If you are a parent or grandparent, the question of how to save for college for your kids (or grand kids) has probably crossed your mind. And in this article I will show how my plan is to save for college with real estate investing.

We could have a long, fabulous discussion about how much we should save for our kids’ college education. Feel free to share your thoughts in the comments below. Also, the explosion of tuition prices and of disruptive technology could mean that the system of higher education will look very different in the next 15-20 years.

But despite those issues, my wife and I want our kids to experience the same growth and opportunities we had with our university educations. While we don’t plan to write them a blank check, we also don’t want them burdened with enormous student debt that will limit their life options after college.

So, we’re saving to pay for a large chunk of our kids’ college education. And we’re doing it with real estate investing.

I’ll unpack the details in the rest of this article, including the actual numbers from two houses we have earmarked for college savings.

How Much Do You Need to Save For College?

The first question you must ask yourself is just how much you will need to save for college. I recommend you take a deep breath if you’ve never done this type of exercise. The numbers are not pretty.

My blogging friend at retirebeforedad.com wrote a very interesting article about his plan to use a 529 Savings Plan to save for his 3 kids’ college. His estimate is a grand total of $716,000 for all three children (or over $238,000 per child at an in-state public university in Virginia)!!

When I read that, my jaw hit the floor in shock! So, I used The World’s Simplest College Cost Calculator to do my own estimate. I like tools like this because they show you the assumptions (like inflation rate of tuition) and let you choose your own.

My own estimate of total college costs came to around $200,000 for my 5-year old and $225,000 for my 3-year old at an in-state public university. But I learned that the calculator assumes we will pay 100% of their tuition, room and board, transportation, and other expenses for four years.

We certainly don’t plan to pay for 100% of college costs. The concept of “skin in the game” in the form of scholarships, work, starting a business, and perhaps small amounts of student loans appealed to us. We also have some tricks up our sleeves for how to hack college housing costs (see house hacking).

But, we want the ability to pay for a significant amount of the cost. So, in the rest of this article I am going to assume that we will need the following:

- $340,000 total or about 80% of the full $425,000 estimated cost of college

- $160,000 in 13.5 years for my first child

- $180,000 within 15.5 years for my second child.

Let’s see how that can happen using real estate investing!

Why Pay For College With Real Estate Investing?

The deadline for college savings comes fast. Depending upon when you start saving, you only have 10-18 years to do it.

So, unlike retirement savings where you can work a few extra years if you mess up your assumptions, you need a very solid plan to achieve your college savings within a certain period of time.

I have nothing against traditional 529 Savings Plan or a Coverdell Education Savings Accounts. They are a viable option in conjunction with real estate or on their own. I also am a fan of stock investing for long-term wealth building. More specifically I like low-cost, widely diversified index fund investing (explained well in the stock series by a favorite blogger of mine Jlcollinsnh).

But for the reasons I’ll share below, I have found real estate investing outside of a savings plan to be a superior choice in our case.

Safe Real Estate Leverage Lets You Start Small and End Big

The basic version of my real estate college savings plan is this:

- Buy a rental property in a solid location that can cover all expenses and then some

- Make a down payment

- Acquire fixed interest, self-amortizing, long-term debt

- Apply excess rental cash flow to accelerate debt pay down

- Harvest the equity when needed for college with a sale or a refinance

This plan is simple. You use safe leverage (debt) against a solid rental property to grow your down payment into significant equity that can be used to save for college.

For example, you could buy a property for $150,000 and put $30,000 down. If you amortize that loan completely in 18 years before college begins, your equity should be worth at least $150,000. At a more historical average of 3% appreciation, your nest egg would be worth more like $255,000 (I used this future value calculator to make that estimate).

On-Time & Predictable Growth

Real estate is not the only vehicle that can grow your wealth. But in my experience this type of real estate investing plan is much more predictable than other options. It has the ability to deliver your savings on-time, as-needed to save for college.

Why is it predictable and on-time?

