Rental properties in the right location and with the right numbers are incredible vehicles to take you to financial independence. But without getting both of those factors right, rental properties may not work well.

So, in a prior article, I shared how to find the right location. In this article, I’m going to show how to find the right numbers. But instead of using in-depth rental property spreadsheets, the math I’ll share can be done on a scrap piece of paper. This form of quickly running the numbers is also called back-of-the-envelope (BOE) analysis.

Why Back-Of-The-Envelope (BOE) Analysis?

You may ask yourself why anyone would run the numbers on the back of an envelope for a major investment like real estate! Isn’t that crazy and risky?

But in reality, this is what most savvy, experienced investors do. Instead of wasting time early on, BOE analysis tells you if a potential deal has promise or not. If the BOE math looks good, you can then make an offer and get the property under contract subject to further inspections and verifications.

Even Warren Buffett, an investor who buys businesses for BILLIONS of dollars at a time, said this about running the numbers on investments during his 2009 annual meeting of shareholders:

If you need to use a computer or a calculator to make the calculation, you shouldn’t buy it”

Good deals should jump off your paper and smack you into action, even with back-of-the-envelope numbers. If you have to overanalyze the deal for hours using spreadsheets in order to make the numbers work, it’s probably not good enough.

With that advice from the Oracle of Omaha in mind, let’s take a look at how to run the numbers for rental properties. Here is an outline of what I’ll cover in the rest of this article (click on a link to jump directly to that section):

- Why good deals are like retirement engines

- The BOE Financial Snapshot

- My two key real estate BOE calculations – income & equity

- Putting it All Together – The Entire BOE Process

- How Faster Decisions Lead to Better Deals

Now, let’s get started!

(Watch me explain these concepts in a YouTube Tutorial)

Good Real Estate Deals Are Like Retirement Engines

Before we get into the nitty-gritty of numbers, let’s take a step back and look at the big picture. The #1 job of your rental property investments is to help you retire earlier and with more confidence.

I look at each property as a train engine. Each individual engine combines with the others to pull your overall finances down the tracks towards your goals. The better the property’s numbers, the more pulling power it has.

There are a couple of important financial goals these engine-like rental properties can help you accomplish.

First, rental properties help you build wealth. Over time, they can turn a small amount of your savings into a much bigger amount. Each of the real estate retirement plans I’ve outlined in other articles accomplishes this wealth-building goal.

Second, rental properties provide cash flow that allows you to live. This cash flow replaces your need to work at a job and trade hours for dollars. It’s the ultimate financial harvest, and it’s likely the reason you invested in the first place.

But how good is a particular rental property retirement engine? A quick back-of-the-envelope “snapshot” of the property’s financials will tell you.

The Financial Snapshot – Income and Equity

In my own back-of-the-envelope rental analysis, I create what’s known as a “snapshot.” A snapshot is like a quick photograph of your deal’s finances (I got the term snapshot from the book The Real Estate Game). You typically create the snapshot early in your deal analysis on a legal pad, envelope, napkin, or whatever scrap of paper you can find.

The snapshot allows you to quickly look at the financial highlights and determine if the deal meets your investment goals. This efficiency is especially handy early in your investing career because you will need to look at many deals (perhaps hundreds) before finding one that works.

My version of a rental property snapshot and the rest of this article focus on two important numbers:

- Income

- Equity

These numbers are related, but they each uniquely contribute to your wealth building and to your ability to generate cash flow that replaces your need to work.

I’ll explain my favorite tools for each of these calculations in the sections that follow. At the end, I’ll pull it all together and show you a step-by-step process to do a BOE analysis.

Income – Rental Property Calculation #1

There are a lot of different ways to define income. But I’m going to keep it simple:

Income is the money you earn after collecting rent and paying all of your expenses

In a basic investment scenario, you rent a property. Your tenants get to use the property, and in exchange, they pay you rent. After all of your expenses are paid, you get what’s left over.

This number is important because renting is the core business of investment properties. It’s the steady engine that pays your mortgage and pays your bills over time. Unlike your equity, which is based upon the relatively fuzzy estimate of the property’s resale value, rental income is less difficult to collect and less speculative.

So, how do you calculate income using back-of-the-envelope math? The following sections will explain my favorite tools to do that.

Gross Rent Multiplier (GRM)

Gross rent doesn’t mean gross as in disgusting. For those of us who collect rent regularly, it’s actually quite delicious:)

Gross rent means the total rent, before subtracting expenses or other deductions. And it’s useful because the gross rent is simple to find and easy to compare to other rental properties.

