings each year for a long period of time.

But before you begin hustling to accumulate wealth and income, let’s look at how to actually calculate your own financial independence number.

How Much Does the Ideal Life Cost?

The formula for financial independence may be simple. But actually squeezing all of your financial hopes, dreams, and insecurities into a math formula is challenging. If you’re like me, it’s a process you’ll continually tweak and update throughout your life.

But the financial independence number does not have to be perfect to be useful. Like any other goal, you can benefit from moving towards a goal even if the goal is just a reasonable guess.

So, how do make an educated guess for your financial independence number? How do you figure out the cost of your ideal life?

I like to begin with the present by calculating your current expenses. You can do this a couple of different ways:

- Estimate your expenses using something like these personal financial spreadsheets.

- Use software apps to automatically track your expenses. You simply enter your credit card and bank account info, and the software automatically tracks and categorizes your spending. Some of the most popular apps for this are mint.com (free) or YouNeedaBudget.com (paid).

Once you have an estimate of what you currently spend over a 1 year period, you can make a guess for the future.

Many people find that their personal expenses will actually go down after retirement. If you pay off your home mortgage before retirement, that obviously reduces one major expense. And you may be surprised how much you can save in taxes when you live off of investment income. My blogging colleague Jeremy at gocurrycracker.com has legally not paid income taxes for over 4 years after retiring early.

For more information to help you estimate your future expenses after retirement, I like the article How Much Will It Cost You to Live in Retirement by Darrow Kirkpatrick of caniretireyet.com. Darrow retired early himself, and he writes about the nitty-gritty financial details of retirement.

My own number may or may not be relevant to you, but I’ll share it just to give you another perspective. I have a basic number of $36,000 per year, which is what I know our family could live off of to cover the essentials. And I also have a comfortable number of $60,000 per year which would give us plenty of cushion.

But the most important number is yours. And that’s something you can now figure out for yourself.

Life After Financial Independence

Reaching your financial independence number does not mean that you can’t still work and make more money. It does not mean you will stop growing financially for the rest of your life. It does not mean you are perfectly safe and secure forever.

Achieving the goal simply means that the pressure is off. Your assets could support you instead of your job.

This is an incredible place to be. An entire universe of life possibilities opens up.

The same job that you once hated could be transformed when you know that you’re there by choice.

Creativity and energy that had been dormant for years will suddenly reemerge.

New opportunities, new businesses, new questions, and new exciting paths will open themselves to you.

And even more amazing, these benefits don’t just emerge once you’ve crossed the finish line. Whether you’re at the peak or just a plateau along the way, the freedom of financial independence can still be experienced.

So, whatever an ideal life means for you, I highly recommend you figure out your own financial independence number. It will provide a clear, focused goal that will help you win with money.

What about you? Do you know your financial independence number? How did you arrive at that figure? How do you plan to get there? I’d love to read your comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

How about # of years you need your number. 20 years is ok but what if you need number for 40 years. $1.2 million is lot easier than $2.4 million.

Thanks for the comment, David. The main point of this article was to figure out what the yearly/monthly income number is. Taking the next step – as you have, which is great – is also critical. That step is figuring out what net worth you need to maintain that income and for how long.

I briefly mentioned it, but my assumption with timing is that you fall into one of two broad camps:

1. You just live off of income and don’t touch principle (most real estate investors). In this case, your income can last for as long as you need it.

2. You use something like the 4% rule (see link in article) to estimate that you can safely take out 4% of your networth each year. If your investments only produced 2% income, for example, you’d also sell some assets to make up the other 2%.

In your case, you could use 6% income rate conservatively with real estate to assume you’d need $1,000,000 equity to produce $60,000.

Or if you used the 4% rule with a more equities-heavy portfolio, you’d need $1,500,000 ($60,000 / .04 = $1,500,000).

There are many opinions about the 4% rule and how long that will last. Given that I have more of a real estate slant to this discussion, it’s probably not the place here. So, my main point would be to build a portfolio of rentals that produce that $60,000 income and then you can be much less concerned about how long your wealth will produce income because you never touch the principle.

I am slightly confused, please advise…if I increase my wthdrawal rate to 5% why does the financial independence number reduce? If I am withdrawing more (5% as opposed to 4%) should I not have a larger base number?

Thanks for the comment, Kev. I didn’t go into the math in this article, but the amount of networth you need is inversely related to the withdrawal rate. I’ll explain with an example.

