Article updated on July 26, 2019

This is part 3 in my series about practical strategies to own free & clear (no debt) rental properties in order to achieve financial independence. This article will cover a short-term buy and hold plan called Buy-3-Sell-2-Keep-1.

Although there are many more variations, so far I’ve provided three general paths that may help you climb the mountain towards this free & clear goal:

- The All-Cash Plan

- The Rental Debt Snowball Plan

- The Buy 3-Sell 2 Plan

In this article, I will explain and give an example of path #3.

Similarities & Differences Between Financial Independence Plans

The common theme of all financial independence plans is that you must become a big-time saver. Like gravity, there is no escaping the fact that you must earn more, spend less, and save money. You can’t get money to invest without this step.

The All-Cash Plan and the Rental Debt Snowball Plan also had a couple of important features in common.

First, the holding period of properties in both cases is long term. The goal was to keep the same rentals for many years into the future.

Second, the primary mechanism of growth was compounding cash flow. With the All-Cash Plan, you save cash flow from your free-and-clear rental properties until you can buy another. With the Rental Debt Snowball plan, you save cash flow and use it to accelerate the pay off of mortgages.

The Buy-3-Sell 2-Keep 1 Plan is different in both respects.

First, your time-frame is a short-term buy and hold. Instead of keeping all of your rentals for many years, you opportunistically sell some of them in just a few years.

Second, the primary mechanism of growth with this plan is profit from selling and not from rental cash flow. Rental cash flow is always nice, but in this case, the growth will come from buying low and selling high.

Now let’s look in more what detail at how this plan works.

The Buy-3-Sell-2-Keep-1 Buy and Hold Plan

There are several reasons you may choose to use the Buy-3-Sell-2-Keep-1 Buy and Hold Plan. For example, maybe you want to:

- Invest in a high priced market where it’s difficult to get good cash flow deals that fit the first two plans

- Use higher leverage to boost your savings (with the knowledge of the associated risk)

- Do deals now instead of waiting until the future when those deals may not be available

Whatever the reason, if you can sleep at night taking on more risk, here is a plan that uses more leverage but that can get you started towards your free & clear goal.

