On your path to a destination of Financial Independence, a simple but powerful goal of free & clear rental properties (a.k.a. no debt) is a good idea. Your free & clear goal might be, for example, to own 10 houses that together rent for $12,000 per month ($1,200 per house) and net $7,000 per month after expenses. In other words $84,000 per year.

Once you have set your personal free & clear goal, the next natural question is how do you get there?

Luckily, there is not one best way to get your properties free & clear of debt. There are actually multiple plans that can work well. Here are three of my favorites:

- The All-Cash Plan

- The Rental Debt Snowball Plan

- The “Buy 3-Sell 2” Plan

In this article, I’ll explain #1 – the All-Cash Plan.

The All-Cash Plan

I am going to start with the most conservative plan. This plan is conservative because it involves no debt.

I am personally not afraid to use debt, as long as it fits my rules. I see it as a simple risk-reward trade-off. In some situations, the rewards of debt clearly outweigh the risks.

But, I have also found that simple, conservative plans executed consistently and with enthusiasm will often out-perform more debt-filled, “intelligent” plans.

In the worst case, these conservative, no-debt plans reach the goal slower. But very often in real-life scenarios, the “tortoises” of the investing world reach their financial goals just as fast. And most importantly, the most conservative investors maintain their financial status over time.

Plenty of fast, debt-filled strategies crash and burn because of their excessive debt. And like the hare who lost to the tortoise in Aesop’s classic fable, what’s the point of being fast if you don’t reach the goal you set out for in the first place?

So my version of a simple, conservative All-Cash Plan basically works like this:

- Save enough cash to buy one income property

- Save 100% of the rental income plus extra savings from a job

- Buy another income property

- Repeat until your goal for free & clear properties is met

Sounds simple, doesn’t it? But will simple work?

Simplicity Executed to Perfection

I love the story of Vince Lombardi, an NFL Hall of Fame coach. It was said that Coach Lombardi ran only two simple plays on offense – a sweep left and a sweep right. This play is as simple (yet powerful) as it gets in football.

His players would practice these two plays over, and over, and OVER! They became sick of the endless and boring repetition.

But, you can probably guess what happened. His players executed these simple plays to perfection and won championships.

So this All Cash Plan is the equivalent of Lombardi’s sweep left and sweep right for real estate investing.

An All-Cash Plan Example

To shed light on how this plan works, let me show you some real numbers using an example of lower-priced duplexes.

