As a beginner real estate investor, have you ever been overwhelmed by the variety of strategies available? An endless supply of blogs, podcasts, and videos give you dozens of amazing ways to make money in real estate. But if you’re stuck in analysis paralysis from too many choices, even the best strategies won’t do you much good.

So, how do you find your focus as a new investor? What’s the right strategy for YOU at this point in your career?

Like a map that guides you up a mountain, this article will help you find your focus in real estate investing. It’s all about developing clarity and confidence so that you can move forward towards your real estate and financial goals.

To get the most from this article, I recommend that you pull out a pen and paper to brainstorm (or open a blank computer document if that’s your style). And be sure to silence the phone and put away any distractions. This is an opportunity to think deeper for a few minutes and improve your future finances.

I’ll begin with some wisdom from the ancient Greeks.

Know Thyself

Apparently, when you walked into the ancient Temple of Apollo in Delphi, Greece you were greeted with the aphorism “gnothi seauton” or “know thyself.” That same advice works well when you’re just getting started with real estate investing.

When I began real estate investing, much of the education and advice were given out like cookie cutters. The teacher, often positioned as an all-knowing guru, dished out real estate strategies that would “certainly” work if I just followed their exact instructions.

The problem with cookie cutters is they try to squeeze you and everyone else into one rigid mold. Instead, the best approach is to know yourself first. Then pick a strategy (i.e. a cookie cutter) that fits your situation.

To help you know yourself better as a new real estate investor, I have three questions for you to consider:

- Do you want a real estate job or a real estate investment?

- Do you want to be an active or a passive investor?

- What’s your wealth stage?

Let’s begin with the first question – whether you want a real estate job or a real estate investment.

1. Real Estate Job vs Real Estate Investment

Real estate is a flexible financial tool. Depending on what you need, it can become a job (i.e. a career), an investment, or both.

Here’s how I see the difference:

- Job – you want or need to use real estate for current income (i.e. to pay the bills)

- Investment – you want to use real estate for long-term wealth accumulation (i.e. to achieve financial independence)

Real Estate Job

When I was 23 years old, I was a recent college graduate. I had about $1,000 in the bank, and I had no college debt thanks to a college football scholarship (go Clemson Tigers!).

But I didn’t have a source of regular income. That meant I needed a job.

After reading a few books, I decided to pursue the real estate job of finding deals for other investors (aka bird-dogging). Essentially my role was to hunt down opportunities for other landlords and flippers. I made a small fee (about $2,000) when they bought a property I found.

If you aspire to eventually invest in real estate, getting a job in real estate (either full time or as a side hustle) can be advantageous. It allows you to earn money while learning and building a network.

Other examples of real estate related jobs include:

- Real estate agent – either as a buyer or listing agent

- Leasing agent – help match tenants to properties

- Property manager – manage rental properties for buy-and-hold investors

- Building contractor – manage remodel and construction projects

- Appraiser – provide valuations of properties

- Surveyor – map and legally describe properties

- Wholesaler – buy and sell properties at wholesale prices

- Fix-and-Flipper – buy properties, remodel, and sell at top prices

You can also pursue more general careers and then focus them on real estate, like as an attorney, a paralegal, a bookkeeper, a Certified Public Accountant (CPA), an engineer, or an architect.

Real Estate Investment

A real estate investment, on the other hand, has a different purpose than a job. Instead of a focus on current income, an investment is more focused on sustaining and growing your long-term wealth.

My favorite analogy is to look at real estate investing like gardening.

Getting a real estate job is like planting short-term crops. When you grow tomatoes or corn, you plant and harvest the crop in one year. On the positive side, you get to eat it right now. But on the negative side, you have to start all over again next year!

Getting into real estate investing is more like planting an apple orchard. You plant the trees as small seedlings. You then nurture, water, and fertilize the trees over many years until they grow big and provide fruit. Once mature, these apple trees can feed you for the rest of your life.

So for now, ask yourself which path aligns more closely with your situation. Are you drawn more to real estate as a job or as an investment? What’s more urgent – cash now (i.e. paying the bills) or wealth building (i.e. moving towards financial independence)?

I will have future articles and resources on pursuing real estate as a job. But for now, the rest of this article is about pursuing the path of investing.

