Hi everyone. This is Chad, and I’m still on the road in Ecuador getting settled for the next year. Amnesty from primal-prosperity.com will be your guest author today in my absence.

I’m excited about this post for a couple of reasons. First, you’ll get nitty-gritty details from one of the 35 real estate niches that I have ZERO experience in (condo investing). And pay attention, because this niche has provided financial independence for Amnesty and her husband.

Second, I’m excited because Amnesty hits on a theme at the core of coachcarson.com – doing what matters. Amnesty infuses her investing with something that matters to her (and to me) – sustainability. But even if that’s not something that matters to you, I think you’ll take away many lessons from her story. And the meta-lesson is that you can use real estate to do whatever it is that matters to YOU.

Enter Amnesty …

Hi, Coach Carson Readers! I’m Amnesty and I’m a sustainability consultant and a real estate investor. I also write over at Primal-Prosperity.com

[A couple of side notes to the readers: These are only my opinions on sustainable real estate investing. I am not a financial advisor or professional real estate mentor. Additionally, you may see a lot of exchange between ‘we’ and ‘I’, in this writing. This is because my husband and I own the properties jointly, but I do all the ‘work’… if you want to call it that. He has no interest in spending time buying or managing. He just wants to enjoy the cash flow. So, when referring to certain tasks and opinions, you will see much more ‘I’ usage.]Sustainable Investments Endure

Sustainability is a term that got hijacked by the ‘green’ industry. I once read author and journalist Michael Pollan alluding to the fact that no one really knows what sustainability is, but we all seem to be for “it”, whatever “it” is…

As a professional sustainability consultant and a real estate investor, what I try to help people understand is that the true origin of the word sustainable is to endure. Whether it is your finances, your environment, or your health, we all want things to endure, right?

There is a term called the Triple Bottom Line, which is optimizing the intersection of the social, economic, and environmental benefits… or people, profit, planet.

And, something that I have learned as a sustainability consultant and a real estate investor is that what is good for people and the planet can actually bring you more profit in the long-term.

Why is real estate investing sustainable, in my opinion?

While I do invest traditionally in an IRA for diversity, I very much prefer real estate investing, because I believe it to be a more sustainable investing vehicle. Let me clarify, residential and multi-family real estate is a sustainable vehicle, and when I say ‘real estate’, that is what I am referring to.

Why is real estate investing more sustainable? Because everyone needs safe shelter. We have evolved over millions of years seeking shelter, but the idea of trading stocks has only been around for a few centuries. We may not need 3,000 square feet of shelter, with a media room and 5 bathrooms, but we need shelter.

I’m not recommending that everyone ditch the stock market and become real estate investors, but this balance just feels right for me, at this time in my life. I feel that my investing strategy is providing a real value to people and something that feels very tangible.

And our multiple long-term tenants will back that up.

From Cubicle to Coffin or $1,000/Hour Investing

That phrase may sound harsh, but I truly don’t think working 40 hours a week in exchange for a salary is sustainable for most people. Our physiology is not meant for long commutes and hours and hours of sitting in a cubicle and/or at a computer, as evidenced by the high rate of disease in our modern ‘civilization’.

So, creating passive income is important to escape cubicle captivity before the age of 65. It’s also important to help you live a full life while you are full of energy, vitality, and good health.

However, real estate is still never entirely passive (but it is a lot of fun!). I once figured out that with the time I spend managing my properties, I probably average close to $1,000/hour for certain properties. Keep in mind though, that this does not include all the time that goes into finding, purchasing, and preparing the property for occupancy. But, this high hourly rate lasts forever, or as long as we keep the properties.

The Investment Vehicle For Regular People

Additionally, when I use the word sustainable, I also mean that the average income earner can start investing in real estate. This is not a game just for the super wealthy. Newcomers seem to get overwhelmed thinking that they need 100 properties to be successful, or even 10. However, just a few properties can actually bring you the basic freedom to do what you want in life and pursue your real dreams.

For example, from a combination of simple living and cash flow, just four properties brought us basic financial freedom.

Three of the properties we own bring in enough monthly cash flow to cover all of our housing expenses, cell phones, basic food and health insurance (for myself). Other means cover my husband’s insurance. The fourth property is a hotel room that we bought and we live in, which is called a ‘condotel’. It provides a wonderful home at a ridiculously low monthly expense to us. You can read more about that here.

