The following is a real title insurance story from my real estate investing business. I hope my own real estate title problems will help you avoid big mistakes with your own real estate investing.

I recently got a call from an attorney. And with apologies to my attorney friends, that’s rarely a good thing!

At the time I’m writing this, my business partner and I are selling off a few of our rental properties. These properties are outliers that were either bad locations, bad financing, or just bad deals. And now we’re liquidating them so that we can move on to better investments.

One of these properties, a single family house, was ready to sell to a new buyer in just another week. Almost everything was finished, including the appraisal and repair inspections.

Typically this is a time to breathe a sigh of relief because we had passed through the toughest parts of a pre-closing.

And then I got the attorney call.

An Attorney Call You Don’t Want to Receive

“I’m sorry to tell you that we’ve found a title problem, and it’s going to affect the closing.”

That was what the closing attorney told me over the phone. And my heart proceeded to take a roller coaster dive into my stomach.

Title problem?

Yes, a title problem.

I’ll spare you every single detail because it would make for a head-spinning, confusing story. But in essence, we don’t technically own all of the property we’re supposed to.

Yep, that’s right.

We paid good money for the property in 2007. We bought it through a reputable attorney. But now we can’t sell it to our new buyer, recoup our money, and pay off a mortgage until this is cleared up.

How Did The Title Problem Happen?

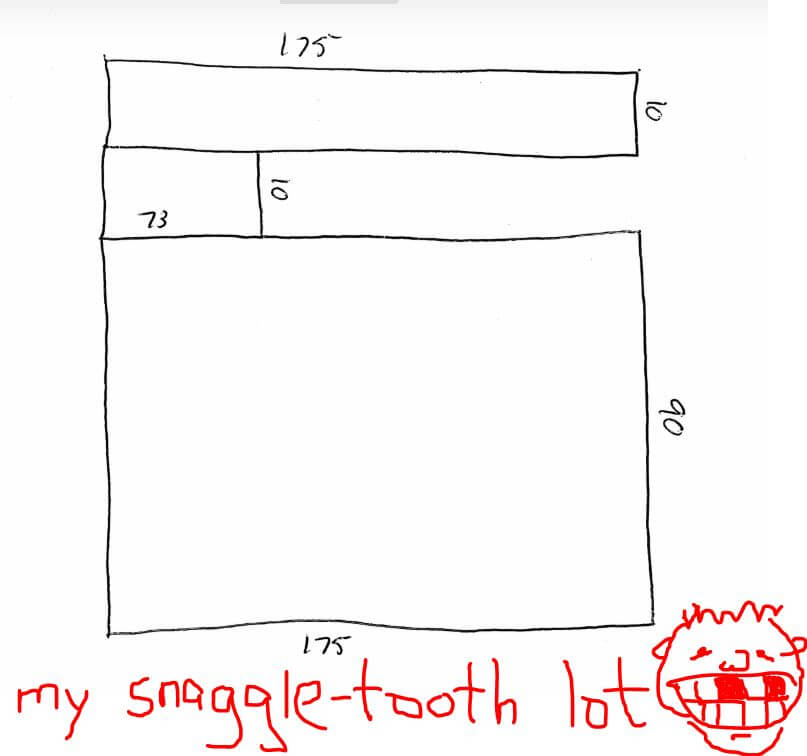

The subdivision for our property was created in 1955. That is when our lot was originally surveyed. And originally it was about 100 feet wide.

Just a few years later in 1960, the lot owner bought an extra 10-foot wide piece from a neighbor. From that point on, the extra 10 feet was included in any property transfers of our lot.

But the problem started when a closing attorney in 1980 created an error in the legal description of the deed that transferred ownership. He didn’t correctly reference the prior transactions, although the intent seems to have been to sell all 110′ of the property.

And to make matters worse, the survey of a next door neighbor’s property in 2016 also made a different but related error. So, their deed was not correct either.

When you put all of this together, our property lines look like the broken-toothed smile of an old hockey player after a fist fight! And that’s nothing to be proud of in real estate!

Did I Get Title Insurance?!

I’ve been purchasing title insurance on every closing I can remember since I began investing in real estate. It was just something that veteran investors told me I needed to do, even though I honestly didn’t fully understand what it covered.