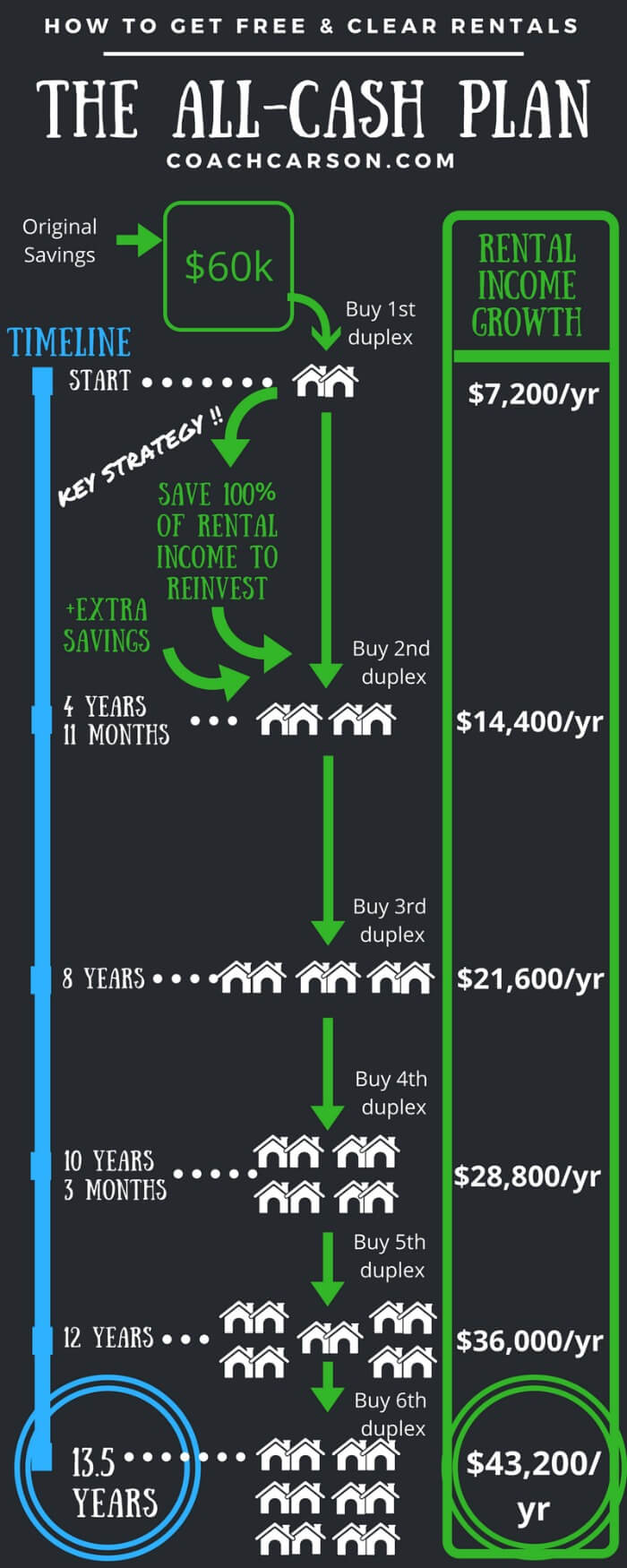

First, you will need to build up savings of $60,000. If you earn a lot, this could happen very fast. If you don’t earn a lot, this could take years.

Either way, you will need to get good at saving lots of money.

Next, you buy a duplex.

Because you own this duplex free & clear, all $7,200 of the net rent goes into your bank account. Importantly, I also assume that you can save $5,000 per year from your job or another source.

So each year you’ll accumulate $12,200 in your bank account (before taxes, although depreciation will likely shelter part of the income from taxes).

After 4 years, 11 months you’ll have another $60,000 saved. So you buy duplex #2.

After another 3 years, 1 month you’ll have another $60,000 saved. So you buy duplex #3.

This pattern keeps going on and on, and the money accumulates faster and faster over time.

The Overall Results of the All-Cash Plan

If you want to see the big picture, in just 13.5 years you would own 6 duplexes (12 units) that produce over $43,000 per year in net rent, free and clear of any debt!

Here is an infographic that shows the simple plan and the fantastic financial results:

How many plans do you know that turn a $60,000 initial investment + $5,000 per year savings into a $43,000 per year income stream for life?

I know of very few.

And the other ones that do claim to work depend on a lot of factors outside of your control. This plan depends primarily upon your ability to do three things:

- Save money

- Purchase good properties

- Manage a small number of properties (or to hire a manager)

I like it when my financial destiny depends upon my efforts and not upon chance or the whims of others!

Objections

I welcome your comments, counter-arguments, or questions. But, there are a couple of primary objections that I have heard in the past when discussing this particular plan.

“I can’t find these great deals in my area”

You might object that these deals have incredible cash flow numbers and that you’ll never be able to find deals like that.

I agree these numbers are very good. But in many markets, you can find deals like this if you are persistent and if you build systems and networks to find deals.

If you are in one of the high-priced markets where numbers like these absolutely won’t work, you may just have to buy in other markets. Or you can try one of the other plans I’ll suggest in subsequent articles.

And even within markets with these types of deals, you have to understand the A-B-C-D scale of properties and neighborhoods. You will likely never find amazing cash flow deals in an A or even a B neighborhood.

My preference for the All-Cash Plan would be a C neighborhood, which typically means working class with a mix of owners and renters. Unless you are very good at property management, I would avoid D neighborhoods with higher crime even if the numbers seem great on paper.

But, also remember that even if you can’t find numbers as good as my example, the principle still works. The time-table just might take a little longer.

“I don’t have enough cash. It will take too long to get started.”

My first response is patience. If you don’t have enough cash yet, you have an earning and savings problem, not an investing problem.

Learn to win the games of earning money and saving money first, then start focusing on investing in real estate. Get a side job, get a raise, cut your personal overhead, sell all your junk, sell your fancy car, get a simpler residence.

Get the picture?

Also, you might consider thinking outside of the box.

Do you have enough money in an IRA or 401k? These types of accounts can be self-directed to buy real estate. I personally have worked a variation of this all-cash plan in my own self-directed IRA with much success.

