Hi everyone! This is a guest post from Pam Storm at RentMarketplace.com. If you have rentals and care about screening for the best tenants, you’re in for a treat with this in-depth tenant screening guide.

Pam is an expert on the science of tenant screening, which is one of the most important parts of the rental business. She has her own rental properties, but she also led one of the nation’s largest tenant screening organizations for years. In the process, Pam helped to facilitate over 16 million (!!) tenant screening transactions. I thought I had done a lot!

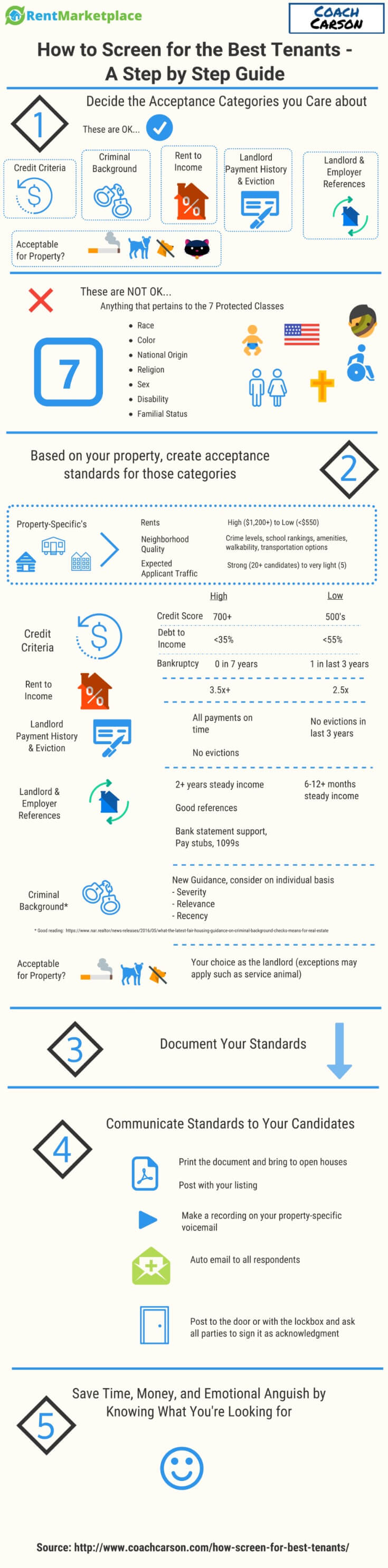

Pam reached out to me and asked how she could help coachcarson.com readers. I told her I would love to get her recommendation for a step-by-step process to screen for the best tenants. She went above and beyond with the following guide, which includes an awesome infographic that I recommend you save and use as a reference.

Be sure to take advantage of Pam’s expertise and leave your tenant screening questions or comments at the end.

Enjoy the guide! Here’s Pam …

Introduction: Great Tenants make Great Rentals

If you’ve been a landlord for a while, you probably agree that great tenants are the foundation of a great investment property. And, if you haven’t been a landlord before, this is probably one of your biggest concerns – how do you make sure you select reliable renters and don’t get burned? For both of these reasons, learning how to screen tenants to find only the best ones is a must-have skill.

Applicant Acceptance Standards: Your Key to Finding Good Tenants

A bedrock to selecting great tenants is knowing and documenting your applicant acceptance standards. And, it’s a valuable skill that you can master.

Simply put, applicant acceptance standards are the criteria you use to evaluate applicants. When you apply the criteria, the output is 1 of 3 options:

- Accept an applicant

- Decline an applicant

- Accept an applicant with conditions (such as an extra security deposit)

Think of acceptance standards like Standard Operating Principles (SOP’s), and imagine trying to run a business without SOP’s.

In the rest of this article, we’ll address the benefits you’ll reap from great acceptance standards and how to create your standards. Then we’ll review a few case studies to demonstrate the impact of using acceptance standards — and what happens when you don’t.