2. Passive Investor vs Active Investor

The Intelligent Investor is a classic book on investing by Benjamin Graham, who was also a mentor to Warren Buffett. Graham made an important distinction between two types of investors:

- Defensive (i.e. passive) investor – focused on avoiding mistakes and minimizing hassle, time, and frequent decisions with investments

- Enterprising (i.e. active) investor – willing to spend time and effort in exchange for safer and better-than-average investments

In both cases, the goal is still to be an investor and increase your wealth. That prioritization differentiates these paths from a job. But they are each very different approaches to investing.

Defensive (i.e. Passive) Investor

As a passive investor, you either don’t have the time or the willingness to actively invest. Perhaps because of a busy career or a general lack of interest, the idea of spending your spare time maximizing investments isn’t exciting.

The most popular investing approach for passive investors is broad indexing. Instead of trying to beat the market, you simply try to be the market. And instead of monitoring markets and making decisions regularly, you make only a few decisions (like asset allocation) and then leave investments alone to grow.

With the advent of low-cost index funds like those provided by Vanguard and others, this passive strategy can be accomplished easily in public markets like stocks and bonds. And fortunately in those markets, passive investing will likely beat the returns of most active investors anyway!

In real estate, the performance advantage of passive investors over active investors is not quite as well-documented or clear. In my experience, a well-educated, active real estate investor can find good deals and safely use leverage in order to outperform passive real estate investing.

But depending on your situation, a portion of your portfolio invested passively in real estate could still make sense. This will likely mean buying REITs (real estate investment trusts). REITs are companies that own many different pieces of real estate, and you earn dividends and growth as a REIT owner.

Enterprising (i.e. Active) Investor

As I said above, the case for passive investing in public investment markets is strong. VERY few professional managers on Wall Street beat the returns of passive investing strategies after including fees. And the ones that do rarely repeat it over long periods of time.

So, if you want to stick to passive, public market investing you won’t get a lot of push back from me. But if you enjoy investing and are willing to spend some time, active investing can pay off.

This is particularly true in real estate, where negotiation skills, hustle, and personal relationships tend to bring higher returns. Your active investment of time might be as little as a few hours per week, or it could be a much larger amount of time depending on the strategy and approach you choose.

Later in the article, I’ll provide some different recommendations for active investing in real estate. But for now, let’s answer one more important question to help you know yourself better as a beginning real estate investor.

3. What’s Your Wealth Stage?

The question “what’s your wealth stage?” basically asks whether you’re an investor with very little wealth, a large net worth, or somewhere in between.

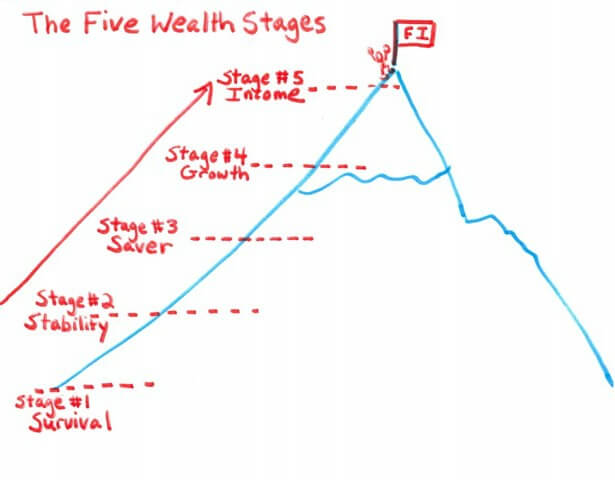

I look at wealth building like climbing a mountain. Most of us begin at the bottom with very little wealth. But as you climb higher on the mountain and your wealth grows, you begin having money work for you instead of simply trading your time to earn money.

Ultimately you reach the peak of the mountain where your wealth produces enough income that you no longer need to actively work for money. You can still work, of course, but now you work completely on your own terms. And you can afford to spend more time on personally rewarding activities like time with family, travel, new hobbies, volunteering, or whatever matters most in your life.

The Five Wealth Stages

To help you identify your situation, think about your journey as passing through five different wealth stages on the way to the mountain peak. These five stages are like financial milestones:

- Survival is the milestone when you’re earning some money and getting your bills paid. It’s also the place where you’re digging yourself out of financial holes from the past.

- Stability is like Dave Ramsey’s first three baby steps. You pay off personal debts. You build cash reserves in the bank. And you build job skills that are in demand and command a better income in the marketplace.