But as soon as I hung up the phone with this attorney, I sprinted to my old real estate file cabinet in the basement.

Did I buy title insurance this time?! My mind was in a panic.

And then I found it. A beautiful policy from First American Title Company, stamped with a gold seal.

To ease my anxious feelings, the policy even had a picture of a big eagle holding what I guess are peaceful olive leaves. I don’t know what THAT means, but it made me feel better all the same!

How to Fix This Title Problem

I’m still in the beginning stages of this problem, so I can’t tell you how it’ll be ultimately resolved.

But two former owners of this property (or their heirs – which could be a mess) have to sign corrective deeds to make my legal ownership paperwork correct. And if we can’t find or get them to agree to the corrective deeds, we’ll have to file a special lawsuit called a quiet title action.

I’m familiar with quiet title actions from my work with tax lien deeds, but this would be my first in this particular situation. And it’ll likely cost $3,000 to $6,000 in attorney and court fees assuming there are no other hiccups.

Luckily, I think our title insurance company should cover this lawsuit cost.

The current closing attorney seems confident that a quiet title action would resolve the problem. But I’ve learned to be skeptical. When you get into lawsuits, crazy things could happen.

And that’s another reason I’m happy we have title insurance. If we can not resolve this problem, I also assume we wouldn’t be able to sell our property for the current market value. So, we’d have to file a full claim on our policy and try to salvage as much money as we could.

Even with a title insurance policy, I’m not looking forward to that possibility. So, I’m hoping we can still work something out before we get to that point.

Sit, Wait, and Renegotiate

Beyond the title issues themselves, we’re also risking losing our buyers while waiting. They initially seem interested in sticking with the purchase and extending our contract. They’re living with family now, so they have some flexibility.

But it will likely be 2 to 5 months until we can resolve the issue. So, we’re working on those negotiations with the buyers right now.

And until the title is resolved, we’ll also continue paying for interest, taxes, insurance, utilities, and maintenance on a vacant house. We may be able to rent the house to the future buyers, but that’s also still up in the air for now.

While we sit and wait, there are no positive cash flow events happening with this house. And that’s the opposite of the kind of real estate investing I like!

Every Problem is a Seminar in Disguise

When we first started investing in real estate, my business partner and I knew that we would make a lot of mistakes. And we also knew that we couldn’t avoid the financial and emotional cost of all of these mistakes.

But we did decide that we could cash in on the lessons! In other words, every problem is a learning seminar in disguise.

Unfortunately, we seem to be education junkies. But it does give me a lot of material for writing this blog!

I’m still absorbing the lessons for this situation. But here are a few key things I think I’ve learned for now:

- Always get title insurance – luckily we did that

- Get a survey before buying – a good surveyor may have caught this problem so we could have avoided the purchase. We’ve been lazy on this one in the past, so it may be the biggest change I make going forward

- Find closing attorneys who are experts at title evaluation – this is a tough one to judge, but I now have more confidence in the attorney who caught this problem. And I have less confidence in the one we originally used.

- Hold cash reserves - if we were tight on cash right now this could be a major problem

- Take a deep breath - there are always problems in business, investing, and life. When they happen, take a deep breath, try to think clearly, and work on solving the problem instead of complaining, blaming, and feeling sorry for yourself.

I’ll update this article as I learn more and as we proceed through this title problem and title insurance claim.

I hope you’ve learned something from attending my real-life seminar. Be sure to take this free seminar instead of having to attend the more expensive one on your own!

Let me know if you have any questions, suggestions, or thoughts in the comments section below. Thanks!

Get My Free Real Estate Investing Toolkit!

Enter your email address and click "Get Toolkit"

Hi Chad, Tnx for writing this story up for your audience. Good reminder of why we should always pay $400+/- for that policy. When I buy a rental I also tell the closer to give me title insurance for the purchase + rehab. They always oblige and up charge for that policy.

Of course the nagging question is why didn’t the attorney / title co who you used to buy this property find this and fix this on the buy side!!!!! I’d have a sit down with that attorney soon.

For other reasons I have found not all closing attorneys or offices are the same, this brings up yet another reason why some closing offices are better then others. Checking title is a task performed by 2 parties working together; the folks who PULL the title info and the Attorney who actually does the work of verifying the info the Title co pulls. I don’t chaulk this one up to bad luck. That survey and ownership problem looks pretty standard stuff.