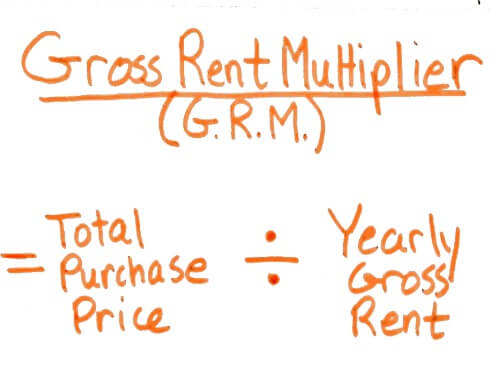

With my back-of-the-envelope snapshot, I begin by using the gross rent to calculate the Gross Rent Multiplier (GRM). The GRM is similar to the Price/Earnings (PE) ratio in stock investing. It’s just a ratio of the property’s total purchase price (including any upfront repair costs) to its yearly gross rent.

Why is the GRM useful? Because it roughly tells us how good a property is at producing income.

For example, a property with a GRM of 12 ($144,000 price / $12,000 rent) is much better at producing income (at least on paper) than a property with a GRM of 20 ($300,000 price / $15,000 rent). The higher the GRM, the less attractive an investment property becomes.

GRM isn’t the only quick analysis I use with gross rental income. A very similar rule of thumb is something called the 1% rule.

The 1% Rule

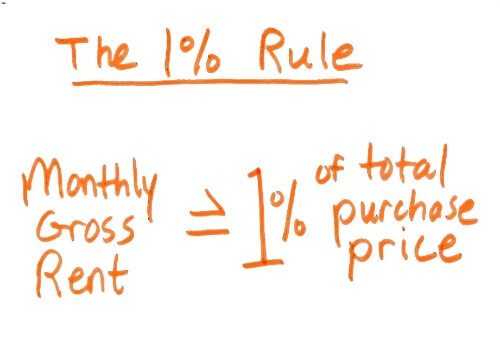

The GRM is a ratio using yearly rent. But real estate investors usually think in terms of monthly rent. So, the 1% rule is a rule of thumb that takes that into account.

I explained the 1% rule in more detail in another article. But in brief, the 1% rule says that the gross rent of a property should equal at least 1% of the purchase costs (or better).

For example, a property with a total upfront cost (price + closing/holding costs + repairs) of $200,000 should at least have a monthly gross rent of $2,000 to meet the 1% rule.

This property that meets the 1% rule would have a Gross Rent Multiplier of 8.33 ($200,000 / $24,000). $24,000 is the annual gross rent, or $2,000 x 12 months.

Meeting the 1% rule does NOT automatically make a deal good. I have even seen properties meeting the 2% rule that I’ve walked away from because of a bad location and rent collection challenges. And properties in high-priced locations will never come close to the 1% rule, yet they still could make financial sense in some cases.

This is a rule of thumb that just allows for quick and easy analysis. If a property DOES meet the 1% rule, it is just one sign that you may have an interesting investment candidate in front of you.

Cap Rate

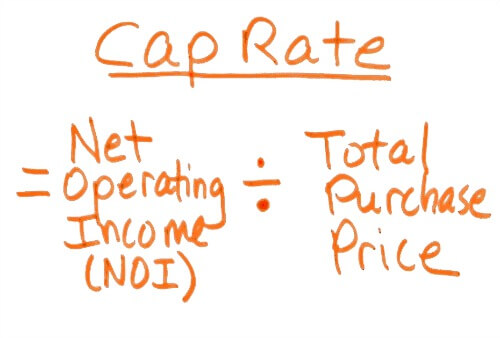

A cap rate is another important income calculation. Unlike the gross rent multiplier, a cap rate tells us how well a property produces income AFTER expenses. In another article, I explained in-depth what a cap rate is and why it’s important. But for now, here’s a basic definition:

In case you’re wondering, the Net Operating Income (NOI) is your gross rent MINUS all of the property’s operating expenses and deductions like vacancy, management, taxes, insurance, repairs, HOA costs, etc. These expenses do NOT include financing costs.

**If you’re a visual learner, also check out the YouTube videos I made for more detailed explanations of Cap Rate and of Net Operating Income.

For an example of cap rate, let’s say a property produces $6,000 per year in NOI and its total upfront purchase costs are $100,000. $6,000 / $100,000 = a 6% cap rate.

Compare this to another property that produces $7,500 per year in NOI and its total upfront purchase costs are $300,000. $7,500 / $300,000 = a 2.5% cap rate.

One deal produces a 6% unleveraged return (i.e. if there was no debt). The other produces only 2.5%. If all other factors are equal, which deal would move you towards your financial goals faster? The cap rate makes this obvious.

