Albert Einstein supposedly said “compounding interest is the most powerful force in the universe.” It is doubtful Einstein really said that (Snopes and Quote Investigator), but it doesn’t take away from the importance of the message.

Compounding is a VERY powerful force that either works against you (borrowing) or for you (investing).

In our world of real estate investing, we can earn income from rentals or income from fix-and-flips and then reinvest that income to do more and more deals. That’s compounding at work.

But a big obstacle to really powerful compounding is income tax. It reduces our ability to compound growth of our investments by taking big chunks of our earnings along the way.

Probably the best legal way to solve this problem is to use self-directed retirement accounts to grow and compound our investments TAX FREE. Self-directed accounts allow you to invest your retirement funds in assets like real estate, tax liens, private notes, or land. A self-directed retirement account can be a traditional IRA, ROTH IRA, Solo 401k, HSA, and more.

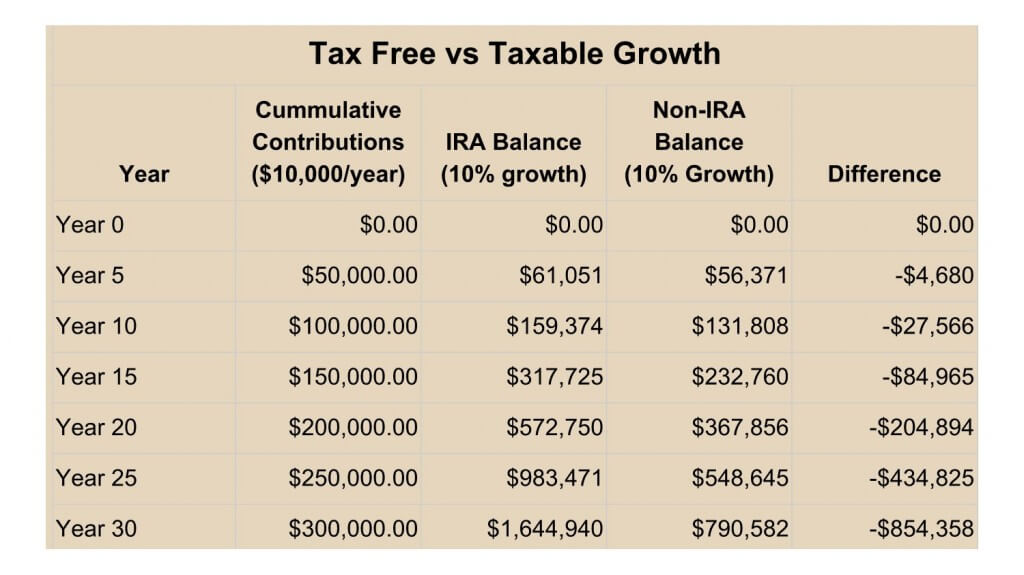

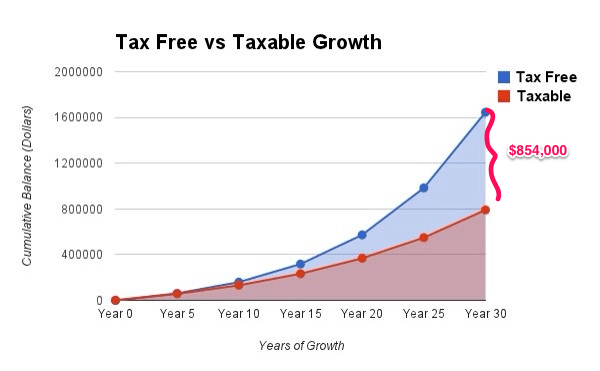

To demonstrate my point I made a comparison between two hypothetical saving plans.

Plan #1 – IRA Balance – we save and then invest money at a 10% rate of return. All contributions and earnings would be kept in a tax-sheltered IRA account. So we would pay $0.00 in taxes, and all earnings would be reinvested (compounded).

Plan #2 – Non-IRA Balance – we would also save and then invest money at a 10% rate of return, but I assumed that all earnings would be taxed at an ordinary income tax rate of 40%. Therefore our NET earning was only 6%, and the compounding was less powerful.

The difference in the final result is incredible. After 30 years the tax-free balance would have over 1.6 million dollars while the taxable account would only have 790,592 dollars.

That’s a difference of over $854,000!

To make that difference real, if the owner of each respective savings account retires and invests their entire year-30 balance into at a 6% yield, their incomes would look like this:

- Tax Free Account: $8,225/month or $98,700/year

- Taxable Account: $3,953/month or $47,436/year

The point of your investing is to eventually USE the money to fund your lifestyle, right? So, this difference is ENORMOUS.

As you can see, it pays to learn how to grow your investments tax-free.

I use my own self-directed IRA accounts for real estate related investments. So soon I’ll share some follow-up articles with my favorite real estate strategies for self-directed retirement accounts.

In the meantime, you can also get a free 1-1 consultation and an educational video about IRA investing from my friends at American IRA by visiting coachcarson.com/americanIRA.

Have you used self-directed retirement accounts to invest in real estate or other assets? Have you experienced positive results? I’d love to hear from you. in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Rule 72.

Short term goals = short term success,

long term goals =

When looking for a deal, think long term.

A 14% return today will double your money and get you to retirement much faster than pulling the trigger too quick on an 8% return deal.

Run the numbers for an investment over 20 yrs.

Post this on your computer to remind you that patience in waiting for the RIGHT deal can save you YEARS of work and bring your financial freedom date much closer.

I love it Paul. Great advice. I like your long-term thinking, and your idea about patience.

I heard Warren Buffett say one time that investing is like playing baseball in the home run derby. As long as you don’t swing, you can sit and wait for the right pitch for as long as you like to. So he passes on a lot of deals for every one that he does buy. He knows his criteria and he’s patient.

It’s truly very complicated in this busy life to listen news on TV, so I only use world wide web

for that reason, and take the newest news.

Can you explain why your example involves a 10,000 annual contribution to an IRA when the current annual limit is no more than 6,000 (7,000 if over 50) (possibly less depending on MAGI)?

Hello,

When clicking on the link the ultimate guide to Saving money (at the bottom of this page) https://www.coachcarson.com/the-power-of-compounding-tax-free/

It sends you to a pornographic website. I’m not sure if you can change that?

Thank you!

ugh. Thank you for letting me know. I deleted. They had linked to this site as some sort of spam ring.

Chad your content is simply astounding. I am learning so much and while I feel I am at the beginning of my overall FI journey I feel more empowered now than ever before due to listening daily to your podcasts and reading your articles. My question is the below, and I know there is a lot of discussion between the two thoughts here:

Is investing in a Roth IRA going to net you more or less in your investments over time? Let’s assume the Roth IRA is holding mutual funds which primarily consist of large cap, growth, mid cap and a few small companies.

My wife and I both have Roth IRAs with a financial investment advisor who we have a great relationship with and trust. I know once you pay into the Roth the earnings grow tax-free as I have already paid taxes on those invested dollars. I just don’t know which overall wins out over the course of 10-25 years; a tax deferred IRA (Traditional) which you pay taxes on once you start making withdrawals or a pre-paid tax Roth IRA as I have which allows you to pay 0 taxes once you make withdrawals (provided you have reached the age to withdraw).

I’ve asked my investment advisor this same question and his answer made sense to me which was that while you may end up with more overall in your account in a traditional tax-deferred IRA, the total taxes you end up paying would still be the same over the course of you withdrawing the funds. It would just be smaller tax amounts at one time since the amount being withdrawn is likely far smaller than the total in that account.

Not a real estate specific question but would love your input on this!

Thank you,

Patrick