This article is about buying properties with lease options (my YouTube video also breaks the topic down further). Some of my most profitable deals of all time have come from the combination of leases and options, so I’m excited to share more with you.

First, if you want to review my previous articles in the creative financing series, here they are:

- 6 Reasons I Prefer Creative Financing to Bank Financing

- My Creative Financing Toolbox (And Why You Need It Too).

- How Seller Financing Really Works

- How to Create a Private “IRA-Bank” For Your Deals

We all know real estate is a powerful wealth building tool. You can make money buying low and selling high, and you can make money holding property for monthly income.

But, the problem with real estate is that it’s expensive! To get these benefits you normally need a lot of money, and for most of us the only way to get in the game is the use of leverage.

How to Lift the World

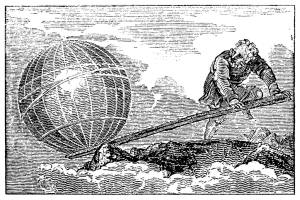

Ancient greek scientist and philosopher Archimedes once said:

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

You can lift very big objects by using a well placed lever like in the picture above.

In real estate, leverage controls houses and buildings instead of big rocks. The most common form of leverage is just a loan from the bank.

For example when you buy a house for $100,000 by putting $20,000 down and borrowing $80,000, the loan allows you to buy the entire property for only $20,000 while your tenant helps you pay back the rest.

But, debt is problematic. Almost as easily as it can powerfully lift an object, it can backfire and “crush” you if values or rents drop or if the banking market changes drastically (i.e. the Great Recession of 2008-2009).

Options and leases, on the other hand, avoid the biggest risk of loans while still giving the benefits of leverage..

Sound too good to be true? I’ll explain more.

Options and Leases Defined

An option is a contract (similar to a purchase and sale agreement) that gives the buyer the right (but not the obligation) to buy a property for a specific period of time for a specified price. The seller gets some sort of consideration, often money, as a compensation for giving up this right.

A lease is also a contract that gives one person the right to use the property of another person for a specified amount of rent for a specific period of time.

Options and leases both control your risk because they limit your promises to very specific amounts of money and very specific time frames.

With an option you control the price but you are not obligated to buy the property. You have the right to buy, but you also have the right to walk away and lose your original consideration.

With a lease that has the right to sublease to another sub-tenant, you can also control the income of the property, but you are not obligated to continue beyond the expiration date of the lease. This time frame could be as short as a few months or as long as 99 years.

In case you’re wondering, these tools aren’t just something obscure used by real estate nerds like me and Dyches Boddiford. Entire skyscrapers in New York City are funded and built using nothing more than a long-term lease! Hong Kong was leased to Britain from China for 99 years! These tools have a long, profitable history.

When to Uses Lease Options

So when is it best to purchase a property with a lease option?

In my YouTube video on lease options (below) I give an example of making a big profit while solving the problem of a tired landlord using only $5,000 cash and a lease option. I think you’ll like the results.

Another common use of lease options are for high priced markets or speculative deals.

When your property prices have appreciated far beyond reasonable rents, you can try making offers with lease options. A seller might be willing to “lose less” on their mortgage by getting some income from you while you work on getting the property sold to third party (likely your tenant).

Other deals like land development and condo conversions can only move forward when a series of contingent events happen. Sometimes these contingencies and due diligence items could take years or never happen at all, so controlling the property with a lease option can avoid a huge loss should the due diligence items not work out.

Look for my next article on using credit partners, a virtually unlimited source of funds for your deals.

Would you like to use master leases, options, or lease options in real estate investing? Have you tried it before? What challenges do you see with this technique? I’d love to hear from you in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Thanks Chad for thoroughly explaining this concept! I also found MMM through you, so consider me indebted 🙂 Say you have the flexibility to purchase the property, vs. doing a lease option. What criteria helps you decide which to do?

No problem, Taylor! Glad the article was helpful for you. And I’m also happy you’ve found MMM. He writes about some great topics in a very funny way, so he’s definitely been a big help to me.

I often let the seller choose which tool I use for a purchase. I usually make multiple offers, and each offer has pluses and minuses (like lease option may have a higher price than a cash offer, or lease options may have a smaller cash down than seller financing, etc). So ideally I’d lay all the benefits out on the table, and let them tell me which direction to go.

There are times when one tool will obviously work better than others, but as a principle I try to be very open and let the seller’s situation guide me. I will of course need to make a profit either way.