- Saver is the stage where you realize the importance of your savings rate and put it into practice. Building wealth is actually simple, but it’s not easy. You need to maximize your income, simultaneously decrease your spending, and set aside a lot of money. Below-average wealth builders save 0-10% of their income, but above-average wealth builders save 25%, 50%, and even 75% of what they bring in. The faster you want to reach financial independence, the more you need to save.

- Growth is the stage most of us think of as investing. It’s taking your $50,000 nest egg and turning it into $1,000,000. The key is to maximize compounding by reinvesting earnings, buying good assets, and maintaining discipline.

- Income (aka withdrawal) is the stage when you already have a large chunk of wealth. You’re ready to begin withdrawing from that wealth and enjoying the fruits of your labor. The objective here is to turn wealth into regular income that gives you time, freedom, and flexibility.

Understanding the concept of wealth stages is particularly important as a real estate investor. Your current wealth stage determines in large part which of the dozens of possible strategies are a good fit for you.

So, here’s the important question:

Which of the five wealth building stages above best describe you? Are you in the stage of survival, stability, saving, growth, or income?

For now, just choose the stage that best fits you. And don’t beat yourself up wherever you are. Everyone has to climb the same mountain, and the fact that you’re doing it now is all that matters.

And now that you’ve gotten to know yourself a little better, let’s take a look at how to find your focus With real estate investing.

How to Find Your Focus With Real Estate Investing

If you’re still with me, I assume you narrowed yourself down to the following categories from the questions earlier in the article:

- Real estate investing (not a job)

- Active investing (not passive investing)

And after the last section, you should have a clearer idea of your wealth stage. So, now you’re ready to focus on certain real estate investing strategies.