Curt, you and I have the same nagging question. I think we could say that title insurance is also a valuable tool when your closing attorney/title company doesn’t do their job!! If I thought a sit-down would help I would, but I plan to just move on to someone who can get the job done in the future.

Fascinating and honest account of the perils of real estate. Thanks for this one, Chad.

Great post! I’ve always wondered if I should be spending the money on an owners policy on top of the lenders policy in a financed deal. Historically I haven’t done this because people seem to frame it as an unnecessary expense. Thoughts? Also, are you now planning to get a survey on each new purchase? Any idea on cost of a survey? Finally, any thoughts/insight on requesting a policy with or without Standard Exceptions? Thanks Chad. Love your IG, blog and podcast!

Hey Zack – the short answer is I’m still thinking about and plan to consult with an attorney about my plan going forward. But I am buying owner’s policies on every property because it’s usually inexpensive (like $100-200) after paying the lender’s policies. But I think it’ll be important to make sure the amount is the same as our investment – like if we’re putting an extra $30,000 in repairs and if the value is going up to get a policy to cover it all. And for now I think I will be getting a survey on every property. Cost will depend on complexity, but for a little neighborhood lot like this example I think it would be $300-400.

Each lesson is a seminar in disguise…I love it!

These are definitely tough to look out for as a newer investor.

I heard quit claim deeds may void title insurance. Any thoughts on this?

Thanks Bo! A title company or title attorney will tell you more definitively than I will. But I have heard the same thing about not using quit claim deeds, for example, if you are deeding from your name to an LLC. Use a warranty deed instead so that the person who originally got the title insurance can be brought in (because they warranted the title was good) if there are issues later on.

Anyone reading who has actually dealt with that let us know!

Interesting post, and interesting to me (as a former title insurance examiner and now oil and gas landman) how different things are in the different states. We don’t use attorneys in Colorado for typical real estate transaction, but the title insurer certainly is on the hook for this one. It would seem to me that the attorney isn’t the one at fault if he didn’t write the policy–he would be serving as a closing agent representing the transaction itself? Maybe you can shed a little light on how it would be their negligence, when it seems to me that it should be the underwriting examiner? I love to hear how it’s different in different states.

Thanks for commenting, Dani. Your background gives you a lot more experience than I have on understanding title issues. But it’s my understanding that in South Carolina, the closing attorney is also the title agent. They handle the escrow of funds and they examine the title search and certify it for the title insurance company. I would guess there is another underwriter behind the scenes at my title insurance company. But practically speaking, the closing attorney is involved now and is working to resolve it. The attorney is also communicating with the title insurance company about the steps to be taken.

Thanks for the post and best practices at the bottom.

Good tip on retaining a surveyor in this type of deal. Based on the rest of the article I suppose that is not a common practice in this type of purchase? What would the additional cost on a deal be to survey the property?

Separately, retaining a lawyer to conduct the legal due diligence is meant to minimize your risk. If there is some problem with that legal due diligence I would think that law firm would be legally liable for this mistake (and the related costs). I recognize that entering into contracted litigation with an entity that does this for a living is time consuming and (potentially) costly, but it would seem there is an argument here for discussing this problem with the firm or taking them to court? Or is the trouble not worth the cost?

Good questions!

In my case I think a survey could have been done for a $300-400.

And I think you’re right that the attorney who originally closed my deal (and missed this!) has some liability and responsibility to resolve it. Fortunately, this attorney has been responsive and is proactively working to resolve it by getting former owners to sign paperwork to resolve the issue. But it’s not done yet! So to be continued …

Curious if there has been any resolution? Did you up doing a quiet title or different route?

Good timing on the follow-up question, Brad! I need to update the article (and will soon), but we sold the property in December after cleaning up the title issues. Rather than a quiet title lawsuit, we reached out directly to the former owners who needed to sign corrective deeds. They agreed (although it took a while), so that settled the issue. But from beginning to end this solution took about 7-8 months, during which we lost our original buyer and we had to make holding cost payments on a vacant property.

Thanks for the info about title insurance. My friend is trying to learn more about title insurance. I’ll share this info about title insurance with my friend later this week.