Benefits of Using Applicant Acceptance Standards

In addition to selecting reliable residents, other meaningful, desirous benefits will follow from using applicant acceptance standards:

- Removing emotion

- Facilitating compliance

- Establishing baselines

1. Removing emotion

When using acceptance standards, declining applicants that don’t qualify becomes easy. There is no emotional fatigue about should I or shouldn’t I, or trying to help someone out, or liking an applicant and wanting to rent to him/her when you know that person is high-risk.

Simply put, there are minimum qualifications for ‘lending someone this asset’ – and if it’s not a fit, it’s not a fit. Communicating this to applicants also becomes easy, because you will have given applicants your acceptance criteria before they apply.

So this one practice removes emotion that can lead to bad decisions, and it also removes emotion from communicating with applicants — two huge benefits from one practice.

2. Facilitating compliance

Documenting your standards and communicating them with applicants helps ensure consistency while evaluating your applicants.

There are two major federal regulations to stay compliant with at all times – Fair Housing and Fair Credit – and this one practice helps facilitate compliance with both. To go wayward, you would have to deliberately violate your own rules and SOP’s, which alone will give you pause.

With written standards, you are well on your way to treating everyone the same way and avoiding discrimination. Remember that even when you “bend” or “sway” with good intentions to “help someone out”, it’s discrimination and poor business practice.

Consistency is key, so the two benefits discussed will help you make better decisions, avoid pitfalls, and be a professional. But there’s more.

3. Establishing a baseline that can be adjusted over time

Lastly, as macroeconomic factors change over time, using acceptance standards will help you establish a baseline to adjust over time.

As you see employment conditions change, school systems improve, and so on — you will be in a good position to easily tighten or loosen certain criteria over time. You will be able to draw correlations between these changing conditions and your acceptance criteria.

In a sense, it becomes much more natural to review and correlate your financial results to your operational standards.

How to Create Great Tenant Applicant Acceptance Standards

Now that we understand how critical this talent is, let’s review how to be great at this skill. The entire process is outlined in the infographic below and then explained in the rest of the article.

Let’s go a bit deeper in some of these areas.

Income and Employment Verification:

This can be challenging since few employers are willing to provide references. There are 3 pieces of evidence you can try to obtain from the applicant:

- Pay Stubs: Preferably for the last two months, minimum. Be cautious, it’s easy to buy a fake pay stub off the internet. You must still call the employer, look at LinkedIn, and find collaborative evidence that the pay stub is legitimate

- Tax Returns: Especially if your applicant is self-employed. Last 2 years minimum.

- Bank statements: Trace the inbound paychecks – again preferable for two months minimum

Debt to Income Ratio:

This is one of the key financial measures you should use, especially for low-income properties where a credit score isn’t really helpful. Use gross figures for both income and expenses, and refer to the example below:

Example

- Assumptions:

- Rent = $1,200

- Monthly bills from credit report total = $525 (also add in child support, alimony if relevant)

- Income = $42,200 (either average out last 2 years’ income or use current income, include alimony etc). Monthly = $3,373

- Monthly Debt = $1,725 ($1,200 rent + $525 from credit report)

- Debt:Income = 51.1% ($1,725 / $3,373) x 100

Prior Landlord References:

Rental history verifications are an excellent resource when done properly. Again for low-income properties where credit and financial measures can be a stretch, a differentiating factor can be these references.

Use your professional skepticism — current landlords may say glowing remarks about their renters simply to offload them. Your best sources are prior landlords who have nothing to gain or lose by telling the truth.

You have two objectives here:

- Validate information on the rental application for trustworthiness

- Ascertain rental behavior

Validating Info on the Application:

Ask detailed questions specifically to verify the information your candidate stated on the rental application. Decline all applicants who have any mistruths on the application. Good examples include:

- What dates did he/she live there?

- How much was rent?

- Was he/she a smoker?

- Were they ever late on a rent payment

Ascertaining rental behavior:

Ask other open-ended questions like:

- Was the security deposit returned in full?

- Would you rent to him/her again? Why/why not?

- Were there pets?