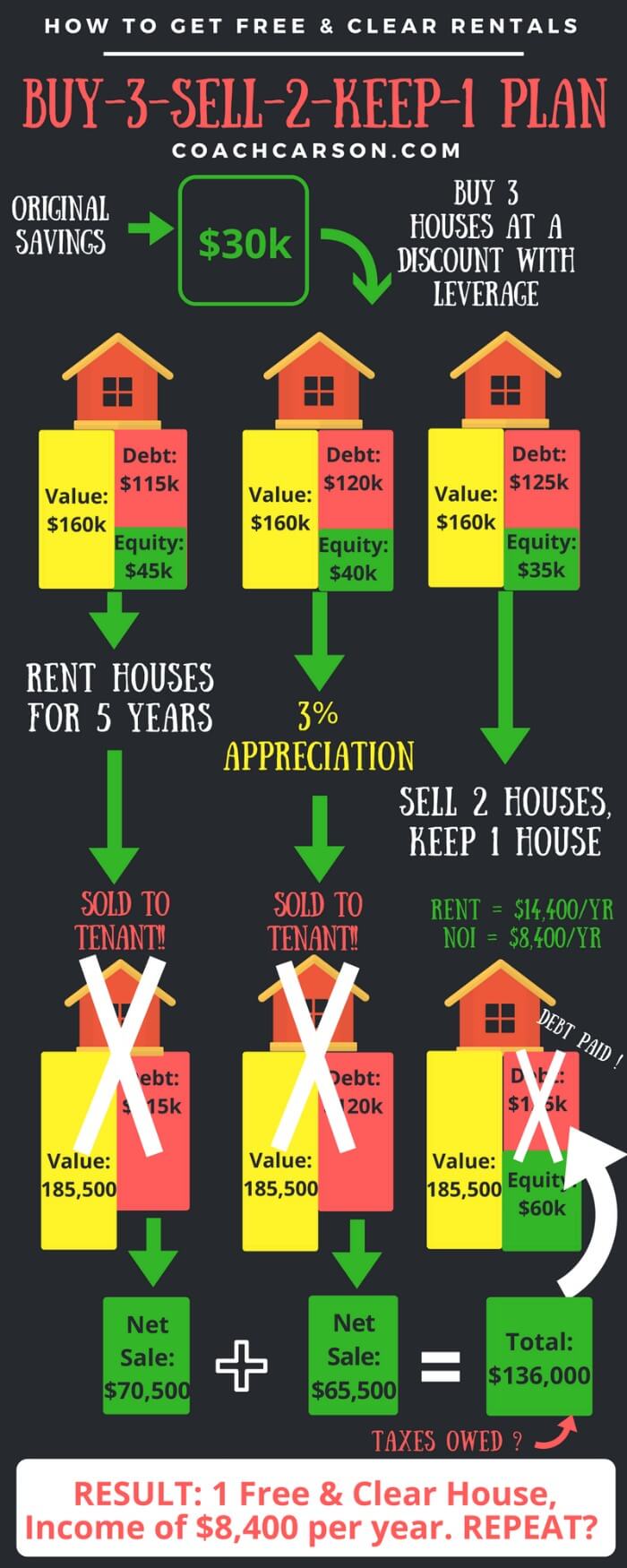

The plan works like this:

- Buy three income properties (or some multiple of three)

- Use small down payments plus loans for purchases

- Rent for a short period of time (1-5 years)

- Sell two of the three properties, but keep the third.

- Use the net sales proceeds from the two sales to pay off the third keeper property.

Example of the Buy-3-Sell 2-Keep-1 Buy and Hold Plan

The primary goal of this plan is this: buy quality properties at a discount.

The quality properties ensure that you can sell someday, hopefully at an appreciated price. The discount on your purchase gives you a better chance of earning a profit when you sell.

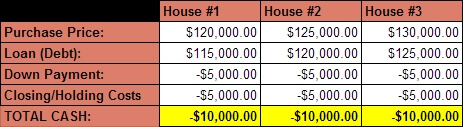

Here is what the initial purchases look like on your sample three properties (if you’re in high-priced markets, just multiple all my prices by 5 or 10).

The down payments in this scenario are relatively small. To do this you will probably need to use a flexible private lender or find conventional mortgage lenders who allow smaller down payments. You could also finance with smaller down payments if you do a live-in flip using an owner-occupant loan.

The assumption in this example is that your loans are from a private lender at 7% interest with interest only payments. If you’ve never borrowed private money, you may find that unbelievable (either too high or too low). But that is certainly a reasonable number based on my experience. The math for the first loan works like this:

$115,000 x .07 = $8,050 ÷ 12 = $671 per month.

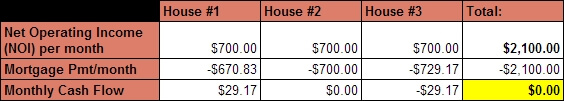

Because of the smaller down payments and higher interest rates, your mortgage payments will be much higher than in the Debt Snowball Plan and your cash flow will be break-even at best, as shown in the chart below.

If you are making zero cash flow, why would you do this?

Answer: the resale of the properties, also known as a capital gain.

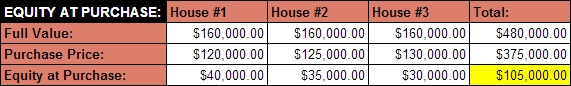

This chart shows that your primary reason for purchasing these properties. You bought them at a discount below the full value.

Essentially you have used your negotiating skills to capture equity that you can harvest later on. It is also possible that you could build more equity if the property appreciates (not guaranteed, but remember this strategy is for higher quality, appreciating markets) and if you get an amortizing loan (you did not in this example).

When you sell someday, you could use the harvested equity to buy more properties, like with a 1031 tax-free exchange. But in this plan, you will just pay whatever capital gains taxes are owed and use what’s left over to pay off debt on other properties.

How to Get Free & Clear of Debt

Let’s say you rent your properties for a short period of time, perhaps 3 to 5 years. Then you sell the properties at top price whenever the timing is right. My favorite method (i.e. most profit, least hassle) is to sell the property to your tenant. Why? Because you avoid vacancy costs, repairs to get the house on the market, and excessive realtor commissions and other closing fees.