I also use the cap rate as a minimum investment goal. I will typically set a minimum cap rate that I’ll accept for an investment in a certain location. If the cap rate is below that number, I won’t buy it unless I can do something to the property to quickly increase it.

Also, keep in mind that appraisers or brokers of investment properties use cap rates to discuss the overall market. They might say, for example, “the market cap rate is 7%.” This means on average most investors in the market purchase their properties with a 7% cap rate.

The 50% Rule

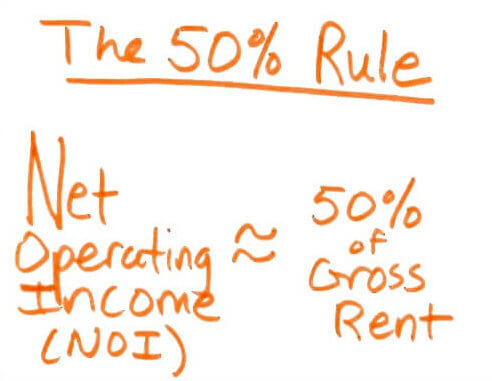

The 50% rule is a shortcut that helps you quickly estimate the NOI and the Cap Rate. But it’s important to remember that it’s just a shortcut and not the final analysis.

This rule of thumb assumes that 50% of your gross rent will be lost to your operating expenses. So, that means your estimated NOI is 50% of the gross rent.

This helps you quickly run the cap rate calculation with your back-of-the-envelope snapshot.

For example, if the yearly gross rent is $18,000, 50% of that is $9,000. If your estimated total purchase investment is $180,000, then your cap rate would be $9,000 / $180,000 = 5%.

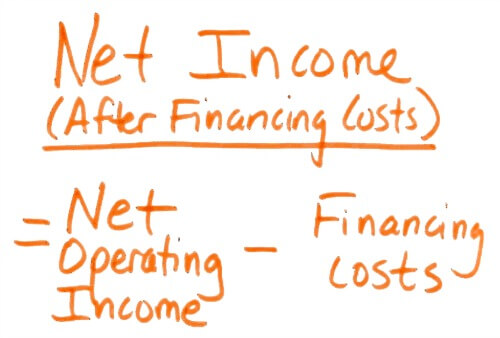

Net Income After Financing Costs

Until now all of our BOE income analysis did not take financing into consideration. But many real estate deals DO include financing. So, you will want to know how much rental income is left over AFTER you deduct our financing costs.

I’ll assume you can figure out how to estimate your monthly mortgage payment. If you need a refresher, I like this free amortization calculator and you can learn how I use it in my article How to Calculate Rental Cash Flow.

Here is the basic formula for pre-tax net income after financing:

You can set goals for a minimum amount of cash flow you’d like to earn per property. For example, your goal may be to earn a net income of $100/unit. So, a 4-unit property would have to produce a minimum of $400 per month.

This type of goal is useful so that you can ensure your property produces enough regular income to reinvest into one of your real estate retirement plans or to pay for your lifestyle once you’re ready to take it easy.

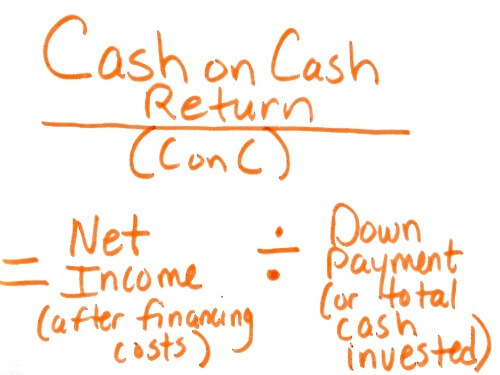

Cash-on-Cash Return

After calculating net income, I like to also run a final income calculation called the Cash-on-Cash (ConC) return. The ConC return tells you how much of your down payment or upfront cash investment comes back to you as cash per year. Here is the formula:

If you have a very small down payment (i.e. large amount of leverage), the ConC return is actually not that useful. For example, if you invested $5,000 and earned $400/month, you’d have a 96% ConC return! Or if you invested none of your own money (I’ve done this), the return is infinite – even with a minuscule positive cash flow.

While you could use these high ConC returns to brag to your friends, extreme leverage is really what makes this possible. And while I benefited early on from this kind of leverage, just remember that leverage-magnified returns can also lead to leverage-magnified losses! Eventually, you should have more cash to invest in deals if you’re successful.

The ConC becomes more useful when you invest these larger amounts of cash up front. It’s a form of discipline to help you compare your cash return from this deal to other potential investments like bank CDs, bonds, stock dividends, and annuities. Because cash flow is so critical to surviving long-run as a real estate investor, I like my rental investments to make a premium ConC return compared to these other lower-hassle forms of investing. So, if risk-free government bonds return 2%, I want to certainly make a lot more than that.

