Recently my friend Paula Pant interviewed the matriarch of money, Suze Orman on her podcast Afford Anything. Less than 2 minutes into the interview, the conversation got very interesting:

“Have you heard of the FIRE movement?,” Paula asked.

“Yes, of course I have,” Suze said. “And I hate it.”

“Really?”

“I hate it, I hate it, I hate it,” she said. “And Let. Me. Tell. You. Why.”

Piqued your interest? It certainly caught my attention when Paula told me these lines at FinCon in Orlando before the episode aired!

As a 38-year-old member of the FIRE community and recent author of the book Retire Early With Real Estate, you better believe Suze was aiming her jabs directly at people like me! But I have some thoughts of my own on the strong opinions Suze expressed in the interview.

And in the rest of this article, I’ll share what I think Suze got right and what I think she got wrong about the FIRE movement.

What Suze Got Right

Overall I think the interview was wonderful publicity for the FIRE movement, for Paula, and for Suze (which is no accident from a media veteran on a book tour, of course). And below the slightly arrogant tone of Suze’s delivery, she’s a smart person with a lot of valuable financial experience to share.

As Paula said after the interview, we should all make a practice of listening deeply to others (especially if you disagree). If you can reserve judgment temporarily, you can always learn something.

Suze spent much of the interview pointing out that people retiring in their 30s or 40s on anything less than $10 million are naive. According to her, people in the FIRE movement haven’t considered the MANY unexpected catastrophes that could wreck our future finances.

From permanent disabilities to medical calamities to natural disasters that wipe out real estate portfolios, life can throw us VERY expensive curveballs.

So, Suze’s right!

Unexpected and Expensive Catastrophes Can Happen

Expensive black swan events (i.e. unexpected and rare) could happen to any of us. And it’s smart to prepare financially (and emotionally) just in case.

Suze also expressed concerns about an uncertain economic future. What happens to our economy if AI (i.e. artificial intelligence machines) replaces 25% of our workforce? She predicted economic strains to our investment portfolios and to government finances.

One possible result would be higher taxes to pay for the exploding costs of social safety nets for displaced workers. And that could mean less money to live on from our investment portfolio.

Could that happen? It’s possible. And to Suze’s point, we certainly should prepare for it.

But Technological Disruption Is Nothing New

I would also remind Suze, however, that in 1870 almost 50% of the U.S. population worked in farming. As of 2006, less than 2% of the population worked in farming because technology reduced the need for farm laborers.

In a 2018 Time Magazine editorial, Warren Buffett said this about that unprecedented technological disruption of farming:

“We know today that the staggering productivity gains in farming were a blessing. They freed nearly 80% of the nation’s workforce to redeploy their efforts into new industries that have changed our way of life.”

New technology has disrupted our societies as long as human beings have been around. And yes, the pace of change is much faster right now. But it’s also possible that our economy, government, and job market will adapt positively to these changes. The economic pie could get even bigger over the long run.

Warren Buffett thinks so:

“This game of economic miracles is in its early innings. Americans will benefit from far more and better “stuff” in the future.”

And that leads me to the three key points Suze got wrong about the FIRE movement.

What Suze Got Wrong

I found myself sometimes laughing and shaking my head in certain parts of the interview. It’s difficult for me to remain serious listening to boastful “I’m the money matriarch of the world” and “the FIRE movement is getting a Suze slapdown.”

But show(wo)manship is what Suze does. In the end, I can look past that.

My issues were more about her misunderstanding of the FIRE movement itself. I think Suze (and many other traditional financial thinkers) miss important nuances that make the concept of financial independence early in life so popular (and reasonable.)

I’ll begin with the loaded word retirement.

1. Our Definitions of Retirement Aren’t the Same

To many people, retirement means withdrawal. You quit work, let your assets (or a pension) support you, and retreat into a life of leisure.

Suze and many others who hear “early RETIREMENT” immediately think of 30-somethings doing this:

Or if we’re not on a beach, we must be on a couch all day, playing video games, and eating ourselves into Cheetos-induced comas.

I’m sure there are early retirees sipping piña coladas and sitting around eating Cheetos on couches. If so, you won’t get any judgment from me!

But in reality, the early retirees I know are MORE engaged in life than before. They’re living on purpose. They’re doing more of what matters!