Because your growth is fueled by the twin engines of:

- Loan amortization (pay down)

- Net rental income

A fixed rate mortgage has a set period of amortization, usually 30, 20, or 15 years. Therefore, if you just make the minimum payment on that loan it will be paid off during that time frame. The plan becomes even more predictable when you apply extra cash flow to the loan to amortize it faster.

And net rental income is much more predictable than the periodic ups and downs of overall real estate and stock market prices. Rental income for well-located properties tends to go flat or appreciate, but it rarely goes down (except in periods like the Great Depression).

All of this just means that you can more easily predict and plan for the growth of your savings.

Control Over Returns

Remember that I said you must be very confident that you can achieve your returns within a certain time frame? I am personally much more confident when I have some sort of control over the outcome. This is my strength (and my weakness) as an entrepreneur! If you share that sentiment, then real estate is an attractive vehicle.

You control (directly or indirectly) picking a good property, borrowing on good terms, finding good tenants, maintaining the property, saving extra cash flow from rents, and eventually harvesting your equity.

Stock and bond investments are more passive, but that is also part of their weakness. All you can control is when to press the button to buy or sell. The rest is up to others.

Simple, Understandable, and Safe

One of Warren Buffett’s primary rules is to purchase assets that are simple and understandable. Residential real estate, particularly houses and small multi units, is the most simple and understandable investment I know.

People like you and me live in rental units. Our needs are things like safety, convenience, comfort, affordability, style, and good school districts. You probably already intuitively understand the fundamentals of good real estate.

Real estate is also a “real” asset. It’s tangible. In the right locations, its value is buoyed by construction costs and salaries which keep getting higher over time. Housing doesn’t go out of style or get replaced by the latest technology. People will still be living in homes long after you and I are gone, and this makes it a safe long-term investment.

Legal Tax Sheltering

Like other large capital asset purchases, the IRS requires real estate investors to depreciate the value of the building over time. Residential real estate, for example, has a life of 27.5 years. On a $100,000 building this would be a yearly depreciation of over $3,600.

This paper expense (it’s not actually cash out of your pocket) can shelter $3,600 of rental profits. This means that less of your rental profits are exposed to current tax expenses. If this depreciation creates a loss for your rental, it can sometimes also be used to shelter other income from tax (with some limitations). See the Incredible Tax Benefits of Real Estate Investing for more details.

Your Savings, Your Choice (Unlike 529 Plans)

I also like real estate investing outside of a 529 Plan or Coverdell Account because it gives you more flexibility with the funds. What if your kid gets a full scholarship? What if your kid can’t be convinced to go to college (or drops out to form the next Facebook)?

With those tax-sheltered savings plans, you must use the funds for educational purposes or pay taxes and fees in order to get the funds out for other purposes. If your plans change with real estate investing, it just becomes another part of your overall wealth-building portfolio.

Multiple Exit Strategies

Growth is only good if you can access your equity when you need it. With this real estate plan, I have at least two different exit strategies which I’ll list below in order of my preference.

1. Refinance to Pull Out Cash:

When I need to begin paying for college, I can refinance the rental properties and pull out cash from the properties tax-free (borrowed funds are not taxable). For example, if my property is worth $220,000 in 13 years, I may be able to refinance 80% and pull out $176,000. I’ll then start over letting my tenants pay back the mortgage for the next 15-20 years.

2. Sell & Cash Out:

If it makes more sense, I could also sell the rental house, pay my taxes, and use the proceeds to fund college. I like this alternative less than a refinance because you give up the costs to sell the property (5-10%) and you pay taxes on capital gains and on depreciation recapture. This could mean you net 70-80% of the full value. But if the finance market is shaky, if you no longer want to own property, and if the market has appreciated significantly, this option could still work.

You might reasonably argue that the exit strategy of real estate is a weakness. After all, it’s not as liquid as stocks or other publicly traded investments. You might also be concerned about your ability to refinance when you need to access the cash.

These are viable concerns, but I think any investment plan has inherent challenges. For example, if you invest in stocks for 13 years, there is a chance that the four years you need the money happens to be a time when the market has tanked by 40%. The liquidity of stocks might lead you to make a bad decision at that point, whereas the relative illiquidity of real estate will force you to wait.

