One of the most important reasons to invest in rental properties is cash flow. And one of the simplest ways to measure cash flow is a formula called the cash-on-cash return (CoC for short).

In this article, I’ll explain what cash-on-cash return is, when to use it (and when not to!), and how cash-on-cash return compares with other popular formulas like cap rate and ROI. I’ll also share practical examples to demonstrate the cash-on-cash formula in action.

Here’s a summary of what you’ll learn below (click on a link to jump directly to that section):

-

- What is Cash-on-Cash Return?

- How Do You Calculate Cash-on-Cash Return?

- CoC Return Example (With a Mortgage)

- What’s a Good CoC Return?

- CoC Return vs Cap Rate

- Example of CoC Return vs Cap Rate

- Why Cash-on-Cash Return is Important

- The Limitations of Cash-on-Cash Return

- CoC Return Isn’t the Same as Return on Investment (ROI)

- Example of Return on Investment (ROI) vs CoC Return

Once you learn how to use cash-on-cash return (along with a few other key rental analysis tools), you’ll be able to more confidently analyze and buy profitable rental properties.

What is Cash-on-Cash Return?

Cash-on-cash return measures cash flow. So, let’s start by understanding that.

Cash flow is what’s left over after you collect rent and pay all of your rental property bills (including your mortgage but not including income taxes). A more specific term for this cash flow is Net Income After Financing (NIAF).

The cash-on-cash return tells you the ratio of NIAF to your original cash investment. In other words, it tells you how much of your original cash investment you get back in one year.

Here’s what that looks like in a formula:

| Cash-on-Cash Return

= Net Income After Financing (NIAF) ÷ Total Cash Investment |

Now let me explain in more depth how you actually calculate this formula.

How Do You Calculate Cash-on-Cash Return?

To calculate cash-on-cash return for yourself, you’ll need to figure out the two parts of the formula:

- Total cash investment

- Net income after financing

First, for your total cash investment, just add up all of the following:

- down payment

- closing & financing costs

- holding/carry costs (costs like interest, taxes, & insurance before you get a property rented)

- repair costs

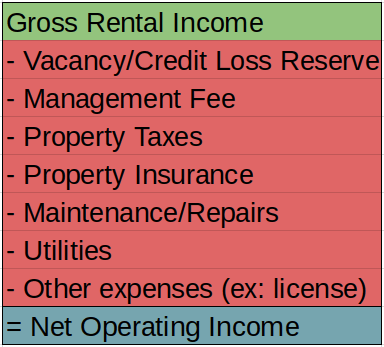

Second, calculate the net income after financing by taking the property’s yearly Net Operating Income (NOI) and subtracting the financing costs (FC).

Here’s the formula for NOI:

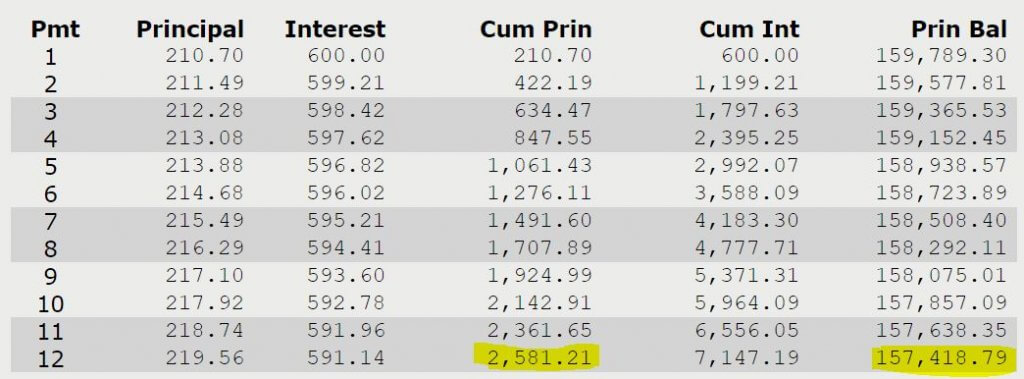

The financing cost is the total principal AND interest payment for your mortgage. You can just plug in the loan amount for your property into a loan or amortization calculator like this free one. Then be sure to multiple this monthly financing cost by 12 to get an annual figure.

Now subtract the financing cost (FC) from the NOI to get the Net Income After Financing (NIAF). Then divide the NIAF by your total cash invested to get the Cash-on-Cash Return.

Let’s look at an example to demonstrate how all of this works together.

CoC Return Example (With a Mortgage)

Let’s say you buy a duplex for a price of $200,000. After making a $40,000 down payment, you get a mortgage for $160,000 at 4.5% interest with a payment of $811/month for 30 years. You also spend $5,000 in closing costs, $5,000 in holding costs, and $10,000 in up-front repairs.