What does this purposeful engagement look like? It varies as widely and beautifully as the variety of people within the FIRE movement.

What Early Retirement Looks Like For Me

In the case of my early retirement, I’ve been doing things like traveling with my family on a 17-month sabbatical/mini-retirement and trying to be a better husband and father.

I’ve also enjoyed staying fit and physically active, especially with pick-up basketball.

And during much of my time, I still work!

*GASP!*

The difference, of course, is that work for an early retiree has less to do with money and more to do with passion. We find projects and causes we love, and we throw ourselves into them.

During a typical week, I spend work time (unpaid) trying to improve walking and biking infrastructure in my hometown of Clemson, South Carolina (Go Green Crescent Trail!).

I also wrote a book (which will pay me some money), and I regularly write on this blog (which pays me very little).

And I still manage my real estate business from a high-level, pay bills, and sometimes acquire or sell properties. The real estate time commitment can range from 2 to 20+ hours per week, depending on the time of year (like when taxes are due).

So, the chastising Suze gave early retirees and the FIRE movement about somehow forgetting to engage with life is silly. In fact, the truth is the exact opposite!

And this leads me to the primary topic Suze addressed in her interview with Paula – risk.

2. Financial Risk Isn’t Even the Greatest Risk in Life

Suze was deeply concerned about risk. She’s seen first-hand calamities in life that destroyed the financial plans of her clients and audience members.

For example, she’s seen permanent disabilities wreck people’s finances. A once active person could get into an auto accident and become bed-bound for life. Not only could they not produce income, but their medical expenses would be permanently higher.

Would an early retiree be able to withstand this long-term financial shock? Would they be able to (or even choose to) get disability insurance?

And what about serious medical conditions like cancer? Could an early retiree who budgeted $50,000/year be able to suddenly pay their out-of-pocket medical costs every year?

These are real concerns. I appreciate Suze reminding us to plan for these possibilities.

But why did she stop with these risks? Some of the more likely and much more grave risks aren’t even financial.

The Ultimate Risk of Regret

“People are frugal in guarding their personal property; but as soon as it comes to squandering time they are most wasteful of the one thing in which it is right to be stingy.”

– Seneca, On the Shortness of Life

Time, not money, is the most precious resource of life. And the greatest risk is wasting the time that is given to you.

Here’s another way to think about that:

What will you regret most on your death-bed?

Is it bankruptcy and financial ruin? I certainly don’t like imagining those. But they’re not even the first regrets that come to my mind. Instead, I would regret:

- spending 12 hours per day working a job while my kids grew up without my presence.

- wondering what might have been if I gave more of myself to my marriage instead of just to my job.

- missing opportunities to travel and explore the world while I was still active and healthy enough to enjoy it.

Does that mean you should throw caution to the wind and live only for the moment? Of course not!

But making life decisions based on absolute financial security and fear of the future is as ridiculous as building your life around pleasure in the present.

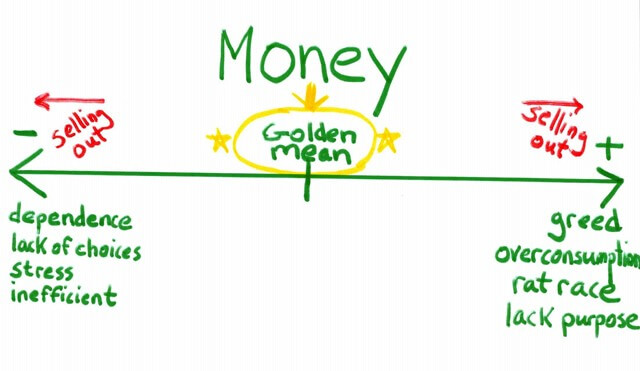

The Golden Mean of Money

As I shared in my Money-Life Manifesto, the ancient philosopher Aristotle taught that there’s always a middle around – a golden mean. For example, courage is a virtue (i.e. a good thing). But you can use courage too much or too little:

And you can do the same thing with money and financial security.

Do you want absolute financial security? Then work a grinding job for 50 years and build your whole life around earning money.

Do you want the maximum enjoyment of life right now? Then go travel, eat, drink, and be merry until your money is all gone in your 30s.

Or do you want the golden mean? Then work hard AND retire early and often (as Paula Pant says).