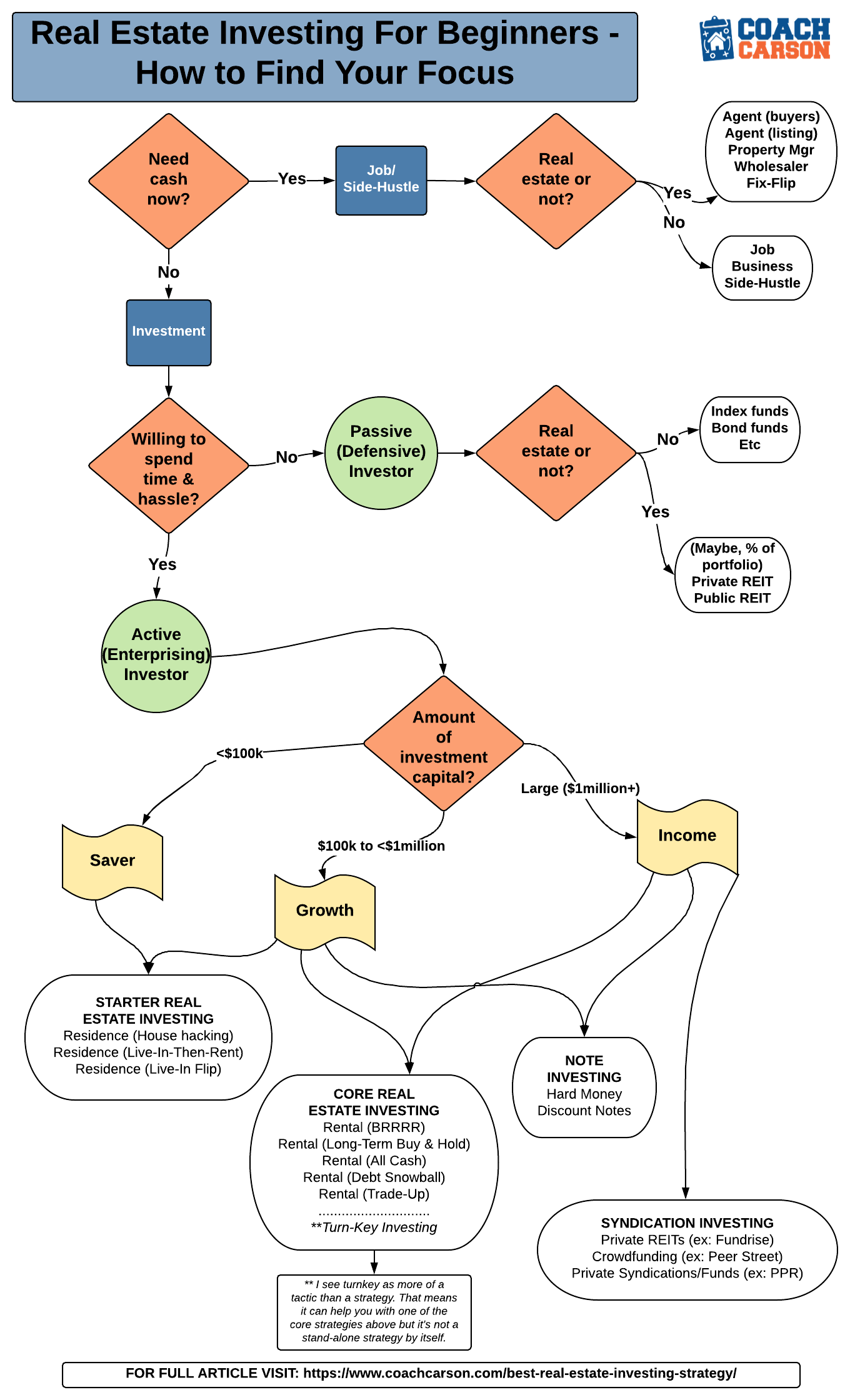

This chart and the sections that follow will help you narrow it down.

Strategies For Stages #1 & #2 – Survival & Stability

If you’re working on wealth stages #1 or #2 (Survival or Stability), you need a job or a simple side business more than you need investing. Investing takes your cash, but what you need is to put more cash in your pocket right now.

How do you get more cash in your pocket? Quite simply – you work!

This may be a regular, non-real estate job. And for those of you in a well-paid profession with that takes most of your time, this may be all you need until later wealth stages.

But if you do have time and interest, you should consider a full-time or part-time real estate-related job. As I listed earlier in the article, you could become a real estate agent, leasing agent, property manager, building contractor, appraiser, surveyor, wholesaler, or fix-and-flipper. In all these scenarios, you’ll learn about real estate while also earning money.

Then once your finances are stable and you’re ready to begin saving more, you can move to stage #3.

Strategies for Stage #3 – Saver

Wealth stage #3 (Saver) is all about increasing the gap between income and expenses. So be sure to keep things simple (and happy) with your personal spending. And you can also use real estate strategies to reduce your expenses and increase income.

Here are a few real estate strategies that work well for people in the Saver Stage:

All of these combine your housing with real estate investing. You have to live somewhere, and this helps you take baby steps into the arena of real estate investing while you’re still working to save more cash.

Once you build a consistent savings track record and a large stash of investing cash, you can move on to the next strategies for Stage #4 – Growth.

Strategies for Stage #4 – Growth

If you’re working on stage #4 (Growth), you should have the credit, income, and capital to jump into real estate investing in earnest. Here are a few real estate strategies that work well for people in the Growth stage:

- BRRRR Investing

- Long-Term Buy & Hold Rentals

- Short-Term Buy & Hold Rentals

- Rental Debt Snowball Plan

- All-Cash Rental Plan

- Rental Trade-Up Plan

- Hard Money Lending

- Discounted Note Investing

The first six strategies of this list are all different ways to invest in rental properties. All of these are specific strategies to consistently and relatively quickly climb the financial mountain. You just need to choose one that you’re comfortable with and that matches the market where you’ll be investing.

If you own an IRA (Individual Retirement Account) at stage #4, you should also consider the strategy of private notes – which include hard money lending and discounted note investing. Certain retirement account custodians (I use American IRA) allow you to self-direct your retirement accounts into alternative investments. This means you don’t just have to use the traditional options of mutual funds, stocks, and bonds.

Keep in mind that private notes have their risks. You should always prepare for the worst-case scenario, which means you could stop receiving payments. You’d then have to foreclose and become the owner. If you don’t want to own the real estate for the amount you loaned, don’t loan the money! And when you do make a loan, use a qualified attorney to prepare your lending paperwork.

Strategies for Stage #5 – Income/Withdrawal

For stage #5 real estate investors, the priorities are more about reducing risk, increasing income, and minimizing hassle.

Here are strategies you can focus on during the Income/Withdrawal stage:

- Any of the strategies from prior stages

- Syndication/Crowdfunding Investing

Other than the syndication/crowdfunding, your options for investing are the same as Stage #4 – Growth. But the difference will likely be in HOW you invest in those strategies.

For example, you may want to invest in less time-intensive Long-Term Buy & Hold Rentals. And you also may want to focus on using less leverage in order to increase your cash flow and decrease your risk. I like the idea of owning at least some of your properties free and clear of debt.