You may also be able to partner with someone else. If you have $30,000 and someone else has $30,000, together you can buy one property.

So, if you like your real estate wealth building steady and super-safe, this might be a path up the mountain for you. There will certainly be challenges, but as you can see, the final payoff is worth the effort.

Do you want to own free & clear rental properties? Does the All-Cash Plan appeal to you? Have you ever used a plan like this or some variation? What challenges do you see?

Please leave your comments below.

*Updated 7/8/2019

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

I love this approach! It shows the true power of real estate, that even without using OPM, you can still achieve financial independence in just 13 years!!

Thank you again for this article.

Thanks Tayolor! I agree. When you eliminate debt from the equation as this plan does, it focuses completely on the twin motors of your savings and the income generation of rental properties. And it’s still powerful (and safe).

My initial reaction was – “wow, this should would take a while”. However it isn’t so bad. Things really start to snowball around year 8 on your infographic.

The biggest challenge might be $60k starting out, but like you said, many people have that in their IRA or 401k that is under-utilized.

This approach doesn’t personally appeal to me because I love the leverage opportunities with real estate. There is an approach for everyone though, so no excuses!

Yeah, it’s interesting to see when the snowball occurs. This plan takes a lot of patience, because it’s not until almost 5 years that you buy duplex #2! But it snowballs fast after that. I think partnering or the 401k/IRA angle is the easiest way to get started. But if someone is really serious about real estate, hardcore savings for a year or two (or flipping a house or two) could raise the $60,000. For the long-term benefits, it could be worth the effort.

Thanks for chiming in with your perspective, Brian!

This plan is super conservative, but being as debt-averse as I am, it really appeals to me. I own a number of rentals free & clear now. Since they’re in an LLC, a lot of bank financing doesn’t really make sense because a lot of the terms include yucky stuff like balloon payments etc that I’d rather not mess with. Too much risk and not to mention the cost of constantly refinancing! So I will stick with the slow and steady method. Nope, it’s not sexy, but I kind of like my long romantic walks to the mail box to collect my rent checks every month 🙂

Lol. I love the idea of romantic walks to the mailbox for rent checks. An old real estate teacher (now deceased) named Lonnie Scruggs used to call that “mailbox money.” Not much better than that, except for maybe “direct deposit money” where you just log on to your computer!

It’s all about finding a plan that matches your own comfort level. I’m glad this one appeals to you. For some people it won’t appeal, and that’s ok. But I wanted to show that there isn’t a right or wrong way. There are just different paths.

This plan makes you too vulnerable to inflation.

Btw, deflation is NOT falling asset prices, but a decrease in the money supply. We can have falling real estate prices while suffering inflation–an increase in the money supply. In fact, we just lived through that. House and stock prices plunged while the FED was madly increasing the money supply, the worst possible combination for the average Joe.

Further, inflation does not have to be at an historically high rate to whittle away your savings. Even a 3% rate year in and year out is confiscatory. To pay off your mortgage is to throw away your inflation protection. It’s also unnecessary for “deflation” protection (although you are incorrect to call it “deflation,” you mean falling asset prices). Cash balances and income production are what you need in deflation, but deflation simply is not going to happen.

Again, we saw this during the crisis. House prices fell, while rents rose. If you had, say 60-70% equity in markets in the heartland, you had little problem. Don’t look at the Case Shiller index, it’s the bubble markets. Look at the freddy mac charts. Prices didn’t go down very much, and even if they did, if you were cash flowing, what difference did it make?

The only protection the individual has against inflation is the 30 yr fixed mortgage. Inflation is the explicit goal of the FED. It makes no sense to throw away the only protection against this insidious tax.

People don’t understand all the effects of inflation and, worse, have been buying the govt line that the US hasn’t had inflation for years, which is a total lie. For a sophisticated yet understandable discussion on exactly what the FED is doing to us–it’s called financial repression–go to danielamerman.com.

Bottom line, if I could talk you out of this post, I would.

Marty, I appreciate your time and thoughts. I don’t disagree that having inflation hedges are smart. I personally keep long-term, fixed interest mortgages against a portion of my own real estate for that reason.

But, my point in this article is to show how someone can build wealth and achieve financial independence with this approach. And the end result of this is income to replace their need to work. It does accomplish that, and that’s a big deal by itself.