Smart early retirees make long-term financial goals. They save a large percentage of their income. And they plan to build wealth for the rest of their lives.

But they also take mini-retirements. They enjoy the many financial plateaus along the way. And they build in flexibility, entrepreneurial skills, and backup plans for true security.

In other words, the golden mean of retirement is to let neither the destination nor the journey dominate your life. Instead, walk the line of your golden mean by keeping your eyes on the peak while also enjoying the climb.

And that financial climb leads me to the final issue I had with Suze’s interview – early retirees running out of money.

3. An Anti-Fragile Approach to Early Retirement

At the heart of Suze’s hate of the FIRE movement was our apparent recklessness. Clearly, we must be underestimating our future financial needs by only saving portfolios of $1 to 2 million and calling ourselves “retired.”

Or in Suze’s words, we’re going to run out of money and get “burned!”

I seriously doubt Suze read the carefully considered withdrawal plans of my FIRE friends like Tanja at OurNextLife.com, Leif at PhysicianonFire.com, or Karsten at EarlyRetirementNow.com. And I doubt even more she’s read my own Rental Retirement Strategy (Or How to Not Run Out of Money).

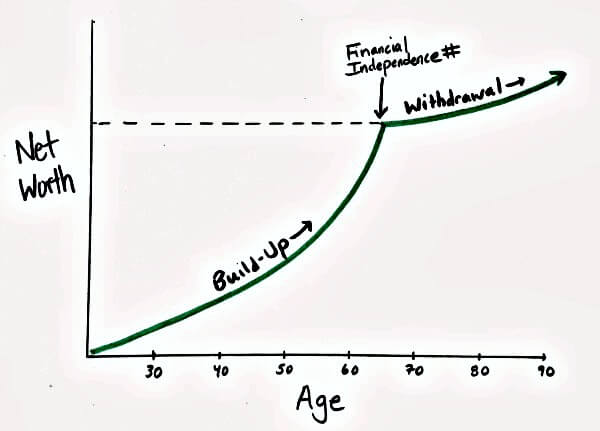

The truth is that few early retirees count on mindlessly living off their portfolios. Withdrawal after financial independence is a dynamic, active process.

And in my case, I practice a real estate-based variation of the “income floor + upside investing” strategy of Darrow Kirkpatrick at CanIRetireYet.com.

Using Real Estate For Income and Long-Term Growth

On the one hand, current income is a priority. My wife and I need to pay for our family’s needs. And we do that primarily with rental income.

Suze said that “$2 million is nothing … it’s pennies in today’s world.” But $2 million invested in a conservative real estate portfolio can produce $120,000 per year of income at a conservative 6% cash on cash return.

$120,000 per year won’t buy a private island, but where I come from, it covers an abundance of current living expenses, insurance of all kind, and even luxuries.

That rental income also doesn’t reduce your investment principle (which makes it hard to run out). And in the right locations, the equity of your portfolio could even continue to increase with property appreciation and mortgage pay down.

So, the goal isn’t to stop wealth building at early retirement. The goal is to live off current income while also growing your wealth and income enough to outpace inflation and other contingencies.

But Don’t Forget About Diversification

But depending too much on real estate (or any single asset class) has its own risks. My friend and long-time early retiree Todd Tresidder wrote in his excellent book How Much Money Do You Need to Retire:

You should be no more willing to bet your entire retirement on an insurance company’s ability to pay an annuity than you would rely on the government to honor its promises for Social Security. It’s okay to make each one a piece of your retirement equation, but each income source has risks that must be managed. Never leave yourself exposed to a single default that can wipe out your financial security.

Todd’s message is clear. Diversify your income and wealth building sources!

In my case, a move from a large concentration of real estate into more equities, bonds/debt, and perhaps commodities makes sense. For some of you with traditional portfolios, an opposite move into real estate may be in order.

But the common theme is that diversification is a key component of successfully surviving (and thriving) during inevitable ups and downs in the future.

And beyond diversification of your investment portfolio, smart early retirees also have backup plans.

Early Retirement Back-Up Plans

“If plan A doesn’t work, the alphabet has 25 more letters – 204 if you’re in Japan.”

– Claire Cook, Seven Year Switch

The primary early retirement plan for me and my wife is to live off our real estate investment income (without touching any principle). If all goes well, these investment assets will be intact and still growing to support us even better later in life.