Like all of these calculations, you have to also look at the entire picture. If you’re making huge returns on the property’s equity, for example, it might be acceptable to have a smaller or even a negative ConC return for a short period of time. But in an ideal world, you’d make acceptable returns with all calculations.

Now that we’ve covered the BOE analysis for calculation #1 – income, let’s continue and look at calculation #2 – equity.

Equity – Rental Property Calculation #2

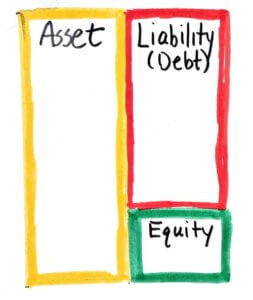

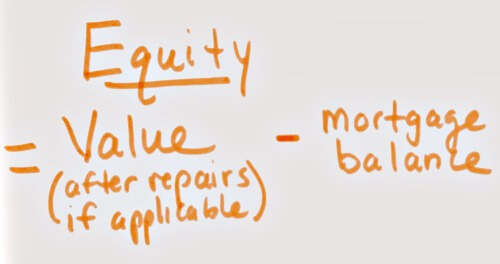

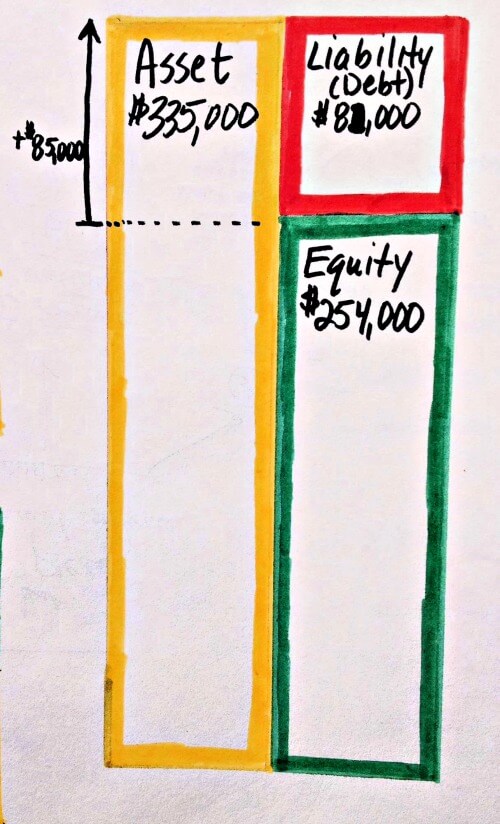

Equity is a financial term for what you own. Maybe you’ve heard equity used to describe shares of a stock in a company, but equity can also be calculated for a real estate property. What you “own” is the difference between the fair market value of the property (your asset) and the balance of any debt (your liability).

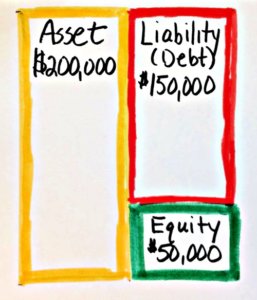

Here is my drawing of a balance sheet to show the basic relationship between assets, liabilities, and equity:

Calculating equity is simple. The math is like this:

There are two numbers you must know for this simple math, the value and the mortgage balance.

I explained how to do a quick property value analysis using comparable properties in The Ultimate Guide to Quickly Estimating a Property’s ARV at BiggerPockets.com.

This DYI valuation process is not a replacement for expert help from an appraiser or experienced real estate agent. But this article is really about how to be the captain of your own real estate ship. So, you should use 3rd party experts as additional resources, not as your only source of information.

The ARV process explained in that article also assumes you’re buying a house or small multiunit that is best valued with comparable sales. If you’re buying a larger income property that obtains its value from the income approach to value, you’ll want to use that process (and certainly get a second opinion). Here’s a good example of the income approach to valuation in action.

The mortgage balance calculation is more straightforward. For the present balance, you’ll just use the amount you’re borrowing. For a future mortgage balance, you can just use an amortization schedule.

To help apply this equity calculation, I’ll share some real-life scenarios.

5 Examples of Equity Calculations

Equity is a simple concept. But it’s also one of the most powerful ways to build wealth in real estate investing. These 5 examples will show you how it works.

Example #1 – Full Price Purchase

In this example, you pay $200,000 for a property, put $50,000 down, and borrow $150,000. Because you paid the full price for the property, your equity is the same as your down payment $50,000.