- Any neighbor issues you had to address, like being loud etc

Now, having said all that, this only helps if you are speaking to the actual landlord and not your applicant’s best friend. To verify you are speaking with the landlord:

- Try to match the person’s name to the public records as the homeowner

- Google the person’s name and call that number versus the # listed on the application (if they are different, beware)

- Before you identify yourself to the landlord as to who you are and why you are calling, ask “is your rental still available?” If the response is “What rental?” you might be speaking to a friend.

Tenant Screening Case Studies:

Let’s try to bring all of this information together with some case study examples. These will show you how the applicant acceptance standards work in action.

1. Crisis averted at a low-traffic, low-income property

Brooke inherited a rental in a different state that had rented for years to one individual. When the renter gave notice, she was terrified. She said, “I was so worried, I needed the rental money, but I’m older, I was scared of being taken advantage of and knew the home was in a bad area.”

Process:

First, Brooke traveled to the rental and had an open house one weekend. Traffic was low at 4 candidates. She didn’t have acceptance criteria, ran credit reports on the candidates, and saw they all had essentially poor credit and similar backgrounds. She selected the one with the best credit. He moved in, paid rent twice, and moved out without notice.

Brooke was now stuck and really stressed.

Desperate, she called a screening company that suggested she document acceptance criteria, with a particular focus on employment, income, and debt. Still, with low traffic, this next time she selected a candidate still with poor credit, but also with:

- Verified income at 2.6x rent from 2 verified employers

- A high but improving debt to income ratio at 54% with no new tradelines in the last 6 months

- Prior landlords who verified facts on the application and said the candidate left the rentals in fair condition

Outcome:

Brooke says “I had such low traffic, I was worried about having acceptance criteria at all. My criteria were actually very low. It was actually the criteria discussion that helped. When I relayed the criteria to one applicant, he was honest about his situation, and he followed up. What he relayed was backed up by the references so although the criteria was low, there were no surprises.”

2. Experienced Landlord With 8 Properties in Decline

Tony had been a landlord for many years and had 8 properties in the Southeast. The properties had generally done well for him, but with each turn over the years, he was finding the renters were getting worse and he was now evicting a renter.

Process:

Tony updated acceptance standards for each of his 8 properties:

- For the 3 low-income properties, he emphasized steady employment criteria (6-12 months+ with one employer depending on the property), debt-to-income under 50% for all 3 properties, no evictions or bankruptcies in the last 2-3 years (depending on the property)

- With the most stable property, he focused on credit score (700+) and debt to income of 35%

- For the student property, he incorporated 3x debt to income requirements, allowed co-signers, required 2 months’ security deposit, no smoking or pets

Outcome:

- When the student property turned, the property was left in much better condition

- One of his low-income properties had been turning routinely. He has reduced turnover there entirely with a couple that pays routinely and intends to stay for years.

- Tony has restored confidence. “When the properties turn again, I have a system. It’s no wonder my properties were going downhill. That won’t happen again.”

Resources

Information in this article covers a broad array of landlords and properties, but of course, each property, situation, and locale are unique. If you want to learn more and go deeper, resources abound:

- For more localized information, check with your local real estate investor association (REIA). Usually, they have a google discussion group in which you can ask networks how they handle this in your specific area

- Google “rental acceptance criteria” and you’ll find a lot of examples from realtors, property management companies and so forth

- Rent Marketplace (www.RentMarketplace.com) has some helpful blogs and guides on tenant screening, compliance and more

In Summary

Reliable tenants make great rental properties, and selecting these reliable tenants can be a systematic skill that you develop. Use these tips to create and deploy great applicant acceptance standards for each property and drive solid financial performance.

This is Chad again. I hope you enjoyed this guide! I know I benefited a lot from it. Pam is the founder of rentmarketplace.com, an online solution for tenant credit/background checks and much more. Please visit her if you need help in that area.

Also, Pam is willing to answer your tenant screening questions here, so please leave a comment below. I’d also love to hear about the tenant screening process you use with your rentals.