This approach is not for everyone, but if it matches someone’s personal risk disposition, it’s more likely to be successful. Therefore, it’s a solid plan. This same person can work on inflation hedges and diversification after reaching this stage.

And while it’s not the BEST inflation hedge, I don’t agree with you that it leaves you too vulnerable to inflation. Would this person not benefit from rising rents? Rising real estate values? People from around the world trade dollars for U.S. real estate for this very reason. They know real estate will protect value in a variety of economic climates better than dollars.

Thank you again for your points. But bottom line, I am very happy with this post and wouldn’t let you talk me out of it.

PS – By deflation I did not just mean falling asset prices. I also meant falling rent prices. Try having a mortgage payment that was previously at 50% of the gross rent now become 100% of the gross rent because rents fell dramatically. Not having a mortgage would certainly be an advantage in that situation. You can say that’ll never happen, but I’m not smart enough to know that for sure. You could even hedge that by owning some properties free and clear and others with mortgages. That might be the best compromise.

Hey Coach Carson! Recently heard your interview with Brandon on the Financial Independence podcast. I’ve always had an interest in real estate but have stuck with stock and bonds as my main investments. Looking to change that soon! I have a couple of questions I hope you can help me with:

1. Where can I find more info about using my 401k/IRA funds to buy rental properties?

2. One of my neighbors seems to be flipping houses and is looking for investors. What due diligence should I perform on him and his business to assess whether or not it may be a good investment?

Hi Juan! Thanks for stopping by. Glad you’re picking up an interest in real estate. It can even be great in combination with your existing investments.

On your questions:

1. The company I use (AmericanIRA.com) has some good basic info on their website about how it works to use your IRA to purchase real estate, tax liens, private loans, and more. I am also going to write a comprehensive article on the subject in the near future because a lot of people ask about it.

2. I’m glad you’re asking about due diligence! Very important. I have made loans and received loans from individuals. I see the due diligence falling into two separate buckets: (A) the borrower (B) the property. The investor borrower needs to demonstrate her competence in flipping properties. So, I’d want to see all the numbers from current and recent deals she’s done. I’d also want to make sure she is the kind of person you can trust in general to pay you back (a credit check is a start). For the property, the lower your loan to value the better. I use the maxim, if I wouldn’t be excited to take the property back if they went out of business, I won’t make the loan. This usually means make sure you’re into the house for between 50-70% of the full value. And if it’s under repair, you need to be careful with draws so that they don’t get ahead of you.

Those are just starting recommendations. If you seriously want to get into this business (it’s called hard-money or private lending) , I’d recommend investing time and money in some education first. What you don’t know could cost you BIG with lending. I like a live class by Dyches Boddiford on the subject. He provides education and lots of the paperwork you need. It’s in April: http://assets101.com/events/hml/.

Good luck!

Thank you Coach! I’ll check those resources out and look forward to your post on the self-directed IRA.

If you have time while you are in Ecuador, go check out my home country of Colombia! 🙂

Definitely want to check out Colombia, Juan! I’ve heard a lot of wonderful things about it.

Hi Chad,

Just came across your website while doing some obscure searches online. I like your straightforward and simple approach, as well as a focus on why. The point of it all, earlier retirement and ability to be free to do what you want,

While I agree with your articles read thus far and I suspect most of your readers are USA based. It is a different matter to try to emulate these strategies in markets outside of the US. In particular where I am (Australia) the housing market is in possibly the biggest bubble of all history! With house prices disconnected from incomes and any common sense.

So one simply cannot find a property in the major centers where employment is (or possibly anywhere in Australia for that matter) that is priced at the figures I’m seeing in your articles!

The medium price of a house in Melbourne for example is currently around AUD$700,000 in Sydney it is AUD$1M. That is the median price and only buys an average house. The best you can get is an old apartment in the suburbs for maybe just under $200,000 in Melbourne or a very old run down house in an outer working class suburb for $300,000 if lucky. Both would produce rent of around $250 per week. Prices around $100,000-$200,00 are prices from around 20 years ago here. While Australian income is on average around $60,000 pa and many do earn more. In other words the cheapest houses at $300K are at least five times average income while the median are at around 10 times plus of income.

Even on my single income of $100,000 it is impossible for someone to get started in this market. I am older and do have properties but it is not possible to expand.

