I am a fan of using real estate investing to climb the wealth-building mountain. One of the most unique benefits of real estate investing is that it can give you the ability to use smart leverage to magnify your returns while also protecting your down side.

The Power (and Danger) of Leverage

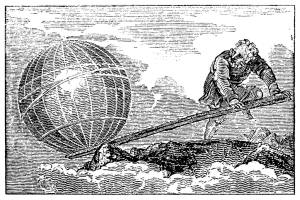

Ancient greek scientist and philosopher Archimedes once said:

Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.

Leverage allows you to lift very big objects by using a well placed lever like in the picture above. The principle works in the world of physics, but it also works in the world of real estate investing.

For example, you could purchase a $500,000 apartment building by using $100,000 of your cash and borrowing $400,000 from a lender. If the building produces a net operating income of $50,000 per year and your interest cost to the lender is $20,000 per year, you could earn $30,000 ($50,000 – $20,000) on your $100,000 investment. That is a 30% cash on cash return.

But as you probably know, certain types of financial leverage can also cause financial ruin. Leverage magnifies financial gains, like in the previous example, but it also magnifies financial losses.

During the 2008 financial crisis, many well-known businesses either went bankrupt or had to receive bailouts in order to survive. These businesses benefited from leverage during the good times, but they paid dearly for their unwise use of it during the bad times.

Low Risk Investing and Buffett’s #1 Rule

Probably the best investor of all time, Warren Buffett, likes to remind us of his simple rules for investing:

Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1.

Buffett prioritizes low risk investing. He realizes that accumulating wealth is a slow and steady game. It takes years of persistent hard work to build a nest egg that gives you financial independence. But a couple of foolish risks can eliminate some or all of that wealth very quickly.

But, just because Buffett is risk averse does not mean he advocates hiding all of your money under your mattress or in FDIC-insured bank accounts with low returns.

To Buffett, being risk averse also does not mean avoiding all debt or leverage, as some teachers like Dave Ramsey advocate.

A smart but low risk approach like Buffett has employed seeks to avoid big losses while also achieving reasonable returns that beat the averages and protect your wealth from being eroded by inflation.

Warren Buffet’s Smart Leverage

Warren Buffett and his company Berkshire Hathaway** have benefited tremendously from the use of leverage in the form of debt (long-term bonds), insurance float, and deferred taxes. Here is a quote from an interesting article in the Economist that explained Buffett’s use of leverage:

Without leverage, however, Mr Buffett’s returns would have been unspectacular. The researchers estimate that Berkshire, on average, leveraged its capital by 60%, significantly boosting the company’s return. Better still, the firm has been able to borrow at a low cost; its debt was AAA-rated from 1989 to 2009.

The key lesson here is that Buffett and Berkshire didn’t just use just any form of leverage. Warren Buffett was conservative and smart in his deployment of leverage.

For example, Berkshire’s total debt today is less than 16% of it’s total assets. This is the equivalent of making an 84% down payment on real estate! And the debt Berkshire does choose to incur is equally conservative. Here is a quote from Buffett in one of his letters to shareholders that I found in the book The Essays of Warren Buffett:

We use debt sparingly and, when we do borrow, we attempt to structure our loans on a long-term fixed rate basis. We will reject interesting opportunities rather than over-leverage our balance sheet.

And Berkshire’s other forms of leverage like insurance float and deferred taxes have extremely low cost and risk. Buffett has used these low-risk debt vehicles to magnify returns from other solid and steadily growing businesses Berkshire owns like Coke, American Express, Wells Fargo, Sees Candies, and more.

Smart Leverage in Real Estate Investing

In real estate investing you can learn from Buffett’s approach and translate it to your own deals. Real estate is just a specialized kind of business, so the same general principles used at Berkshire can apply to your business of purchasing income property.

Here are a few ideas for how to employ smart leverage in your real estate investing:

Borrow Debt Safely

While my career of 13 years in real estate investing is not long by some standards, I have observed in my time that more real estate investors fail from problems with debt than with any other.

Think about it.

Some people worry about paying too much for a property, but if you overpaid and used 100% cash (no debt) for the purchase the only problem would likely be lower than expected returns. Not great, but not dangerous either.

But when you add debt to the equation, paying too much and borrowing too much can create negative cash flow, stress, and potential foreclosure or bankruptcy if the entire loan can not be paid back at the time of a balloon payment.

I grew up with family who hunted and taught kids early about gun safety, so I have always compared using debt to a loaded gun. A gun is a hunting tool that can feed you very well if you use it safely, but it’s also a tool that can cause great tragedy if you use it carelessly. Debt works the same way with your real estate investing.

4 Tips for Smart and Safe Debt

I wrote an entire article called Is Debt Dumb in Real Estate Investing, but here are a few important tips to ensure your real estate investing debt is smart and safe:

- Use long financing terms – You want to avoid 3-5 year balloons. My preference is 10-15 years or more in order to move past most tough economic cycles. Be careful assuming you can sell or refinance in the future. No one really knows what the future will hold, so you must assume it will be difficult to pay these loans off. If you could not sell or refinance, what would you do? In 2008 many corporations and real estate investors found that out the hard way when the entire credit market contracted and loans could not be easily refinanced.

- Fixed interest rates – Interest rates have been held low for a long time. No one really knows exactly when rates will change, but we do know interest rates have no where to go but up. If you borrow too much with adjustable rates, the entire cash flow of your portfolio could get turned upside down during a drastic rise in interest rates.

- No personal recourse – When possible, you should avoid personally signing on mortgages because this exposes all of your other assets to risk of loss. Of course almost all bank mortgages require personal guarantees, which is one of six reasons I prefer non-traditional, “creative” financing. Instead I like to use an uncommon financing toolbox. But, if you can get a fixed, long-term bank mortgage on a property that cash flows well, it can often be worth breaking this rule. But just remember that banks will often cut you off after 5-10 of these mortgage loans, and self-employed borrowers will have a much harder time qualifying.