But if not, our first and most important backup plans are our retirement accounts. At 38 and 41 years old, we don’t plan to touch those accounts until well after turning 60 years old. And even without future contributions (which we do plan to make), it’s very possible that these accounts will be worth $2 to $3 million after growing and compounding tax-free for 20 to 30 years.

And beyond retirement accounts, I wrote extensively about other backup plans in my book Retire Early With Real Estate. Here’s a summary list of those ideas:

- Live more simply, frugally, and happily – spending less isn’t always a bad thing. Even in a financial pinch, you may find that a simple life is, in fact, a happier life.

- Practice location arbitrage – My family and I spent 17 months in Ecuador and lived like royalty for $3,000/month (including private schools and good health care). There are many low-cost living opportunities around the world and within the US and Canada.

- Downsize or get creative with housing – Home equity isn’t an optimized investment. In a pinch, you could sell and downsize (or even rent) to save money. You could also earn income from your housing using the classic house hacking technique.

- Buy and sell properties – For those of us investing in real estate, buying a couple of extra fixer-upper houses to flip each year is very reasonable. At $20,000 to $30,000 per sale, this can be a solid source of potential extra income.

- Side Work or Side Hustle Business – This may not be possible if we’re in bad health, but it’s very reasonable to think we could make a little money on the side. Just $20,000 per year is the equivalent of retirement savings of $500,000 at a 4% withdrawal rate. So, a little income goes a long way.

- Sell a rental – This backup plan essentially eats into your principle. If you have enough principle elsewhere (like in a retirement account that you can’t yet access) selling a rental could make sense.

- Refinance a rental – Instead of selling, you could also refinance and pull out a big chunk of cash funds tax-free. Yes, you’d have a mortgage payment and increased risk. But done responsibly, you could just let the tenant’s rent begin to pay down the mortgage for you again. This means your net worth would once again grow.

- Seller finance a rental – Seller financing (aka an installment sale) means you sell a property, receive a down payment, and receive the balance of the price (plus interest) over time. This can be a great way to get more income passively if needed.

- Buy a Single Premium Immediate Annuity (SPIA) – This isn’t my area of expertise, but Jim Dahle at whitecoatinvestor.com call these SPIAs “the good annuity” for people in certain situations. They’re lower cost and free of the complex contracts of many other annuities.

- Reverse mortgage – Like annuities, reverse mortgages are controversial because they often have high fees and complex terms. But if you have a lot of equity in your home and don’t want to sell, it can be a backup source of income later in retirement.

So, will a solid early retirement portfolio, retirement accounts, and backup plans be enough to cover every single contingency? Maybe not 100%.

But do I sleep well at night? Absolutely.

And when I wake up from that sleep, I get a chance to do what matters and live a life I won’t regret.

That’s a risk-reward tradeoff I’ll take any day.

A Gift From Suze Orman

In the end, Paula’s interview with Suze Orman is a gift to the FIRE movement. It’s given us an opportunity to reflect and learn from a veteran of the financial industry. And it’s sure to bring even more attention to the idea of gaining financial independence earlier in life.

I also hope this article has helped to correct a few of the issues Suze got wrong:

- Early retirees are not withdrawing from life. They’re embracing a purposeful life MORE fully than ever.

- Early retirees are not wild risk-takers. They are calculated risk-takers. They see the old bargain of a 9-to-5 job until they’re 70 as riskier than an early-retirement.

- The retirement plans of most early retirees aren’t naive, fragile castles built on sand. At least the ones I know of are anti-fragile, multilayered, flexible plans built on a combination of investment savings, retirement accounts, side businesses, and backup plans.

What will the FIRE movement look like in the future? The next market downturn will certainly upset or delay some plans. And I’m sure the paths of most early retirees will have serious ups and downs.

But the movement is here to stay. The secret is out. You don’t have to delay the good life until you reach “retirement age.” You can work hard, save money, retire early and often, and do more of what matters.

Have you listened to the Suze Orman interview? What did Suze get right about the FIRE movement? What did she get wrong? I’d love to hear from you in the comments.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Excellent article and congrats on the book release! I’ve got to go check out that podcast now!

Thank you! Definitely check it out and let me know what you think.