After a few months of remodeling and finding good tenants, you receive a monthly rent of $2,400/month or $28,800/year.

Your total cash invested will be the following:

|

$40,000 – down payment |

And your net income after financing is the following (calculated on an annual basis):

|

$28,800 – gross rent |

Now you can calculate the cash-on-cash return:

|

NIAF ÷ Total Cash Invested = Cash-on-Cash Return $7,548 ÷ $60,000 = 12.58% Cash-on-Cash Return |

What does this cash-on-cash return actually you?

It tells you that the rental income from this duplex will pay you back 12.58% of your cash (before taxes) during the first year or so.

So, you naturally might ask yourself this. Is 12.58% a good cash-on-cash return?

Let’s take a look at that question to find out.

What’s a Good CoC Return?

In general, higher returns are better and lower returns are worse. This is also generally true of cash-on-cash return.

But a good or bad cash-on-cash return will depend on your personal preferences and goals for a particular property. I have had properties at a 6% cash-on-cash return that I’ve been very happy with. And I’ve had others at a 15% cash-on-cash return that I wanted to get rid of because of other problems, hassles, and risks.

It’s also tricky to identify a “good” or “bad” cash-on-cash return because the results from this formula can be misleading.

For example, let’s say I invested $1,000 down on a $200,000 property. If somehow I got a $500/year cash flow (NIAF), my cash-on-cash return is $500 ÷ $1,000 = 50%.

50% is off the charts! Isn’t that good?

Not exactly. $500 per year is a tiny cash flow compared to the value and debt of this investment property. The cash will likely be eaten up by the fluctuations of repairs, vacancies, and other expenses. And if the property goes down in value even by only a few percent, you will be upside down and owe more debt than the property is worth.

So, the lesson here is that cash-on-cash return becomes less helpful as you increase your leverage. But if you have a more traditional 20-30% down payment, a cash-on-cash return can be a useful metric.

For example, a 10% return could tell you that you are maintaining a reasonable cash-flow discipline for the risk you are taking. While a 3% cash-on-cash return might be a red flag.

To increase the usefulness of cash-on-cash return, I like to use it in conjunction with another metric called cap rate.

CoC Return vs Cap Rate

I have an article and podcast episode about capitalization (i.e. cap) rates if you want to really go deep on the topic. But if you just want the basics, cap rate is a formula that’s a close relative of cash-on-cash return. The primary difference is that the cap rate ignores the use of debt.

I’ll explain what I mean with the formula:

| Cap Rate

= Net Operating Income ÷ Purchase Price |

The cap rate is simply a ratio of the income a property produces to the price you paid for it. It assumes you pay cash for it (i.e. using no debt). And this is useful as an investor because it allows you to compare one property to another without the distraction of mortgage financing.

But if you do actually pay all cash for a property, the cap rate will basically the same as a cash-on-cash return.

I say basically, however, because we need to make one adjustment to the cap rate formula to make it exactly the same as cash-on-cash return. I’ll demonstrate with another example.

Example of CoC Return vs Cap Rate

To make cash-on-cash return and cap rate the same, we need to change the definition of cap rate from net operating income ÷ purchase price to net operating income ÷ purchase cost.

Price is just what you pay the seller. But your cost includes price, closing costs, holding costs, and repair costs. It’s basically the total amount of money you have to invest, which is really the most important thing to know.

Cap rate defined this way (NOI ÷ total cost) isn’t technically correct. Just know you may ruffle the feathers of a few commercial investors and appraisers if you use this non-textbook definition (I know – I’ve received their cap-rate-rath in YouTube videos!). But this alternative definition is commonly used by many investors, and it’s actually a more useful formula when you’re buying investment properties.

But in order to avoid confusion, I’ll more correctly call this useful “cap rate” the return on asset (RoA). Now, let’s look at the relationship between RoA and cash-on-cash return using our prior example.

Again you buy a duplex for $200,000, but this time you put 100% or $200,000 down instead of using a mortgage. You also save some money on closing costs ($5,000 to $1,500) and holding costs (from $5,000 to $2,000) because you have no financing.

As a result, the return on asset and the cash on cash return are the same:

|

Net Operating Income ÷ Purchase Cost = Return on Asset Net Operating Income ÷ (Purchase price + closing costs + holding costs + repair costs) $17,280 ÷ ($200,000 + $1,500 + $2,000 + $10,000) $17,280 ÷ $213,500 = 8.1% – Return on Asset |

And here’s the cash-on-cash return:

|

NIAF ÷ Total Cash Invested = Cash-on-Cash Return (NOI – Financing Costs) ÷ Total Cash Invested = Cash-on-Cash Return ($17,280 – $0) ÷ $213,500 = 8.1% Cash-on-Cash Return |

So if you are an investor who follows an all-cash (no debt) investing plan, there will be no difference between the return on asset and cash-on-cash return.