The key with any path you take will be preparation and flexibility. For example, if you are two or three years away from the beginning of college, it might be prudent to refinance now to pull out some of the money if the timing is good. In another example where you had to wait until after college started to pull out money, you might be able to fund some costs from other sources, such as current income or loans, and then pay yourself back as soon as you’re able.

Our Plan to Save For College Using Real Estate Investing

I have given you a lot of reasons to use real estate as a vehicle to save for college, but now let me share the numbers on my actual investment properties. I get pretty creative with some of my purchases, so I have simplified some of the financing terms to make them easier to illustrate. But the core numbers and results are the same as reality.

The Assumptions

If you remember from the beginning of the article, our goals for college savings are the following:

- $160,000 within 13.5 years for our 5-year old

- $180,000 within 15.5 years for our 3-year old

We would like to have 100% of these funds available before the first year of school. These funds would cover approximately 80% of in-state tuition, room, board, and other costs at a public university. If our kids choose a private or more expensive school, the balance will have to be paid with scholarships, grants, working income, or loans.

Here are the details of the two houses we have earmarked for college savings.

House #1

We moved into this house about 1.5 years before our first daughter was born. It is a simple, 1-story, 1500 square foot house with 3 bedrooms and 2 baths. It is less than a mile from a university campus, which makes it a very attractive rental for many faculty and students.

We purchased the home from a landlord who agreed to receive a small down payment and carry back seller financing for the balance with a fixed payment and interest rate over a long period of time.

When we bought the house it was a major fixer upper. The wall studs looked like Swiss cheese in many spots from termite infestation, and the layout and finishes were very outdated. We spent a lot of money repairing the property before even moving in, and as a result, our total investment including repairs and purchase price was as much or more than the full value of the property.

We moved out of the house after a couple of years, and we’ve rented it ever since.

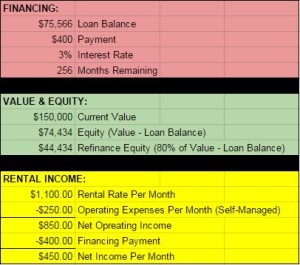

As of this writing, the financial picture for House #1 looks like this:

We will need $160,000 in 13.5 years when our eldest child begins college, and currently, we only have $44,434 available to pull out with a refinance.

How will we grow our savings?

Growth Source #1 – Amortization of Loan:

We’ll continue using the rents to pay the minimum loan balance. In 13.5 years (162 months) we will only owe $33,472, which adds $42,094 to our original “refinance equity” of $44,434.

Total Savings = $44,434 + $42,094 = $86,518

Growth Source #2 – Net Rental Income:

We can use the extra $450/month rental cash flow to set aside in a savings account, to apply to the loan to pay it down faster, or even to invest in index funds with a more traditional 529 Plan or Coverdell Account.

Even without any investment growth, this extra cash flow produces $72,900 over the next 162 months (pre-tax). If this extra income can be invested at 3.0% monthly (the rate on our loan), this portion of the savings would grow to $89,738.

Total Savings = $86,518 + $89,738 = $176,256

Growth Source #3 – Appreciation:

Sources #1 and #2 already surpassed our savings goal, but we can also hope for appreciation of the market value of our home. I say hope, because this is not guaranteed. But the historical average of single family house appreciation has been approximately 3% nationally, and this particular location close to a large, public university leaves me reasonably confident that we’ll meet or exceed the average.

With a 3% appreciation rate for 13.5 years, our home price would increase from $150,000 to over $226,888, or an additional $76,888 in new equity. We can only harvest 80% of that with a refinance, so we’re left with $61,510.