Let’s say you need $60,000/year to live on.

In order to withdraw $60,000/year at 5%, you need $60,000 / .05 = $1,200,000.

With 4%, you need $60,000 / .04 = $1,500,000.

It’s just a math ratio.

But how much YOU actually need to feel comfortable is another matter all together. Some people want to be more conservative and save more money for an extra cushio. Others are willing to be more aggressive.

I hope that helped to answer your question. If not, let me know.

Guess what I mean is if I have $1.2 million and my number is 60k a year. Have I reached my number if I have enough to cover 20 years. Assuming I keep my $1.2 million in a bank account making little to no interest. No risk storage.

In fact your number with 1.2 million in liquid and 60k expense per year is what my current situation is ( considering we paid off our mortgage ) . My husband was just being let go after I quit my job as a stay at home mom . He is now working to get a job . I wonder if he can retire now to cover our expense for 15 years . He will get his pension when he retire .

Lynn,

There are obviously a lot of details to consider in your situation. So, I (or anyone else) couldn’t give you a great recommendation without further discussions.

But the principle I mentioned in the comment above is my own personal bias. I like to own rental real estate as a foundation for retirement. This is because it produces stronger income than most other assets, and you can live off of that income without touching the principle.

In my case with the properties I buy, I could certainly retire with 1.2 million (or a good bit less) invested in real estate because I could produce well over $60,000 per year.

Good luck with your planning, your husband’s job, and next steps!

Thanks Chad. I have followed your blog quite awhile and understand the power of rental income and like your view towards money . Our new goal has evolved to be minimalist so that we can nurture and travel with our son .When I started to quit my job and acquire the rental properties a year ago, my husband has been let go due to company merging. We have no idea where his next job will be and I feel more comfortable to manage the properties myself in my area . My goal is to have rental cash flow of just 2 to 3 k per month while my husband will invest in other area. So far his non real estate passive income is 25 K . Now I only have 2 rental properties using IRA for retirement giving me cash flow of 1.1 K per month . THe uncertainty of where we will make me quite stuck at the moment as I can’t continue my acquisition.

Lynn,

Thank you for sharing your story. I love your goal of evolving to become more minimalist and then invest your money so that you can nurture and travel with your son. I wish you best of luck in your next acquisitions. Thank you for following along. It’s an honor.

As you know, I’ve hit my ‘freedom’ point, but I also live a very low cost life. Like you said, for me, the independence comes with creating, giving and doing things that matter. I don’t want to ever go back full time where I don’t have the time for these things. I like working part time also because it allows me to be a very generous giver and I can continue to invest.

We also want to travel, but not in the touristy way. I’m writing a post now about journeys over travels. So, for me, the journeys that will fill my soul the most, won’t cost much at all.

Hi P. PRosperity ,

I just happened to read your article and realize we have quite similar investing style – focus in condo, simple and do it one at a time . I will stop once our passive income slightly over our expenses.I clicked your website the first time and pleasantly surprise you are one of the minimalist that my husband and I are beginning to embrace . We will put the current 3000 sf house on sale by next month and will purchase a much smaller house or condo with no mortgage .

My plan is to travel lightly, work as a sub teacher ( that is what I do now once a week ) and volunteering . I am so amazed by your idea of living in the studio hotel unit . Having a six year old , I am not sure this will be an ideal path . YOur idea of living in a hotel unit definitely open up my eyes as one of the way to retire when my son leave the nest . 🙂

I look forward to read about your post about your journey .

Lynn

Hi Lynn, That’s great that you will downsize and be mortgage free! I have to say that I don’t mind mortgages as leverage for rental properties, but as my main residence, I prefer not to have one.

Primal Prosperity, I love how there are a variety of freedom numbers that vary depending upon the person. I’m definitely in the same boat as you with respect to minimizing expenses. I’d rather have a lower freedom number so that I get to experience the richness of time. That is rarer today than ever, despite the fact that we are a richer society than ever.

I loved reading all the comments above. It’s an education in itself. My husband and I have from the very beginning made choices that include living below our means, while raising 6 children. It’s a mindset and we did not find it difficult. This led us to be able to save. The missing part was learning how to take those savings and investing them to create wealth. We’re finally doing it now. Very happy to have discovered Chad’s channel! I sat down with my husband tonight and he thinks that we could live on $25/per year – haha. He’s probably right, but after further discussion, we are aiming for about 50-60k per year.