Things might change after a collapse. And I am figuring out just how else to also personally achieve an end goal of more time and less work. I certainly do envy that real estate in the USA is so cheap (in comparison). It is truly affordable, and yet still produces great rent yields. Anyone not buying up real estate and setting themselves up is just not being disciplined.

Peter,

Thank you for your perspective and for stopping by to read my articles. I certainly don’t have experience in the Australian market, and on the surface if prices are disconnected from income I’d certainly be more cautious.

If I were dropped into the Australian market, I think my first approach might be to focus on creative financing strategies. For example, master leasing (lease for $1,000 from owner, sublease to a sub-tenant for $1,500) or leasing with option to buy. If I control a property with an option for a few years or more, I could possibly resell my option for a relatively low risk. See my YouTube creative financing playlist for more ideas: https://www.youtube.com/playlist?list=PL5F-I4oW-y2GT1sXIBio2rEycQ6v38iyH

The theme is I wouldn’t want to borrow money or deploy my own capital with incomes at such a low % of price. But there are always motivated owners everywhere, and I bet you can find someone willing to think outside the box if you add value to their situation.

But overall I agree that the first step is always to evaluate the fundamentals of the market. Those ratios are not as attractive as some other locations.

In the U.K you could not buy a property for 60,000 but if you were able to but one for say £200,000 you certainly would not get another one at that price 4 years later.

Thanks for your comment, Keith. I understand prices are much different in different markets and countries. If I would have used $500,000 to fit more of the urban markets, I would’ve had comments from people in South Carolina or Indiana saying those prices are crazy. Lol.

And I tried to keep the example simple to demonstrate the principle. I agree that prices will very likely be higher over time. That just means it could take longer. Although I’m careful to say “certainly” will be higher. Who knows what can happen in 3-5 years in any market. People who had cash in 2008-2010 in the USA got a big discount compared to 5 years earlier.

I commented above to someone from Australia, and I think my initial approach in your market would be the same. I would research master leasing, lease options, and other low-risk ways to leverage the high price market. I’d also consider changing my investment location outside of the high-priced areas of the country and/or switching property types (perhaps condos?). The income to price ratio is always an important fundamental, so it would give me pause too. Thanks for the feedback.

I am late to the game in some ways, I am 57 and hubs is 54. We own our home free and clear and have for years, comps in our neighborhood are going for 185 to 200,000. My husband is afraid of debt so we have never used our equity to our advantage. I think I am close to convincing him to rent our home out to Section 8 tenants for 1650.00 monthly and using my GI bill benefit to purchase a home no money down, no PMI. My husband is an extremely talented tradesman and this leads me to thinking a flip and then snowball for a few more rentals. Am I on the right track?

Thanks for commenting Leslie! I like how you’re thinking creatively and applying your own preferences and skills to your situation.

First of all, congrats for being smart enough and conservative enough to own your home free and clear. That’s an accomplishment in and of itself. If you’re still wanting to grow financially (which it sounds like from your story), I like the idea of generating income from the free and clear house while you’re growing. And if you simple rent it, you can always move back in if that’s your long-term idea. But in the meantime you can do a couple of live-in flips or other strategies to build some wealth for the long-haul. There are details to figure out, but in general if you’re ok moving it sounds like an interesting path.

Best of luck!

Thanks Coach.

This method is simple and reliable.

I can vouch that it does work. People think I’m simple-minded doing this. But my assets and rental income outpace theirs.

This one is close to my way of thinking. I’m debt-averse. Mostly because of my desire to not owe others or be dependent on them.

I also don’t want to spend the time and hassle filling out forms, applying for debt, making payments, etc.

I disagree with the comment about inflation risk. As prices go up, so do salaries and my rental income. Others will see rising prices as a reason to take out a larger mortgage. One of those buyers will buy my appreciated properties when I choose to sell. I didn’t take on any additional “risk” buy avoiding debt.

I originally thought I would buy 10 as you outlined. After buying a few SFH outright I bought into multiple apartment complexes. That adds some diversification, tax benefit, and “forced appreciation.”

I never bought a duplex. They seem hard to find. But maybe I should? Do you have reasons for recommending them?

Thanks for stopping by, Wealthy Doc. The longer I’m in the game, the more I like the simple approach. And you explain the benefits very well.