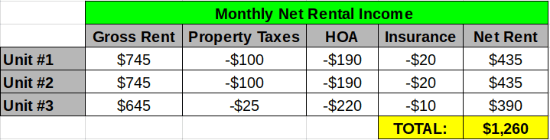

Rough Outline of Our Financials:

When I write about finances, I like the flow of round numbers to the readers. It is easier to visualize and calculate, so I almost always round up or down to the nearest $5. Here is a summary of our own financials.

Rental Income:

A couple of notes about income:

1. Our net cash flow here is rental income minus operating expenses of taxes, insurance and HOA dues. It does not incorporate misc. repairs and capital improvements, which in condos are minimal. Most major expenses are building repairs which get managed and paid for through HOA dues. In 10 years, between multiple condos, the biggest repair cost I have had to write a check for, was a $500 plumbing fix, and these types of repairs don’t happen often. We also have a hefty emergency fund to cover repairs and income loss for vacancies. Something I recommend to every real estate investor.

2. There is always the risk of a special assessment. Over 10 years, between multiple condos, I have experienced only $1,000 total in special assessments. That’s not much over that time frame. The key is to do your due diligence up front when buying your property, which is a topic that could be a whole article in itself. Additionally keep in mind that taxes and HOAs will go up over the years, but rents should also go up to offset this.

Necessary Monthly Living Expenses (roughly):

- $520 = Housing (includes taxes, HOA, ALL utilities, internet and cable in a studio size condotel.

- $60 = Cell Phones

- $380 = Health Insurance

- $960 = Subtotal

That leaves $300 for food and local transportation.**

Our Freedom Point

**Again, this is just our ‘freedom’ point – the point at which we can meet our basic needs of food and shelter without having to work. At 43, I only work 2-3 days per week, because I want to, not because I have to.

We definitely spend way more on food and eating out from other income sources and we also like to travel, but in a pinch, we could survive on this. We have Roth retirement funds that we can also draw from, without penalty, if necessary. While we don’t intend to, you never know if a large medical bill or some other major incidental will come up.

We are able to save most of our income that we make while working since our basic needs are ‘paid’ for most of the time. Knowing that your basic needs are met allows you to feel much freer, even while working. It means you don’t need to sweat a downturn or job loss. You don’t have to fret over annual reviews. And you can do a good job and sleep well at night.

Remember though, I can’t stress this enough, this “freedom” point, with just a few properties, is only possible (sustainable) with an emergency fund for unforeseen repairs, or a backup source of income for the vacancies, such as a retirement account. It is up to you to decide how much that would be and where you would keep that funding.

This freedom point is also only made possible because of simple living. It is achievable for everyone, but not necessarily desirable in our modern world. I get that. That is why it is just a point to start from, not necessarily a point to end at. I always say, get your freedom first, make money later. However, for me, simple living is environmentally friendly, and I would much prefer to spend my time satisfying my ‘primal’ needs of getting sun, movement, community and creativity, all of which are free.

The Properties That Brought Us Freedom

You might think that four properties sound expensive, but they weren’t for us.

We bought two rental properties for $33k each (in the same building), one for $19k and then the one that we live in for $41k. (Note these costs include the purchase price and necessary repairs to bring to rental standards, but not closing costs, which are minimal.)

I know that the purchase prices might give someone the idea that we are “slum lords”, or that they are far out in rural areas. But that is not the case at all. I won’t buy properties that I wouldn’t live in myself. These are all one bedroom units and condos.

Condos are much, much cheaper than stand-alone buildings. Many people don’t like investing in condos because they have HOA fees and they don’t trust the “Board”. However, I have owned stand-alone houses and condos, and I have since sold the stand-alone’s and now only invest in condos.

These properties are also located in cities where there is a lot of supply, which brings down the price. They are in locations that aren’t suburban-like, yet aren’t in the high-priced downtown areas. (Except for the condo for $41k, where we live. You can learn more about that in this article.)

(For privacy reasons, I intentionally don’t list the locations of my properties online, however, if you want to learn more, feel free to email me at TheRealWorldMBA @ gmail.com.)

Funding Our Investment Purchases

We have bought all of these properties as cash offers by using a line of credit. The line of credit then gets paid down with the rent and by using income from our part-time careers.

The key is to be prepared. Have your funding set. Have your emergency fund in place. Then look constantly. That way, when a good opportunity comes up, you can jump on it.

We also have three other condos that have mortgages. These were bought before I knew much about real estate investing, and they were bought as main residences where we used to live. They don’t cash flow, but they do break even and they are in class A neighborhoods, so they tend to get long-term tenants.