That was an awesome episode! Paula handled the interview amazingly and her take at the end was spot on. But I have to admit, I did find myself agreeing with Suze on some points.

Lost compound interest is a huge opportunity cost that many probably don’t truly appreciate when coming up with their FIRE number. I also think Suze is genuinely concerned that some won’t have enough of a safety but most of what she mentioned is insurable and you can budget for it.

Interesting debate!

Well put, Coach!

I’m a little embarassed that you published that picture of me lounging on the davenport, but I appreciate you photoshopping out the Cheetos crumbs from my bare chest.

Your conclusion is correct — the latest “controversy” gave us an opportunity to both reflect on our plans and remind the naysayers that we are both taking a calculated risk while taking many steps to mitigate the various risks to our FIRE plans. I think more people will be better educated and may perhaps refine their own plans as a result.

Cheers!

-PoF

Lol. Thank you for taking one for the FIRE team with that photo!

And thank you for all your good work to educate people about FIRE (and the value of a good craft brew:).

Wow! Excellent, well-thought-out response. 🙂 FIRE consists of “anti-fragile, multilayered, flexible plans built on a combination of investment savings, retirement accounts, side businesses, and backup plans.” Perfectly said. This is the nuance of FIRE that the world needs to know. 🙂

Thank you, Paula! Nuance is tricky in the sound-byte world, isn’t it? It’s why I think we both like the long form so much better.

Great article and rebuttal, Chad! In some ways, if she accepts your tenet of there being a Golden Mean, it throws some, maybe much, of the advice upon which she has sold millions of dollars worth of books out the window. It seems natural to me that she would be very defensive and give a bunch of examples why we should be afraid.

I want to put something else into perspective – $1 or $2 million is a TON of money, more money than 99.9% of the people on the planet will ever have. How do so many people live happy, meaningful lives having fractions of a percentage of that total amount (or less)? Because, it’s not really about the money and I that’s one of the important messages in your blog.

I love how you used the antifragile and black swan terminology… Are you a Nassim Taleb fan, too?

Yes, I definitely appreciate Teleb’s ideas. I’ve had a hard time getting through AntiFragile on my shelf (picked up and put down several times), but the ideas stick with me none-the-less.

Thank you for the adding the perspective about how much money $1 to $2 million really is. My spanish teacher (college educated) in Ecuador supported a family on $500/month. There is a lot of living going on for less than $10 million dollars!!

I always enjoy your thoughts. Thanks for sharing!

Hi Chad, I’m finding Taleb’s latest book; Skin in the game, his most useful in an every day way book. But still its a slog to get through, but I find I re read chapters because they’re interesting.

A simple example of Skin in the game usefulness: Take advice from a source that has been around a long time (Seneca et al) and endured.

Another; Take advice from one who has skin in the game, IE, DO what they talk about,,, being wrong brings high losses to the advice giver. IE they have a feed back path for giving good advice else they (die) taking their bad advice with them.

Suzy is an example of why She may NOT be one to listen to; it seems (from many past scenarios) her bad advice, errors, did not have a killing her off effect, she’s still given a worlds platform in spite of failing the important requirement of being one to take advice from; having skin in the game of being wrong, having a serious negative consequence.

LOL!!! Taleb also explains in this latest book why the blow hard minority (our current political mess,,, Suzy Orman’s and the many talking heads) actually have high leverage and power in controlling our airwaves and (currently) our lives. Frustratingly,,, power is not of the majority it’s of the blow hard minority… Taleb was very informative,,, and frustrating in explaining how things really work, not how I thought they worked, worse, how I wished they worked. 🙂

To me, Taleb explains Orman’s of the world, along with economists and talking heads. :> IE near zero risk for being wrong, and varying, sometimes huge, gains from being inflammatory. Sound familiar (if you where US news bound)?

Circling back; Chad, you and the FIRE authors, after reading Skin In The Game, are on the path to being enduring sources! You all have a lot of skin in the game, consequences for being wrong, are DOING what you are talking about. Thanks Chad and FIRE’ites.

Wow, very informative Curt! Thanks for sharing. I’ll need to check out Taleb’s new book.

The idea of skin in the game makes a lot of sense. And I can see how the “blow hards” as you say don’t have a lot of it in the game. Sensationalizing topics (instead of keeping them practical and helpful) actually works in their favor (but perhaps not the audience’s).