Total Savings = $176,256 + $61,510 = $237,766

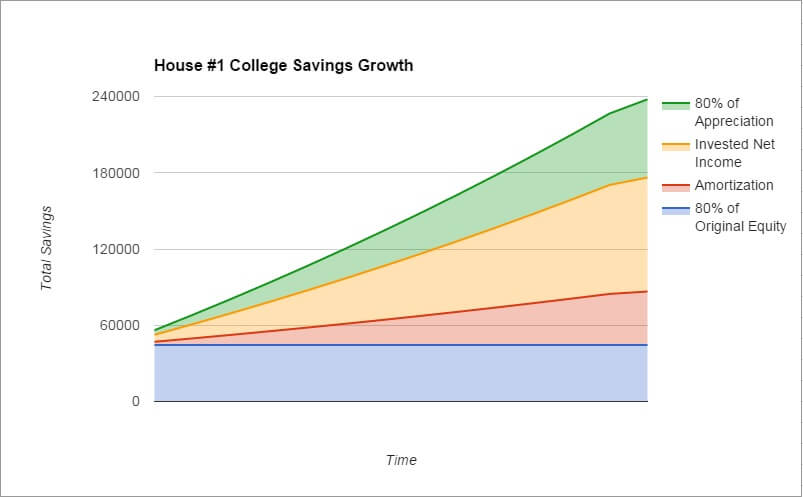

Here’s a graph to show you the total estimated savings over time and a breakdown of where the growth comes from.

As you can see, our House #1 projections have successfully met and exceeded our savings goal for our eldest kid. Now let’s if we can save for our second kid’s college.

House #2

Remember when we moved out of House #1? We moved because we got a great deal on House #2. This new house also had a less busy street, a larger house, and a nice lot.

Although not nearly as bad as House #1, this one was also a fixer-upper. We still currently live in this house, but in the future, we will move out and rent this house as well.

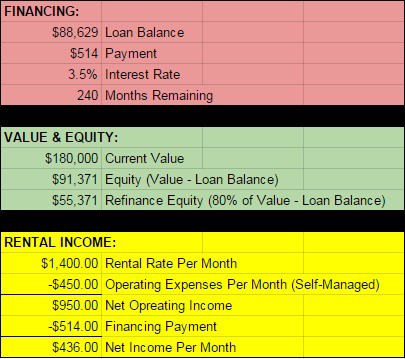

As of this writing, the financial picture for House #2 looks like this if it were rented:

We will need $180,000 in 15.5 years when our youngest child begins college. Currently, we only have $55,371 available to pull out when we refinance.

**Update as of March 2019 – Since I originally wrote the article the equity already looks a lot better. We now owe $80,000 and the house is worth more than $200,000. So, the current equity is about $85,000.

How will we grow our savings?

Growth Source #1 – Amortization of Loan:

We’ll continue using the rents to pay the minimum loan balance. In 15.5 years we will only owe $25,647, which adds $62,982 of equity to the original “refinance equity” of $55,371.

Total Savings = $55,371 + $62,982= $118,353

Growth Source #2 – Net Rental Income:

We can use the extra $436/month rental cash flow to apply to the loan to pay it down faster. Or we could use it to invest in a savings account or a more traditional 529 Plan or Coverdell Account.

Even without any investment growth, this extra cash flow produces $81,096 over the next 186 months (pre-tax). If this extra income can be invested at 3.5% monthly (the rate on our loan), this portion of the savings would grow to $107,472.

Total Savings = $118,353 + $107,472 = $225,825

Growth Source #3 – Appreciation:

We have just met our savings goal of $225,000 with sources #1 and #2, but what if we added appreciation? Again, we can hope for appreciation although it is not guaranteed. But if our home appreciates at the historical average of 3%, it will be worth $288,847. That’s an additional $108,847 in growth. We can only pull out 80% with a refinance, so that’s an extra $87,048 available to pay for college.