Every month, rent from our tenants pays our mortgages down by close to a total of $1,000 per month. We would actually prefer to sell them and reinvest in properties that cash flow to get us past the ‘basic’ freedom point. But the markets have changed since they were purchased. And, while they are providing a nice long-term investment for us, and growing our net worth while we sleep, if I knew what I know now, I wouldn’t have purchased these types of properties. But, that is an entirely different article topic!

Ok, so let’s get into the sustainability guidelines of real estate investing.

Our Sustainability Guidelines For Real Estate Investing

1. People over profit: No exceptions. This doesn’t mean you shouldn’t evict or that you need to provide top of the line appliances and finishes, but you do need to provide and maintain clean, safe housing. Keeping up your properties and addressing tenant issues right away is the best way to keep a long-term tenant. And turnover is much more costly than repairs. Again, I could write an entire article on this concept this alone.

2. Anchors:. This is important. Towns and cities can have wild economic fluctuations, based on the local industry. I personally would not buy in areas that are heavy in manufacturing, oil and gas drilling, or specific to a federal sector, such as the military or NASA. In general, industries that are polluting will not attract long-term tenants. Political changes can easily impact federal programs. And military tenants are not usually long-term. Instead, focus on anchors that bring value to society as a whole. These are entities like universities and hospitals. These are steady industries that also don’t have a lot of competition overseas.

3. Walkability:: Not only is the walkability of a neighborhood extremely environmentally responsible, but it is highly desirable for tenants. Walkability creates safer streets and brings together the community. It also attracts local businesses and commerce. It is the most important factor in balancing the long-term bottom line of people, profit, planet. While researching a potential rental property, you can enter the address into walkscore.com or you can do your own research. I only buy properties that have a minimum of at least one bus line stop within a couple of blocks… and sidewalks… nothing is more ‘unsustainable’ than suburbs that were designed without sidewalks.

4. High-Density Housing: As a sustainability specialist, I know that energy and water won’t stay cheap forever. You can put in high-efficiency fixtures into your units, however, properly maintained high-density housing is the most environmentally friendly type of housing. Period. Plus, it is usually close to bus lines and located in walkable neighborhoods. If you want to make environmentally friendly investment decisions, this should be the first place to start. From a financial standpoint, I would also much rather have a monthly HOA fee than have to account for replacing a roof. Additionally, it is like having a ‘free’ Property Manager, and they can easily be managed remotely. I find that condos are far much less work to manage than stand-alone buildings, which factors into the whole freedom/passive income philosophy.

5. Existing Buildings: This is a big one from an environmental standpoint. I’ve never built a new house or building for personal investing, so I can’t claim to understand the finances and whether it is a better upfront investment, but I do know the statistics that buying an existing building is much, much more environmentally friendly than building a brand new high-efficiency building.

Sustainability 101 and Real Estate 101, wrapped up into a nutshell.

Now, I understand, that in today’s world, we all want to maximize our dollars. And, you may be able to find a great real estate investment that doesn’t meet any of the sustainability criteria listed above. But we do need to think about the long-term sustainability and endurance of our investment decisions.

For me, I also would definitely forgo some ROI % to do the right thing and sleep at night. I’d much rather ‘brag’ about the good things I did in life, rather than how much money I made. I understand that this is my personal choice, and you should do what feels right for you. But regardless of our decisions, we should all be able to make ‘educated’ decisions.

So, I’d like to get feedback from the readers:

Did you know much about sustainability before reading this article? Or is the concept new to you?

Do you consider the long-term sustainability (i.e. endurance) when you invest?

Does ‘doing the right thing’ factor into your investment decisions, whether it is the stock market or real estate?

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Hi Chad, Thanks for the opportunity to guest post!

I’m very happy to share it with my readers. Thank you for putting a lot of thought and time into it.

Wow I have to say I learned a ton in this post. I have previously rented out my home and lived with roommates but had no idea how affordable it could be to rent out condos to people. Plus making $1,000 an hour isn’t a bad days work 🙂

Thanks for sharing!!!

Hey thanks MSM! Glad you found the article helpful. If you find the right market, it can be very affordable to get into real estate.

Very interesting argument for buying condos as investment properties. And I love how you wove the sustainability factors into it. Thanks for the great read!

Glad you liked it, Mr Crazy Kicks! It’s good to know that others care about the sustainability factors.

This was a great article. The “people over profit” hit home. I feel when we focus on the process (providing safe and affordable housing for people), we get the product (money, wealth) in return.

Totally agree. Process is a much more important and attainable goal, and the results tend to take care of themselves. And in this case – serving people – just happens to be the right thing to do anyway.

Helping people usually pays. It just comes around. Do some good and good will come to you.

Well said!