Blogging and the new-media environment more broadly (YouTube, podcasting, etc) are certainly different than traditional media. There is constant accountability and conversation with the audience. And in many ways it IS the audience speaking as opposed to a talking head up on the hill.

But there can also be a lot of competing (and often dangerous) voices in the blogosphere because anyone can say whatever they want. So, we’ll have to keep up our diligence and BS meters – both as writers and readers:)

Well thank you for your kind words, Chad. And I agree that Taleb is difficult to read – I’ve only read The Black Swan and Anti Fragile, admittedly, I didn’t read enough before I had to return to the library but being the visual and slightly nerdy math person that I am I liked how convexity makes you antifragile because it (or you) bends away from the origin and allows you to benefit from disorder. Makes me think about a lot of things including heart opening yoga poses which can be overwhelming but do amazing things for your mind and body in a literal sense but by throwing ourselves out there in the figurative sense, while it can exposes you to chaos and disorder, it makes you stronger in the long run. Curt, thank you for the new book recommendation! I’m going to have to put these back on the library list.

What I haven’t seen mentioned in the discussion of possible catastrophic disasters like a debilitating injury or cancer or other health related and expensive life change is that these circumstances would be financially ruinous for anyone – working or not working. If you suffer a health emergency that means that you usually have to stop working and earning income. So how is being employed supposed to make this disaster less ruinous? We all have to live knowing that there is risk but can only plan so much for something so devastating.

Yes, you’re right. I guess Suze only point is that many traditional employment positions have disability insurance. That seemed to be one of her main arguments for staying with a job until 70 years old!

Cancer – we’re all in the same boat. Having healthcare available even with preexisting conditions has made the landscape for non-employees like me (and many FIRE early retirees) much more reasonable. But it’d still be very expensive.

But as you said – at some point we all have to live with risk. And on the flip side of that risk coin is enjoyment and appreciate for this precious life!

Disability insurance rarely is bundled into the benefits package, basic health ins is, but disability is NOT! Its one of those add on, if you check the box and pay $150/mo (+/-) for. That zaps Orman’s advocation to keep the 9-5, as Thomas mentions! Orman’s theoretical safety net from working 9-5 doesn’t exist, having left a 9-5 at a fortune 50 from a rather good job. Its a potential not a given.

To fact check Orman, one would need to investigate what jobs (and percentage of all jobs) come with built in disability ins AND basic health ins that covers multi-year cancers etc? I bet her fabled safety net actually doesn’t exist, least in a scalable and replicatable way. IE great advice,,,, for a very very small group of workers.

Chad, tagental to this topic, I bet you’ve seen in your travels health care systems that work better then the US’s?

I don’t have any experience or knowledge about traditional employers and disability insurance, so thanks for clarifying.

And boy could I get started on health insurance comparisons internationally! But it might take thousands of words (is that a topic for this blog? not sure).

But to put it succinctly, there is a lot less anxiety and expense when getting basic health care in many other countries (including Ecuador where I lived). Replacing a knee? The US is probably the place to be. But basic tests? Primary care? Everyday health care? At least from this patient’s perspective, the US system is broken and beyond expensive. Health care has been one of our bigger frustrations in transitioning back to the US this year.

Wow, one of your best posts Chad! I’m so glad I didn’t write a rebuttal to Ms. Orman as it would pale in comparison to this and some others I’ve seen.

The discussion of time is what she obviously doesn’t get. The quote from Seneca says it all. It was great meeting you in Orlando!

Thanks! I’m sure your rebuttal would have been excellent.

As life goes on, Seneca and the wisdom of other Stoics speak to me more and more. They remind us that risk (and death) help us to appreciate NOW.

Suze is completely out of touch. Paula did a great job with the interview. Nice pictures of us FIRE people, thanks a lot, LOL.

Lol. Yeah, that one image is hard to get out of your head. Sorry!

Sorry, but I have to agree in large part with Suze. It appears that a large percentage of the retire early types think that buying into etfs/passive investing is going to carry them until they drop dead. They are going to be in a world of hurt because they have no idea what they are doing. They have drunk the JL Collins kool-aid and think that riding the stock market down is a great strategy. I guarantee that the majority of these people will not make it.

