Most of us have heard that the secrets to great riches and wealth are:

- OPT – Other People’s Time

- OPM – Other People’s Money

OPT and OPM are found on the right side of the Quadrant. For the most part, people who work on the left side of the Quadrant are the OP (Other People) whose time and money are being used.

Robert Kiyosaki, Cashflow Quadrant

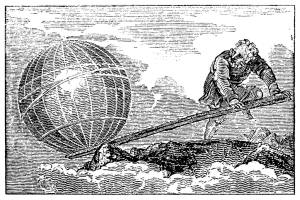

Leverage is a powerful concept. A lever allows you to lift a very large object using a relatively small amount of force.

In business, the most powerful forms of leverage are OPT and OPM. Entrepreneurs harness other people’s intelligence, talents, and energy to build their businesses. Entrepreneurs also harness other people’s money in the form of debt and equity in order to fuel their business growth.

Without this leverage, most businesses would stay small and make little profits for their owners and little impact on society.

In my own case, my business partner and I started our real estate business with very little money. Many of our first property acquisitions were completely leveraged with debt financing from banks in combination with private financing from individuals. We eventually used more of our own money, but the early financial leverage allowed us to acquire a large number of profitable properties.

We also leveraged the time and talents of other people. Our engine of growth was fixing up old properties, increasing their value, and reselling them for a profit.

But we did not do all of the work ourselves. Instead, we managed the processes of finding, fixing, financing, and reselling these properties. We hired carpenters, electricians, plumbers, drywall installers, painters, and other contractors to do the repair work. We hired attorneys to handle the title work and contracts. We hired realtors to sell the houses.

Yes, we got our hands dirty. Yes, we worked hard. But our success in making profits would not have been possible without OPT and OPM.

We owned the system. We hired the people. We borrowed the money. And we got to earn the profits (and sometimes the losses!).

It goes without saying that leverage can be as dangerous as it is powerful. Just like a power saw used to build a house, leverage can be productive if you use it safely or it can cut off a finger or worse if you’re careless.

In another article, I outlined my own system for How to Use Smart Leverage in Real Estate Investing.

Have you successfully used the leverage of OPT or OPM in your business? How has it helped you? What did it look like in your business? What are some ways you’ve found to avoid the dangers of leverage? I’d love to hear from you in the comments section below.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

I use OPT in my business – I build up a tutoring company where I don’t do any of the teaching anymore. I’ve been staying away from OPM to maintain complete control. But I definitely see where active real estate investors can use it to take things to the next level.

Cool example, Brian. I think using OPT is more impressive than OPM based upon all of the systems and trusting relationships it takes to work effectively. So kudos to you!

I also count mortgage leverage in the OPM category. But I haven’t done a lot of the OPM (equity) money. Keeping it small and simple works for me:)