I do think the inflation “benefit” is overplayed with people who advocate lots of leverage. Like all leverage, it just magnifies the benefits of inflation. But as you said, that doesn’t mean non-leveraged portfolios don’t benefit as well.

And I also think the benefit of getting investable cash flow early and often with the no-debt portfolio is understated. It gives you an enormous amount of flexibility and patience, because you can start and stop your growth as needed. With a leveraged portfolio – you can win big. But you’re also much more at the mercy of market forces so you can time your exit selling properties or getting them paid off.

I don’t have any preference for duplexes other than they seem to be more plentiful than tri-plexes or four-plexes and they tend to be in single family neighborhoods. For people just starting with house hacking, I like 2-4 units for the attractive financing terms they can get. Anything 5 and over requires commercial financing. But for you that wouldn’t matter anyway!

I think this is a great strategy. At 55 years old I had no rentals. I’m now 65 and have about 30 rentals all paid for! They provide excellent retirement income/ rent inflation/ tax favored returns . (A dozen are owned by IRAs.)

Amazing! What an accomplishment in 10 years. That’s got to be a great feeling. Thank you for sharing.

Hi Chad,

Thanks for the great article!

Unfortunately, we don’t have any market in Ontario where we can buy something under 100K or even under 200K,,,, that’s the reason I am actively looking to invest South of our border. And looks like this can be a v good strategy for me as I can’t get a mortgage in the USA as a Canadian citizen. Do you have any specific insight/advice for us, Canadians who wants to invest in USA real estate?

As you mentioned this example property was too good to be true. I have seen similar income producing properties in some markets, Rochester, Buffalo, Niagara Falls in NY state….I am not sure if they are B or C or D markets though.

Hi Chad, you and I live in the dirt cheap south east where paying off debt is (more) possible.

50% or so of the members of my REIA don’t even have the cash for a down payment. Which points to creative financing of sub-to etc… Or serially buying primary residences every few years with 95% conventional financing. Which clearly leaves behind a rental portfolio of 90-95% LTV. 🙂

I know this article’s point needs to be published for those for whom that can do it, the majority can’t (in my opinion). I’m more concerned and interested in helping the majority… FYI a fellow senior educator tells me that I focus on the new investor, his avocations (identical to yours of pay off debt to zero) focuses on the retiring or retired investor.

This weekend I had the good fortune of attending a fellow experienced investor and speaker’s 3 day talk on creative deals focusing on pre-forclosure and sub-to, which is do able by folks with time but little cash. One younger student pressed me on how he can buy a rental with little of his own cash. I quoted FANNIE that you can’t borrow the down payment… A long face followed. I mentioned portfolio / asset based 30yr lenders but the LTV goes up to 70% rarely up to 75%. So no / not enough DTI is not a hindrance but the pile of cash to buy a house goes up.

Chad you are one of the most honest and helpful REI coaches, educators and publishers I know (I’m being honest) I’m only mentioning the need for debt and the scarcity of even down payments as a hook for the readers of this article who are cash and cash flow strapped,, that they are more normal then they may feel! I’m suggesting that until they have ramped up their free cash flow, such that they can afford to pay down a core of debt, that they need to study up on creative deal scenarios, keep on buying with max leverage to build the number of doors up till they have FI or FI + some pad..

Join ALL of your local REIAs, pay for education on sub-to, lease-options, wholesaling lease options, and how to find owners who are ripe for a creative deal solution. Such that they may some day look back on this “debt free” avocation and ponder their risk, debt, LTV and whether its time to reduce their portfolios debt.

This article to me is advanced strategies, or mature investor strategies, which are an educational, evolutionary and decision making process in my view. FWIW even though I have lots of grey hair I still believe in lots of portfolio leverage. I plan on dieing with leverage. Why and how can I carry rentals so long with debt? I have a target of DSCR = 2.0 or better AND high quality rentals that don’t turn over but at most every 5 yrs. You did mention quality, I’ll repeat, you did mention cash flow, I’ll repeat that too, but I prefer as a personal preference to keep debt, just to target moving from purchasing DSCR of 1.5 to a holding DSCR of 2.0, and when it goes above 2.0 that says to me says that house’s debt needs to be “tweeked”. 🙂 🙂 🙂 Thanks so much Chad

Great points, Curt. And your point is well taken that many beginner investors don’t even have enough money for a down payment. So, how can they get their head around an all-cash strategy?