People need to pay attention to her warning about having to care for family–not just their parents, but their children as well. Consider that both parents and children might need help at the same time.

At the very least, it would be wise to keep your hand in some kind of business with an eye to being able to jump back into the job market. When you’ve been wiped out by a market crash, or raging inflation, you’ll at least not be viewed as a dead beat who hasn’t held down a job in 10 years.

Thanks for sharing your thoughts, Marty. Passively sitting and waiting for an index fund (or any investment) to see you through for 40 years is certainly naive. If that was all the FIRE movement was about, I’d also have a concern. I think conversations from people like Suze and others is a good reminder to many early retirees (myself included) to diversify your plans. Equities, real estate, side businesses, job skills, retirement accounts, and more should all be part of the plan. In order to be anti-fragile (i.e. surviving and even thriving when things get bad) it takes more than passivity.

We were just talking about FIRE in our personal finance mastermind and I will say – you are really the ONLY FIRE person I know that is doing meaningful work. There needs to be more talk of a sense of purpose, duty, and giving back.

You live an abundant life because you use your gifts – you teach things others can not accomplish in a way that’s easy to comprehend and inspiring. The face of FIRE is typically trying to make more money – but I dont hear the give back, living in purpose. The brand is a bit outdated, I guess.

But you – you serve an example with your infrastructure projects and teaching. Your give back to family and community. That’s a conversation that should be lighting a fire in FIRE community yet rarely rears its head. I’ve been on that FIRE newsletter for 10 years, and your the first to address it. I hope you start being the change that talks about a higher purpose than leisure.

congrats on your book!

Lisa Phillips

Thank you Lisa. I hope I can live up to your compliments, but I’ll certainly try. You have been an inspiration for me in that department because I love how you mix your real estate wealth building with a sense of purpose to help people in neighborhoods that a lot of investors ignore or don’t see as much value in. It’s possible to make money AND do good. Let’s keep that conversation going, because I agree – if we have all this free time and financial freedom but don’t DO something with it to make the world a better place – what’s the point?!

And congrats on your book too, Lisa! Happy to see it up on the top lists on Amazon.

“Overall I think the interview was wonderful publicity for the FIRE movement.”

Totally agree with you, CC! People don’t get that she just give us a huge gift–every time she goes on to promote her book, our FIRE movement gets a boost.

Cheers to all of your well thought out and thorough arguments! It’s too bad Suzy didn’t do her homework before attacking the FIRE movement. #LearnBeforeYourBurn

#LearnBeforeYouBurn – lol. Love it! Thanks for stopping by to read and make a comment. We’ll keep riding that wave of publicity Suze makes for us:)

How about #StudyBeforeYouSmackdown? 🙂

I agree. It’s all about the publicity/marketing for both – the FIRE movement and the Suze movement.

It was a bit hard for me to hear her argument through all the smug entitlement, but I agree that she basically misunderstands FIRE; I think she’d be fine if we just described it as FI instead and left off the RE. To me, FIRE is for those stuck in the rat race whereas FI is for those who actually like their job and/or the self-employed. The only difference is that FIRE people chase their passions after they quit the rat race.

Another point she misunderstands is the 4% rule: 4% withdrawal is for the initial year only, after which withdrawals are supposed to increase with inflation. Mad Fientist had a great podcast on the topic a few months back.

Really, both of these are common misconceptions, but I’d expect more from a self-described “matriarch.” 😉

Sendug, I agree it’s tough to hear her message through some of the TONE of her message. Perhaps this will be a conversation that brings a little better understanding (though I doubt it).

Suze lives in her own bubble and doesn’t even realize it. Her solution is to have people save 30k a year putting it in a retirement account. Most people don’t have the means to do that. Her financial planning world has got retirement all wrong. Retirement should operate just like if your going to work. You anticipate your paycheck from work each month and in retirement with RE you anticipate your income each month regardless of what the stock or housing market is doing. Suze is just interested in protecting her brand and the financial planning business.

Yeah, I’ve also found the real estate approach to retirement to be a very different mindset than traditional planning. It’s more like building a pension than the traditional retirement account model. I find it much simpler to apply (which is one reason I wrote the book!).