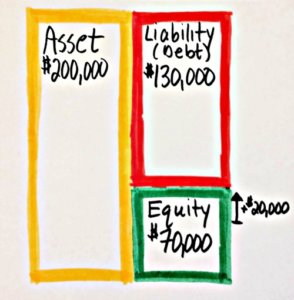

Example #2 – 10% Discount

In this example, you work directly with the seller (no listing agent), close quickly, and pay cash. This allows you to negotiate a 10% discount from the full value of $200,000. So, you pay $180,000 for the property, you still put $50,000 down, but you now borrow $130,000.

Now your equity looks like this:

You spend the same $50,000 out-of-pocket, but your equity is now $70,000 ($50,000 + $20,000) including the 10% price discount.

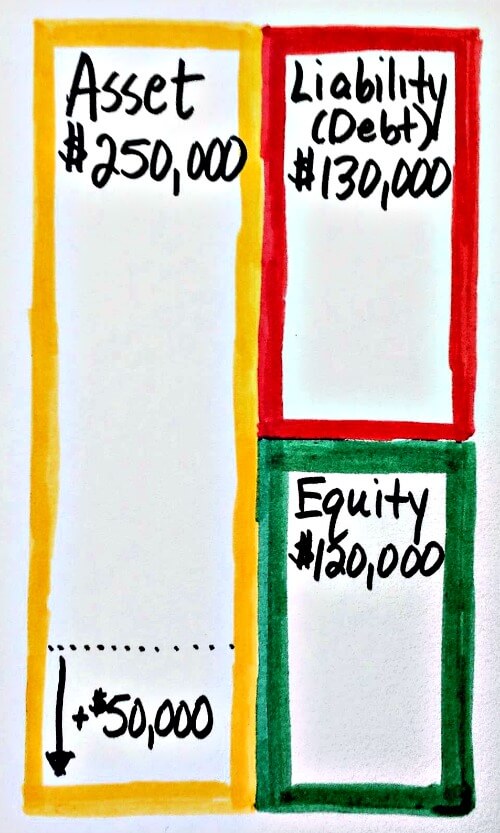

Example #3 – 10% Discount + Forced Appreciation

In this example, you again pay $180,000 for the $200,000 property, you still put $50,000 down, and you again borrow $130,000. But you see an opportunity to invest an additional $25,000 into property improvements that will increase the total value by $50,000 to $250,000.

Now your equity looks like this:

You spend $75,000 out-of-pocket, but your equity is now $120,000 including the original price discount and the forced appreciation from your improvements ($50,000 + $20,000 + $50,000 = $120,000).

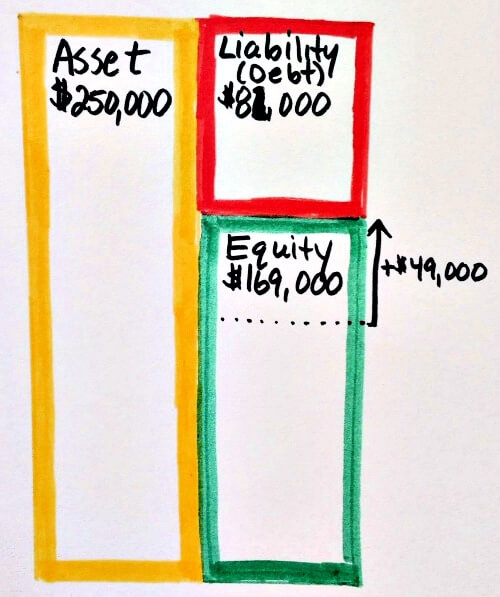

4 – 10% Discount + Forced Appreciation + Principal Paydown

In this example, you again pay $180,000 for the $200,000 property, you still put $50,000 down, you again borrow $130,000, and you again invest $25,000 to increase the total value to $250,000. But you now hold the property for 10 years and allow your net rents to pay down the mortgage principal balance.

I’ll assume that the mortgage had a 5% interest rate, a 20-year amortization, a payment of $858, and the net income at least covered the mortgage payment or more. Using my trusty online amortization calculator, I learn that my mortgage balance in 10 years will be around $81,000.

After 10 years, your equity now looks like this:

You spend $75,000 out-of-pocket up front, but 10 years later, your equity is now $169,000 including the original price discount, the forced appreciation, and the $49,000 of principal paydown during the holding period ($50,000 + $20,000 + $50,000 + $49,000 = $169,000) .

5 – 10% Discount + Forced Appreciation + Principal Paydown + Appreciation

In this example, everything is the same. Once again you also hold the property for 10 years while your net rents pay down the mortgage principal. But this time, the original full price of $250,000 after improvements passively appreciates by 3% per year to approximately $335,000.