So, as a follow-up point for everyone reading this and to confirm part of what Curt is saying – I personally didn’t get into real estate investing paying all cash. I put $5,000 down on a creatively financed rental.

And many other people I know get into the game on their first couple of deals with creative or low-down-payment strategies like house hacking, live-in-flips, live-in-then rent, BRRRR deals (Buy, Rent, Remodel, Refinance, Repeat), etc. So, for many of you new investors don’t feel bad (safely) leveraging a first deal.

But if you do have access to lower priced properties (I know someone in South Carolina who bought $5,000 to $20,000 tax sale properties) or if you have the patience to save up cash for your properties in any market, my main point in this article was to affirm it is possible and it can make sense. So, more power to you!

And thank you for your kind words, Curt. You’re doing good work helping people are your REIA. That’s an often thankless job that makes a big difference for so many local investors.

Sorry, don’t understand the benefit of this strategy even with your num.bers. In the end you have income of $43k from 12 units. That sounds like a full time job for manager that would eat this 43k. Not talking about risk of having bad tenants multiplied by 12. Correct me if I’m wrong, I have only experience renting out 1 apartment. How much would such manager cost in the area of such chip apartments?

Hi Dana,

I appreciate your question.

Regarding management fees, I personally pay a 10% management fee on my properties. I know some investors who pay more, some who pay less. And I always build this fee into an analysis of a property before buying it. If I can’t make good money AFTER paying a manager, it’s not a good deal in my book.

With a manager, 12 properties would certainly not be a full-time job. On a normal month you might spend a couple hours on book keeping and checking in with property manager. And some parts of the year you might want to spend more time visiting your properties and doing more in person meetings. But overall, this would be a VERY part-time job.

The risk of bad tenants is always there, but you can reduce that risk by (1) buying and fixing up your properties to attract good tenants and (2) screening all prospective tenants very well. You can see a post on my site that discusses how to do the screening: https://www.coachcarson.com/how-screen-best-tenants/

Dana, Chad has many posts / helps re screening for good tenants. You say “apartment” and I’ll say without top training on screening I can see that you may be worn out with just one door. I recommend David Tilney as a national trainer on landlording, he teaches in Tampa FL a great town to visit.

I self manage 38 doors of decent quality SFR and I spend an hour a week, my wife does rent rolls and spends a few hours per month, for the entire portfolio. Its all in how you’ve bought the house then screened for tenants.

Dog houses get you dog tenants.. Which eat your time.

FWIW I wrote up my buying / running rentals tips into a free paper I post up on biggerpockets.com off my profile. The URL is here:

https://www.biggerpockets.com/files/user/sweetgumga/file/how-to-buy-a-bullet-proof-rental-portfolio

There’s no pitch in this doc, just a help for your rental business.

Paying off properties then quiting is a Dave Ramsey ish strategy that is right for those who are debt-o-phobic. As my comment above, I’m debt-ok which allows me to own more doors.

Math: wealth growth speed = proportional to number of doors that are appreciating in parallel.

Math 2: net income max = max number of doors you can buy using max LTV debt. When you buy at the 1% (guide) its about 8% cap, your net income will go up with more and more doors, all with high LTV debt. But debt does have its down side as Chad says above. I advise safety by buying at or quickly getting to a DSCR of 1.5 or better (raise rent to improve DSCR)…. So over time rents go up yet PITI stays the same, your safety will go up because DSCR goes up (cash flow per door).

I digressed from Dana’s issue with pain per door. I did address her issue with my help plus the URL to my Bullet Proof paper. Good luck Dana, this is a learning and improving business. David Tilney https://davidtilney.com

I like what you said about saving enough cash to buy an income property. My wife and I would like to start investing in real estate. We’ll be sure to look into our options for saving some money to help us accomplish this.

Thanks for stopping by and for commenting, Dylan!

If you don’t own a home, buy one. If you own a home, buy another one. If you own two homes, buy a third. And, lend your relatives the money to buy a home

Real estate is an imperishable asset, ever increasing in value. It is the most solid security that human ingenuity has devised. It is the basis of all security and about the only indestructible security

Good morning,

I am curious what the effect on taxes once these houses are paid off, but still receiving rental income? Is it worth paying them off and losing out in the 20% deduction? Please advise

Thanks for the question, George. You and a few others who asked this question inspired me to make a video about whether it’s smart to pay off a mortgage when you lose the deduction. Here it is: https://youtu.be/7d1iZq0cI9Q

Interesting blog on real estate Investing without debt. Please keep sharing.