But remember our other cash-on-cash return example using a mortgage?

In that case, the cash-on-cash return was 12.58%. But the same property produces a return on asset of 8.1%. That difference of 4.48% demonstrates the powerful effect of positive leverage on your overall return.

Now let’s return to the cash-on-cash formula and explore why you should use it in your real estate investing.

Why Cash-on-Cash Return is Important

In real estate investing, there are three primary ways you build wealth:

- Cash flow from rents

- Pay down of mortgage principal

- Increase in price

#2 and #3 can certainly build a LOT of wealth over the long run. So, you don’t want to only concentrate on cash flow. This is why cash-on-cash return should not be used alone. Instead, it should be one of several analysis tools you use for real estate investing.

But #1 – cash flow from rent – is typically the primary driver of your investment returns. Without cash flow, your investment is much more speculative.

For that reason, using cash-on-cash return is a form of cash flow discipline. It’s a way to keep your focus on the main thing.

You can also use it as a goal when analyzing and making offers on investment properties.

For example, you may have a goal of a 12% cash-on-cash return. If a deal does not produce that return, you will either have to renegotiate your purchase price and financing or walk away.

But there is danger in depending too much on cash-on-cash return. It does not measure the pay down of the principal or the increase in price I mentioned above. And it also has other limitations, which I’ll explain now.

The Limitations of Cash-on-Cash Return

Like any metric or formula, cash-on-cash return has its limitations. I’ll explain three of the most important ones here:

- Sensitivity to leverage

- Ignores the future

- Doesn’t account for taxes

Sensitivity to Leverage

Cash-on-cash return becomes less useful with extreme leverage. Remember the example with $1,000 down and $500/year in cash flow? A 50% return isn’t necessarily as good as it sounds.

This is one reason I always like to pair cash-on-cash return with Net Income After Financing (NIAF).

For example, you may set a goal of $200/month or $2,400/year of NIAF for each rental unit that you buy. Then you may also have a goal of a 12% cash-on-cash return.

If you have a $2,400/year NIAF and a $20,000 total cash investment, you’d meet both of your goals ($2,400 ÷ $20,000 = 12%). But if you anticipated investing more, say $30,000, your cash-on-cash return would drop to 8% ($2,400 ÷ $30,000). You’d then either have to find an alternative purchase/financing strategy, reduce your expectations, or walk away from the deal.

Ignores the Future

Cash-on-cash return typically takes the current cash flow and compares it to your cash investment. But for patient investors, much of your profit could come in the future.

For example, my business partner and I once bought a multi-unit property in my hometown of Clemson, South Carolina that initially rented for $375/unit. But after extensive cosmetic remodels, we increased the rent to $655/unit.

In the beginning, the cash-on-cash return was VERY unimpressive. But once we used our entrepreneurial skills to change the picture, our cash-on-cash return grew dramatically.

In addition, the initial cash-on-cash return of our multi-units didn’t account for future changes in financing. Because we have also increased the value of our property by 50-60% above our original purchase price, we can now refinance to pull out some or all of our cash. With no cash left in the deal, the cash-on-cash metric would mean very little.

So for more complex deals like this one with uneven cash flows that spread out into the future, it’s smart to also use other investing formulas like an Internal Rate of Return (IRR) or a Net Present Value (NPV).

My new course Rental Property Analysis goes into more depth and provides a spreadsheet to calculate these more advanced formulas.

Doesn’t Account For Taxes

The final limitation I’ll mention here is that cash-on-cash return is a pre-tax calculation. But in the real world, you DO have to pay taxes!

Study my article How to Calculate Rental Property Cash Flow to see the after-tax cash flow formula. And work closely with Certified Public Accountant (CPA) or other tax professionals who can help you understand and plan for your actual income taxes.

Luckily on many rental properties that use leverage, you may pay little income taxes anyway. This happens when your property depreciation is larger than your taxable income.

Depreciation is something required by the U.S. government that spreads out most of the cost of real estate purchases over 27.5 years (for residential buildings). This creates an annual depreciation “expense.”

But this isn’t a real expense that actually comes out of your bank account. It’s just an expense on paper, and it legally shelters other passive income. In this way, you can often pay less income tax as a result.