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

This is SUPER USEFUL information. I’m in the middle of buying a property and inheriting the tenants. I am TERRIFIED of having to find new tenants since I hear tenants make or break the landlording experience. I will not only bookmark this page, but share it with my readers when the time comes to write about the process.

Thank you, Chad and Pam, for the great content!

Thanks Gwen! I agree – Pam delivered a super-useful post. Glad it will be a helpful resource for you and your readers.

I have followed Gwen’s story and blog, and I can’t wait to learn more about her new property deal. Definitely check out her blog if you haven’t already.

I’m so glad it’s helpful (Pam here). Happy to answer any questions, love helping people feel confident about their screening, compliance, and tenant selections!

I’ve had a few interesting income evaluation failures to share.

– Never include the income from kids. Typically a single parent and a few kids with jobs apply. The kids can be older adults even. Parent does not make enough unless you include the kids. They move in, the kids move out, leaving you with a problem. Never include income from kids even if they are older adults. One person needs to have enough to qualify and their story has to make sense that if all else fails or changes, its the one with the most income will be the one that stays..

– Often single parent but need not be, claims income from SSI for kids, or child support. They don;t qualify on their own income, they need the SSI or child support. They loose the kids OR the SSI / support ends. Now you have a problem.

This all boils down to holding out for stronger applicants, better jobs, a couple with dual jobs. I’m avoiding single parents with weak jobs or income that does not qualify on its own. The best scenario are married adults with good enough income. Not married couples or just one adult and kids all are a path to weaker and weaker renters.

My role as a business owner is to NOT solve social problems, but to run my business, thats it. Sometimes this is a tough job.

Hi Curt, thanks for sharing your experience and perspective! See you this Saturday at the webinar.

We’ve overall been lucky with good tenants. However, the only eviction we’ve had was actually my husband’s brother. I told him it wasn’t a good idea because I knew his brother’s past, but he wanted to help him out. It was a disaster to say the least!

I agree, getting good tenants is so important. Kind of like proper due diligence when buying a property, the same due diligence must be given to screening tenants.

Great resource! It is vital to take time in screening your tenants. Don’t accept in a hurry it might cost you more than what you can potentially earn. Follow those step and you will be safe.

You’re so right about not being in a hurry. I don’t know why I’ve had to learn that the hard way so many times:) Thanks for commenting.

Great point on the relationship, thanks for posting. Having your rental acceptance criteria in place may help avoid this situation and it definitely helps take the emotion out when evaluating other tenants that you may not know but are tempted to help… Thanks for sharing.

Thanks for explaining how a landlord will talk to your previous landlords to verify all of the information you have put on your application. My fiance and I are looking for a place to rent once we get married. We’ll be sure to put information that matches with what our current landlords say so that the new one will accept our application.

Hi, Coach Carson, I enrolled in one of your REI University courses several years ago. I believe my husband and I had two properties, now about to be 8. We are in our 60’s so a different criteria and goals than the younger set has.

This article is very timely as we have decided to self manage some of our properties. Having a built in rental acceptance criteria will create a firm foundation in tenant screening. Thanks for re-posting this episode. I’ll be sure to look up Pam’s website.

I’m interested to know what software/service people use for the applications/upload paystubs/credit, reference and background check

All good info BUT , I read somewhere that a LL cant deny prospective tenant based on a felony record . Maybe I’m wrong .

Also I always try to see where the prospect lives and visits .I also take a good look at their insides of their car .

Another thing I usually try to fit into the conversation a phrase that could be considered an “insult ” and see what the prospects reaction is .

Is there any law on not wanting to rent to fat obese people who smoke ?

Too many toilets have been broken.

These days with people not wanting to work and if they do want to work they EXPECT $15 /hr …hey rent just went up !

It made sense to me when you pointed out that there won’t be emotional fatigue when you use acceptance standards in declining applicants. My aunt is planning to have her three-story house leased starting next month. Her busy schedule won’t allow her to find and screen tenants. I will ask her to consider using a property leasing service in order to make sure that finding tenants would not consume so much of her time.