Thank you Ashley!

Very nice approach to explaining the debit and net cost with examples and calculations if every real estate agent get this type of approach then he definitely increases the leades

Wow! Such an elaborate post ! Thanks for writing and sharing it.

Thank you for reading! I’m glad you found it helpful.

Thank you for recommending a nice article.Excellent and satisfactory post. It will beneficial for the real estate professional. Thanks for sharing one of these wonderful posts. It is extremely helpful for me.

Buy a duplex for 60k? Haha. Ok

That’s a constructive comment.

One of the best website and amazing content there is a lots of information about real estate and many more join us for more details we are also offer real estate offer.

Thank you for this information! I have recently committed to a debt free life 🙂 I have 2 properties now that are free and clear, but have personal debt that I am working hard to pay off within a few months 🙂 Where do you recommend keeping money while saving up to buy these properties? Do you try to earn anything on this money while its building? Online savings such as ally bank offer a pretty good rate, but someone suggested that I invest it in ETFs while I’m saving it. I like the convenience, security, and simplicity of just leaving it in my bank, but would that come with an opportunity cost that would make it unwise? What would you do?

Hi Tara, thanks for reading! And I love the idea of your debt free life.

I personally keep the savings in a savings account – not in ETFs. If I’m going to use use the money within a year or two, the ETFs have too much risk of falling in price. I only invest in those with a longer-term (15-20 year) horizon.

Hope that helps!

Thank you Chad! ?

could you help with any resources for cash deals for houses that do not require any active participation i.e passive investment

No debt houses or apartments or shares in real estate companies

Commercial real state is a powerful business now a days, ever increasing in value.

Muchas monedas se ven afectadas en tiempos de crisis, con lo cual valdrán menos internacionalmente en comparación a monedas más fuertes como el Euro o el Dólar. Las propiedades en general se tasan y valorizan en dólares o según cierta comparación con el mercado internacional o regional. Invierte tus ahorros de manera rápida y segura.

These are in fact wonderful ideas

When is your real estate start school start again?

Hi Anthony, thanks for the interest. It begins again in March 2021. If you’re on my newsletter list you’ll get notified when it’s open.

I will sign up for your course

Very interesting article. I love it!

Worth reading article from now on this is one of my favorite blog. I have save your site and definitely I will visit here again.

I totally agree that we should save enough cash until we can afford to buy a property. I’m really afraid of committing to long-term payment plans offered by lending companies and I’d rather use my entire savings in one go. It might be a good idea to start shopping for country club properties for sale and see if I can afford them now.

Informative and knowledgeable article thankyou so much for sharing it.it really increased my knowledge.

Thanks a lot for the article. 100% agree that we should control our expenses and save more. With duplexes, you showed me the great power of real estate, and not I’m thinking about investing and get the maximum of it.

Hey, This article provides me best knowledge. Kindly provides some trending real estate information as you can

I like the way you interpret the topic it’s very fascinating and the information you shared with us is essential for the public.

This is a great idea thank you Carlson. I only see any properties in that price range outside of a 10hr drive radius. Would you recommend only buying properties within a 2hr drive radius?

If you want to buy lower-priced properties so that you can pay all cash, then I’d recommend investing long distance to make that happen. You’ll just have to build a team to help you make that happen.

Good and interesting read.

The main thing is to make your mind about freelancing. Assuming you are prepared to be a freelancer, you need to make your brain. Don’t rely on others they will try to distrct you by saying Is Freelancer Safe? Don’t lose your temprament. Toward the beginning you need difficult work on your profile to draw in customers this will possibly happen when you are putting sufficient time in this field. You need to comprehend the idea of this business. Utilize your online media contacts to self-advance your business

Good reading!

Great! Loved reading this post as it includes amazing tips to invest in real estate without having debt. Thanks for sharing this huge guidance and informational read.

Great article! Can you get a discount on purchase price if buying with cash? Thanks!

Informative and knowledgeable article thankyou so much for sharing it.it really increased my knowledge.

Informative and knowledgeable article thankyou