After 10 years, your equity now looks like this:

You spend $75,000 out-of-pocket up front, but 10 years later, your equity is now $254,000 including the original price discount, the forced appreciation, the principal paydown, and the 3% passive appreciation during the holding period ($50,000 + $20,000 + $50,000 + $49,000 + $85,000 = $254,000)

As an aside, isn’t this impressive to see the potential equity growth of real estate over just a decade?! And this does not include any potential income benefits or outlandish appreciation assumptions.

** For bonus points, in scenario #5 what is the investor’s compounded annual rate of return over 10 years beginning with $75,000 and ending with $254,000 of equity? Ignore income or tax implications. Leave your answer in the comments section below so we can all compare notes.

A Note About the Fuzziness of Future Value

Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

Warren Buffett

The equity calculations above rely on the estimate of the property’s value. But as I said in the section on income, the entire process of calculating your equity is unavoidably fuzzy and speculative.

Why is this? Because calculating the present value of a property is an inexact science. Just ask any appraiser, or better yet read their disclaimer in the appraisal itself! And when you add the uncertainty of the future to that already imprecise value calculation, the picture gets even fuzzier.

This means you will need to decide how much you depend upon future predictions that are outside of your control. For me, I like to have equity growth WITHOUT counting on passive appreciation. If my property appreciates (which has certainly happened to me in the past), then I just get bonus returns.

This means that my BOE equity analysis just uses the future calculations that I can reasonably control, which include:

- the discount achieved at the time of purchase

- forced appreciation from improvements

- pay down of the mortgage principal

If, as in equity example #4 above, I can more than double my money from $75,000 to $169,000 in 10 years WITHOUT passive appreciation, I like the deal. But if I have very little equity growth without counting on passive appreciation, I need to make sure the income compensates me for that speculation. And if both income and equity calculations are unacceptable without appreciation, I will move on to another deal.

So, should you include passive appreciation in your equity calculation? It’s up to you. Some investors do. But just know that even in the best of locations, it is a more speculative form of investing than building in equity growth from those other sources.

Putting it All Together – The Entire BOE Process

You’ve looked at a lot of numbers and calculations so far! But let’s wrap this up to make these tools something you can use in your personal investments.

Here is the BOE analysis process in a nutshell:

- Find a potential property to evaluate

- Study current market rents and current operating expenses (or for quick analysis use the 50% rule)

- Create a snapshot of the property’s income by calculating:

- the Gross Rent Multiplier (GRM)

- 1% rule

- Cap Rate

- Net Income After Financing

- Cash-on-Cash Return (ConC)

- Study comparable sales in order to estimate the current value or the After Repair Value (ARV)

- Create a snapshot of equity by calculating:

- Current equity (Full value – debt balance)

- Future equity (Full value – future debt balance)

Now, you have numbers scribbled on your envelope. What’s next? And how will this help you buy profitable rental properties?

How Faster Decisions Leads to Better Deals

With your BOE snapshot in hand, you can now compare the deal numbers to your investment property goals. And this comparison – reality vs goals – is where the critical investment decisions are made.

The typical process works like this:

- Set your goals.

- Hunt for deals.

- Compare the potential deals to your goals.

- Make decisions.

Your decision could be to purchase a potential property for its current asking price. Or you may decide to make a lower offer that does meet your criteria. Or you may choose to walk away and pursue other deals.

But whatever you decide, the BOE analysis tool can help you do it more confidently and more quickly.

And making decisions quickly is important because buying good deals is a numbers game. You must look at a lot of losers before you find a winner.

When I began investing, a smart teacher told me that I would need to look at and analyze 100 properties before my initial real estate investing lessons could really soak in. After looking at and analyzing thousands of properties myself, I know the teacher was right!

So, if you want to improve your skills as an investor, the 100 property exercise would be a smart place to start. It will give you an opportunity to practice running these back-of-the-envelope numbers, and you might even stumble upon a deal along the way!

Conclusion

This article was all about running the numbers for rental properties on the back of an envelope. The idea was to give you a quick yet effective tool that you can use to buy more rental properties.

If you still love spreadsheets (like I do), don’t worry. There is still a time and a place for in-depth analysis during a due diligence stage. But the most effective real estate investment pros I know do this quick style of math on the back of an envelope (or even in their head) while out in the field looking at deals. I highly recommend you add it as a tool in your own real estate investing toolbox.

I wish you the best in your rental property hunting!

What were the biggest takeaways for you from the article? Will you use back-of-the-envelope analysis for your real estate investments? Do you have a different approach to analyzing deals?

I’d love to hear from you in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Scenario 5 Bonus answer: 23.87% annual return?

I meant to add – very useful post! Thank you for sharing this. Great breakdown of the key metrics to evaluate deals.