Total Savings = $225,825 + $87,078 = $312,903

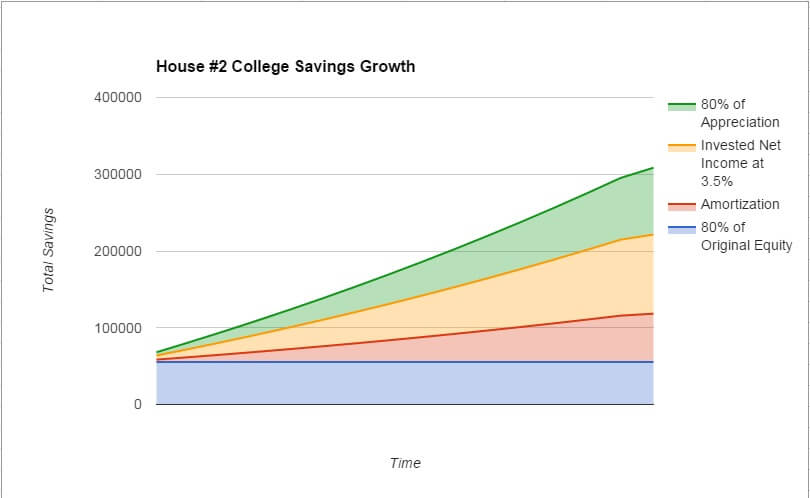

Here’s a graph to show you the total estimated savings over time. It also includes a breakdown of where the growth comes from.

Once again the rental property projections came through and exceeded our college savings needs.

Closing Suggestions to Save For College With Real Estate Investing

I have given you very specific scenarios to save for college with real estate investing. I hope it makes the concept more real. But you should know that my scenario won’t be exactly like yours. You should also know that my own scenario won’t even turn out exactly like my illustrations above.

Reality is constantly changing. The art of entrepreneurship is matching a plan on paper with the reality on the ground.

Former president Eisenhower wisely said,

In preparing for battle I have always found that plans are useless, but planning is indispensable.”

The power is in the planning process and in the concept. Just apply the concept to your own plans to save for college, and you will be ahead of the game. It’s then your job to adjust and to learn as you go.

Of course, also feel free to adapt my plan. You may use 100% real estate investing, or you might combine it with other strategies to give yourself diversification. The important step is that you feel comfortable executing your plan.

Also keep in mind that real estate investing has a learning curve. You will need to learn how to analyze purchases, acquire financing, and manage tenants and properties. None of these are insurmountable, but they’re not as simple as ordering stocks on your computer.

That’s another reason to stick around and subscribe to my weekly newsletter!

I hope you found this article helpful. Best of luck with your college savings plans.

Is real estate a good plan to save for college for your kids or grandkids? Do you know someone who has used this strategy successfully? Do you have another plan that you like better? Did I miss something in my analysis? I’d love to hear from you in the comments below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Fantastic article at the perfect time! We are expecting our second child this month and I didn’t realize that the numbers to pay for college were quite so staggering but I shouldn’t have been surprised. I love the idea of doing a refinance so that you can keep the asset to benefit you and your spouse down the road as well. Great content! Chad what do you think of the concept of employing your child so that they have earned income and you can start a Roth for them as well (I understand that they realistically need to be a bit older)? I know you are very knowledgeable about self-directed retirement accounts and how they can be used to pay for qualified educational expenses and I presume part of the reason you are not too keen on the Coverdell is that the contribution limits are not very high. Would love to get your thoughts, thanks!

Hey Sean,

Glad the article was helpful! Yeah, there’s nothing like that second child to bring home the reality of expenses:)

I have not done it yet, but I love the idea of employing your child so they have earned income so they can open a ROTH. That makes a lot of sense, and it gives you more fire power and flexibility than a Coverdell account. Obviously I’m not knowledgeable enough, because I did not think of that idea. So thank you for bringing it up!

I think for me the vehicle to use (Roth, Coverdell, or personally owned) will depend upon which assets I’m hoping to buy. Investing in a rental property outside of an IRA makes more sense to me because it’s easier to leverage and just a little more straight forward and flexible. But it could make a lot of sense to buy options, private notes/mortgages, tax liens, and even traditional stuff like index funds with your ROTH, Coverdell, and/or 529. And of all those, I like your ROTH idea best because if there’s money left over, the child can use it in the future for their retirement. And they can take out the contributions tax free.

This would make a great conversation. How about a guest article on saving for college with ROTH IRA’s?!

Any value in putting property in kids name ? Or a partnership – llc of flp family limited partnership – gradually turning over interest to kid

Funding roth with the rent

Would any of it affect there eligibility for student loans – even though it would cover there tuition – they could use these loans to fund there own properties

Jack,

I have not gotten to the place where I am comfortable turning the properties over to the kids in their names. It is certainly something I’d consider.