Now that you know its limitations, let’s look at how cash-on-cash return compares to a more comprehensive, total return on investment (ROI).

CoC Return Isn’t the Same as Return on Investment (ROI)

Cash-on-cash return is important, but it’s only one aspect of the total return on investment (ROI). As I mentioned earlier, you can build wealth in real estate with (1) cash flow, (2) pay down/amortization of principal on a loan, and (3) increase in price.

Cash-on-cash return only measures one of those! So, to figure out your total return on investment, you need to include those additional sources of profit (amortization and price increase) into the analysis.

Here is a basic formula for ROI:

| Return on Investment (ROI)

= (Net Return ÷ Total Investment) x 100% |

Net return includes all of the sources of return (i.e. profit) from your investment property, net or after deducting the expenses from the investment. And the return is expressed as a percentage to make it easier to understand.

Let’s return to our prior example to demonstrate how this ROI could work.

Example of Return on Investment (ROI) vs CoC Return

Remember from our prior example, you buy a $200,000 duplex, put $40,000 down, and borrow $160,000 at 4.5% interest. You also have additional costs of $20,000. This brings your total cash out of pocket (i.e. investment) to $60,000 ($20,000 + $40,000), and your total purchase cost to $220,000 ($200,000 + $20,000).

Let’s say your property appreciates to a new full value of $250,000 (remember, you did repairs and received stable rents). To calculate your full return, you need to figure out the net (after expenses and mortgage payoff) proceeds from the sale of the property.

First, let’s say you’d incur 5% costs of selling (commissions and closing costs).

| Sales Costs

= Sale Price x 5% = $250,000 x 5% = $12,500 |

Second, don’t forget about income taxes! Actual income taxes will vary depending on your tax bracket and the tax policy where you live at the time of sale. But let’s assume a 20% tax on any gains from the sale (i.e. capital gains).

| Tax liability from sale

= Capital gain x 20% = (Sales price – Sales Costs – Original Cost/Basis) x 20% = ($250,000 – $12,500 – $220,000*) x 20% = $17,500 x 20% = $3,500 |

And third, your mortgage balance has been paid down by $2,581 to a balance of $157,419 after 12 months.

Now you can calculate your net proceeds/return from the sale of the property:

| Net Return From Sale of Property

= (Sale Price – Loan Balance – Sales costs – Income Taxes) – Original Investment/Cash Out of Pocket = ($250,000 – $157,419 – $12,500 – $3,500) – $60,000 = $16,581 |

So, your net return including ALL the sources (rental income and resale) is this:

| Total Net Return

= Net Income After Financing + Net Return From Sale = $7,548 +$16,581 = $24,129 |

And finally, the return on investment (ROI) is this:

| Return on Investment (ROI)

= (Net Return ÷ Investment) x 100% = ($24,129 ÷ $60,000) x 100% = 40.22% |

Figuring out ROI requires many more steps than CoC, doesn’t it?!

But in the end, you can see that the CoC return in our example (12.58%) is only a part of the total ROI (40.22%). If you had only used CoC return, you would have ignored almost 70% of the profit on this deal!

The lesson is that cash-on-cash return is an important but incomplete tool if you want to properly analyze a real estate investment.

Conclusion

You’ve now taken a deep dive into cash-on-cash return.

In summary, you learned what cash-on-cash return is, how it’s calculated, and what its limits are. You also learned how to apply it to your personal investment purchases and compare it with other returns like a cap rate and a return on investment (ROI).

The best way to learn is to practice! So, be sure to use this formula and start analyzing some properties in your town as soon as possible.

Also, make a commitment to learn the other formulas that can help you in an analysis of a real estate investment. You can begin by reading my article How to Run the Numbers – Back of the Envelope Analysis or join my course Rental Property Analysis, which includes a comprehensive spreadsheet to help you use several formulas at once.

Best of luck with your own real estate investment analysis!

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Great article! CoC is the first thing I look at when analyzing a deal. I read a book the other day that said something interesting. It said Cash on Cash is really valid only for the first year you own the property (you mentioned this in the article) after the first year it might be helpful to do a similar analysis, but on your equity at that point instead of your cash invested. This analysis produces some interesting results and might help make the case for refinancing at some point. Though to do it you have to make a guess at the market value of the property, which is sometimes hard! Just wanted to share.

great point on year #1 and CoC. Yes, the return on equity calculation makes a lot more sense at that point so that you can decide whether selling, refinancing, or keeping makes more sense.

Great content! thank you! Quick question, the NIAF does not include the income taxes, but does it include property taxes (which vary greatly based on the Millage rate for that specific school district)?

Nevermind, just saw it on the chart, thanks!