Using this method, the net cash from the two sold properties can then be used to pay off the debt on the third keeper property.

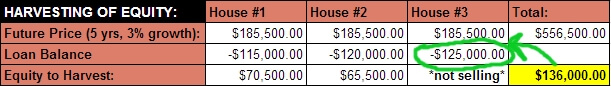

Here are the numbers from the example when you harvest the equity:

At an appreciation rate of 3%, the net proceeds of the sale of two properties will generate enough net cash to pay off the third loan on your remaining rental.

There is, however, a big caveat. In many cases, you will owe taxes at the time of the sale. The taxes come from the capital gain (i.e. your profit) and from depreciation recapture. It’s also possible you’re in a lower tax bracket where capital gains taxes is lower or non-existent. It all depends on your financial situation.

So, I wanted you to at least be aware of this tax liability. And if you do need to pay it, you would need to come up with the extra cash to cover those taxes. In the infographic below, I keep it simple and don’t include taxes.

Here’s what the whole process looks like.

Bingo! Goal accomplished!

You can repeat this process over and over until your hit your goal. You can also begin with a bigger number of properties (like we did) so that you end up with more properties in the end.

Or you can just use this method to get a couple of free of clear rental properties quickly, and then you can switch to other strategies, like the All-Cash Plan or the Debt Snowball Plan to grow your base steadily over time.

Now, aren’t we having fun?!

Closing Thoughts

The primary concept of this plan is to use the power of a short-term buy and hold rental. You buy low, rent short-term, and patiently sell high. It’s this buy and hold concept (not the specific numbers) that I hope stimulates your thinking. And this concept can certainly be applied and adapted to your situation.

You will always have to adapt plans to the reality of your life, your location, and your market fluctuations. My numbers may not match your numbers or realities, and that is ok.

All three plans in this series are really basic and fundamental. I hope you see that you don’t have to get fancy to make big progress financially using real estate. Getting fancy too often distracts you from the core ways to make money and build wealth.

Most of us just need a simple plan that we can stick to over the long run because consistent, persistent, long-run actions lead to the financial independence you are looking for.

So, if you like the free and clear goal and if one of my three plans resonates with you, just begin!

That is the big point here. Movement.

You need a plan to get moving. Once you start, you can adjust as needed.

As always, it is a privilege to share this information with you. I hope it is helpful, and I hope you’ll share your comments, your questions, and your successes in the comments section below.

What do you think of the Buy-3-Sell-2-Keep-1 Buy and Hold Plan? Is this something you could use with your real estate investing? What advantages and challenges do you see?

Please share your questions and comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

All fine and dandy except a 7% interest rate is outrageous and secondly your calculations don’t include any capital for repairs or vacancy.

Ross,

By outrageous do you mean that 7% is too high? Or too low? I consistently borrow from private lenders at 6%. And these private lenders are very intelligent, high net worth individuals. So, not sure how that makes 7% outrageous.

Regarding vacancies and capital expenses, I think you made a lot of assumptions that I didn’t get into in this short article. Was the home brand new or very old? Was it self-managed or 3rd party managed? Was it a high-tax municipality or more affordable? I just said the gross rent was $1,200 per property and the NOI was $700. That’s a 58% operating ratio. I would want to be more conservative on a long-term hold where things would start needing replacement, but given this situation of 1-5 year horizon and if the houses were fully remodelled, I wouldn’t have a problem with those numbers on certain properties I own right now.

You’re welcome to adjust the numbers as you see fit for yourself. The principle and point of the article still holds. Thanks for the comment.

Hi Chad,Could you elaborate on how you sell to your renters.. Is is a lease to own option? Are there limits to how many homes you can lease option or (other, owner contract..in a home owned outright)?

I like your thinking!