Using private notes is also an interesting option at this stage because it matches your need for solid income with low-hassle investments. Just make sure to set aside plenty of reserves in case you need to foreclose on borrowers who do not fulfill their end of the bargain.

Clarity Breeds Confidence & Momentum

When you first start (or restart) real estate investing, overwhelm and paralysis are the enemies of your future success. That’s why this article has been all about helping you move forward as a real estate investing beginner.

Knowing yourself and choosing a strategy are the anecdotes to overwhelm. This process of focusing will help gain clarity, build confidence, and most importantly move forward with concrete steps.

Best of luck with the next steps of your real estate investing journey!

Do you want to use real estate investing as a job or investment? Are you going to be active or passive? And which strategy makes the most sense for you? Are there any steps I left out?

I look forward to hearing from you in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

I really like the systematic approach of your article. Thanks for that, and keep up the good work!

Thank you, Tobias! For better or worse – my mind works in systems:) Glad it was helpful.

Chad,

Funny that you mentioned reits. It”s a great way to generate great returns like 9% and more. The only issue is that when the market crashes so does the stock price. But good reits continues to pay the dividends. There are many like Pennsylvania Real Estate Investment Trust. This one is paying over an 11% yield. It’s just one I follow.(not promoting by any means). Not many people know about these. Of course, they CAN CUT the dividend if they aren’t doing well.

Thanks for all the great information about your real estate journey. I have a specific question about getting started.

If I have a solid emergency fund but also a sizeable HELOC balance would you recommend paying off the HELOC before saving a down payment for our first property?

We are certified, trustworthy,reliable, efficient, Fast and dynamic.

We give out all kinds of loan like:

Business loan,

Personal loan,

auto loan and other good Reason.

We also give out loans from the rang of $10,000USD- $10,000,000USD at 2% interest rate. Duration of 1- 15 years depending on the amount you need as loan.

If you are interested please contact us for more information.

Ford Credit Centre,LLC offers business loans to help you grow and expand your business.

Thank you Coach Carson for your page and information!

Awesome work!

I’m just starting and I have my home that I want to start doing Live-in House Flip.

This greatly encourage me to make it happen!!!

Glad to hear it Manon! Thanks for reading. And best of luck with your home flip!

However the situation arises, Bad credit does not necessarily mean its end of the road for people who need to secure good loans.

The application process was slow and not quite easy and I wasn’t approved because I couldn’t meet up with some demands. Same thing I experienced when I was applying for loans for my most recent investment property , my score was in the mid-600’s. I had four late payments, but the lenders actually looked at my report and refused me a loan. I explained this to my close friend who later introduced me to a credit repair specialist ”FixMyCredit” whose hacking skills are the best I know. They helped clean debts on my credit card, my report, increased my score to 795 and erased all the negative items and all the late payment appeared as on time payments. I simply can’t thank him enough. Six One Nine Six Three Zero Nine Zero Eight Five… for credit help.

However the situation arises, Bad credit does not necessarily mean its end of the road for people who need to secure good loans.

The application process was slow and not quite easy and I wasn’t approved because I couldn’t meet up with some demands. Same thing I experienced when I was applying for loans for my most recent investment property , my score was in the mid-600’s. I had four late payments, but the lenders actually looked at my report and refused me a loan. I explained this to my close friend who later introduced me to a credit repair specialist whose hacking skills are the best I know. They helped clean debts on my credit card, my report, increased my score to 795 and erased all the negative items and all the late payment appeared as on time payments. I simply can’t thank him enough. Six One Nine Six Three Zero Nine Zero Eight Five… for credit help.

SOLID content and overview!!!! I help dozens of clients/residential real estate investors on the mortgage side, and majority of them are just normal everyday people trying to figure it out. Your content is spot on!!!!

Great share and useful information. Thanks for sharing.

Real estate investments can also play a key role in your retirement strategy. Investing in multifamily real properties is an outstanding way to retire early with real estate. Get more details on Terraequitygroup.

Real estate investments can also play a key role in your retirement strategy. Investing in multifamily real properties is an outstanding way to retire early with real estate. Get more details on Terraequitygroup.

really good information I appreciate you sharing. Your retirement plan may also include significant real estate investments. A great option to retire early with real estate is to invest in multifamily apartments. Learn more about Terraequitygroup.

There are many factors to consider when making an investment. If you don’t do your homework, it can be a recipe for disaster. However, when investing in real estate, which is likely to increase in value over time and build equity, the prep work can be an exciting part and help you pick winning properties.