Thanks for commenting and reading, Michael! And for the bonus question – I had a different number. Let’s see if anyone else chimes in first, and then I’ll share what mine is.

But to answer that question, I used a financial calculator. Present Value (PV) = $-75,000, Periods (N) = 10 years, Future Value = 254,000, PMT = 0. Then I solve for rate (r).

Ah I see what I did wrong, tried to be first too fast. 12.97% is the correct answer I think…

That’s my answer too! And it’s not too bad considering it does not include any income, right?

Right, so even though in this example you are using the rental income to pay down the loan, that money could be coming from anywhere. So yeah, quite impressive on its own, and then when you take into account that the asset itself is paying you to pay down the loan…not a bad deal! This is why I really want to get into RE investing. Been on the sidelines for a while, learning a lot about the industry, inhaling Bigger Pockets episodes (I heard you on there, great stuff). Need to figure out my focus and really try to put something together.

Incidentally how would you figure out that total return? Would it basically be the rental return + above yield?

Michael, for total return – at least the total with pre-tax income and equity yield from this article – you would just add one more factor to your entry into the financial calculator – Payment (PMT). This would be your yearly net income after financing. So, if you made $2,400/year in income after financing, that would be your PMT. And in that case, your return would be 14.871 assuming income was consistent for 10 years. Tax costs also needs to be considered, but it varies a lot depending upon the person (or the political climate).

Great to hear you’re planning to get into real estate. I have two articles I wrote to help with the first stage focus: 1) https://www.coachcarson.com/best-real-estate-investing-strategy/ and 2) https://www.coachcarson.com/real-estate-investing-niches/. Hope those help.

Great article, I think I will link to it in my real estate investing post, thanks!

Awesome! Thank you!

Thanks for sharing. I liked having all the “formulas” all in one spot. I finally joined the club and bought my first duplex. I did over analyze it with spreadsheets but I like the quick BOE idea. Thanks again

Thanks, Cheryl! Glad it was helpful.

Congrats on the duplex! And no shame in using the spreadsheets. As I said in the article, I am a spreadsheet nerd:) The BOE process is just a good tool to have during your first pass at deal. Then bring in the heavy horses with spreadsheets to verify later.

Dear Chad Carson,

Thank you very much for your regular knowledgeable articles…

I am regular reader of your site/articles without fail.

I am from India and investing in real estate as a fresher investor with only 2/3 properties.

But in India, I find it very tough to get high cap rate. Cap rate of 6 to 8% is very high enough in India (particularly commercial offices only fetch 6 to 8% of cap rate). Residential investment fetch only 2 to max 3.5% of cap rate. Again, this is same across all cities. Interior cities (or small towns) fetch only 1 to 2% of cap rate. Hence, it becomes very tough to get high cap rate (which you mentioned) with any idea. Again loan rate (mortgage rate) is also very high in the range of 11 to 13%.

Though, growth rate of India is nearly 7% and again inflation rate is also nearly 6 to 7%.

Hence I find it very tough to invest with real estate (particularly residential). I had started investing in commercial office space, which fetch merely 6 to 7% of cap rate before repairs, maintenance or mortgage.

Now my question is,

(1) what may be the reason for lower cap rate? And which can be the best strategy to invest here in India?

(2) How high growth rate and higher inflation rate will affect property rate in future/appreciation of property?

(3) I am investing with half amount of property as mortgage and half of amount as cash in commercial office real estate. But What can be the best way to invest for real estate in India?

I request you to guide me in the matter.

Thank you in advance…

Regards,

Divya Parekh

Hi Divya,

First of all, thank you for reading and for commenting! I’m honored you’d visit from India.

You’ve brought up very interesting questions.

Why are cap rates lower in India? My short answer is “I’m not sure, but I’m researching with interest.” I found this article that may make interesting reading on this topic of comparing cap rates internationally:

– https://www.weforum.org/agenda/2016/01/cap-rates-cycles-and-how-to-inflate-a-real-estate-bubble/

It seems investors there are either buying with expectations of high growth/inflation (thus a lower required income return) or they are just accepting lower rates in general. I assume it’s more about the first, but I don’t know.

It definitely makes your decisions more difficult. Rental income (cap rates) are the core way to make money. Growth/inflation can help, but it’s more unpredictable.

People who invest in low-yield/high price markets in the US often have to look at other investment options. Can you buy properties that you can add value to (repair/add-on space/increase rents) in order to get higher yields? Can you look in different sub-markets within India that do have better yields? Or maybe can you look at other asset classes all together (like loaning money to other investors and earning those 13% returns!).

You’re asking good questions, and it sounds like you understand the fundamentals. So, I’d keep hunting and researching before I lowered my standards. Thanks for bringing your situation to my attention!