Hi Elizabeth! That’s a great question. My choice of exit strategy depends upon the property. But in the context of this plan where I want to liquidate within a few years, I prefer just to rent in most cases and verbally tell the tenant that if they’re interested in buying, I’d be happy to talk to them when they’re qualified for a loan. I tell them we can discuss a price when they’re ready to buy. But I’d also consider a short-term lease with an option to buy (1-2 years) if the tenant has a reasonable option deposit (usually 5% of the price or more) and can show they have a very good chance of buying within that window. There is no monthly rent credit towards the purchase price. Rent is rent. But the option deposit does get credited towards the price if they execute their option. They also benefit because they get to lock in their price and have a purchase contract in writing.

You asked about how many homes you can lease option. If you use a TRUE lease option (not owner financing), I don’t know of a limit. But there could be different local laws in your jurisdiction, so it’s worth checking into with a local attorney. But if your lease option morphs into owner financing because it looks too much like a contract-for-deed/bond-for-title, you could fall under the umbrella of Dodd-Frank regulations and a whole bunch of other regulations that need to be considered. I would avoid that if possible in this case.

Coach, great blog! Is there a reason you use $60k ($600 net rent) for the rental property purchase price in the all cash plan and $120k purchase prices ($700 net) rent in the buy 3 sell 1 and snowball methods?

I’m currently in the market for my first rental property (probably taking some variation of the snowball method). It seems like there must be a way to find the perfect purchase price to net rent ratio. Why buy a $120k home that only cash flows $700 when you can buy one at half the cost for $600 cash flow?

Keep the articles coming, they are a great resource!

Hey Justin, Thanks for the insightful comment. I did deliberately make the cash flow less attractive for the higher-priced property. That’s typically the way it works. But sometimes you find a sweet spot with less cash flow on PAPER but over the long run it’s more profitable because the tenants stay longer, damage the property less, and pay on time. That sweet spot will vary in each location.

In a perfect world, you’d buy a property for the lower price, higher cash flow, and it still be a quality long-term rental. If you can find it, GO for it. But in reality as you move into the median price range of any market and as you move into higher priced markets overall, the rent to price ratio tends to get worse. So, I wanted to show how it could still work without the homerun cash flow of the All-Cash example.

I’ve had some people contacting me from other countries and states where houses rent for $1,200 yet cost $400,000 to buy! So, it’s going to vary a lot by location.

HI Chad, I actually have this same scenario and own 3 rental properties at fairly low interst rates 3.5 % adjustable, 4.5 % fixed and 5% fixed. All have enough equity now to pay one off. Which two should I sell, highest equity, interest rate, or least positive cash flow. Thank you!

Moody

Hey Moody, there could be a lot of other things to consider. So, please take any comments from me with a grain of salt and do your own homework. But adjustable rates always catch my eye. There may be other factors, but if all other things are equal, I’d consider that one if you’re going to sell.

But you also want to think about which properties are best as long-term rentals. You don’t want to sell your best ones, even if they have the worst loan. You could possibly even keep all three, if you wanted, with some strategic refinancing.

For example, let’s say you had three $200,000 properties with $100,000 loans each. You could refinance TWO of them at $150,000 to raise $300,000. The $300,000 would pay off all three loans, but you’re new mortgages would just be on two properties. So, the third would be free and clear. I would much rather be in this position with one free and clear and two 75-80% mortgages than three at 50% LTV.

Just food for thought. Good luck.

Thanks Chad! Does this method work even if you choose to hire a realtor to sell the 2 houses? Because the agent commissions potentially cancel out the appreciation. Also, do we have to buy the 3 houses at the same time?

Good questions, SP. I’ve actually sold many of my rental properties with agents so it’s certainly possible. The margins are smaller, that’s for sure. So, the numbers in this example would not be as good. But in real life, I typically sold them during a hot market when listing with an agent often got me higher bids and a larger audience of potential buyers. So, I ended up doing well enough to make it worth while.

And definitely don’t have to buy all 3 houses at same time. I just explained it that way for simplicity. The main concept is building wealth through short-term holds and then recycling that wealth (in this case) to pay off debt.

good luck!

Thanks Coach! 🙂

Awesome content, Coach! I met you when you spoke at the Upstate Creia event in Greenville. Very inspiring stuff. Also really glad to see that you’ve branched out into podcasts. Keep ’em comin!

Can you give me a couple of contacts for low down payment loans such as you discuss in this article?