I appreciate how you describe real estate as a pension or an annuity. Real estate cash flow is much more predictable, IMO, than dividends and stock selling which is why it’s an important piece to my puzzle (1/3 of the entire portfolio) and why I also plan on adding some other real estate pieces down the road. Namely, I have an idea to add a garage apartment as VRBO or AirBnB as an accessory dwelling unit to my property, which if the data I’ve pulled is correct, would generate more cash flow and ROI than a stock market investment though it requires slightly more effort. I know I can’t time the market but the price of materials and the costs for highly skilled contractors is through the roof right now, so I am not in a rush, but it’s in my 5 year plan.

Yeah, accessory unit rentals are awesome and flexible if your town allows it. Do check on the current (and pending) regulations regarding Airbnb.

Every time I hear someone attempt to bash the FIRE movement, their entire position is based on misunderstandings and misconceptions of what this community is actually about. The FIRE movement has never been a singular rigid path that you must do perfectly in order to retire at 32.7 years old. People are like, “oh, I can’t endorse the FIRE movement because I like to work”. Guess what! So do many of us in the community. You don’t HAVE to quit your job. You don’t HAVE to do pretty much anything. All you need to do is engage with your future a little bit more proactively and deliberately. What would YOU like to be doing in 10 years? Make steps toward that. How you achieve your specific brand of FIRE is entirely up to you, and that doesn’t invalidate either the FIRE movement, or your own approach. It’s all the same thing.

And I’d like to add: It’s nice to see someone respond to those misunderstandings so effectively. It seems like most of the time, no one offers any counterpoints and the people who have these misunderstandings and misconceptions just walk away never hearing another perspective. Not that all will listen, but some will.

“How you achieve your specific brand of FIRE is entirely up to you, and that doesn’t invalidate either the FIRE movement, or your own approach. It’s all the same thing.”

Really like that!!

Yeah – why does everything have to be turned into a rigid path? What I love about FIRE is the general concept of doing life and work differently. But the application has a lot of variety.

Thanks for stopping by to share your thoughts!

Hey Chad, Great post. You mention you lived like royalty on $3,000/mo. in Ecuador. Do you have any tips on locating housing, schools, etc in other countries. Did you have things in place before you went or did you go and then figure it out? This is something I’d love to do with my family in a few years as a “mini-retirement” but have found it hard to know where to start in doing research, etc.

Hey Kenny,

I hope you and your family are able to do a mini-retirement abroad! It was an amazing experience. My wife and I kept a personal blog detailing some of the questions you asked. It’s at: http://www.openroadcarsons.com/. Some of our later posts – like on the Galapagos – are missing or not activated after changing hosts, but hopefully we’ll have them up soon. But the early stuff on finding schools, etc is there.

Excellent discussion here. To bring some levity to the discourse, I thought I’d share a recent blog post by my cat, Milo, who has very strong opinions about the FIRE movement — “Cat on FIRE”. https://emusements.com/cat-on-fire

Chad,

Great article, and I just picked up your book and am looking forward to digging into it! While Suze is right to bring up the risks involved with retiring early, she is completely ignoring the far greater (and often equally depressing) risk of having worked one’s entire life in a rat race without ever exploring the possibility that you may not have to! Not to mention the huge risk of completely missing out on very important years with your family, important years where your body is functioning better than it will later on, the risk that you die before “retirement age”, etc, etc, etc.

It takes a lot of work to put yourself in position for early financial independence. It takes a ton of guts to actually walk away from the “safe path” and go do it. Those that are able to do it are calculating and cautious types that actually spend a lot of time thinking about their future and how they want to live their best life.

Keep fighting the good fight, Chad. As a fellow Clemson alum, I’m proud of what you have accomplished. On a side note, I’ll be in TigerTown very soon and would love to connect. I also work in real estate and am very much wanting to further fast track my financial independence. Search your recent email and LinkedIn under the name Gabe/Gabriel for my contact info. Go Tigers!

“the far greater (and often equally depressing) risk of having worked one’s entire life in a rat race without ever exploring the possibility that you may not have to! Not to mention the huge risk of completely missing out on very important years with your family”

Well said. I fear that regret MUCH more than the other fears Suze brings up (legitimate or not). And I’ll definitely connect. Go Tigers!

I wouldn’t rely solely on Suze to be my guide for building wealth and making investments.

Love this response, very thoughtful and thorough.