Hi Chad Carson

Thank you very much for your timely reply.

Article you suggested is indeed very interesting, thank you for suggesting such article.

I am using innovative loan facilities from bank, which can give me lending rate of 8 to 9% as against 11 to 12%. I am also investing in very high growth rate market of India (away from home), with some innovative techniques, for higher cap rate yield. Yet, again increasing my knowledge also with coach like you.

Thanks again.

Regards

Divya Parekh

Awesome article coach! It will be useful im sure. I want to find a deal but still have lots to learn. Thanks for sharing and coaching!

Thank you Manuel! I hope these tools are helpful for you on your first deal. Keep practicing (and look at those 100 properties!).

This is an awesome guide so I can get started looking into properties with a little more knowledge! Your blog is a great resource – keep the great content coming!!

Thank you, Grounded Engineer! I really appreciate you reading and taking the time to comment. Good luck with the next steps on your properties!

Hi, Chad, so this example describes about a 15% annual return. What would you estimate one’s average annualized returns could be via carefully constructing a portfolio of rentals per your methods? Sounds like 15% is a reasonable assumption? Thanks for awesome content!

Hi Matt, I personally wouldn’t do a deal if I couldn’t extrapolate a 15-20% TOTAL annualized return (including all of the different profit sources). But I’ve also had some deals that certainly made below that as well. I need to go back and calculate my average annualized returns more closely at some point, but given the growth I’ve had I still know it’s at that figure or above.

Do I think that’s possible for others? Yes. Is it easy or will it happen for everyone? No. But especially using leverage, these returns or better in real estate are achievable with sound principles (which I try to share here) and a lot of hustle.

Chad, thanks for the reply. I’ve been able to get similar returns from my apartment LP investments. In the last few years with appreciation we’ve been able to finance out a good portion of our equity which further increased return on equity. I’ve been encouraging Jonathan and Brad at ChooseFI to hone in on the stocks vs. real estate for FI conversation. I think it would be a valuable and fascinating post if you broke down your actual returns! I’d love to see it anyway. Many thanks for the awesome content and your overall value-add to FIRE community!

Great idea for a post! Thanks for the suggestion. I’ll add to the “work-in-progress” library:)

Thanks for sharing your own experience, Matt. And thanks for encouraging Jonathan and Brad at ChooseFi. I too think that would be an excellent discussion comparing stocks vs real estate.

I’ve been so busy writing (and enjoying life) that I haven’t dug out all the past returns, but thanks for the encouragement:) I’ll see what I can do.

Refinancing equity certainly makes a difference in boosting overall returns. Generally that also adds risk, but if it’s done carefully and thoughtfully in the right amounts, at the right time, and with the right terms, the risk can be manageable.

I look forward to staying in touch!

Thanks for the reply. Good stuff. Yeah, disciplined rule systems are key. A few of my rules:

1. Buy into properties where rents are less than the average housing expense for the area.

2. Buy into properties where rents are less than 25% of average take home pays.

I took these from the classic “How I turned $1,000 into a Million in Real Estate in My Spare Time” by William Nickerson. These rules allow me to own properties that the majority of the population can afford in good times and bad – keeping vacancies low and rents more stable.

You still planning to be at the Oct 7, 2018 Chautauqua? If so, I’ll look forward to meeting you in person then!

Matt,

I like those two rules! Definitely better to be in the range where people can always afford your payment. Thanks for sharing.

Yes, I’ll be at the Oct. 7th Chautauqua! I look forward to talking more there.

Presentation easy to follow .

Homework is required .

Probably would have traded many College classes for your presented information .

Hey Chad, great article that I found thoroughly helpful.

One suggestion I would make: I find it helpful to steal a page from the corporate finance playbook and differentiate my thinking between “Revenue” or “Top Line” (total amount of money a business or, in the case of Real Estate, a property generates) and “Income” or “Earnings” (the amount of profit your asset produces, after expenses).

As an example of this type of differentiation in thinking: GRM is actually a measure of how effective your property is at generating revenue, but it doesn’t tell you a thing about how much of that revenue you get to keep, in the form of profit. For that, you’d want to look at something like Cap Rate, which is basically a measure of profitability.

Good distinction and thanks for sharing. I agree – it’s valuable to know both, but either piece of data in isolation from the other is much less useful. Definitely useful to borrow from the big boys and girls in corporate where we can!

Thanks – great post, really helpful.

Thanks for sharing this with us!!!!!!!!!!

23.8%

Thanks for the good article!!!

Thanks for sharing such a detailed article about non-recourse reverse mortgage protections explained keep up the good work!

There are so many blog i read right know but any one of them satisfy me but this one is so informative blog.