- Use conservative financial ratios – As I’ve said before, debt is the most likely culprit to tank your real estate investing portfolio. So it makes sense to use conservative ratios in order to avoid future problems. This would include low loan to value ratios, i.e. a larger down payment. It also includes high debt coverage ratios, which basically means have a lot more income than you need to make your payment. Finally, it makes a lot of sense to keep large cash reserves. I feel more comfortable with a minimum of 3 months of total mortgage payments in reserve, but you will want to find a number that you feel comfortable with.

Use Alternative Forms of Real Estate Leverage (Lease and Options)

One of the big forward leaps I took in my real estate investing career was when I realized I did not need to own a property in order to enjoy all of the benefits normally associated with ownership. Instead I could control property, profit from it, and avoid the biggest risks using leases and options.

Many people buy investment real estate for income, but a contract called a master lease (lease with right to sublease) can allow you to control and profit from a property’s income without owning it.

Many people buy real estate for forced or natural appreciation, but a contract called an option to purchase can allow you to control and profit from the price appreciation of a property without owning it.

Many people assume they must borrow thousands or hundreds of thousands of dollars (usually from a lender) in order to purchase a property, but relatively small amounts of cash or other objects of value (like private notes, cars, land, mobile homes, etc) can be given to the seller as consideration for a lease or an option contract that delays having to borrow from a third-party lender.

These alternative forms of real estate leverage require some specialized knowledge, a good local attorney on your team, and a study of contracts and local laws. But, I promise you the investment in that education is well worth the effort.

While it is not his primary business, Warren Buffett and Berkshire Hathaway have made large profits from more exotic versions of option contracts in the stock and bond world. Buffett essentially made large profits without ever owning the assets themselves.

Take Advantage of Real Estate Tax Deferral Strategies

Few people realize that a large part of Warren Buffett’s leverage strategy is to use tax laws that allow him to save money today and invest the savings for years until the taxes are actually owed. Essentially he is “borrowing” these tax savings from the government at no or little cost and on a very long time frame (20-30 years).

You can do the same thing with your rental properties.

Probably the most powerful tool in your tax deferral toolbox is a like-kind tax-free exchange (most commonly know as a 1031 Exchange). You can essentially sell or trade a property, use the equity in your property to buy a new property, pay no tax on the transaction right now, and continue renting for years to come.

This tool allows you to use the full amount of your property’s value to purchase another property. If you sold without this tool, you would lose much of your purchasing power.

For example, if you sold a property for $200,000 and paid taxes of $75,000, you wold only have $125,000 left to reinvest. But with a tax-free exchange, you get to use the entire $200,000! You are essentially borrowing that $75,000 from the government tax-free with no deadlines for repayment. Not bad!!

Another method of leveraging tax-deferred funds is the use of a depreciation expense.

Here is a basic explanation of how depreciation works. Essentially you must write off a portion of your building value (not land) each year as a depreciation expense on your tax return. This passive loss can offset other income in many cases.

So for example, if your depreciation expense was $3,000, it could offset $3,000 in income. At a 28% marginal tax rate, this would equal a savings of $840. That doesn’t seem like a lot, but the numbers can get a lot bigger the more property you own.

There are a lot of IRS rules related to how much income your passive losses can shelter (passive loss rules), who is eligible, and when these losses can be used. So definitely consult a CPA on this topic.

Conclusion – These Tools Are Made For Climbing

This article has been all about the use of smart leverage in real estate investing. I hope you can see the benefit of balancing between the extremes of overly conservative and overly risky when using leverage.

Above all, please remember that all of these methods to grow your money and to control your risk are just tools. These tools are made for the purpose of climbing your own wealth-building mountain. In other words, the purpose is to help you win with money so that you can live a better life.

Living better, whatever that means for you, is what this financial journey is all about. It’s why I enthusiastically write these articles. It’s why I get excited to hear your feedback and stories of successful progress on your own financial journey.

So if the ideas in this article are helpful to you, do yourself (and me) a favor by applying them as soon as possible. Your future better life depends upon it.:)

Thank you for the opportunity to share with you. It’s a privilege.

What do you think about using smart leverage in real estate investing? Have you used any of these leverage tools? Do you avoid leverage all together? I’d love to hear from you in the comments below.

_________________

**In the interest of full disclosure, I own stock in Berkshire Hathaway Inc. The price of a stock is affected by investors’ willingness to buy the stock. Therefore, the author’s personal wealth could increase if he persuades investors to purchase the stock.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

I see you recommend the book “Building Wealth One House at a Time” by John Schaub. Have you read his latest one published in 2016? Just wondering if there’s any fundamentally useful in that one versus his 2005 book. Thanks!

Hey Brecken, good question. I have not read his brand new revision, but I’d like to. In any area I study, I like to read everything by my favorite teachers. So I can’t see going wrong with getting the new edition even if you have the old one. Perhaps you could also talk your library into order it? Then you could check it out for free.

Thanks for posting!

Hey Chad,

Great article…really informative and helpful for a young investor like myself!

Thank you, Zac! Good luck!

Very smart is strategy to use real estate investments to leverage and expand financial returns. Great article.

Thank you for reading and commenting, Filipe!

Lately I am researching a lot on the subject that involves real estate investments because I intend very soon to start making investments in this sector because I believe it is a good option, thank you very much for sharing your knowledge Mr. Chad Carson, I am grateful.

Thank you for visiting and reading, Silva! I’m happy it was helpful. And good look with your next steps. If I came help in any way, be sure to drop back by and leave more comments.