I guess at this point I’m of the opinion that the gift of this college fund will be plenty. In the format above I could use the money to pay for their college. If they get full scholarships, I could also use it to help them fund a business or a first real estate investment.

But beyond that I’m ok with them striking out on their own in the wealth building arena. If they want it, my encouragement, experience, and knowledge will always be available to them. And the extra effort they’ll need to expend to build wealth on their own will be good for them.

Are there any extra benefits I may be missing in the Roth, family limited partnerships, or other entities? I’m open to new ideas.

This article was beyond helpful as we plan to send two kids to college within the next 6 years. Our friends are using their state’s 529 plans. We’ve opted to invest in Real Estate, which has been a solid choice if you’re ok with being a landlord. Personally, we believe this strategy makes the most sense because it offers flexibility This is the most comprehensive and well laid out article to explain why it works. Thank you Chad!

Thelma

Thank you Thelma! So glad the article was helpful. There are many different ways to accomplish a goal, but like you, I personally can’t see any better way to pay for college than this.

Best of luck with your next steps!

Chad,

I have a lump sum of cash to help pay for college. My son will be starting college this Fall. Would it be prudent to purchase a college rental house with the cash and have my son manage the property? I can then take a Home Equity Loan against the newly acquired property to pay the college tuition. At the end he has his college diploma and I have the house (instead of having just given all the money to the school). Is this legal? What are the drawbacks of this idea?

Interesting idea, Chris. It sounds similar to my own plan to own a free & clear house before college, then refinance, and use that cash to pay for college while still owning the asset.

My cautions would be (1) make sure it’s a good deal. Even though the concept is good, the entire plan could go sour if the property you buy doesn’t cash flow well, requires big cash infusions, or loses money. (2) Borrow smart. Most home equity lines of credit are shorter term and have adjustable rates. I’d rather use a long-term, fixed mortgage in case you need to hold long-term. (3) I love the idea of your son learning to manage, but I’d want to perhaps have a trial/learning period where you work together, he understands the outcomes you want as an investment, and he understands his buddies have to pay because “the owner” needs his money. It’s a business, not fun money. It would be easy to have it slide from a true investment into a less optimal one because it’s friends/family.

But congrats on saving the cash you need. Please let me know how it goes!

To get all the tax benefits, must you invest in real estate personally or can you invest via a Limited Liability Corporation? Renting properties personally may open up liability issues. Your thoughts would be appreciated.

Thanks for the comment J! You can get many of the tax benefits while also investing in an LLC. You can see a full list of the tax benefits and how they work at this article I wrote for the Mad Fientist: https://www.madfientist.com/tax-benefits-of-real-estate-investing/.

I’ll also mention that there is often tension between (1) liability protection – like with an LLC & (2) the best financing. The 30-year, fixed mortgage type financing that many investors get on their first 5 to 10 rentals can only be obtained if you own the property in your own name. Some people borrow money in their own name, and then later deed the property to an LLC. It may be worth the risk, but you should talk to the attorney who helps you set up the LLC about this because doing that may also create issues with the mortgage’s due-on-sale clause.

Just met with my CPA. I invested in a rental property in 2011 after my Nevada 529 got beat up in the stock market it was difficult to see the amount decrease after 10 years, I pulled it out and bought a rental property. Even with the penalty it was a great decision. The past 10 years I have been putting the proceeds into a savings account for college. I have about 30k in the account after paying for two years of my son’s college, adding $650 a month from rental income after expenses. The CPA mentioned if I transferred the month from my savings account and put it into a state 529 before April 15th I could withdrawn the money needed in August to pay for tuition and write it off on next year’s taxes. Any advice would be appreciated.

I’d say that this is the best piece of advise ever given. As a Chartered Financial Analyst with over 15 years of Wealth, Banking and Investment experience, I independently arrived at a similar conclusion but finding your article helped validate a lot of conversations that I’ve been having with friends that have started families and thought a 529 was the only way to go! Share, share, share!

Wow, thank you Rich! That means a lot coming from someone with your expertise. I appreciate the share and the feedback.